(CHOIVO CAPITAL) A Look At OPENSYS (M) Berhad (OPENSYS)

Choivo Capital

Publish date: Sun, 09 Jun 2019, 02:47 AM

For a copy with better formatting, go here, its alot easier on the eyes.

===================================================================

Well, its been sometime since I last wrote. And well, it was mostly out of me being a little lazy, more focused on my reading, as well as some self-reflection in terms of my investing and how I go through life in general.

In any event, I decided to get back in the groove of things with this bit of research I did for OPENSYS (M) Berhad.

The reason i’m sharing this is due to,

-

Better or similar opportunities in the market, especially globally, given the fall in prices recently.

- I’ve already bought my position. For the record, it’s a smallish position mainly due to me finding opportunities elsewhere.

In addition, I also felt that as most of my insight was already stated out in bits and pieces by others via blogpost or comments, with some stretching back to 2015. It would not make much difference for me to share my research.

As always, criticism is preferred.

OPENSYS (M) Berhad (KLSE: OPENSYS - 0040)

Recommendation

We are long OPENSYS (M) Berhad (OPENSYS – 0040), with intrinsic value estimated to range from RM0.273 to RM0.664 per share. This represents a range from, a downside of 11% to an upside of 118% from the current share price of RM0.305.

Business Description

OPENSYS (M) Berhad principal activity consist of assembling and maintaining machines/providing solutions relating to,

- CRM Machines (2012 onwards)

- Cheque Truncation System (CTS)

- Payment Kiosk

Prior to 2012, the company’s main business consists of providing cheque processing services by selling and maintaining the CTS machines, which via image processing, converts cheques and standing instructions into electronic fund transfer instruments, with as much as 80% operational cost savings to banks at less than half the price of traditional systems, as there was no need for the physical movement of cheques.

They also provided non-cash-dispensing self-service kiosks that allowed customers to make deposits of cheques and cash, pay bills and renew insurance premium and subscription plans using cash, cheques, credit and debit cards.

In both areas, they are both the cost, product and market leaders. However, both industries are currently in a period of contraction.

Cheques used to be the only/easiest way to provide multiple approvals for certain payments, however, these days, most banks have made special approval tokens, that can be given to multiple individuals and only have payment made when all relevant parties have given approval via those tokens.

As for Payment Kiosk, most of these with online and electronic payments, not much point going to a branch to use a computer, when you can do so at home.

The company makes money by selling the machines at a gross profit margin of 10 - 15% and charges an annual maintenance fee of 10 – 12% for the machines. The main portion of the profit comes from the maintenance services which have much higher margins.

In 2012, they embarked on a new area of growth via CRM Machines, an industry which many would also consider a declining industry, but I digress.

Investment Thesis

-

Cash Recycling Machines are the best product/solution based on first principles.

Compared to other solutions, such as Cash Dispensing Machines and Cash Deposit Machines, Cash Recycling Machines offer roughly 30% savings in operational cost and capital expenditure.

The logic is quite straightforward, you now only need one machine, and as the machine can both accept and dispense cash, the amount of times you will need someone to come and either collect/refill the money will naturally reduce by around half.

-

Cash will continue to consist of the bulk of payments (by transaction count) globally for a long time.

Other than Sweden, cash is still widely utilized worldwide making up 85% of global transactions by volume.

Now, naturally most will point to China, where cash is used increasingly less due to the proliferation of QR codes.

The question we need to ask is, are situations like these the rule or the exception?

Despite the systems used by Alipay etc being the best technologically (highest capacity and processing speed) and having the lowest cost. Why is VISA and Mastercard still the mainstay globally?

Why do people still use credit cards and debit cards instead of e-wallets like Alipay etc? The reason is two pronged.

Firstly, the Chinese population was severely under-banked back when Taobao etc was launched by Alibaba etc in 2003 and 2004. Alibaba then introduced Alipay as a solution process payments on that platform.

