(CHOIVO CAPITAL) POS (4634) – The Next Proton (Except you can buy it directly)

Choivo Capital

Publish date: Sat, 31 Oct 2020, 08:50 AM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) POS (4634) – The Next Proton (Except you can buy it directly)

========================================================================

“Never Waste a Good Crisis.”

Winston Churchill

One thing about a crisis, is that they change consumer habits, speeding up both the demise and growth of different industries.

As this is Bursa Malaysia, when one can only go long and not short, i’ve spent quite sometime the last 1-2 months looking for companies whose growth have sped up, or whose business is poised for a turnaround as a result of this crisis.

And most importantly, companies whose valuations are still logical.

And this last criteria of logical valuations is particularly hard to meet, especially these days, when every glove, plastic, healthcare stocks are flying through the roofs.

Last week, I think I’ve found a fairly compelling idea.

I’m still in the process of doing a very deep analysis on the company and am planning to do a full write up.

However, it appears that doing so will take much more time than expected.

So here is a summary instead, which i think is more than comprehensive enough, and conveys most of what I’ve discovered and think about the company.

The Online Delivery Boom

One industry I thought should do well during this crisis, is the companies in the Delivery Industry, whether they are a “Last Mile Provider” or “Warehouse/Integrated Logistics Provider”.

Larger amounts of online deliveries (number of parcels processed per day have doubled from 400k to 800k according to POS Laju), should result in a drastic expansion in this industry.

I mean, even the government is sending you SMS’s to start buying things online.

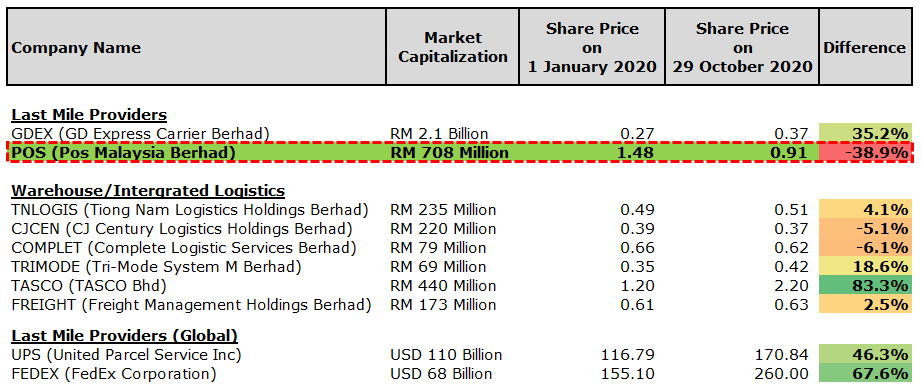

And looking at their share prices below.

As we can see, most of them have recovered up to their pre-pandemic valuations. Some of them are also doing very well in terms of share price appreciation.

GDEX is an obvious candidate to benefit from this, given that their biggest business (more than 95%) is in the last mile delivery.

Meanwhile, companies like TASCO benefited from being linked to vaccine transportation by virtue of their cold logistics chain (they have since denied it), as well as an increase in flight freight rates which implied increased profits.

Or, TRIMODE who benefited from being the logistic provider of choice for most glove companies in Malaysia.

However, one thing that stands out the most for me, is the underperformance of POS Malaysia in terms of share price.

POS Malaysia, like GDEX is the most direct beneficiary of the E-commerce Boom but is a major laggard.

However, unlike GDEX, who has seen its share price increase 33.3% since the start of the year, the share price of POS Malaysia has instead fallen by 39%.

I don’t think this is justifiable, given their position as the largest last mile provider with the widest reach in Malaysia.

Especially since POS Malaysia have particularly strong market share among SME’s and new e-commerce businesses, which are currently the main drivers of e-commerce and likely to continued doing so in the future.

The Transformation of POS Malaysia

& Taking Advantage of a Crisis

Nobody ever said that only people in the equities market can take advantage of a crisis. Businesses can too.

So how has POS Malaysia taken advantage of this crisis?

Or more precisely, what are the things POS Malaysia have spent the last 3 years doing in order to be perfectly poised to take advantage of this crisis?

Opening an Online Portal (POS Laju Sendparcel)

On October 2019, POS Malaysia Launched POS Laju Sendparcel.

This is a fully online platform, which allows customers/businesses to auto generate consignment numbers easily, provide 24-hour access and fast order placements, instant pricing quotes, and drop off parcels at drop off points (they can come to you if volume is enough), and auto-calculate volume discount.

