The Big (Gloves) Short

Ben Tan

Publish date: Tue, 05 Jan 2021, 09:04 PM

Yesterday was the first Bursa trading day for the year 2021. One of the most noteworthy events of that day was the huge sudden drop of all the major glove stocks. Some of them stopped just short of intraday limit down. The sell-off was not the result of any logical, material event that happened during the long weekend. The only thing that had changed was that yesterday regulated short selling (RSS) was allowed once again on Bursa, after a 9-month ban (Source).

A check in the official data released by Bursa on Short Selling Trade Detail By Stock shows that enormous short positions have been opened for each of the 4 large glove manufacturers. Below is a table of the statistics, together with some extra data for context:

| Company | RSS Volume (shares) | RSS Value (RM) |

%Volume of Total Outstanding Company Stock |

%Value of Total RSS Value |

| TOPGLOV | 106,111,600 | 573,223,825 | 1.30% | 60.44% |

| HARTA | 18,752,700 | 197,557,326 | 0.55% | 20.83% |

| KOSSAN | 23,263,500 | 92,104,637 | 0.91% | 9.71% |

| SUPERMX | 11,079,500 | 61,749,059 | 0.42% | 6.51% |

At a total of RM948,417,253 worth of short-sold shares for the day, the 4 glove companies represented 97.5% of the entire value of the short sell trades. For comparison, the next closest most shorted counter was BURSA with a total value of RM4,658,269 of short selling, or a little less than 0.5% of the total value of the short sell trades. Another way to look at it - the total value of all the other short sell trades for all of the other RSS approved stocks on Bursa was RM23.71 million.

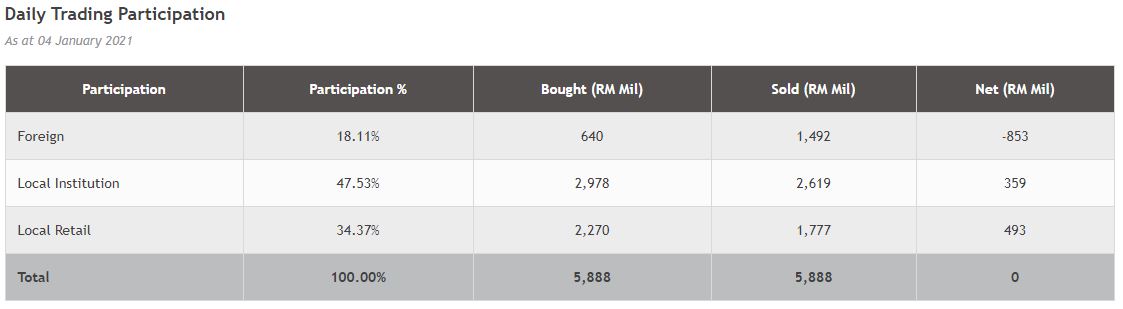

This implies an attack on the glove counters on an enormous scale - not many players can offload close to RM1 billion in 1 day into short positions. The breakdown of trading participation for the day may give us an idea of where we might need to look in this case:

Source: Bursa Malaysia

One can immediately notice the huge discrepancy between buying and selling in the case of foreign market participants. Coincidentally, the difference amounts to RM853 million - a little less than the total short position opened on that day for all of the glove counters (RM924 million).

What can you do as retail investors?

The best thing you can do as a retail investor is to hold the ship. The only way such short selling pressure could subside would be if the price doesn't fall too much. Every time the exercise is repeated, the short seller stands to sustain significant losses if they are unable to buy back the shares before a certain date. Of course buying back the shares of itself will cause the price to increase. Thus, the exercise is a sum-negative for the short seller as they usually have to pay a fee to borrow the shares and sell them. In other words, with other things equal, if market activity goes as per normal, the short seller should lose.

Short selling pressure doesn't affect a company's earnings prospects in any way. Thus, if you have bought the shares at a higher than the current market price, considering that price fair for the corresponding earnings the company generates, there is no reason to sell the shares only because the price might have fallen as a result of short selling. On the contrary - this might be a good opportunity to pick up more of the shares and decrease your average acquisition price for the stock.

Update: January 6, 2021

The short selling has continued today, although it is not clear if it is being done by the same player(s) as yesterday, or by someone else. The numbers below are based on the official release by Bursa, which you could find here.

| Company | RSS Volume (shares) | RSS Value (RM) | %Volume of Total Outstanding Company Stock | %Value of Total RSS Value |

| TOPGLOV | 18,431,000 | 104,232,941 | 0.22% | 54.46% |

| HARTA | 4,795,700 | 50,279,086 | 0.13% | 26.27% |

| KOSSAN | 4,193,100 | 16,796,904 | 0.16% | 8.77% |

| SUPERMX | 453,500 | 2,570,763 | 0.02% | 1.34% |

The total value of all short selling trades for the day was RM191,406,053, so the short selling of the 4 glove stocks represents 90.8% of the total value of short sales for the day. This means that the total value of all the other short sell trades for all of the other RSS approved stocks on Bursa was RM17.61 million - similar to yesterday's total non-glove short selling trade value of RM23.71 million.