With the sheer growth in these online shopping platforms which very quickly captured the bulk of the market for both suppliers and customers.

This resulted in most people in China having and using an Alipay account, before they even had a bank account, much less a debit or credit card.

Other than car loans, housing loans and corporate loans, the people of china completely skipped this process of being banked by traditional providers.

This meant there was no momentum or vested interest stopping banks or financial providers from going cashless.

The second reason is, till today, Alipay does not charge even 0.01% in transaction cost for any of the more than USD6 trillion processed each year. They make money from the fact that the vast majority of the Chinese people actually keep their savings and current accounts on ALIPAY, and buy their money market funds, fixed deposit and other financial products.

This meant that most merchants are more than happy to use ALIPAY. This is clearly not the case in Malaysia or most countries.. Most e-wallets merely serve as aggregators for other payment services such as Master, Visa etc, which charge a fee from 0.15% to 2% depending on the type used.

Good luck having vendors swallow that, especially since they can’t charge more for people paying using debit/credit cards, pursuant to a new BNM ruling. And let’s not forget the monthly fee to rent a merchant processing machine, which Alipay does not charge.

I don’t see my favorite hawker ever taking payment via visa anytime soon.

Currently, most e-wallets are going on a tear bleeding money like crazy to acquire customers. Touch N Go went from making RM20m a year to losing RM40m a year just from trying to acquire customers. The only reason most people have in using the current e-wallet services (Grab, Boost etc) is due to these customer acquisition promotions.

At some point, the Softbank etc venture capital money is going to run out, and these companies are going to need making money. I bet they will run out of money before people stop using cash.

-

The Opensys Edge

Currently, OPENSYS is the market leader in CRM machines, with 80% of the market share.

Most people may not know this, but CL Systems was the first in 2011 to introduce a self-service cash recycler machine. OPENSYS only thought started going through the process of qualifying for providing the machines in 2012 and sold their first machine late 2012.

Despite giving their competitors a head-start, by 2016, OPENSYS still obtained an 80% market share of the CRM Market, with the remaining 20% shared by CL Systems, NCR and Diebold Nixdorf.

This out-performance can be attributed to a few reasons,

- For most banks, the Cash Deposit and Cash Dispensing Machine runs on two different computer systems, the difficulty then lay in creating the software to combine these two channels into one. OPENSYS was the first to do that.

-

This business is similar the rubber glove business, in that the maintenance and capital expenditures machines consist of a small portion of the Bank’s cost, with service, quality and technology being the focus of the banks, assuming the pricing is similar.

In these areas, OPENSYS is easily the best, with the two most kiamsiap and China-man banks in Malaysia, Hong Leong Bank and Public Bank adopting their CRM machines en-masse.

-

This one is purely anecdotal, however, unlike CL Systems, NCR and Diebold Nixdorf, OPENSYS/OKI is a local business run by local Chinese.

The other 3 are MNC’s whose base of operations are in Hong Kong, America and Germany, with the Malaysia business is run by one of their local branches.

Well, I would bet my money on the local Chinese with skin in game, being a lot more driven than some Ang-Moh manager here on work holiday.

Catalyst

- High probability of tripling to quintupling the profit related to Software Solution & Services

Recently, Bloomberg just reported that for the first time in a long time, the number of ATM’s have fallen by 1% globally.

What Bloomberg does not tell you, is that their ATM count consist of 4 different types of machines. They are, Cheque Deposit Machines, Cash Deposit Machines, Cash Dispensing Machines and Cash Recycling Machines.

Given the 30% savings operational maintenance and capital expenditure, banks are often replacing two machines (cash dispensing and cash depositing) with one cash recycling machines. Share of these machines have increase from 34% to 38% compared to the previous year.

They are currently roughly 17,500 (2017) Cash Dispensing and Cash Depositing machines in Malaysia, with growth expected to be roughly 5% per annum. To be conservative, let’s assume growth to be zero.