Since it opened in October last year, they have grown exponentially (with the numbers exploding upwards due to the CMCO), and now have 86,000 users (that is a lot of users if your customer base is SME’s), and is on track exceed its initial target of RM30 million in Revenue for its first year.

From barely 400k average parcels per month for the period of (October 2019 – June 2020), to 2 million packages a month for September. Utterly incredible

Creation of Fully Automated Fulfillment Centres

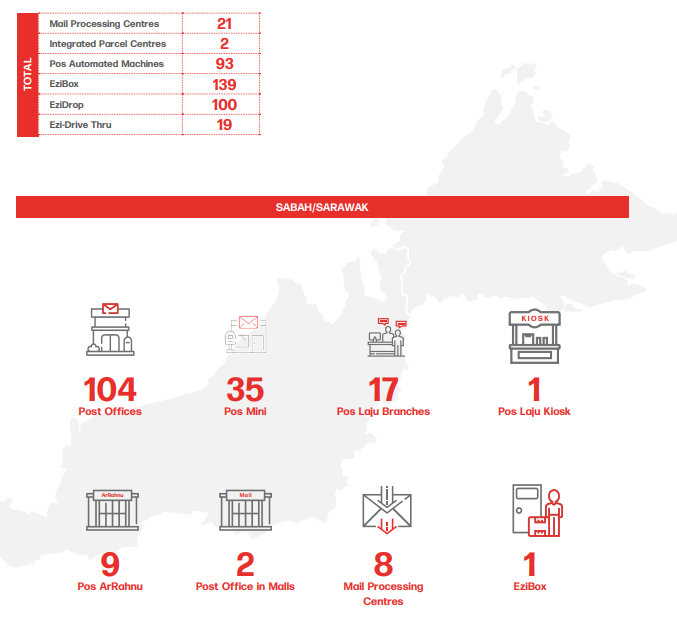

Currently, POS Malaysia has a courier segment capacity of 530,000 parcels a day from two parcel processing centres in Shah Alam and at KLIA2 (That excludes 78 Pos Laju offices nationwide, which double-hat as a front office to receive parcels as well as to act as mini parcel processing centres in the back of the premises).

As many would have noticed, the two main parcel processing centers are in Selangor.

As there is no other parcel processing centers anywhere else this increases processing time. For example, a package from Singapore to the receiver in Johor, needs to pass by KLIA first.

To make their courier segment/parcel delivery more efficient, they will be spending approximately RM340 million develop fully automated integrated fulfilment centers in the Northern region, East Coast Region, Sabah and Sarawak.

Their first one in Senai Airport (costing RM40 million with the capacity to process 120,000 parcels a day) will be completed in 2021.

These fully automated integrated fulfilment centers will enable them to do cut them processing time, and provide same day deliveries in these areas.

Installation of Semi Automated Sorting Systems

Over the last two years, since the new CEO have joined, POS Malaysia have installed 28 distribution centers with semi-automated sorting systems which reduce manual workload and streamline workflow for total efficiency.

The installation of these semi-automated sorting systems results in immediate benefits to its processing capacity and speed, where they are now able to process 60 per cent more items, bringing down the total processing time by one to two hours per day.

Drastically Increasing Personnel via the POS Rider

Scheme (Bypassing Unions)

For Q2 2020, courier volume increased 72% versus Q2 2019 from 343,000 parcels daily on average, to 590,000 parcels. Today, the daily average is 600,000 to 800,000 parcels a day.

To cope with this increased demand, POS Laju decided to take advantage of their POS Rider Scheme (launched October 2020), which paid their riders purely on commissions (They took in an additional 1,300 riders initially).

This bypasses their Unions (There is 7 Unions in this Company), and makes these additional costs purely Variable instead of a Fixed one.

In addition, it also appears to be decent for the riders, many of them who have lost their jobs during this crisis.

This also appears to be the model POS Malaysia will be taking in the future, likely reducing their overall “all in” cost in the future.

Directly Hiring Cargo Planes

Since April, POS Malaysia have taken to directly engaging with Cargo Flight Services to supply the sudden increase in demand. Increasing the capacity of cargo transportation from 200 tonnes a week to 510 tonnes a week.

And all this during a time when rates for planes are at close to all-time lows, from jet fuel being so cheap these days (it used to be the highest and most expensive grade), that it is even being blended and used in Ships (which typically uses the lowest grade).

