(CHOIVO CAPITAL) LCTITAN (5284) - Rising ASP's, Falling Costs, Butadiene (Glove Proxy), Hurricane, Selling For Cash (A Summary)

Choivo Capital

Publish date: Fri, 25 Sep 2020, 11:02 AM

Well, this is a piece i've started studying for the last two weeks, and i think its one of the best ideas i have had in Bursa.

I will only be sharing the summary for now. The full article will come this weekend.

Enjoy, and i hope you as my reader, can pick it up cheaply still.

This is the full article.

https://klse.i3investor.com/blogs/PilosopoCapital/2020-09-26-story-h1514324256-_CHOIVO_CAPITAL_LCTITAN_5284_Five_Magic_Words_Rising_ASP_s_Falling_Cost.jsp

======================================================================================================

Overview

COVID19 resulted in increase in demand for online delivery for goods and foods, as well as face mask, PPE, throat swabs etc as well as nitrile gloves.

This resulted in large increase in demand for plastics and butadiene.

Currently supply for Plastics is insufficient, from April to July, inventories of PE and PP in the US have already fallen by 756 million lb or 343,000 metric tonnes due to the increased demand.

In addition, globally, butadiene prices have increased very strongly with even TOPGLOVE facing supply shortage.

Despite explosive earnings projected for Q3 and Q4 2020, share prices of plastic and butadiene focused petrochemical companies are sharply down.

Why LCTITAN?

80% of revenue is from polyolefins (polymers and plastics), and polyolefins segment contributed more than 85% to its Profit Before Tax in FY2019. PCHEM plastics contribution is less than 50%.

Feedstock consist of 95% of petrochemical company’s costs. PCHEM feedstock is Natural Gas (up 5% for the year), LCTITAN feedstock (Cost of Goods) is Naphtha (down 34% for the year).

Rising ASP's

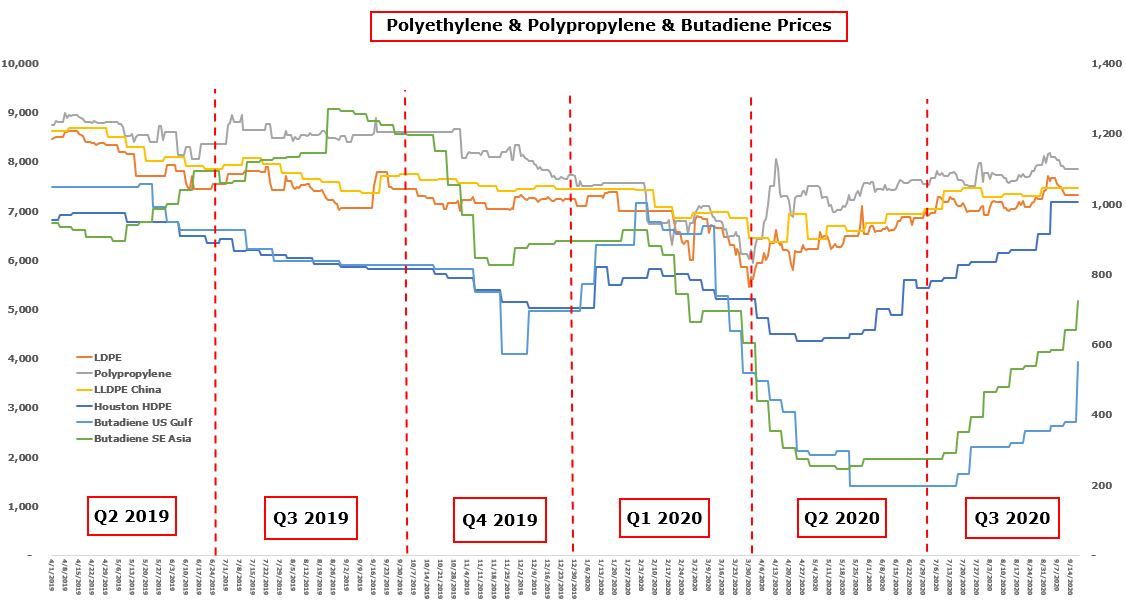

Polyolefin and Butadiene prices have increased strongly due to supply shortage and is higher than 2019 or pre-covid levels.

