Mplus Market Pulse - 5 May 2021

MalaccaSecurities

Publish date: Wed, 05 May 2021, 09:25 AM

Market Review

Malaysia: The FBM KLCI (-0.2%) trended lower for the third straight session after enduring a choppy period, bogged down by selling pressure in gloves heavyweights. The lower liners finished mostly higher, while the broader market ended mostly higher with the Energy sector (+1.2%) leading the pack.

Global markets: The US stockmarkets finished mostly lower as the S&P 500 and Nasdaq shed 0.7% and 1.9% respectively after Treasury Secretary Janet Yellen brought about potential rates rise amid the strong economy growth rate. European stockmarkets were downbeat, while Asia stockmarkets closed mixed.

The Day Ahead

The FBM KLCI posted losses for the third consecutive session as upward momentum on glove heavyweights has waned quickly on profit taking in the afternoon session. Tracking the negative performance on overnight Dow, our local exchange is expected to remain subdued on the back of rising Covid-19 cases which led to a tighter MCO implementation on six districts in Selangor. Meanwhile, the technology sector may see further pullback following the overnight decline of Nasdaq in Wall Street. On commodities, Brent oil price has seen a spike near to 2- month high on the back of demand optimism, while lumber futures charged towards all-time-high region.

Sector focus: We continue to like packaging-related stocks amid implementation of stricter MCO. Besides, higher Brent oil price, coupled with the higher-thanexpected results from the oil giant Saudi Aramco could spur buying interest, while trading interest should be noticed within lumber related stocks.

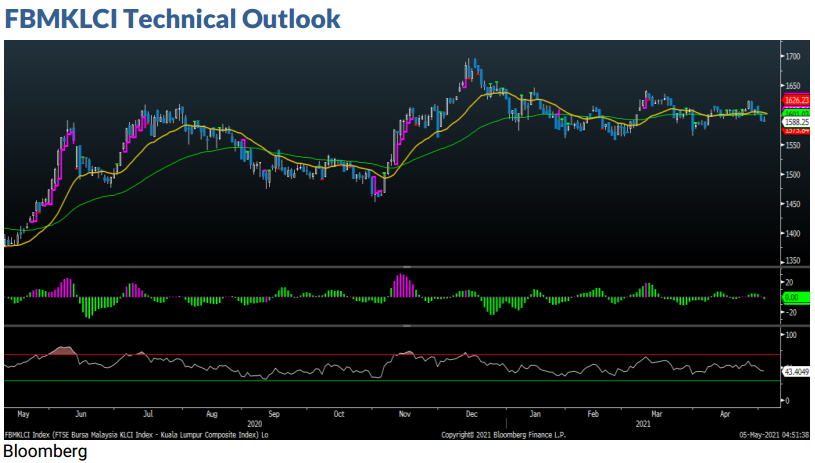

The FBM KLCI extended its losses for the third straight session, hovering below the 1,600 psychological level. Technical indicators remained negative as the MACD Histogram has extended a red bar, while the RSI was hovering below the 50 level; MACD line oscillated below the zero level. The next resistance is envisaged around 1,615-1,635 if the key index managed to stay above the 1,600 level; while support is set at 1,565.

Company Brief

Hartalega Holdings Bhd’s 4QFY21 net profit surged 878.1% YoY to RM1.12bn, as demand increased tremendously due to the impact of the global Covid-19 pandemic. Revenue for the quarter jumped 195.5% YoY to RM2.23bn. A third interim single tier dividend of 17.70 sen per share, payable on 9th June 2021 was declared. (The Star)

T7 Global Bhd has secured a RM50.0m work order award from Petronas Carigali Sdn Bhd for the provision of plug and abandonment integrated services. The energy solution provider said the work order was awarded to its wholly-owned subsidiary Tanjung Offshore Services Sdn Bhd and is effective from 29th March 2021 to 28th December 2021. (The Edge)

KLCCP Stapled Group’s 1QFY21 net profit fell 17.4% YoY to RM146.1m, as the prolonged Covid-19 pandemic dragged the group’s retail and hotel segments. Revenue for the quarter slipped 20.4% YoY to RM282.4m. A dividend of 7.0 sen per stapled security was declared. (The Edge)

Fraser & Neave Holdings Bhd’s (F&N) 2QFY21 net profit grew 1.3% YoY to RM103.5m, on the back of higher sales, favourable product mix, as well as prudent control of advertising and promotion spend. Revenue for the quarter rose 8.6% YoY to RM1.09bn. An interim dividend of 27.0 sen per share, payable on 16th June 2021 was declared. (The Edge)