Bringing Forward IT Investments

(Save Costs, Increase Revenue, Expand Bottomline)

For most companies, increasing IT investments during this period means spending money on ZOOM, Microsoft Teams, and Laptops.

This is not the case for POS Malaysia.

They have brought forward their plans to spend RM100m to digitalize their core systems, including a new track-and-trace system, to drive up revenue and service quality up while containing costs.

The new core systems are expected to be fully operational by mid-2020, with the peripherals and sub-systems to follow.

The data analytics portion will be fully online in two years. The data analytics portion is there to help them manage their resources more efficiently, for example, in terms of manpower distribution and responding to volume growth in different areas.

Funding the Above – Simplify, Simplify, Simplify

(Disposal of Non Core Systems)

How to pay for the above? Right issue your ass all the way to Holland?

Well this not the POS Malaysia way.

Since the new CEO came in, POS Malaysia have taken steps to dispose partial stakes of their Non-Core Business, to business partners with the capability to run it well. Just like Proton.

-

Divestment of 51% shares in wholly owned subsidiary World Cargo Airline Sdn Bhd (WCA) to Asia Cargo Network Sdn Bhd (ACN) via issuance of new shares in WCA to ACN for RM40m cash. This will give rise to RM63m in disposal gain. Last year, this company lost RM32m.

-

Divestment of a 49% stake in Pos Aviation Engineering Services Sdn Bhd to SIA Engineering Co Ltd for a cash consideration of RM10.09 million in February 2020.

- At least one more divestment is will happen next year, and if I have to guess, it will be the Ah Rahnu pawn broker.

Finding the Right Management

For some of you who have been keeping track of POS Malaysia, and Syed Mokhtar Albukhary’s companies in general, you would have noticed quite the flurry of activity.

Interestingly, unlike the children of most extremely rich businessman (like the YTL daughters who seem more interested in enjoying the nice things in life) this lady appears to be quite the go-getter and have quite the CV.

Like many of the third-generation children, she has immaculate University Credentials, and Investment Bank experience (This can also be Top Tier Consulting Firms, or Banks), which, to be fair, is definitely something that can be bought with connections, donations or the potential of future business.

However, in her case, one thing really stood out.

She was also an external consultant for the Bill & Melinda Gates Foundation from October 2015 to May 2016, where she produced an integrated index to measure women’s empowerment and submitted a list of realistic recommendation on empowering women in various age groups.

Unlike, the above, this is something that cannot be bought.

In addition, in POS Malaysia, Syed Mokhtar changed 3 CEO’s in 2 years, in search for the right person, and most of them have very Non-GLC backgrounds, whether it was an ex Airasia C-Suite member, or people who worked for a long time in his other companies.

In addition, the new Chairman, Datuk Yasmin binti Mahmood, is not some political appointee or ex-government personnel who is there to warm the chair for optics. She was formerly the Managing Director of Microsoft in Malaysia.

Let’s not also forget, that Syed Mokthar was the person who dared to sell 49% of Proton (A company with the entire eyeballs of Malaysia on it, and deep emotional attachment for the Bumiputra’s) to a Chinese company, and have a Chinaman run it.

This is clearly not your typical GLC.

The Art Of Turning Weakness

Into Strength

Now looking, at the constantly down trending chart, the market no doubt seems to be thinking that the challenges being faced by POS Malaysia far outweigh the actions above taken by the Company to turn things around.

Let’s look at some of the key risk’s and challenges being faced by the company and see if this thinking is justified.

POS Malaysia have 7 Employee Unions and is

inefficient.

One thing people like to refer alot to, is the seven employee unions under POS Malaysia, and how this must mean that the company is inefficient.

It does sound quite reasonable, but let’s see if this is the case.

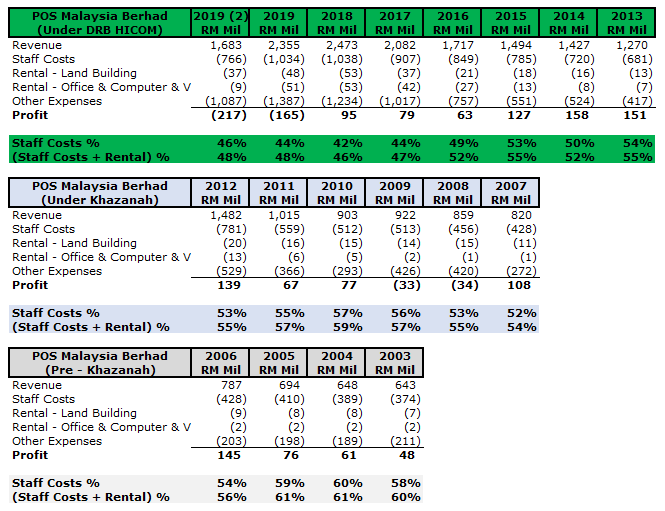

Since being taken over by DRB-Hicom/Syed Mokhtar in 2012, POS Malaysia have steadily recorded a reduction in Staff Cost % over Revenue.