Polyethelene (LDPE): USD7,105mt to USD7,325mt (3% increase)

Polypropelene: USD751.5mt to USD784.6mt (4% increase)

Polyethelene (HDPE – Houston): USD705mt to USD1,005mt (43% increase)

Polyethelene (LDPE – China): USD744.0mt to USD747.3mt (0.4% increase)

As for Butadiene, prices have doubled since Q2, and is higher than Pre-Covid levels, which I’ve defined as Feb 2020.

Versus Q2 2020

Butadiene (South East Asia): USD275mt to USD725mt (163.6% increase)

Versus Feb 2020 (Pre Covid)

Butadiene (South East Asia): USD665mt to USD725mt (9.0% increase)

Even with just these prices (before the Hurricane Price Spike comes), LCTITAN can go back to Q3-Q4 2019 earnings, RM130m per quarter, or RM520m per year, except Naphtha cost today is much lower.

Falling Costs

Naphtha is the main feed stock for LCTITAN and 95% of their costs. Prices for Naphtha is close to all time low, fallen from USD536.17 to USD353.85 (Down 34% for the year).

The last time Naptha prices was around this level was in 2016 (it was still higher then). In 2016, LCTITAN recorded their all time high profit at RM1.3bil.

Hurricane Laura Decimating Petrochemical Refineries in USA

Just like the previous petroleum refinery trend in 2017-2018, a hurricane occurred just last week in Louisiana, United States.

Hurricane Laura has hit and affected the petrochemical complexes in Lake Charles, Louisiana, and this is expected to further squeeze the already rising and high PE and PP prices.

("With not enough PE or PP supply to satisfy demand prior to Hurricane Laura, these markets have just become extremely tight," Pruett said. As Hurricane Laura approached Louisiana, Pruett said that 10-15% of US PE and PP production shut down as a precaution.")

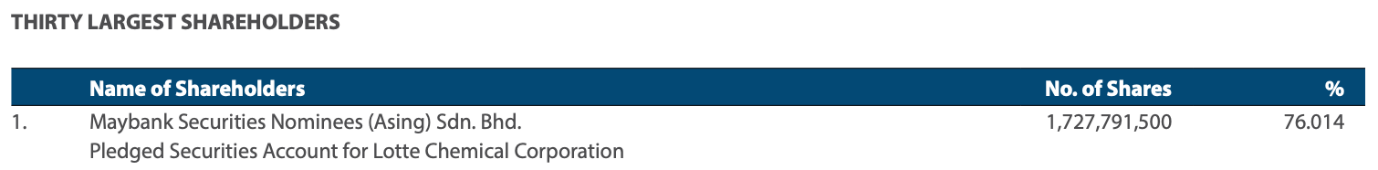

Public Float

76% shares held by Korean Holding co who won’t sell. As the free float is only 24%, share price is likely to increase without much resistance when market realizes their potential.

There is also now increased liquidity due to the Dividend Reinvestment Scheme by the company.

50% Dividend Policy

Historically, LCTITAN have paid out dividend every year, and have 50% dividend policy.

Reduction in dividend previously was due reduced earnings, from falling PE and PP prices in 2019 (due to the ban on plastics import from the US by China, resulting in flow of US supply to Asia) combined with higher Naphtha prices.

Explosive earnings in Q3 & Q4 2020 is likely to result in a high dividend pay-out this year.