Can-One Bhd has received a notice of unconditional mandatory takeover offer from major shareholder Eller Axis Sdn Bhd after the latter has inked an unconditional share sale agreement with Genkho Candoz Sdn Bhd to acquire 40.2m shares or 20.9% in the metal-can manufacturer at RM2.50 per share or RM100.6 m in total, in cash. With the 20.94% stake buy, the collective equity interest held by the offeror and persons acting in concert increased to 60.6%, prompting this mandatory offer for RM2.50 per share. (The Edge)

Tomei Consolidated Bhd's 1QFY21 net profit 244.0% YoY to RM13.8m, mainly due to an increase in consumer demand, particularly for yellow gold jewellery. Revenue for the quarter gained 91.0% YoY to RM244.2m. (The Edge)

YTL Corp Bhd’s 98.0%-owned subsidiary YTL Cement (Hong Kong) Ltd has finalised the disposal of its 100.0% equity interest in Zhejiang Hangzhou Dama Cement Co Ltd (Dama Cement). YTL Cement invested in Dama Cement in 2007, and has seen aggregate returns of about CNY1.30bn (RM827.0m) and profits of about RM250.0m from it, since. YTL Corp, however, did not disclose the disposal price for Dama Cement. (The Edge)

S P Setia Bhd has proposed the establishment of an Islamic medium term note programme of up to RM3.00bn in nominal value. Proceeds from the proposed issuance will largely be used to fund capital injection into the group’s joint-venture Battersea Power Station project and refinance earlier borrowings undertaken to fund this project. (The Edge)

Velesto Energy Bhd is investigating the worksite incident involving the Velesto Naga 7 rig occurred at the worksite due to rapid penetration into the formation whilst operating in offshore Sarawak for a client. The rig is covered by insurance, and recovery efforts are ongoing and monitored. Drilling activities have not commenced and no well has been drilled. (The Edge)

Mah Sing Group Bhd’s wholly-owned subsidiary Nova Century Development Sdn Bhd is buying an approximately 2.0-ha land in Tempat Jalan Genting Kelang, Setapak for a proposed estimated RM618.0m mixed development, comprising residential and retail components, from Teratai Constructors Sdn Bhd. Based on preliminary plans and subject to approval from authorities, the new project, to be named M Astra, is planned for a mixed development comprising two blocks of serviced suites and some retail lots. (The Edge)

Rohas Tecnic Bhd had secured a transmission line fabrication job with an estimated value of RM37.0m. Its wholly-owned subsidiary Rohas-Euco Industries Bhd had accepted an order from Larsen & Toubro Ltd for the fabrication of 500kv Overhead Transmission Towers for the transmission line connecting a 1,200MW power generation plant in Pulau Indah to the Olak Lempit main intake substation. (The Edge)

Focus Dynamics Group Bhd and LKL International Bhd have teamed up to initiate the rollout of a chain of lifestyle-based pharmacies in the Klang Valley, and eventually nationwide. The two companies will set up a dedicated vehicle to house the new business, with Focus Dynamics taking a majority stake of 60.0% and LKL the remaining 40.0%. (The Edge)

Source: Mplus Research - 5 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

SPSETIA2024-11-17

T7GLOBAL2024-11-17

YTL2024-11-16

HARTA2024-11-16

TOMEI2024-11-16

VELESTO2024-11-15

F&N2024-11-15

SPSETIA2024-11-15

YTL2024-11-15

YTL2024-11-15

YTL2024-11-14

F&N2024-11-14

HARTA2024-11-13

F&N2024-11-13

F&N2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

KLCC2024-11-13

KLCC2024-11-13

SPSETIA2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-12

F&N2024-11-12

F&N2024-11-12

F&N2024-11-12

HARTA2024-11-12

HARTA2024-11-12

HARTA2024-11-12

KLCC2024-11-12

KLCC2024-11-12

KLCC2024-11-12

KLCC2024-11-12

MAHSING2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

T7GLOBAL2024-11-11

F&N2024-11-11

F&N2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

YTL2024-11-08

F&N2024-11-08

F&N2024-11-08

HARTA2024-11-08

KLCC2024-11-08

KLCC2024-11-08

KLCC2024-11-08

KLCC2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

MAHSING2024-11-08

T7GLOBAL2024-11-08

YTL2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

LKL2024-11-07

LKL2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

MAHSING2024-11-07

SPSETIA2024-11-07

SPSETIA2024-11-07

YTL2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

SPSETIA2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-05

F&N2024-11-05

F&N2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

SPSETIA2024-11-05

T7GLOBALMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024