This is from efficiencies found in the business, as well as, acquisition of DRB-Hicom’s logistics division to be integrated into POS Malaysia

(In case anyone is wondering, the acquisition was paid for with POS Malaysia Shares then, at RM3.3 per share. Which I think is fairly decent given that POS Malaysia shares were overvalued then)

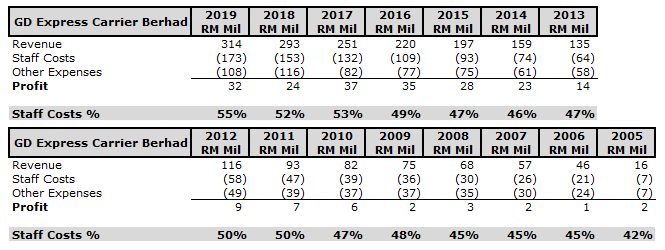

However, when looking at the numbers, we must always think about the comparison to its competitor.

And who better to compare against, other than GDEX.

The second biggest last mile provider in Malaysia, and because it is run by Chinese and have Singaporean links, is widely seen to be highly efficient.

As we can see from here, this is not really the case.

In fact, POS Malaysia staff cost as a percentage of Revenue, is lower than that of GDEX.

And even if we were to ignore the acquisition of POS Logistics in 2016, it does not change the fact that GDEX’s staff costs % have been steadily increasing over the years, while POS Malaysia’s have been staying even or reducing.

Why is this the case? Which brings us to the second point.

Mail Volumes have seen an accelerated decline

As it is widely known, around the world, mail have seen an accelerated decline over the years.

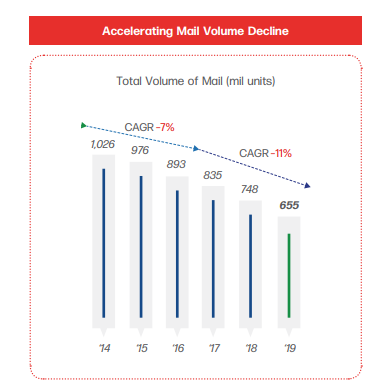

And this is no exception for POS Malaysia, from 2014-2016, total volume of mail has fallen from 1.026 billion to 893 million per year, for a CAGR of -7%. This has accelerated and from 2016 to 2019, this has fallen from 835 million per year to 655 million per year.

And the reason is obvious, with the advent of email, the internet, the mobile phone etc, the need for physical mail have fallen drastically.

Historically, the biggest users of mail with 95% share of customers, is commercial companies, such as banks etc who use it to send physical bank statements.

However, today, most people are getting their statements via email, which reduces the usage of physical mail. This along with other similar factors, resulted in the reduction of mail volume.

Historically, sending mail is a high volume, low value, low margin (if any) business, whose selling prices is capped by the government.

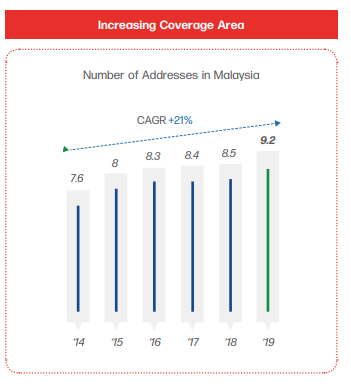

Except, cost escalates every year from both inflation, and the government’s requirement for increased coverage area (as they are a Universal Service Provider).

Since 2010, these rates have not been adjusted until 1 February 2020, when POS Malaysia got government approval for a postage rate increase for registered mail, commercial mail and small parcels below 2kg.

Stamp Rates (Commercial Mail): RM0.60 increased to RM1.30 (most companies use this when sending out mail)

Commercial Private Letterboxes: RM150 increased to RM 200 per year.

Postage of Commercial Registered Mail: RM2.20 increased to RM3.10

Postage of Non-Commercial Registered Mail: RM2.20 increased to RM2.40

As explained earlier, one of the roles of National Postal Services companies like POS Malaysia is their “Universal Service Obligations” to serve every corner of the country.

