HEVEA : Ingenuity Accounting (Bomb No.1) 亿维雅之"超乎完美"会计 (第一炮)

robertl

Publish date: Sun, 10 Jan 2016, 05:49 PM

As reported earlier by Kannibu on the several active court cases among the substantial shareholders of Heveaboard Berhad, which are as follow :

Civil Appeal No. N-02(IM)(NCVC)-836-05/2015

Civil Appeal No. N-02(IM)(NCVC)-1143-07/2015

Civil Appeal No. N-02(NCVC)(A)-1425-09/2015

between Dato' Loo Swee Chew, Liang Chong Wai and Sung Lee Timber Trading Sdn Bhd

and

Yong Kian Seng @ Yoong Tein Seng, Yoong Hau Chun, Tenson Holdings Sdn Bhd, Firama Holdings Sdn Bhd and HeveaWood Industries Sdn Bhd

and

Seremban High Court Originating Summon No. 24NCVC-197-09/2014

The Informant has now further divulged that the crux of the matter which give rise to the disputes that are now before the Court of Appeal, was that the minority shareholders of Heveawood Industries Sdn. Bhd. were contemplating to wind-up and dissolve Heveawood Industries Sdn. Bhd. itself on the ground that they were oppressed as a minority shareholder. The strongest mooting points and arguements put forth include irregularities in its accounting, book keeping of secretarial documents and the management of company funds and affairs.

To get our bearing right, the majority shareholders of Heveawood Industries Sdn. Bhd. consists of the Yoong Family (52.51%), Dato' Loo Swee Chew (21.66%), Liang Chong Wai (15.83%) and Sung Lee Timber Trading Sdn. Bhd. (10.00%).

Before we look at some discrepancies in certain accounting documents, I would like to correct a vague but important fact as was said in Kannibu's article that "Words around the privileged inner corporate circle disclosed that in one occassion, drinking glasses were thrown in a Heveawood Industries shareholders meeting at their Company Secretary's office at Bangsar South and thugs behaving violent manner rampantly displayed. Yoong Hau Chun, the MD of Hevea was even threatened at a shattered glass' point to tone down his word by Dato' Loo Swee Cheong."

If you read in one go, you maybe are of the opinion that it was Dato' Loo who had thrown the drinking glasses. As a matter of fact, it was Yoong Hau Chun, the MD of Heveaboard that was the one who throw the drinking glasses. Angers erupted and the ensuing act was that Dato' Loo picked up a piece of the shattered glasses and threatened Yoong Hau Chun to tone down, and shouted 目无尊长 to Yoong Hau Chun. A physical clashes nearly occur if not for the timely intervention by all those present.

Now let's get to some disturbing news about Hevea. And I promise you, this is not even an appetiser to begin with.........

This is how it all started.

Shortly after Hevea was listed, it went on a borrowing spree of some RM200 plus million in committed loans and debts. And only to find itself engulfed right in the eye of the US Subprime storm in 2008, saddling it with a huge debts to the tune of hundreds of million. And the shares price of Hevea once tanked to as low as 7 sen a share. Almost all of the substantial shareholders' Hevea shares were forced sold by OSK Securities.

In order to ride through this hardship, besides selling their personal properties and assets to meet the bankers and stockbrokers' demand for payment on a personal level, Hevea is also cash-strapped. And there are hundreds of mouth waiting to be fed in the now idling and redundant factories.

The shareholders of Heveawood Industries Sdn. Bhd. (as it is only an ultimate shareholdings entity to Heveaboard Berhad and still remained relatively clean in balance sheet) decided to gear itself up, in order the secure the much needed cash flow to sustain Hevea.

One of these financial life lines availed by Heveawood Industries Sdn. Bhd. to Heveaboard Berhad was that it will help pay off an euro-debt of € 890,000 by instalments, which is owed by Heveaboard Berhad to one of its European machinery suppliers.

It was agreed among both Heveaboard Berhad and Heveawood Industries Sdn. Bhd. that once the financial situations of Heveaboard Berhad returns to normalcy, Heveaboard Berhad will not only repay this € 890,000 to Heveawood Industries Sdn. Bhd., but it will also pay an additional equivalent amount of € 890,000 to Heveawood Industries Sdn. Bhd. as a "reward or compensation" for throwing the much needed money-buoy to Heveaboard Berhad.

