THIS COMPANY IS UNDERLOOKED !!! IT HAS A PLANTATION BUSINESS TOO !!!

Investhor

Publish date: Sat, 04 Jan 2020, 11:50 AM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

SCOPE INDUSTRIES BERHAD or SCOPE (Code 0028, ACE Market, Industrial Products & Services)

SCOPE - THIS COMPANY IS UNDERLOOKED !!! IT HAS A PLANTATION BUSINESS TOO !!!

1. SCOPE Has a PLANTATION Business - Which Should Benefit From the Recent Surge of Price in Crude Palm Oil (CPO)

Recently, CPO prices have shot thru the roof. A lot of CPO counters have staged a big rally such as FGV, JTIASA, THPLANT, RSAWIT, TDM and many more just to name a few.

I believe that SCOPE has been underlooked, as they too have a plantation business. The price of SCOPE has not yet rallied as strong as the other CPO peer counters.

Below the screenshot of their website.

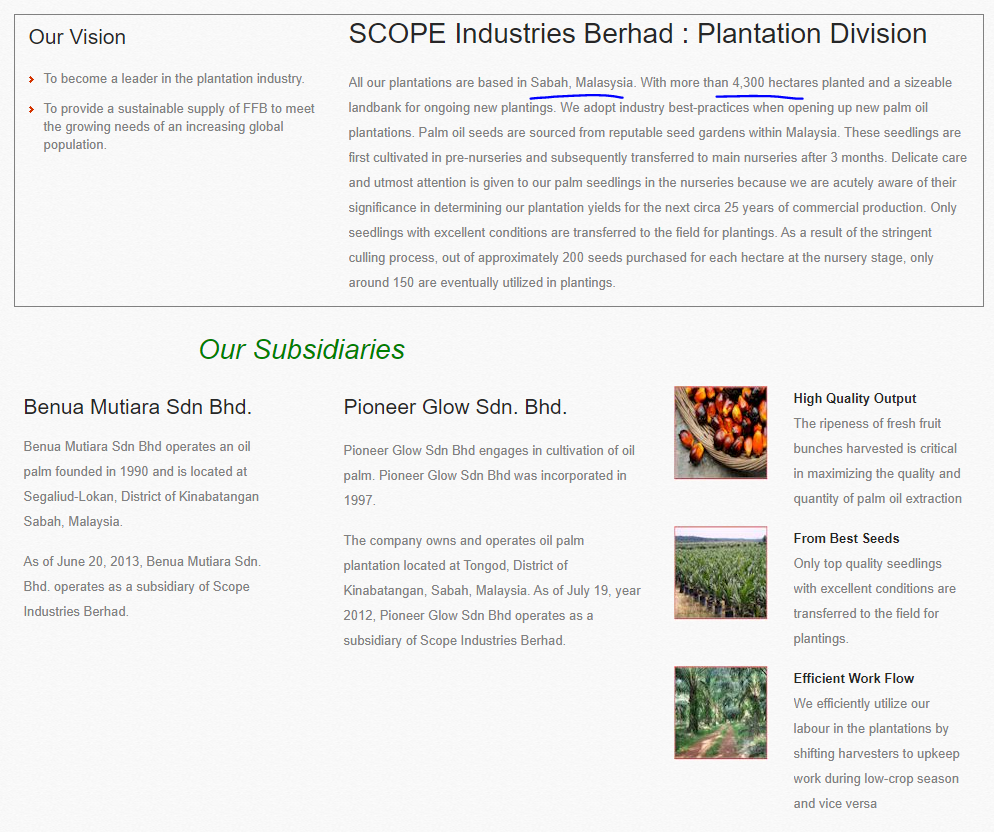

As you can see, SCOPE has about more than 4,300 acres of plantation land in SABAH. With the recent rally in CPO prices, SCOPE should also be benefiting from it thru higher revenue from its palm oil business, which should contribute to better earnings in the near future.

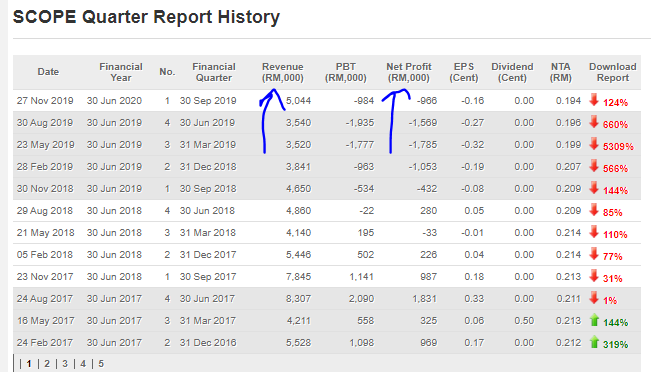

2. FINANCIALS - Worst is Over - Loss is Reducing and Better Earnings Ahead with CPO Price Rally

Refer below summary of latest SCOPE quarter resiults summary. The revenue has improved to a latest of RM 5 million, with the net loss reducing from -1.7m to -1.55m to -0.97m in the latest quarter.

As the company had commented in its prospects section of the latest QR, the Plantation segment will be mainly driven by CPO prices movement. As the CPO price staged a big rally recently, this should be contributing to better earnings in SCOPE plantation segment in the upcoming quarters, which should mean a possible turnaround in its quarter losses to quarter profits.