And currently, there is no profit in providing this service, it is a cost.

This increase in rates and is expected to contribute an additional RM100 million to RM150 million in pure net profit per year to POS Malaysia and help to reduce the cost of providing this service significantly.

And so, we must ask ourselves, is the reduction in usage of Mail a bad thing to POS Malaysia?

The answer is surprisingly not so simple.

Historically, “Mail” and “Courier/Poslaju” are two very distinct divisions. They often have their own sorting center, routes, delivery staff, and delivery vehicles etc.

However, as POSLAJU grew to represent an increasingly larger percentage of revenue and the “Postal” segment, POS Malaysia have started to take steps to merge these operations and consolidate them.

This initiative started somewhere around 2012 when DRB-Hicom took over and have only accelerated since then.

If you were to check with your typical POS Malaysia delivery person today, chances are their items consist of both Parcels and Mail.

Now, on average each piece of “Mail” gives slightly over RM0.70 of revenue, while each “Courier” on average gives about RM10 or so of revenue.

Given that operations are now consolidated, would it be better to drive 5km to deliver one piece of mail for RM0.70 (on average) or to deliver a Parcel which gives you RM10 (on average)?

Of course, there is the matter of sizing. However, I think that pales in comparison to the staff cost and fuel cost etc involved.

With their consolidated “Courier” and “Mail” segments, the reduction in “Mail” items and the increase in “Courier” items means that, POS Malaysia’s Postal operations is transitioning upwards in the value chain from low value items, to high value items that include tracking.

Too Many Outlets

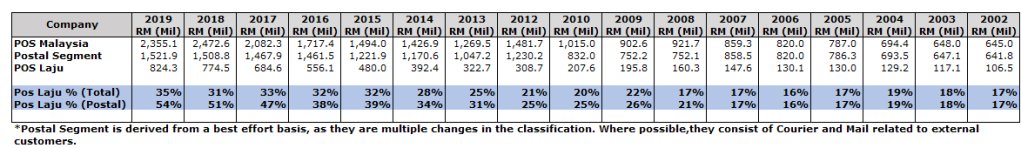

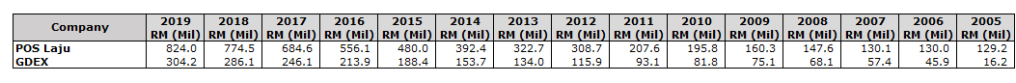

Now, in the point earlier, I showed that the revenue of POSLAJU/Courier segment have been increasing very strongly.

However, when analyzing a company, we must look at the numbers not in isolation, but in the context of the industry and other players.

And who best to compare to, then the second taikor of the Malaysia courier industry, GDEX.

Now what does these numbers mean?

Who grew faster?

Well, whether on a 3 Year, 5 Year or 10 Year basis. At every level, POS Laju have grown faster than GDEX.

How can this be the case?

How a Malaysian “GLC” beat a private company that is run by both Chinese and invested by TEMASEK (Singapore’s National Fund) and SingPost (Singapore National Postal Company)?

The answer is simple.

By virtue of being forced by the government to be a Universal Service Provider, this meant they needed to have a nationwide presence.

This network and coverage is something that was built up by POS Malaysia over its more than 100 years history.

And it is also the reason for their absolute dominance in the Consumer or SME market which led to their faster growth rate.

Now, for many of us, when we get a parcel from Shopee, Lazada (for example) these days, it would be from J&T Express, GDEX and POS Laju etc.

It would be fair to say that the smaller players, especially if combined, hold more market share in these large e-commerce businesses.

Now, business with large e-commerce players is something most would welcome due to the large volume.

But the fact of the matter is, businesses like this is not that lucrative. Because these business have have very strong negotiating power, and you can bet that every year, they will find a way to chop you on the price.

Now, let’s talk about the consumer of small SME market instead.

Let say you have a package to post, its very easy to find a POS Laju outlet, where on earth do you find a GDEX outlet or a J&T outlet?

These outlets do not exist (you can try to find a “Mail Box Etc” outlet, but these are far and few in between).

And if you are a standard consumer, or just started your business due to this pandemic, chances are POS Laju will be the first thing on your mind for delivery options, and you will be paying the list price.

In addition, E-commerce is largely driven by small businesses. The top 100 largest ad spenders on Facebook (less than 0.1% of business users), constitutes of only 17% of their revenue. It isn’t the giant businesses who will make up for the bulk in online spending.