The main "victim" was once again Top Glove. For the second day in a row more than 50% of the total short selling value on the entirety of Bursa Malaysia was focused on this one stock.

Yesterday foreign investors were net sellers on Bursa. Today, expectedly, they turned into net buyers, but by a narrow margin:

This means that the short positions likely haven't been covered yet, to a significant extent. In other words, the price movement in share price for these 4 stocks since yesterday morning is based predominantly on regular market activity plus the aforementioned additional short selling, rather than by the major short seller(s) from yesterday (and today?) buying back the shorted shares. We will have more clarity on the extent to which those short positions from yesterday have been closed tomorrow when we will get an update on the net short positions for each of the stocks. You can see the current situation here (note: these files tend to disappear, so I'd suggest that if you want to refer to it at a future point, you download it on your computer). Note also that as of yesterday, there were already some existing short positions for Top Glove due to SBL activity (another type of short selling activity that was allowed throughout last year). The total short position as percent of the outstanding stock of the company was 0.22%.

Update: January 7, 2021

The statistics for yesterday are already out. The short selling has continued, slowing down only so slightly. You can review it here. Below is the stats for each of the 4 glove manufacturers:

| Company | RSS Volume (shares) | RSS Value (RM) | %Volume of Total Outstanding Company Stock | %Value of Total RSS Value |

| TOPGLOV | 13,410,100 | 76,988,384 | 0.16% | 49.13% |

| HARTA | 4,045,900 | 42,725,990 | 0.12% | 27.26% |

| KOSSAN | 1,904,900 | 7,646,729 | 0.07% | 4.88% |

| SUPERMX | 734,500 | 4,299,879 | 0.03% | 2.74% |

The total value of all short selling trades for the day was RM156,709,530, so the short selling of the 4 glove stocks represents 84% of the total value of short sales for the day. This means that the total value of RSS trades on Bursa for yesterday, except for these 4 companies, was RM25.07 million.

The more interesting question that couldn't be answered yesterday was - are the short sellers covering their positions? The Net Short Positions form gives us the answer. You can review it here. Note that this, like the form above, includes only the short selling volume for the first 3 days of this week. Based on our calculations from above, the open RSS short positions were quivalent to:

| Company |

RSS %Volume of Total Outstanding Company Stock (based on 3-day calculations) |

RSS %Volume of Total Outstanding Company Stock (based on Bursa form) |

| TOPGLOV | 1.68% | 1.52%-1.74% |

| HARTA | 0.80% | 0.71% |

| KOSSAN | 1.14% | 1.08% |

| SUPERMX | 0.47% | 0.46% |

The more observant would have noticed that the actual total net short position for Top Glove in the form is 1.74%. However, as mentioned above, there was an already open SBL short position (a different kind of short selling trade) before this week, equivalent to 0.22% of the company's outstanding stock. We do not know what percentage of the already close short position as of end of trading day yesterday belongs to the SBL short position closing, and what percentage belongs to the closing of RSS short positions. In the maximum case scenario, if all of the closed short positions belong to the RSS trades, positions equivalent to approximately 0.16% of the stock's outstanding shares would have been closed up to now.

In other words - the short positions have been closed only to a very minimal extent up to now, ranging from just 2% of the entire short position for Supermax, to 5% for Kossan, to about 9% to 10% for Top Glove and Hartalega.

Update: January 8, 2021

The short selling pressure didn't subside yesterday. On the contrary - it intensified, particularly in the case of Top Glove (you can find the data here):

| Company | RSS Volume (shares) | RSS Value (RM) | %Volume of Total Outstanding Company Stock | %Value of Total RSS Value |

| TOPGLOV | 35,228,300 | 205,252,696 | 0.43% | 74.55% |

| HARTA | 2,994,000 | 32,374,318 | 0.09% | 11.76% |

| KOSSAN | 3,635,900 | 14,611,967 | 0.20% | 5.31% |

| SUPERMX | 620,600 | 3,777,319 | 0.02% | 1.37% |

The RSS trades on these 4 counters represented 93% of the RSS on the entirety of Bursa. As you can see the pressure on Top Glove was enormous with the short selling on the counter representing almost 3/4 of all the regulated short selling on Malaysia's stock market.

