UNDERVALUED STOCK - FOR BARGAIN HUNTERS (EPF A SHAREHOLDER) !!!

Investhor

Publish date: Tue, 03 Mar 2020, 06:16 PM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

EG INDUSTRIES BHD or EG (Code 8907, MAIN Market, Industrial Products & Services, Food & Beverage)

EG - UNDERVALUED STOCK - FOR THOSE BARGAIN HUNTERS (EPF A SHAREHOLDER) !!!

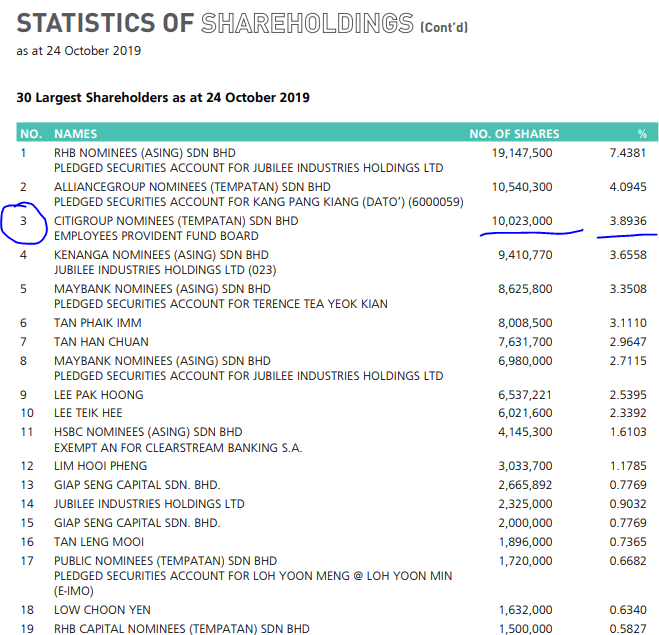

1. EPF As A Substantial Shareholder As of 2019 Annual Report - 10.023 Million Shares (3.89%)

Below is the list of 30 largest shareholders as at 24th October 2019 (taken from Annual Report 2019).

As we can see, EPF is one of the major shareholder holding 10.023 million shares or 3.89%. I believe EPF made an investment into this company, due to its long term profitability potential and asset positioning in Malaysia.

EG operates mainly in Kedah, Penang.

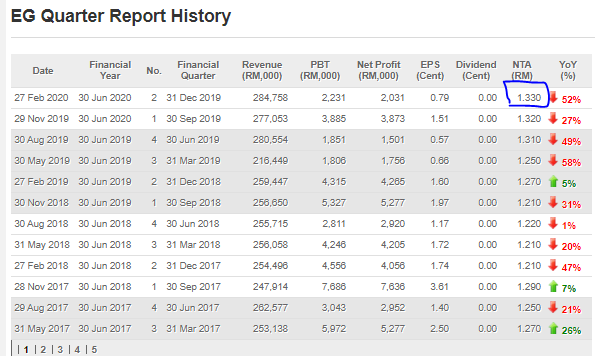

2. Stock Price Is Way Below Its NTA of RM 1.33 & Low P/E Ratio At 6.3X

Below is the latest quarter result summary of EG. A few observations:

i. Revenue has been consistent since last 3 quarters at RM 277 - 284 million per quarter

ii. Net profit ranged between RM 1.7 - 3.8 mil in the last 4 quarters

iii. NTA value stood between RM 1.25 - 1.33 in the past 4 quarters. The current closing price of 29c, is way below its NTA value of RM 1.33 as of latest quarter. Longer term investors might be looking for such a bargain in the market.

iv. Current 2 quarter Earnings Per Share (EPS) stood at 2.3c. If this performance is maintained for the following 2 quarters, the full year EPS will stand at 4.6c. This means that the current closing price of 29c, is only a 6.3X PE Ratio for this company. Considering a company in manufacturing sector, this is quite low as compared to a few peers below in same category:

BOILERM, P/E RATIO 10

DANCO, P/E RATIO 9.7

FPGROUP, P/E RATIO 29

3. Prospects Which Might Boost Earnings In Upcoming Quarters As Commented by The Board

As mentioned in the Annual Report 2019 and Latest February 2020 Quarter Report (links provided below), the below prospects of the company look promising:

i. Group anticipates global electronic manufacturing services to continue to shift out from China to South East Asia (the effect from US-China trade war). Thus factory expansion Malaysia will be ongoing as the Group had received more enquiries from several multinational companies and several new projects successfully launched in 2019

ii. The newly-acquired land and factory is the Group's first fully automated manufacturing facilities has commenced operations in November 2019, enabling the Group to take on more jobs and expected to contribute positively in coming quarters

iii. Group will continue its effort towards adoption of Industry 4.0 and factory automation to improve its overall cost-efficiency, quality and reduce reliance in human labor

iv. Group to continue to enhance product mix to focus on high margin operations and constantly look for ways to enhance production efficiency

v. Group will target more on medical and automotive industry, as these 2 industries are seen to continue rapid phase of growth in technology. These 2 industries will be relying heavily on Internet of Things (IoT) in the future. Group will actively engage sector players, to offer high quality standards and broad range of solutions.

February 2020 Quarter Report link:

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=208808&name=EA_FR_ATTACHMENTS

2019 Annual Report link:

4. TECHNICAL ANALYSIS - Trading At Historical Low Price, With Sellers Volume Diminishing

Let's take a look at the monthly chart of EG:

A few observations below:

i) EG is now trading at historically low prices since its listing. The previous historical low was 32.5c, during the 2008 financial crisis. It seems the selling has been overdone, considering the strength in company revenue and prospects, coupled with improving economic conditions, do not indicate that we are in any financial crisis

ii) Stock is now trading at lower BB, indicating a bargain hunting opportunity for long term investors

iii) Selling volume is diminishing, and buyers are rejecting lower prices

iv) RSI and stochastics also indicating oversold positions

Let's take a look at the daily chart:

A few observations:

i) Stock touched a low of 28.5c and refused to drop further. Volumes of buyers are starting to support it

ii) Stochastic and RSI indicating oversold condition

iii) Volume of sellers are diminishing

5. Lower Entry to EG via EG-Warrant C (EG-WC)

For investors with lower capital, may consider entry into the company warrants.

Let's take a look at profile of EG-WC:

![]()

A few observations:

i) Maturity in November 2020, another 8 months to go till expiry

ii) Strike price of 42c, which is considerably ok considering the amount of time left until expiry

iii) Premium of 55%

If we look at the mother share price, EMA14 is at 40 cents. Should the mother shares see rebound in price soon, the warrants will also see potential gain of price as there is sufficient time for price appreciation and the strike price is reasonably within the range of achievement within 8 months.

CONCLUSION

Based on my opinion, I believe EG is undervalued and should be given attention, based on below:

i. EPF as a substantial shareholder in EG at 10 million shares (3.89%)

ii. Stock trading way below its NTA of RM 1.33 and Low P/E Ratio at 6.3X

iv. Chart Shows Buyers Rejecting Lower Prices, And Stock Is In Oversold Condition

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

Armada An Quantum Leap Stock In 2019/2020

Yaa , i hope eG management will not take his parent company (jubilee) 'offer to Buy' parent share.

Judging from Jubilee long pressurised price it wont be a good sign at all aspects.

2020-03-04 09:04

Armada An Quantum Leap Stock In 2019/2020

Simple trading entry !

Scenario #1;

To whom betting qtr3 deliver $1mil pat.

Safer entry wud be at $0.230-0.250

Scenario #2;

For those confidence with its next qtr3 to deliver $3.6mil pat

Can possibly reap big by entry at 0.270

Above estimate breadth dies comply my 1:3 risk to reward principle.

2020-03-04 09:08

Armada An Quantum Leap Stock In 2019/2020

Kena margin call kali,hehe !

Better he sell all, let stronger investor Quanta in.

2020-03-05 08:56

lol. epf major shareholders in many company, doesnt mean anything ... example mrcb and mbsb ... does the share price move up?

2020-03-05 16:58

another one naive people

thinking EPF buy is good share price will up

thinking NTA high than share price , share price will up

2020-03-05 17:36

U see they have about RM3M of receiveables that is 60-90 days over due date. If this is written off as bad debt next quarter. The profit for coming quarter will be 0. or negative if the fail to make less than RM3M... I don't really like its huge overdue RM140M (1-90days overdue) receivables which actually exceeds its current market cap lol

2020-03-05 18:26

Armada An Quantum Leap Stock In 2019/2020

I feel amaze with your multiple view perspective in this stock.

Cant object above points u dissected.

Only thing is, what if its next release qtr3 pat < qtr2 ? What will be the damage to its share price ?

To be fair, a better qtr3 than qtr1 is not totally impossible.

If, someone does compare over the Risk vs Reward ratio, then it wud be a much confident trade by knowing what level to entry best.

2020-03-04 08:48