It is the SME’s who do online Facebook live shows, or have a small e-commerce stores etc like these who will drive e-commerce.

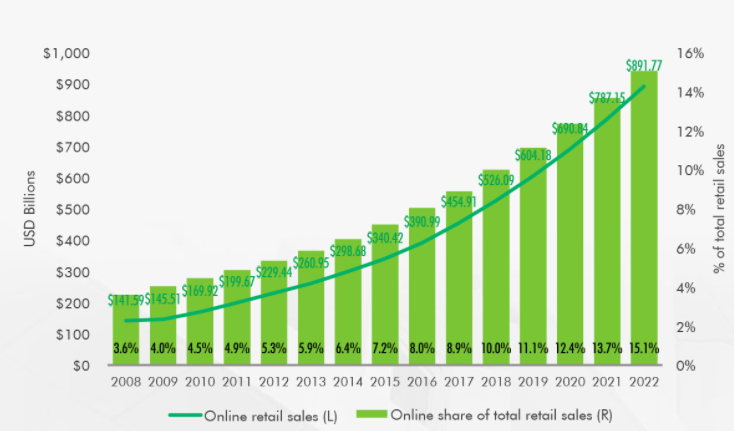

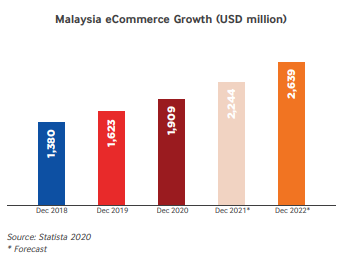

And this E-Commerce trend is only going to be accelerated by this pandemic and keep booming upwards in the coming years.

And it is far easier and cheaper to maintain a network of about 1,000 contact points to grab this Consumer/SME market, than it is to build one from the group up.

When I was studying POS, I could not help but notice the similarities between POS and Intel (back in the 1974-1984).

Back in 1974, Intel had 82.9% market share in DRAM, and this contributed more than 90% of their revenue.

Over time, the Japanese improved, and obtained production yields of around 40% higher than the US companies. They then flooded the market and turned DRAM’s into a commodity.

Intel suffered. And by 1984, their market share was just 1.3%.

Now, from 1974 to 1984, their Microprocessor division have been growing to become a large part of the business, and some of their middle managers have also quietly made the decision to adopt a new process technology which inherently favored Microprocessor rather than DRAMS.

And in 1984, at this inflection point, when facing the decision to on whether to throw more money into the DRAM blackhole, or to leave that business (it would be equivalent to Ford leaving the car business) and go all in into Microprocessors.

They picked Microprocessors, and until recently again got back a 90% market share.

Like Intel back in 1984, looking at the rise of ecommerce and the boom in the parcel business, POS Malaysia is currently at an inflection point.

And they have chosen to go all in, into the courier business and optimizing every inch of it.

Projected Profit for Q3 2020?

And so, I can hear the questions already.

“OK, it looks like it has a good chance of turning around this year.

You know, maybe the last two years results are not so good as it was still the gestational period of installing semi-automated sorting systems, and starting the online platform, and there was no rate increase then.

But what is the proof that all this is working?

Show me the numbers!”

Well, when POS Malaysia changed their CEO to Syed Md Najib in 2018, they embarked on a 5 year transformation plan, starting 2019, with plans to breakeven by 2021.

In a recent interview on 20 September 2020, he said that, due to the increased postal revenue from its SendParcels business as well as measures to increase the efficiency of its operations.

The original plan to breakeven for the year by FYE 2021, have been brought forward a year to FYE 2020.

His exact words are:

“A lot of our forecasts and plan had been expedited because of the Movement Control Order (MCO).

It would be fair for me to say that our plan has been fast-forwarded by about a year owing to the increase in demand for SendParcel’s services during the MCO period.

Originally, we forecast to break even [for the year] by the end of FY2021.

But now, we think we can hit break-even point by the third quarter and be profitable by the fourth quarter.

If the trend of increased demand for e-commerce continues, we are hopeful of reaching this target”

Now, this seems like a very bold statement to make, especially for a Company that made losses since Q2 2018.

In addition, for the year-to-date Q2 2020, POS Malaysia have made a net loss of RM66.75 million.

In order to breakeven by Q3 2020, it needs to make around that RM66m in profit.

Now based on the CEO’s statement above, he appears to be banking on the “Postal Segment” (their biggest segment) to turnaround and post profits.