More importantly, let's compare this data to the official data on the net short positions as of close of trading yesterday (see the official form here):

| Company |

RSS %Volume of Total Outstanding Company Stock (based on 4-day calculations) |

RSS %Volume of Total Outstanding Company Stock (based on Bursa form) |

% of RSS short position closed |

| TOPGLOV | 2.11% | 1.69%-1.91% | 9.5%-20% |

| HARTA | 0.89% | 0.83% | 6.7% |

| KOSSAN | 1.34% | 1.16% | 13.4% |

| SUPERMX | 0.49% | 0.49% | <1% |

What this means is that while simultaneously increasing the RSS short sale volume, the short seller is also covering some of the short selling positions opened earlier - in particular on Kossan stock. It is possible that the same is happening with Top Glove, but it is harder to guess because of the aforementioned 0.22% of SBL short sales that were outstanding as of January 4, 2021.

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

HARTA2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

SUPERMX2024-07-22

SUPERMX2024-07-22

TOPGLOV2024-07-22

TOPGLOV2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

TOPGLOV2024-07-18

HARTA2024-07-18

HARTA2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-17

HARTA2024-07-17

HARTA2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

TOPGLOV2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

SUPERMX2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

TOPGLOVMore articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

emsvsi, thank you for your comment.

Margin Call was indeed a good movie, I particularly liked Jeremy Irons' play.

There are indeed many leveraged investors. However, the post's purpose was not to focus on the wide variety of scenarios one could find themselves in, especially if they have taken on a significant amount of risk to begin with. That is why in the disclaimer it is mentioned that one should always "make any decisions based on your personal situation."

For the average retail investor who has taken a standard amount of risk by purchasing stock with their existing liquidity (the vast majority), the situation remains unchanged.

2021-01-06 07:42

Ben : thks for the sharing. Very informative and helpful by knowing the major incident taking place on the counters. Keep it up.

Regarding margin, my view is that those big players with margin financing will not stretch themselves to the limit that cannot absorb the 10% drop in collateral as what happened on Monday.

2021-01-06 08:10

dawchok, thank you very much for your comment.

I agree that the big boys would generally have no problem absorbing the temporary damage, even if leveraged. I doubt that they were the ones with the knee-jerk reaction, which caused the plunge in price (the RSS was responsible only for the initial drop, thereafter it was knee-jerk reaction from the broader market).

2021-01-06 08:17

Damn good article. To all retail investors, it is a good time to buy and keep the shares. Better than fixed deposits.

2021-01-06 10:50

If it is so simple then you would have become billionaires.

Those foreign funds has money to play with you all year round. So what if you knew if it is cheap? Are you gonna sell your kidney and all in? Just trade with rationale, not emotions.

2021-01-06 11:01

bpsiah, dumbdumb123, and Andre Kua, thank you for your comments.

Andre, the underlying logic is surprisingly simple in some cases, like this one. You don't need to sell your kidney, you just need to think rationally about the actual economic impact any action (or inaction) has. In this particular case, inaction might be more beneficial than action to most.

2021-01-06 11:08

Gloves now at tail ebd of bull run

Palm oil just beginning

Fcpo jan 2021 now Rm3980

Only Rm20 more to all time historic high of Rm4000

2021-01-06 11:20

calvintaneng, thank you for your comment.

Thank you for the suggestion, although this might be a topic for another discussion.

2021-01-06 11:45

Thanks for your brilliant writeup.

Just ignore the clowns, they will always be clowns.

Looking forward to more write-ups from you.

2021-01-06 12:48

paperplane and Goldberg, thank you for your comments.

paperplane, I enjoyed your post on game theory and the effects of oligopoly in the glove manufacturing space (saw it for the first time now). I wrote a post on a similar topic just a few days ago on another platform, from a different angle (from economies of scale point of view), with the same conclusion.

2021-01-06 12:57

LaoTzeAhSir, thank you for your comment, but let's not call each other names here. It's not beneficial.

2021-01-06 12:59

Short sellers have various costs to bear, the longer the price does not go down as hoped,with time depreciation, they will feel the heat.Once the facts and fundamentals of the stock reassert itself positively, it will be a scramble for them to unwind safely and quickly without incurring massive losses....

2021-01-06 15:13

BuLLRam, thank you for your comment. Indeed that is the case, and how the story ends (or rather how quickly it ends) depends on the existing investors.

2021-01-06 16:43

Thank you, Ben. I definitely will hold ship and not influenced by selling on emotion.

2021-01-06 16:55

ckkhen, thank you for your comment. I believe your decision will pay off eventually.

2021-01-06 17:17

Thanks for the article. It's a good one and as commented by Goldberg clowns will be always be clowns and so just ignore the noise they made. Please keep up the good work.

