SYMLIFE (BSKL : 1538) : Attractive Bargain for Investors - Read Carefully !!

Investhor

Publish date: Thu, 18 Oct 2018, 01:53 PM

SYMLIFE (BSKL : 1538) , Target 1 : 45c, Target 2 : 55c, Target 3 : 75c

As you know, recently SYMPHONY LIFE BERHAD (SYMLIFE, BSKL 1538) has executed a rights issue to raise capital. I would like to elaborate on my opinion with regards to this.

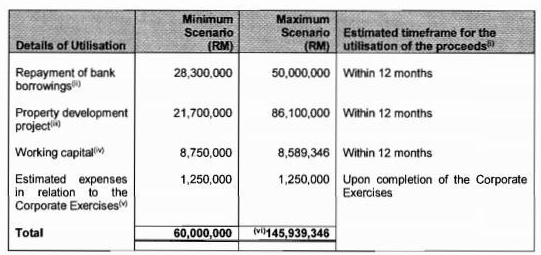

1. Purpose of Rights Issue

Refer above image from the rights issue prospectus. Roughly half of the money will be used to repay bank borrowings, and another half to be used for its property development project and working capital. In my opinion, this is a positive sign for executing this rights issue as it allows the company to reduce its gearing and at the same time ensure timely delivery of its projects.

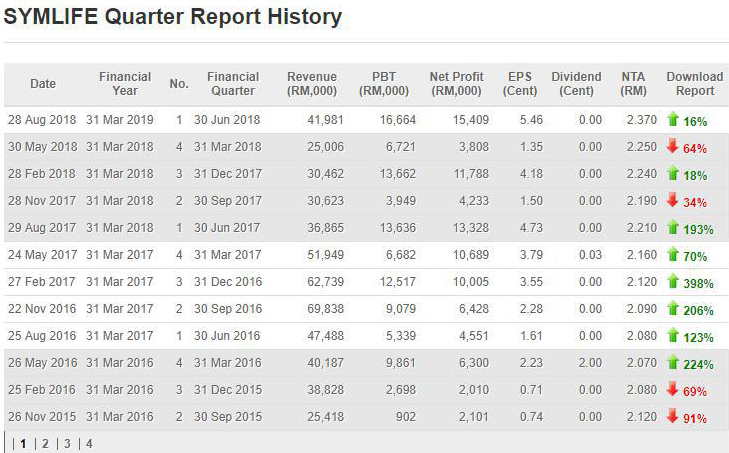

2. Financial Prospects

Refer image above on its latest 12 quarter report results. We can see that this company is making consistent earnings for the past 2 years, around 10-12 cents per share. Therefore, taking a conservative PE of 5 times makes its price target to 50-60 cents. For a more aggressive approach of 7-10 PE, we should get a range of 70c to RM 1.20 as the target price for longer term (6-12 months).

3. Technical Analysis

Refer weekly and daily charts above. It has to be noted that SYMLIFE is trading at historical lows since its listing. Current historical low is 35.5c and at the time of writing, it is trading at 36.5c, just 1 cent above its historical low. Looking at the daily chart, volumes are starting to pickup showing gains in interest at this counter. The price is oversold at daily, weekly and monthly charts. Therefore, as an investor, I would take this opportunity to invest and hold for mid to long term.

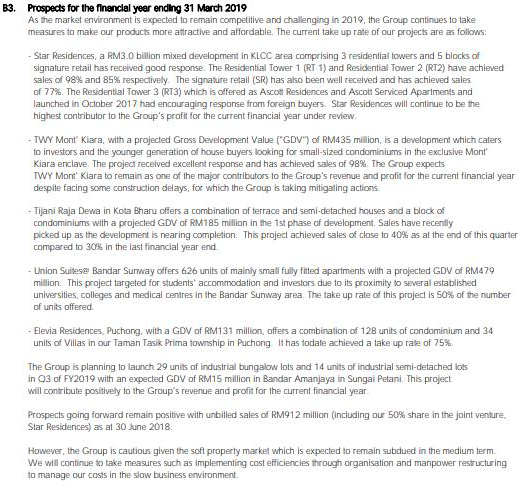

4. Business Prospects

Refer above prospect taken from latest QR. In summary, the takeup of projects as below:

a. Star Residences, RT 1 achieved 98%, RT 2 achieved 85%, Signature Retails achieved 77%

b. TWY Mont Kiara, takeup rate 98%

c. Tijani Raja Dewa (Kota Bharu), takeup rate 40%

d. Union Suits @ Bandar Sunway, takeup rate 50%

e. Elevia Residences, Puchong, takeup rate 75%

Unbilled sales is RM 912 million as at 30 June 2018.

From above numbers, I see that this company is very occupied and has a strong order book for the next 1-2 years.

Conclusion

As an investor, I opine that the prices of SYMLIFE has been suppressed due to the execution of rights issue. However, looking at multiple factors of financial, technical and business prospects, an investor should look at an entry at this current price range (either thru subscription of right issue, or buying in open market) as the downside is limited compared to the fruitful upside potential.

I reiterate my targets, 45c, 55c and 75c respectively in the mid term.

Yours Hammer Truly,

INVESTHOR

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020