Is this possible?

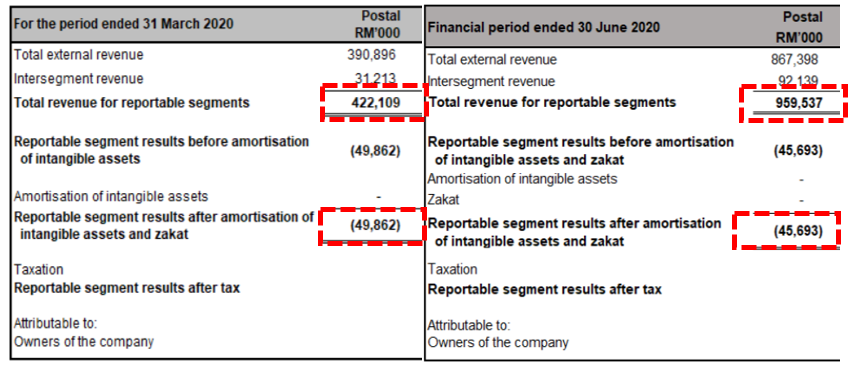

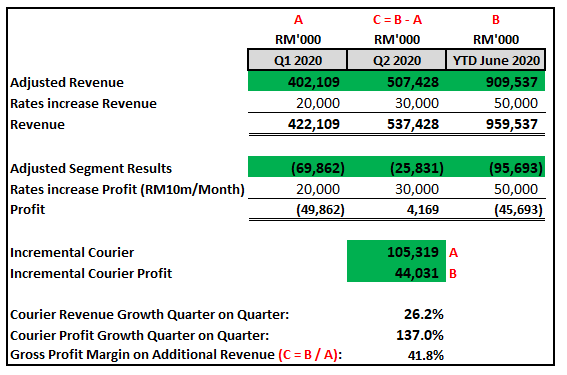

Let’s look at the Postal Segment results for Q1 and Q2.

Now, the above numbers are “Year to Date”. This means they are cumulative and not for Q1 and Q2 separately.

And you can see something a little strange here, the YTD Revenue for 30 June 2020 (RM959.5m) is higher than YTD Revenue for 31 March 2020 (RM422.1m), but the YTD Loss is lower.

Breaking it down into the individual quarters, and

Firstly, we exclude the additional revenue from the increase in mail rates (which was projected to be around RM100-150 million a year).

This is because we want to estimate the increase in mail volume and revenue due to this pandemic, and not have the data distorted by this increase in rates.

We estimate this at RM10m per month.

From here, we can see that Q2 actually recorded a profit of RM4.2 million, versus the RM49.9m loss in the previous quarter.

As this segment has high fixed costs (but low variable costs), we need to calculate the Gross Profit Margin of the Additional Profit, and the Additional Revenue for Q2 vs Q1.

And from above, we can see that from Q1 – Q2,

- Courier Revenue and Volume have grown by RM105.3m or 26.2%

- Courier Profit have from increased by RM44.0m or 137%

- Gross Margin on Additional Revenue is 41.8%

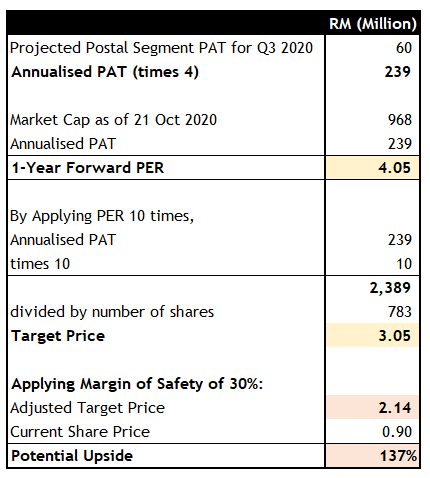

And using the above Revenue Growth Rates for Q2 and the Q2 Gross Profit Margin on Additional Revenue, Projected Revenue and Profit for Postal Segment for Q3 alone is RM640.3m and RM59.7m.

Now, they are three other segments in POS Malaysia, “Aviation”, “Logistics” and “Others”. How would these perform?

-

Aviation: This division is going to be impacted by planes being grounded etc, as the previous two quarters have shown. However, POS Malaysia also have their own planes, and airfreights rates have increased very strongly the last few months. And is evidenced by TASCO’s Q2 profit quadrupling from RM2.6m to RM10.7m.

