Mplus Market Pulse - 17 Aug 2020

MalaccaSecurities

Publish date: Mon, 17 Aug 2020, 11:48 AM

Momentum still weak

Market Review

Malaysia: The FBM KLCI (-0.8%) erased most of its previous session gains weighed down by the weaker-than-expected 2Q2020 GDP data that contracted -17.1% YoY – the weakest quarterly performance in history. Consequently, the key index shed 0.9% WoW. The lower liners also edged lower, while the broader market was painted in red with the healthcare sector (-5.1%) taking the heaviest beating.

Global markets: US stockmarkets closed mixed as the Dow (+0.1%) chalked in mild gains while the S&P 500 slipped 0.02% after the retail sales in July 2020 rose 1.2% YoY; the third straight monthly gain. European stockmarkets was downbeat on weakness in travel & leisure stocks after UK added France and the Netherlands to its quarantine list, while Asia stockmarkets ended mixed.

The Day Ahead

Expectedly, quick profit taking sent the FBM KLCI alongside with major indices to close in the red. The weakness was compounded by the sluggish 2Q2020 GDP growth data that came below consensus expectations. Moving forward into the final two weeks of the month, we think that investors will be focusing on a barrage of corporate earnings data that is expected to be as dour on the whole, in tandem with the recent release of Malaysia’s GDP data.

Sector focus: While the volatility will remain a feature, we think that the pullback in healthcare and technology sector may warrant another look with the resilient demand and upcoming batch of corporate earnings from the aforementioned two sectors may also outperform their peers.

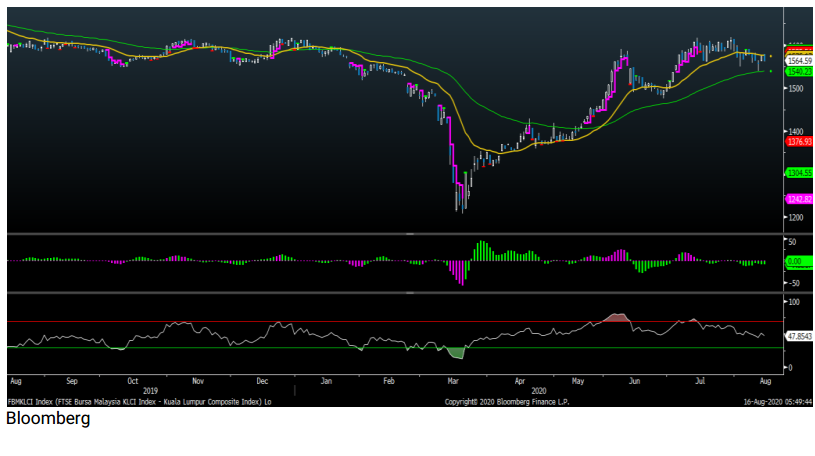

FBMKLCI Technical Outlook

The FBM KLCI has formed a bearish candle to reverse most of its previous session gains after lingering largely in the negative territory. We think that the consolidation may remain in place with the immediate resistance located at 1,590, followed by 1,615. On the downside, the immediate support remained pegged at 1,550, followed by 1,540. Indicators are still weak with the MACD Line continues to tread below the Signal Line, while the RSI remains below 50.

Company Brief

Kelington Group Bhd’s wholly-owned unit, Kelington Engineering (Shanghai) Co Ltd has received a re-measurement contract from the largest semiconductor foundry company in China to perform gas hook up works in Shanghai, China. The period of the contract is two years, commencing 5th August 2020. Total contract value worth RM61.8m subject to the actual amount of work carried out. (The Star)

JF Technology Bhd has proposed a placement. The proceeds from the placement would go towards increasing its total built-up area from 46,000 sqf to 90,000 sqf, building additional facilities and expanding its capacity by about 60.0%. It is also allocating one floor to go into Test Interface services to move higher up in the value chain where there are less competitors and better margins. (The Star)