20% of them consist of CRM machines, with OPENSYS having 80% market share. They had installed a total of 2,500 and 3,200 CRM as of 2017 and 2018.

Most ATM and CDM machines were likely to have been bought before 2015, when OPENSYS is going around making banks aware of the technological and cost benefits of CRM’s, having started selling to Hong Leong and Public Bank, as well has having passed trials for other banks.

As most banks in Malaysia are now fully aware of the technological and cost benefits of CRMs and are planning to replace their machines CRMs when their equipment reaches the end of their life-span, which are typically 8 to 10 years. (Other factors such as end of vendor support for software operating systems, regulator changes and compliance to international standards, may shorten the replacement cycle for ATMs and CDMs.)

We can safely say the bulk of the remaining 80% of non-CRM, Cash Dispensing and Cash Depositing Machines in Malaysia will be replaced within the next 5 years.

Given OPENSYS’s ability to hold 80% market share within 2 years, despite giving their competitors a 1-year head start, it seems highly likely that they will be able to maintain this market share as the remaining machines are replaced.

Giving a potential 5X growth in maintenance revenue and earnings in 5 years, or 3X growth, assuming that the remaining 80% is evenly split between Cash Dispensing and Cash Depositing machines, and they are converted to CRM Machines on a 2 to 1 basis.

Ie: One Cash Dispensing and one Cash Depositing machine, is converted into one CRM Machine.

Key Risk

-

OPENSYS may not be able to maintain the market share.

Currently OPENSYS have sold CRM machines to every major bank in Malaysia, however, the bulk of the machines are sold to Hong Leong Bank, Maybank and Public Bank.

It is a little odd, why the rest of the banks seem to be a little slow in adopting the CRM compared to those two banks who are replacing the machines very aggressively. Especially since so many Cash Dispensing and Cash Depositing machines are so old.

It could be the typical GLC “take your time” attitude, or it could be a matter of solving the software programming to tie up both cash dispensing and cash depositing computer systems.

- Forex Risk

Profits from the sale of the machines do get affected by forex risk, as purchase is denominated in JPY. However, this is not the bulk of the value of this Company in our opinion.

- The Company is unable to maintain non CRM related Software Solution & Services revenue and profit

The non CRM related Software Solution & Services revenue and profit may well fall exceeding the gain in CRM related ones.

I don't think the revenue related to kiosk is significant, however, we may very well be proven wrong.

Valuation

For our valuation, extremely conservative assumptions will be taken, and four different scenarios will be performed, common assumptions are as follows.

- 0% Growth in Total number ATM and CRM machines (Consensus is 5% growth).

- Discount Rate of 4.5%.

- All un-allocated Expenses and Income relate to “Software Solution & Services” (SSS).

- 20% of Machines are CRM, remaining 80% is equally split between Cash Deposit and Cash Dispensing Machines. (Cash Dispensing Machine is likely to be far more than Cash Deposit Machine)

- Tax Rates of 24%.

- Zero profit from CRM Machines (This is the most onerous and unlikely one).

- The market values OPENSYS at a PE of 10 in 5 years.

Scenario 1

Profit 5 years from now is calculated by taking the 2018 SSS Profit, less all un-allocated income and expenses. A corporate tax rate of 24% is then applied.

The remaining 80% Cash Deposit/Dispensing Machine are all converted into CRM Machines (essentially X5).