-

Logistics: Given the strong demand for logistic services recently this division should do fairly well, or at least better than the last quarter.

- Others: Revenue from here come mainly from their pawnshops. Whose profits have increased very strongly. They made RM8.9m profit in Q1 and doubled this to RM17.6 profit in Q2.

All in all, it looks like the turnaround is real, and there is a good probability that POS Malaysia is going to breakeven for the year 2020 on Q3.

And one last things, since no analysis is complete without a reference to Vaccines or Covid-19.

To put the cherry on top, since early 2019, POS Malaysia have been doing deliveries of medication, lab samples and the like for some government hospitals.

This means they have the capability to distribute the vaccine as well.

Given the fact they initiated the POS Riders initiatives, which helped the government to reduce joblessness and increase the income of the people, who do you think the government will give the COVID 19 distribution contract to?

I think it’s going to be POS Malaysia.

Target Price

And so, to calculate our target price.

To be conservative, we are just going to assume that the other divisions combined make a grand total of zero profit, and only use the “Postal” numbers.

Make no mistake, these growth in earnings are not a one-time show.

This turnaround and success happened when the 2 years of hard work from POS Malaysia and the new CEO Syed Najib to make the company more efficient, automated and increase sales channels, meets an unprecedented opportunity, ie the COVID 19 crisis which caused an E-Commerce boom.

POS Malaysia and Syed Najib are the phrase “Never let a good crisis go to waste” personified.

Again, target price is dynamic, as people realize that this company is turned around, it should go to around RM1.5.

When Q3 comes out and people see proof of the turnaround, it will go to RM2.1.

As people realize POS Malaysia have turned around and is going to record increasing profits due to the accelerated growth of E-Commerce, there will be significant additional price appreciation.

In addition, whether got MCO or not MCO, COVID or no COVID, POS Malaysia is expected to continue growing at an accelerated pace.

Don’t forget, POS Malaysia was a RM5 company back in 2018, before the new government came in.

And it was a RM3 company when the new CEO first came in, and it is a far better and far more profitable company today than it was then.

And, One Last Thing

Like my LCTITAN pick, I don’t like investments or trades where all the upside is priced in, like the current glove counters (You think Covid-19 will stick around forever? You think nobody will open new factory?).

There is a reason why despite making record profits, share prices went down instead.

Think again, why on earth would Top Glove pay out a fat dividend, and then plan to raise more money by selling shares on another listing in Hong Kong?

I like my investments, where they will do well whether COVID 19 is around or not.

Fact of the matter is, even after COVID 19, people are still going increasingly do their shopping online as it is just a better solution.

And so, we must ask ourselves, is it priced in? Has this stock been fried?

Like my previous pick, LCTITAN, this stock is

pretty damn clean.

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM1.5, despite being projected to make more money in Q3 2020.

Clearly the market still thinks this is some random GLC that is inefficient and going to suffer (or even potentially go bankrupt like MAS) for the next 1 – 2 years.

It had unfortunately shot up a bit due to the SMS from the government, which resulted in people turning their eye to the logistics industry.

However, I don’t think most people understand the full scale of how much better POS is doing to do. Most of the facts I have written above have been priced into the stock at all.

As always, buy and sell it at your own discretion. Determine for yourself whether this is a trade or investment.

Target price is dynamic. Set your own based on your own understanding of the situation, your sizing and your risk assessment/tolerance.

All the best and good luck.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

hahaha.. I realised you deleted my comment by reposting this again. Trying to con retailers is bad Karma. Anyway I won't comment further as you will delete it so for Investors beware of this Guy....Cheers

2020-11-02 10:11

In bursa we have to 'saya jaga saya' motto or else you will see all your money disappeared.

2020-11-02 10:23

Joker come con your money. please dont even read and follow. he post and he ady bought u all help him make money

2020-11-05 17:16

Icwin is correct. he will rot in hell. karma guy. his project of lctitan 8 bucks. where is it.

2020-11-05 17:16

lcwin,

if i want to, i can just make it so cannot post comment.

I deleted and reposted to ensure it gets tagged to the stock page.

Who are you btw? You're not that important you know.

2020-11-05 18:18

If you wake up, nothing to do and want to post comment. Go post all you want.

All my post allow people post comment one.

2020-11-05 18:19

haha... lame choivo is at it again. please comment lctitan 300 million profit my dear... post exaggerate thing to con ppl... bossku

2020-11-05 18:38

VenFx

Give 1 like for Pos article

2020-10-31 10:12