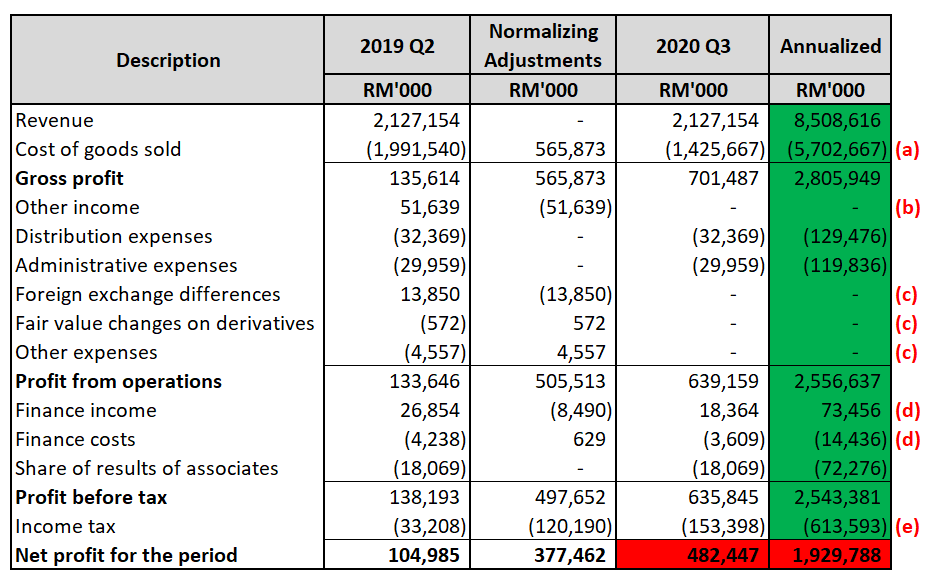

Projected Earnings

- Cost of goods sold include depreciation and staff cost. These are removed to isolate the Naphtha Feedstock cost. Amount shown is the 34% savings in net Naphtha costs.

- This is writeback of inventory (additional profit) for Q2 2019. It is a one-off item and thus not included to be conservative.

- These items are usually random and small in nature, as the net impact is an addition to profit, it is removed to be conservative.

- Interest income and expenses is adjusted to account for the lower BLR rate.

- Income tax is adjusted to 24% of the profit before associate loss and finance income.

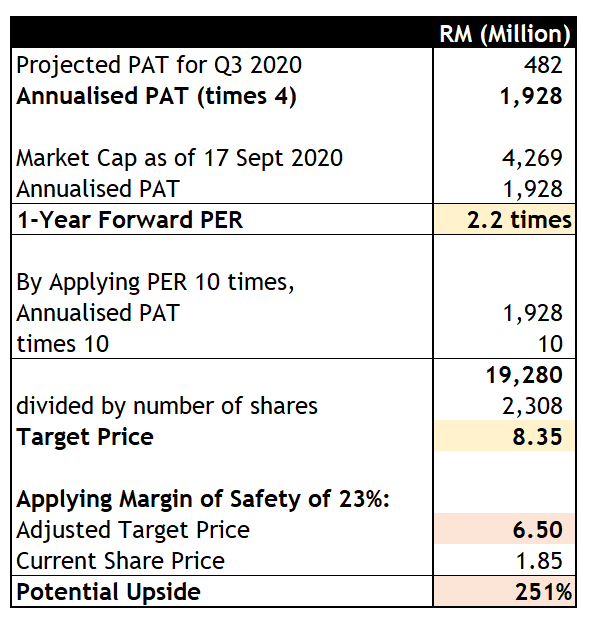

Q3 2020 profit projected to be around RM482mil, with an annualized number of RM1.9bil.

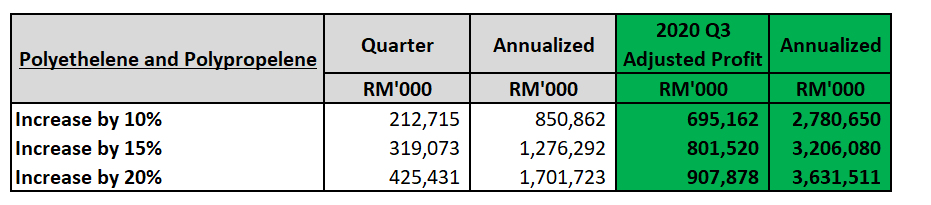

When PP and PE prices increase due to Hurricane Laura,

Q3 & Q4 2020 profit is around RM695m – RM908m with annualized profit of RM2.8bil to Rm3.6bil.

Valuation

Market Cap today, RM4bil, and,

![]()

Its also a zero Debt Company, with net cash of RM4bil.

Buy RM1 for RM1, get company that can make RM1.9b annualized for free.

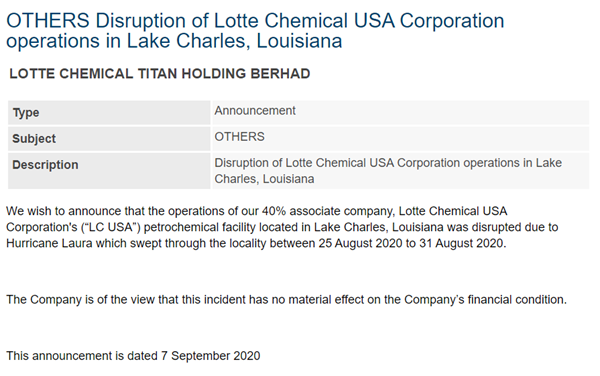

Risk Factors: Lotte Chemical USA Corporation

LCTITAN owns a 40% share in an ethane cracker and monoethylene glycol (“MEG”) plant in the USA. This plant was started up in September 2019 and primarily used to make ethylene from ethane. And MEG from ethylene.