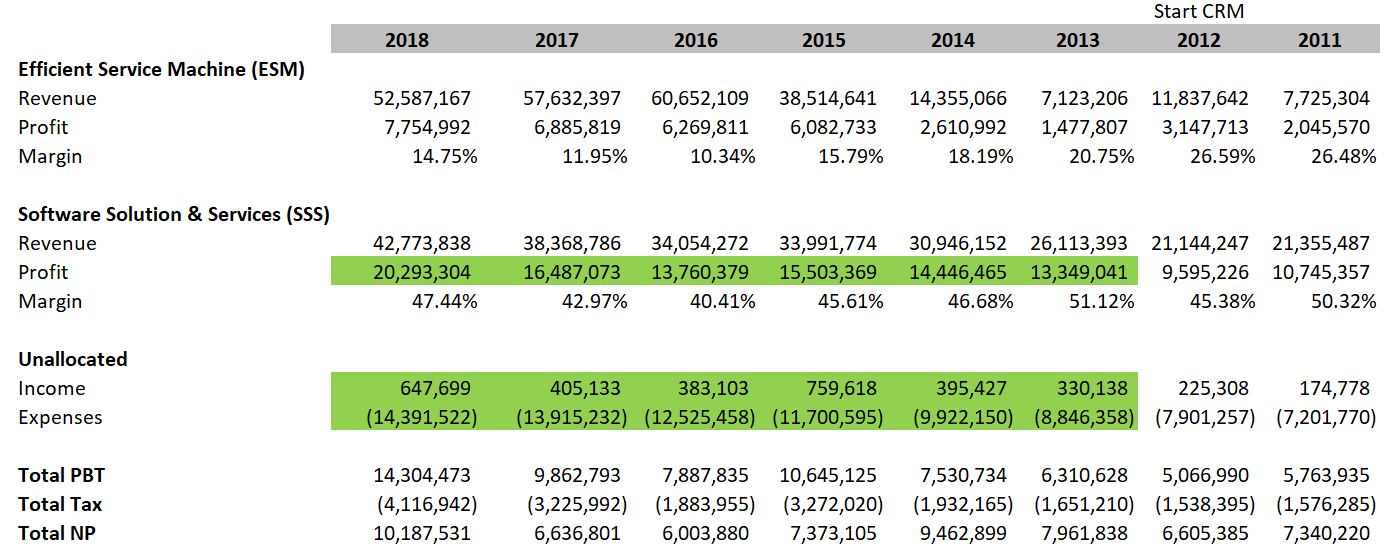

2018 SSS Profit: RM20,293,304

Less: 2018 Net Unallocated Income and Expense: RM(13,743,823)

Equals: Profit Before Tax: RM6,549,481

Less 24% Corporate Tax - Profit After Tax: RM4,977,606

Profit After Tax in 5 Years when remaining 80% Machines Converted to CRM (X5): RM24,888,028

Market Capitalization in 5 years (10PE): RM248,880,280

Discounted at 4.5% for 5 years: RM197,700,306

Price per Share: RM0.664

Scenario 2

This scenario is the same as scenario 1, except, the remaining 80% Cash Deposit / Dispensing Machine are all converted into CRM Machines on a 2 to 1 basis (essentially X3).

It assumes that if a branch has one Cash Deposit Machine and one Cash Dispensing Machine, it will be converted to one CRM Machine. This is quite unlikely as banks usually convert both to a CRM.

2018 SSS Profit: RM20,293,304

Less: 2018 Net Unallocated Income and Expense: RM(13,743,823)

Equals: Profit Before Tax: RM6,549,481

Less 24% Corporate Tax - Profit After Tax: RM4,977,606

Profit After Tax in 5 Years when remaining 80% Machines Converted to CRM on a 2:1 basis: RM14,932,817

Market Capitalization in 5 years (10PE): RM149,328,170

Discounted at 4.5% for 5 years: RM118,620,183

Price per Share: RM0.398

Scenario 3

This scenario is a much more conservative.

The profit 5 years from now, is calculated by taking the "Incremental net profit before tax growth related to CRM SSS only", that is then added to the current 2018 SSS Profit, less all un-allocated income and expenses in 2018. A corporate tax rate of 24% is then applied.

"Incremental net profit before tax growth related to CRM SSS only" is calculated by taking only the difference in SSS profit in from 2012 to 2018 (first machines sale is in late 2012, maintenance service revenue kicks in on 2013), less the proportioned (based on % of the 2012-2018 difference, on 2018 SSS Profit) un-allocated expense and income.