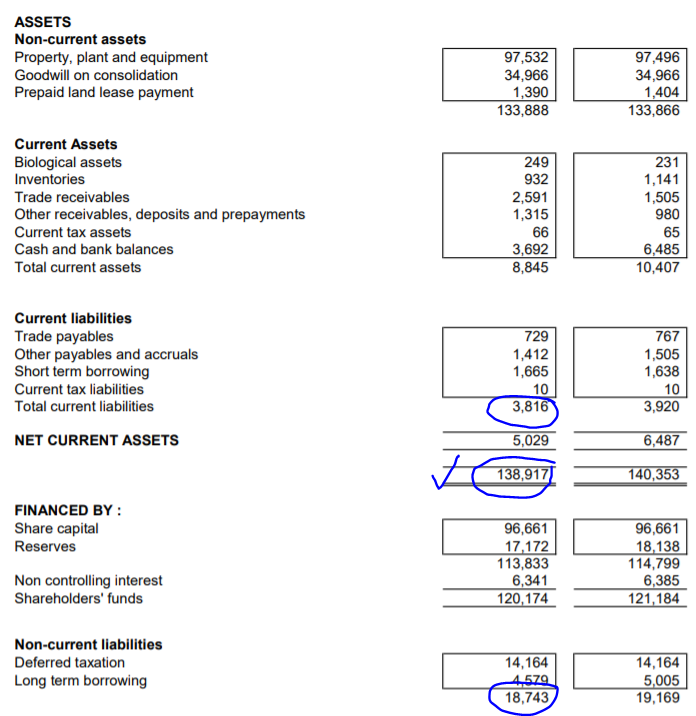

3. FINANCIALS - High Assets Versus Liabilities (RM 138.9m Assets versus RM 22.5m Liabilities)

A further look at the financials in latest quarter results, reveals that the company is quite lightly geared. With a total Asset value of RM 138.9 million, versus Liabilities of RM 22.5 million (Current Liabilities RM 3.8 mil + Non Current Liabilities of RM 18.7 mil).

This means that the total assets are about 6 times that of its total liabilities.

4. CHART - Triple Bottom on Monthly Chart, EMA breakout & Volume Building in Daily Chart

Let us first look at the monthly chart of SCOPE. A few observations:

i) A triple bottom pattern is forming, with the support around 12-13c area. A triple bottom is a bullish pattern (refer below link on investopedia for the basics on triple bottom pattern)

ii) Currently pending breakout of downtrend at 21c, towards the important resistance level of 23c. If broken at this level, then the price should test highest towards 30-33c

iii) Volumes are building up in the past 2 months candle

REFERENCE: https://www.investopedia.com/terms/t/triplebottom.asp

Let us look at the daily chart. A few observations:

i) Recently, price has broken up above the important EMA200 and EMA365 to indicate a long term change in trend towrads uptrend

ii) Volumes are starting to buildup over the past few days

iii) MACD crossings upwards and indicating uptrend in near future

CONCLUSION

Based on my opinion, I believe SCOPE should be seeing better future ahead, based on below:

i. Having a Plantation Business Besides Its Manufcaturing Business - To Ride on the Recent CPO Price Rally

ii. Financials Improving - Revenue Increase and Loss Reducing

iii. Lightly Geared Company - High Assets Value Versus Liabilities

iii. Chart Shows Triple Bottom Bullish Pattern, With Short Term Momentum Upwards

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

@slts - refer above screenshot of company books, they have current assets of about rm 8.8m which should be sufficient for them to operatesnd turnaroud the company once improved earnings from plantation segment comes in

2020-01-04 17:38

@newbie911 - refer to the chart..the volumes only started to enter recently around 20c area..the volume was too small before that hence it could potentially be negated..compared to the other cpo counters which have rallied for 3-4 weeks, this counter has not seen enough interest as it should..

2020-01-04 17:42

Yes, lagging behind. Potential price spike is there .

Will add some on Monday . Thank you Investhor for sharing .

2020-01-04 18:08

Financially, Scope is lower gear and with huge plantation asset backing. We should see huge jump in revenue being reported soon.

2020-01-04 22:30

investhor sai lang Scope already, now need all uncle & aunty to push up for him

2020-01-04 23:16

With a plantation profile of 50% aging trees (15 years and above) in need of replanting, they will be enjoying the increased cpo prices at absolutely the wrong time.

In addition to that 25% of their revenue came from a customer which decided to build and produce their own production lines to meet the demand.

They are scrambling to meet an entire year of bad luck.

Investhor if you want to buy and push this stock to i3 investors you really have to try much harder, this has been a bad company for years, and the cpo price runup is not going to be sustainable.

But the poor management capability is going to continue for the entire length of time that you hold this stock.

Id advise you to sell and avoid this stock.

2020-01-05 12:52

@Philip Greta - not sure how you know so much details of their business (maybe you have a friend working there, or God knows how)..but my opinion is based on the facts and figures available in the company official reports..it is better for you not to speculate if you are not an official spokesperson of the company..

also, why would you assume that I am buying this stock to push to other investors? it really is low of you to simply assume like that..whereas like I said I am simply sharing opinion and it would be up to the market to decide the price of the stock

2020-01-05 13:30

thumbs up to you Philip Greta. Not afraid to call a spade a spade and dont play to the gallery.

a tip to the topic starter - a shrinking NTA is not a good sign if there is no corporate exrcise.

2020-01-05 13:43

@gohkimhock - funny that you said there is no corporate exercise..they had just completed a private placement of 56,048,443 new Scope Shares on 18 March 2019 for expansion of their electronic manufacturing business..

also, the majority shareholder had crossed over 32 million shares to INVENTEC APPLIANCES CORPORATION, which signals a strong partnership in its manufacturing section

maybe a tip to you..don't simply make a statement before studying the company's recent announcements..you will make yourself look bad

2020-01-05 13:58

Investhor

On Manufacturing Side, they have INVENTEC APPLIANCES CORPORATION (from Taiwan) as a business partner, with a 32 million (5.17%) shareholding in SCOPE.

IAC had acquired this stake in 2019. This partnership should contribute to better earnings in their manufacturing division in the long run.

2020-01-04 12:29