Hurricane Laura also affected that plant as you see here.

Worst case scenario, it is shut down like in Q2 2020, where coupled with the low ethylene prices in the US then, it recorded a loss of RM18 million.

This loss is included in my target price estimate to be conservative.

However, the power plant was running and contributing to profit for a full 2 months, and with ethylene prices increasing strongly from July to September 2020.

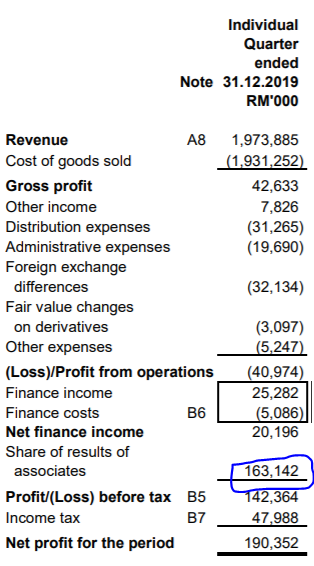

The more important question is this, how much did this refinery make when running at full capacity?

Profit of RM163m in ONE QUARTER (Q4 2019).

How much do you think it will contribute this round, when ethylene prices are higher than it was in Q4 2019?

And, one more thing

Is it priced in?

Has anybody fried this share up so far?

This stock is more virgin than extra virgin olive oil and is completely untouched.

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM2.4, despite being projected to make more money in Q3 2020.

Clearly the market is still pricing LCTITAN as some random petrochemical company that is going to suffer for the next 1 – 2 years due to reduced demand.

NONE of the FACTS I have written above have been priced into the stock AT ALL!

Do note my target price does not incorporate this. If this is included, earnings is likely to be 30% higher than the RM489m projected just for Q3.

In addition, in the statement, LCTITAN states that the impact will not be material, this means it should affect less than 5% of revenue, or in this case 10% of profit.

Target Price

Why 23% Margin of Safety?

Because I want the target price to be IPO price. Haha, but I think its adequate.

This company is going to go from being valued on a Price/Book basis, to Price/Earning basis, resulting in explosive share price growth. This does not account for momentum trading and herd mentality which is likely to increase the share price further.

Forward PER less than 2X.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Whatsapp: Email me, for Whatsapp, i can only accept up to 256 people (unlike telegram where the limit is 20k). So i try to be more selective for this.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Haha,

A first for sharp mind and acid tongue Philip to say something good about Jon, this make it a “must buy and don’t miss category”

Philip ( buy what you understand) Bought lctitan 200k shares on 22-23 after reading some reports from Jon around 1.79

25/09/2020 4:50 PM

2020-09-25 18:55

Nice one! But I couldn't quite get it until I red the other article by JomnJerry.

2020-09-26 00:58

https://klse.i3investor.com/blogs/PilosopoCapital/2020-09-26-story-h1514324256-_CHOIVO_CAPITAL_LCTITAN_5284_Five_Magic_Words_Rising_ASP_s_Falling_Cost.jsp

This is the full piece.

2020-09-26 08:42

TQVM Jon,

Finally a turnaround, dividend giving and potential growth stock, I’m waiting for to employ part of cash in my hlebroking trading account. (Bought about RM250K worth) My only complaint why Philip manage to get at RM 1.79 whereas my cost is about RM 1.84?

https://www.grandviewresearch.com/industry-analysis/global-plastics-market

2020-09-26 10:03

Haha, this fler is a NO principle guy. Previously keep criticise other ppl as quarterly predictor and now this fler become quarterly predictor. Obviously can sense him NO profitable track records on investment n just pandai talk, while I hv spotted a few good stocks n earned comfortably over 4-5 years. He often say want long long term investment but now pick cyclical stock like LCTitan.

2020-09-26 13:35

soojinhou

Haha what do you know. The fler who called everyone else quarterly predictor himself became a quarterly predictor haha. Talk about irony.

2020-09-25 18:19