The remaining 80% Cash Deposit/Dispensing Machine are all converted into CRM Machines (essentially X4).

This scenario this amount assumes that the non CRM related revenue and profit is maintained.

However, it also severely understates the growth in in CRM related revenue and profit, as the gain in CRM related SSS profit is more than the net difference, due to the fall in cheque processing SSS profit from 2012 to 2018.

It sounds a bit confusing, but you can better understand it from the working below.

Difference in 2018 and 2012 SSS Profit: RM10,698,078

Less: Proportioned Un-allocated Expense And Income: RM(7,245,370)

Equals: Profit Before Tax from CRM only: RM3,452,708

Profit Before Tax from CRM only in 5 Years when remaining 80% Machines Converted to CRM (X4): RM13,810,833 (A)

2018 SSS Profit: RM20,293,304

Less: 2018 Net Unallocated Income and Expense: RM(13,743,823)

Equals: Profit Before Tax: RM6,549,481 (B)

(A+B) Less 24% Corporate Tax - Profit After Tax: RM15,473,839

Market Capitalization in 5 years (10PE): RM154,738,390

Discounted at 4.5% for 5 years: RM122,917,841

Price per Share: RM0.413

Scenario 4

This scenario is the same as scenario 3, except, the remaining 80% Cash Deposit / Dispensing Machine are all converted into CRM Machines on a 2 to 1 basis (essentially X2).

It assumes that if a branch has one Cash Deposit Machine and one Cash Dispensing Machine, it will be converted to one CRM Machine. This is quite unlikely as banks usually convert both to a CRM.

Difference in 2018 and 2012 SSS Profit: RM10,698,078

Less: Proportioned Un-allocated Expense And Income: RM(7,245,370)

Equals: Profit Before Tax from CRM only: RM3,452,708

Profit Before Tax from CRM only in 5 Years when remaining 80% Machines Converted to CRM (X2): RM6,905,417 (A)

2018 SSS Profit: RM20,293,304

Less: 2018 Net Unallocated Income and Expense: RM(13,743,823)

Equals: Profit Before Tax: RM6,549,481 (B)

(A+B) Less 24% Corporate Tax - Profit After Tax: RM10,225,722

Market Capitalization in 5 years (10PE): RM102,257,220

Discounted at 4.5% for 5 years: RM81,228,951

Price per Share: RM0.273

Conclusions

Needless to say, if one were to properly take into account in the valuations,

-

The consensus 5% growth in total number ATM and CRM machines.

-

The profit from CRM Machines over five years fully paid out as dividend amounting to RM115,200,000:

- Selling price: RM72,000 per machine

- 12.5% margin

- 12,800 machines - remaining 80% not yet converted to CRM, assuming same market share.

Valuations are likely double at minimum. However, im quite the risk averse person who believes in erring strongly on the side of caution. Feel free to do the math if you have the time.

In addition, for those who are unaware, i am not in the business of doing quarter prediction analysis. The total revenue and profit for Opensys is likely to be quite lumpy, from the ESM/Hardware sales.

The main goal for this bit of research, is to show and understand the SSS revenue and profit for the CRM business.

Do let me know if you have any comments.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Morning Jon, thank you for this sharing.

One question, what is your timeline for your forecast, one year, five years?

2019-06-09 09:51

teoct,

i expect 5 years for or so for complete conversion for all non crm to crm's.

2019-06-09 10:52

Another potential risk is

https://www.socash.io/

But i dont really see how it will become the norm.

2019-06-09 11:00

No idea.

Do note its not a target price, its the range of values i consider the company to be worth today.

====

Posted by teoct > Jun 9, 2019 11:12 AM | Report Abuse

Sorry, i meant timeline for your prediction on the share price.

2019-06-09 11:14

There are currently more and more entities joining the e-wallet race. Eventually there will be a shake out.