Air Asia seeks to play a bigger role in the medical tourism sector by providing medical charter flight services. It is working closely with medical institutions and government authorities to ensure inbound patients have a seamless travelling experience from Indonesia to Malaysia as Indonesia accounts for the highest number of inbound healthcare tourists arriving into Malaysia. Air Asia will continue to work with strategic partners like Hospital in Penang, with support of Malaysia Healthcare Travel and will launch an end-to-end online health and wellness platform on AirAsia.com. (The Star)

Pentamaster Corp Bhd's 2QFY20 net profit fell 12.9% YoY to RM17.0m on lower contribution from the telecommunications segment, which was partially offset by higher contribution from the semiconductor and medical devices segment. Quarterly revenue was down 14.7% YoY to RM103.0m. (The Edge)

Carlsberg Brewery Malaysia Bhd's 2QFY20 net profit dropped 83.7% YoY to RM10.7m — its weakest since 2QFY09 as pandemic-driven lockdowns from the COVID-19 outbreak in Malaysia and Singapore severely impacted its production and sales. Revenue for the quarter fell 40.2% YoY to RM287.3m. No dividend was declared for 2QFY20. (The Edge)

KNM Group Bhd’s wholly-owned KNM Process Systems Sdn Bhd has received a purchase order from Single Buoy Moorings Inc (SBM Offshore), a Dutch-based oil and gas company to supply PME pressure vessels separators for the Prosperity floating production storage and offloading (FPSO) project based offshore Guyana for a contract sum of US$4.1m (approximately RM17.1m). The supply and delivery duration of the contract is for a period from 13th August 2020 until 1st June 2021. (The Edge)

IOI Corp Bhd has partnered Malaysia-based plantation sustainability and technical support organisation Wild Asia to connect and give more value to small producers within IOI Corp’s supply base. Its responsible sourcing team under commodity marketing had completed its first physical raw material connection with the Wild Asia Group Scheme (WAGS) programme. The WAGS aims to build a network of small producers that are working on their land sustainably towards enhancing essential soil organic matter and growing healthy produce for the betterment of our ecosystem, communities and the environment. (The Edge)

T7 Global Bhd has secured the approval of Bursa Securities to proceed with a 20.0% private placement exercise encompassing the issuance of up to 117.0m new shares to partially fund its on-going projects. The exercise will raise up to RM42.0m and will be utilised for three on-going projects. (The Edge)

KPJ Healthcare Bhd will allocate capital expenditures of up to RM150.0m per year for 2021 and 2022 to add 900 beds progressively up the end of 2023 with 600 new beds from the expansion of existing hospitals and a further 300 beds from its new hospital, namely KPJ Damansara 2 at Bukit Lanjan, Selangor that will employ an asset-light model. (The Star)

Source: Mplus Research - 17 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

CAPITALA2024-11-22

IOICORP2024-11-22

KGB2024-11-22

KPJ2024-11-22

KPJ2024-11-22

KPJ2024-11-21

CAPITALA2024-11-21

IOICORP2024-11-21

JFTECH2024-11-21

KGB2024-11-21

KPJ2024-11-21

KPJ2024-11-21

KPJ2024-11-20

IOICORP2024-11-20

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-19

KGB2024-11-19

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-18

IOICORP2024-11-18

KGB2024-11-18

KGB2024-11-18

KGB2024-11-18

KPJ2024-11-18

KPJ2024-11-18

PENTA2024-11-15

IOICORP2024-11-15

IOICORP2024-11-15

IOICORP2024-11-15

IOICORP2024-11-15

KGB2024-11-15

KGB2024-11-15

KGB2024-11-15

KPJ2024-11-15

KPJ2024-11-15

PENTA2024-11-14

CAPITALA2024-11-14

CARLSBG2024-11-14

CARLSBG2024-11-14

CARLSBG2024-11-14

IOICORP2024-11-14

IOICORP2024-11-14

IOICORP2024-11-14

KGB2024-11-14

KGB2024-11-14

KGB2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

PENTA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

IOICORP2024-11-13

IOICORP2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KPJ2024-11-13

KPJ2024-11-13

PENTA2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-12

CARLSBG2024-11-12

CARLSBG2024-11-12

IOICORP2024-11-12

IOICORP2024-11-12

IOICORP2024-11-12

KGB2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

PENTA2024-11-12

T7GLOBALMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024