2021-01-06 18:11

vvcb, thank you for your comment. I believe everyone has a right to express their opinion, although it is of course always best for that opinion to be supported by solid data and logical arguments. If that is the case, I am always up for discussions :)

2021-01-06 18:28

good review. i guess the gloves big 4 had come back to its real indicative valuation in the past 2 months, but the short selling creates an attractive situation

2021-01-06 22:09

Hold tight not to give way to long term shorties to take advantage to reap ill gotten profits dampening gloves shares price.

2021-01-06 22:10

arv18, Felicity, michaelwong, and calvintaneng thank you for your comments.

Felicity, the glove manufacturers' stock has not been moving in tandem, although it might seem so if you don't zoom in closer. Top Glove's price has run furthest away from its fair value, followed by Supermax earlier, and then Kossan over the last couple of weeks of December. Hartalega's price has stayed close to its fair value (or, dare I say, a little bit higher than that). However, the current market prices are off by a significant margin in my humble opinion.

calvintaneng, as mentioned above, this is a topic for another discussion. Good luck with the CPO trades.

2021-01-07 10:46

Philip ( buy what you understand)

are you holding gloves ben and what price did you enter sir?

2021-01-07 14:20

Philip, yes I am. I started entering Top Glove at 6.80 with more significant volume buying at around 6.60; and Supermax at 7.80, with most of my purchases below 7.30. At the current valuations I have considered entering Kossan recently, but TG and Supermax are attractive enough.

2021-01-07 15:21

Palm oil bull is not different with gloves enjoying windfall profit. Nothing to be proud of.

2021-01-07 18:01

treasurehunt, thank you for your comment. There are significant structural differences between the extranormal profits experienced by glove manufacturers and the peak profits expected to be experienced by palm oil producers. I will probably write a more detailed article on that a little bit later this year.

2021-01-07 18:04

Thanks for the detailed article. You are the rare breed in this forum. Someone who is posting facts instead of personal opinion n rumours.

Keep up the good work!!

2021-01-07 18:13

witan, thank you for your comment. I hope the information is at least a little bit useful.

2021-01-07 18:20

Ben, there has to be a reason for the Short Selling. When the fundamentals of all the companies in the segment are so strong, there has to be a compelling reason.

From my assessment, it's the CFD's. The structured warrants.

No sense in empathy for the mistake in setting exercise values because I sincerely think that CFD's are a curse on the financial system. Designed to Destroy value & wealth. Refer back to the historical data and you will see the Billions these IB's have made from them and also see that 99% of the time Only the issuer makes money.

For those of you who are unaware, a CFD is 'Contract For Difference'. That's what this instrument is. It is called Structured Warrants to make it sound like Company issued Warrants. Basically making a fool of all of us.

2021-01-07 18:46

Morpheus61, thank you for your comment.

As we have discussed in the past, my personal opinion is that short selling on relatively small, local stock markets should be allowed only when necessary, and only with good reasons, especially when it comes in high volumes.

Regarding the structured warrants, unfortunately there the situation might be one of supply and demand. As long as there is demand for these products, someone will come around and supply them. I have little hope for them being disallowed straightaway any time soon.

2021-01-07 19:33

thank you for the insights. The RSS vol/data is also available via eforce portal, get it before the day end, Mon2Thu.

2021-01-10 19:47

From another forum...

@Nyago here attached, is the full JPMorgan report.

Few comments from first read:

- His fair value is based on 18x PE of FY2022 profit estimate

- While everyone is entitled to their opinion, FY2022 NP estimate for Topglove of RM1.6b is extremely bearish. The most bearish analyst of 23 analysts. Consensus has it at RM3.9b.

- I find his comments on correlation between share price of gloves vs number of COVID19 testing and how it's positively correlated an odd and inaccurate study. Global daily cases (related to global testing) are at record high but we are definitely not seeing all time high in glove share prices.

- Dividend yield of 12.6% in FY2021 is inconsistent with this own profit calculation for the same period at 70% payout.

- Having a blanket 18x PE of FY2022 on all glove within his coverage (KOSSAN TOPGLOV & HARTA) shows a lack of familiarity of the subject matter. HARTA from historical facts and figures, never trade at such valuation nor it had been categorized within same valuation bracket as the other glove makers.

Lastly @CRUSADER888 I don't think many glove bulls - other than KYY - uses "glove is needed to administer vaccine" as a strong case in point for their thesis. Glove usage on Vaccine administration helps to increase demand for glove, but it's not signifcant in the grand scheme of things. What's significant is more towards perception of hygiene. Afterall, assuming the entire world population requires a pair of glove for them to get vaccine done, that's merely 14b gloves. That's only about 4% of current glove demand.

2021-01-14 19:19

emsvsi

Not very sharp argument, since you've obviously never heard of Margin Call (which is also a movie, clever eh) :)

2021-01-06 00:29