Personally, will eventually use it as looking for change is most annoying and I am from the dinosaur age.

Reason why in China, Alipay and the others have not charge for the terminal and transaction fee is because they earn interest on the float (that is before money is credited to the merchant accounts). China central bank is proposing changes to this as technically the float money belong to the many merchants. And also the many users balance, no interest paid (unlike banks saving accounts).

I am not sure of Bank Negara rules on this.

2019-06-09 11:23

Short Sell loh.

I must be the first person to write a "Long Article" while telling you potential downside 20%.

Manage to get out of dayang?

2019-06-09 12:44

Very conservative valuation!!

Why?

1. CRM sales are material starting only in 2014 and peaking in 2015 until 2018 (see table ESM revenue >RM50m)!!

2. Opensys provides 3 year free maintenance period. It means maintenance profit started only in 2017!! (see table SSS margin)

3. Maintenance profit margin is north of 80%!! Just ask any software maintenance guys. There is almost zero cost. Majority fixed labor cost.

4. PE ratio should >15x because earnings growth potential >30% for next 3 years and recurring income is >80% of profit!!

5. Free cash flow > net profit. Very little capex for a software business. Some value in property bought few years back!!

Opensys is easily worth >RM300m market cap (<RM100m today)!! When profit double in 2 years, it will start to attract attention!! People are fixated on e-wallet today because of free cashback!! Cash is king!!

2019-06-09 13:08

Good Analysis.

Personally I think the machines are not very user friendly, spit out money over and over again. (In fact I think Diebold has the best performance in that regards). But that probably doesn't matter as banks only look after their own interest.

In China, CRMs are horrible (as bad as their banking service). Their CRM gives you fake money because the machines cannot recognise fake money when it was deposited. If that happens in Malaysia, nobody would want to use CRM.

2019-06-09 13:47

Interesting, thanks. I didn't know that about china.

From an investment perspective, the keep spit out money thing is probably a plus, since it really helps with keeping out the fake notes.

I'm assuming Diebold is also just as effective at that, but more effective at identifying old notes vs fake notes? I never thought to test like that as i don't think it affects the economics of the business. Still its interesting to know.

2019-06-09 14:03

(US/CHN trade war doesn't matter) Philip

Actually one interesting point which I am trying to figure out. Opensys does not do their own R&D for these machines, and it is instead a licensed technology from OKI, Japan. The question which I could not clear up the answer to is:

1) what is the terms of the technology partnership. Is it a profit sharing deal, or just a pure franchiser/franchisee deal where OKI sets the master price and opensys sells based on the listed price to customers. What is the minimum stocks level to keep, will the system buying costs erode/increase over time, and most importantly is opensys working on their own homegrown solution in the future to compete with fintech and peers.

2) it seems your assumption of profits here are all based on pure sales only ( correct me if I am wrong). But another part of opensys sales is also based on leasing of machines as banks I believe will be far more interested in short term 1-3 year leases of the esm equipment at a higher service price, but without the hassle of buying and storing the equipment. For opensys looking at note 14 of inventory there is write down of used machines, as these machines cannot be cannibalised for new equipment or reused for other applications. There is a 10,313,089 write off of esm equipment which I assume is the leasing part of equipment that has been obsolete/ revamped. As OKI does not have a policy of taking back old machines and refurbishing I believe the difference in service actual profits will be quite substantial, as I am taking the example of my office leasing the latest xerox photocopy machine for a 3 year contract and returning it after the lease is up for a newer model, which is cheaper than buying a new machine.

In the end what will be the market size of this industry, what will be the acceptable method for it's main customer base ( fintech, direct purchase and ownership, leasing) and how clear will be the profit and revenue growth 5-10 years from now are frankly speaking quite murky for me.

I would say it is not a bad business, but neither will I submit capital into such an endeavor. Opensys has a huge market share 80%, but in a space where the total addressable market is very small. The customer base is also very niche, which is worrying all the same as some believe opensys is worth 300+ million.

Time will tell.

2019-06-09 14:54

Fair points phillip.

I dont think they lease machines, more like receive payment for each transaction, when it comes to the kiosk and cheques. Look at the revenue note, they dont state any lease/rental income.

I'm fine with the write offs. You see the big ones in PPE note, however, i noticed that they are mostly fully depreciated to begin with. The adjustment amounts to only about 24% of current year depreciation, so an error rate of about 2-3% per annum on a straight line basis, relatively normal.

I do however, find it odd that they disclosed the write off in inventory. Probably need to find out.

Having said that, if we perform a valuation where every division except for CRM contributes zero, ie, we only take into account CRM SSS net profit, and included the discounted net profit from CRM sale, we are still looking at intrinsic value per share of around 40 to 50 plus cents.

Pretty good, but not utterly amazing, which is why its a relatively small 6.5% position.

You may want to take a look at kraft heinz and intel.

2019-06-09 15:39

(US/CHN trade war doesn't matter) Philip

The intrinsic value is based on a proposition that trajectories will stay current. I guess the big puzzle is to always understand if any slowdown in growth is permanent or temporary. Opensys already had a drop-off in machines sales in the latest annual report.

The usual mathematical assumption is

If 1 bottle of beer is sold at $1, then 100 bottles of beer is $100.

But in the real world if you went to the market to buy 100 bottles the price is more likely to be $90. A bigger bulk discount. As different modes of payments compete, I believe most banks will choose the option the involves the lowest cost of maintenance and financial expenses.

I believe based on slower than expected contribution over a longer period of time than expected, inclusive of increasing costs, exchange rates and competition, you will be be closer to a intrinsic value per share of 19 to 25 cents. Using your crm projection based on projected sales. But again this is projection as I am more conservative on the real number of CRM upgrades, replacements and it's maintenance in the long term.

In my opinion, the dividend payout will not match the earnings growth in the long run, as the earnings and revenue of the latest quarter will not match the expectations of further growth as expected.

It is the age old question, give out dividends now and sacrifice future growth, or withhold dividends so earnings growth can match future expectations.

It is like asking people in the 50's if credit card will ever take off, everyone believed then that credit card fraud will be it's downfall. If you told them visa would process 11 trillion dollars in payment volume in 2018 it would boggle their mind.

My personal opinion is that fintech will be a booming monstrosity, and as usage becomes more prevalent, there will be less and less OTC transactions and machine cash applications in the future. I can't remember the last time I carried a 1000 ringgit note, much less bringing the 10,000 singapore dollar note around.

I believe cash will definitely have it's place in the future, but ATM, CRM usage will definitely drop as cashless payments become more secure and easy to use.

Lightning always finds the path of least resistance to earth.

2019-06-09 18:24

In terms of value, electronic have far far exceed cash.

I have never carried a 1000 or 10000 sgd note out before, usually i ask them bring it to my house.

However, i think almost all of us here, visit the ATM once or twice a month at minimum. And assuming you do go out to eat, you will be spending cash.

You buy durian from uncle on the street? Cash.

Why don't i think e-wallets will make it in malaysia? Its simple. The economics dont make sense. You can't make money from e-wallets.

Why do shops accept e-wallets now? Because e-wallets are paying out subsidies to attract them, giving discounts on the vendor's goods to their customers, paid out of their own pocket.

Of course i'll help you as a vendor.

But if the economics become, i will charge the vendor 0.1%-2% when they receive payment, and due to BNM ruling as well as the fact customers wont want to swallow this, the vendor cannot pass on this cost, will i accept card or accept cash?

Unless you run incredible cash volumes, it would not make sense to rent the terminal and pay the 0.1-2% per transaction.

At the end of the day, the sheer fact is that this service is not free (and cannot be free due to economic reasons), unlike alipay in china, it will be unlikely become the mainstay, at least in terms of transaction volume.

2019-06-09 18:35

they make money or lose money.....who cares? makes any difference to dividends?

this kind of business, one year make, one year lose.

this is at best a family kind of business , marketing agent of MNC.

2019-06-09 18:38

landscape, technology, market leaders, competitions changes over night....no point.

2019-06-09 18:43

fund managers prefer some thing more solid, preferably large accessible markets, own technologies, repeatable businesses, continuous improvements, sustainable and predictable.

2019-06-09 18:51

by the way, traders like me may be interested if there is a reason to trade the share.............is there one?

2019-06-09 18:53

before that there is Dataprep and its Lityan Systems...where is Dataprep and its ATM systems now?? started with a lot of promises....same kind of business.

market cap $ 90 million looks low....but there are reasons why so low.

2019-06-09 19:03

Well, opensys have captured 80% of the market now for CRM and in cheques, they hold 85% of the market.

I think they can get the bulk of the market, esp since no bank is a fan of maintaining two systems. Think of it, when a company buy IT equipment, they just all whack dell, or apple etc

Paynet has been around since 2014.

It would be interesting if banks were to allow instant transfer at zero cost instead of debit cards.

But why do so? Debit card transactions is about RM21 billion this year or about 150 million transactions for malaysia. Rates of debit card is lower of 0.21% or RM0.70 +0.01%.

For simplicity, lets just use the 0.21%. That is about RM44.1 million raked in from fees, basically free money.

For the record, that amount is more than triple the total amount of profit from the maintaining ALL ATM's (CRM etc) in malaysia (based on my working above). Its about double the revenue from maintenance services for ATM.

Lets not even talk about credit card.

Nobody is going to shoot their own RM44.1mil free money ricebowl.

2019-06-09 21:34

(US/CHN trade war doesn't matter) Philip

True story, I bought durians in tangkak using alipay.

2019-06-10 06:45

(US/CHN trade war doesn't matter) Philip

http://www.xinhuanet.com/english/2018-08/18/c_137399728.htm

This durian seller is using alipay and wechat to receive payment from tourists.

The convenience for tourists and for himself in not needing to hold can that can be stolen by thieves is definitely a boon.

2019-06-10 09:19

investing is participating in its growth...................market growing?

market share growing ? 80% already.

2019-06-10 17:29

value investors have under performed all other investors long long time already.

2019-06-10 19:09

Should emphasize more on the maintenance income from CRMs which is recurring and growing. When I discuss about Opensys, most people think it's all about sales. As in the company sells a CRM and gets money, don't sell no money. What they don't get is that every CRM that Opensys sells will generate maintenance income. Opensys gives free maintenance for 3yrs. After 3yrs, Opensys charges about RM6k per machine per year. For those going for the AGM this week, can confirm with the company.

2019-06-10 21:19

u know this maintenance revenue thing, its like palm oil trees reaching maturity, first u have 700 machines contributing, next its 1400, then 2100, 2800 and 3500 trees generating cash for opensys, the revenue curve will go up year after year, and so will the profit curve. but now heres wwhere it gets exciting, the number of staff will hardly increase, because for 3 years when machines were under warranty, they already had to be maintained "for free" the workforce structure is already in place to support this 3200 machines, meaning after 3 years, the revenue kicks in but costs dont go up. (because no new hires are needed) every rm 1 in revenue flows directly to the bottom line, if 19 mil rev comes in and no increase in costs, the company should get close to 14-15m in PAfter tax. that is 200-300% what it is earning now.

2019-06-11 02:05

calvintaneng

Good and thorough writeup. Thumbs up.

For today also visit www.chick.com

Btw.

Banks do put cash collecting and dispensing in petrol stations, shopping complex or places where there is heavy footfalls. As space will be limited and rent going up it will be cost effective to install one rather than 2 if one can do the job of 2

2019-06-09 08:35