I have combed through all the prior years annual report of Heveaboard Berhad to find this "reward or compensation" but to no avail. However, it is said by some Heveawood Industries Sdn. Bhd shareholders that this € 890,000 "reward or compensation" is embodied in a covenant in the multiparties Settlement Agreement with Heveaboard's bankers and creditors when the latter sought for winding up protection in 2009.

One strict condition as stipulated in the said Settlement Agreement was that firstly, Heveawood Industries Sdn. Bhd cannot be paid this €890,000 unless all the bankers and creditors are fully paid under the said Settlement Agreement. And secondly, Heveaboard cannot start paying dividend to its shareholders (Heveawood Industries Sdn. Bhd. included) until and unless certain loan pay down ratios have been achieved.

If Heveaboard choose to pay this € 890,000 to Heveawood Industries Sdn. Bhd. nonetheless, then all outstanding sums due to the bankers and creditors became payable and are on demand immediately.

Now, two main and serious wrongdoing on the part of Heveaboard Berhad may have arise.

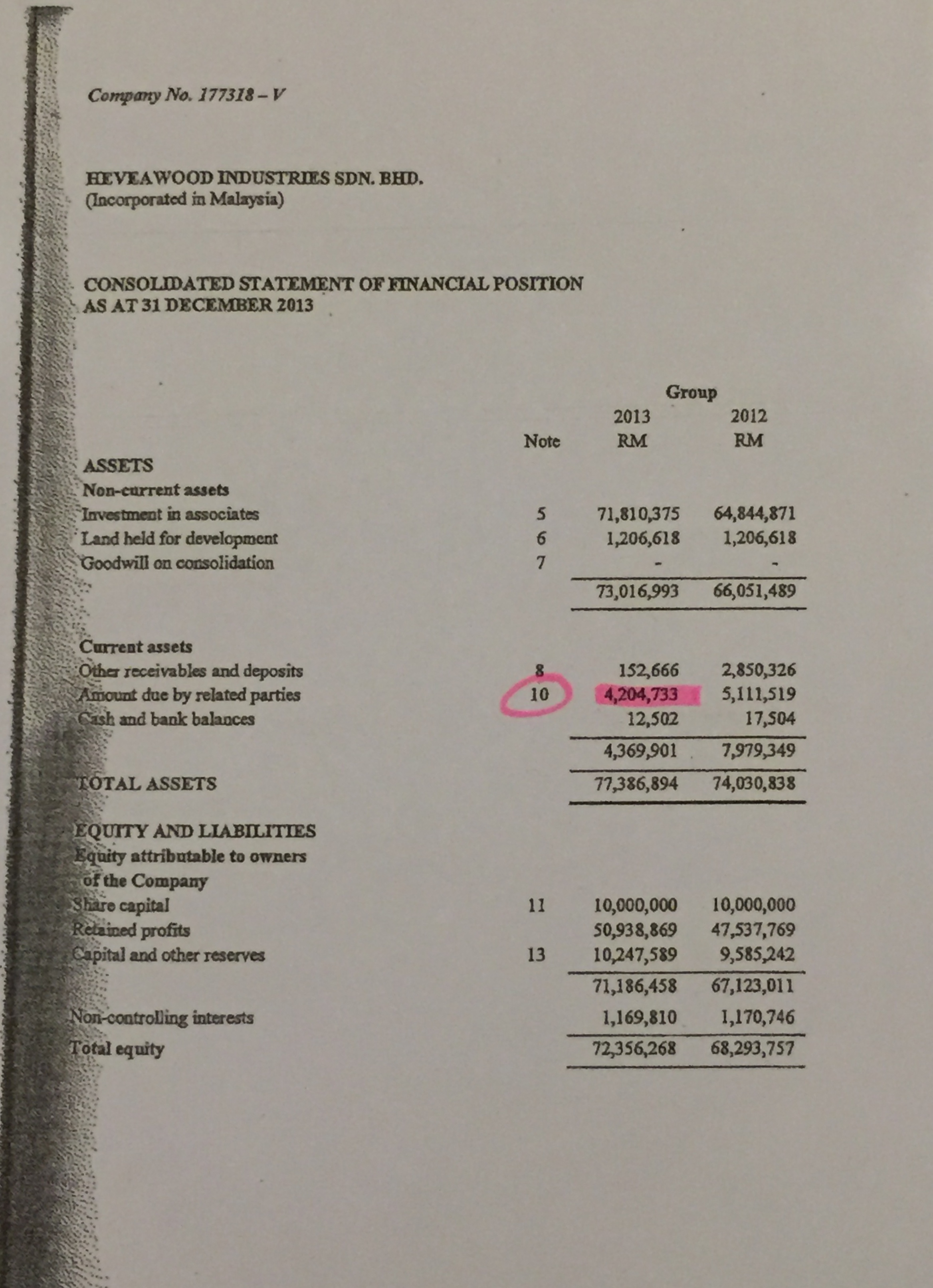

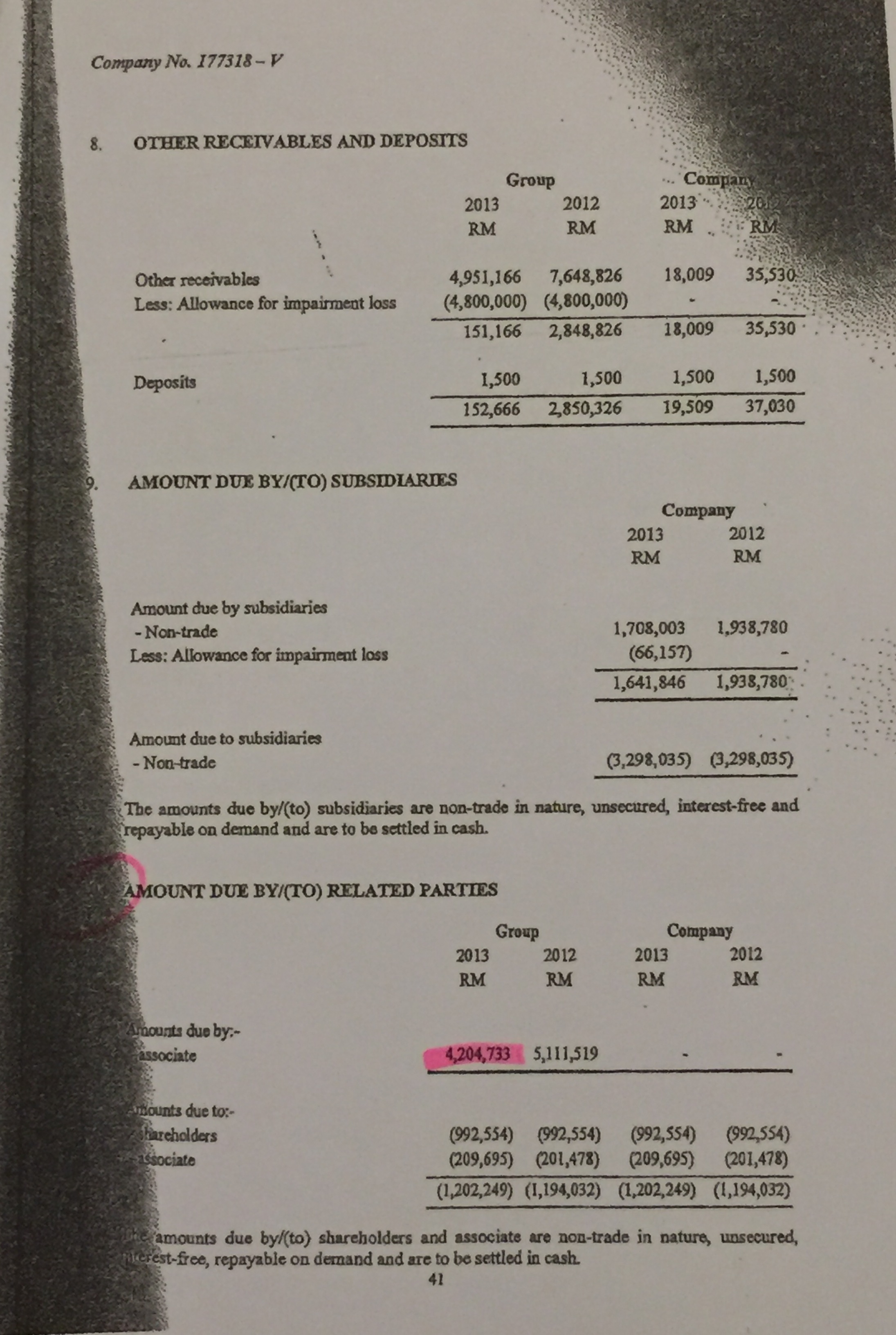

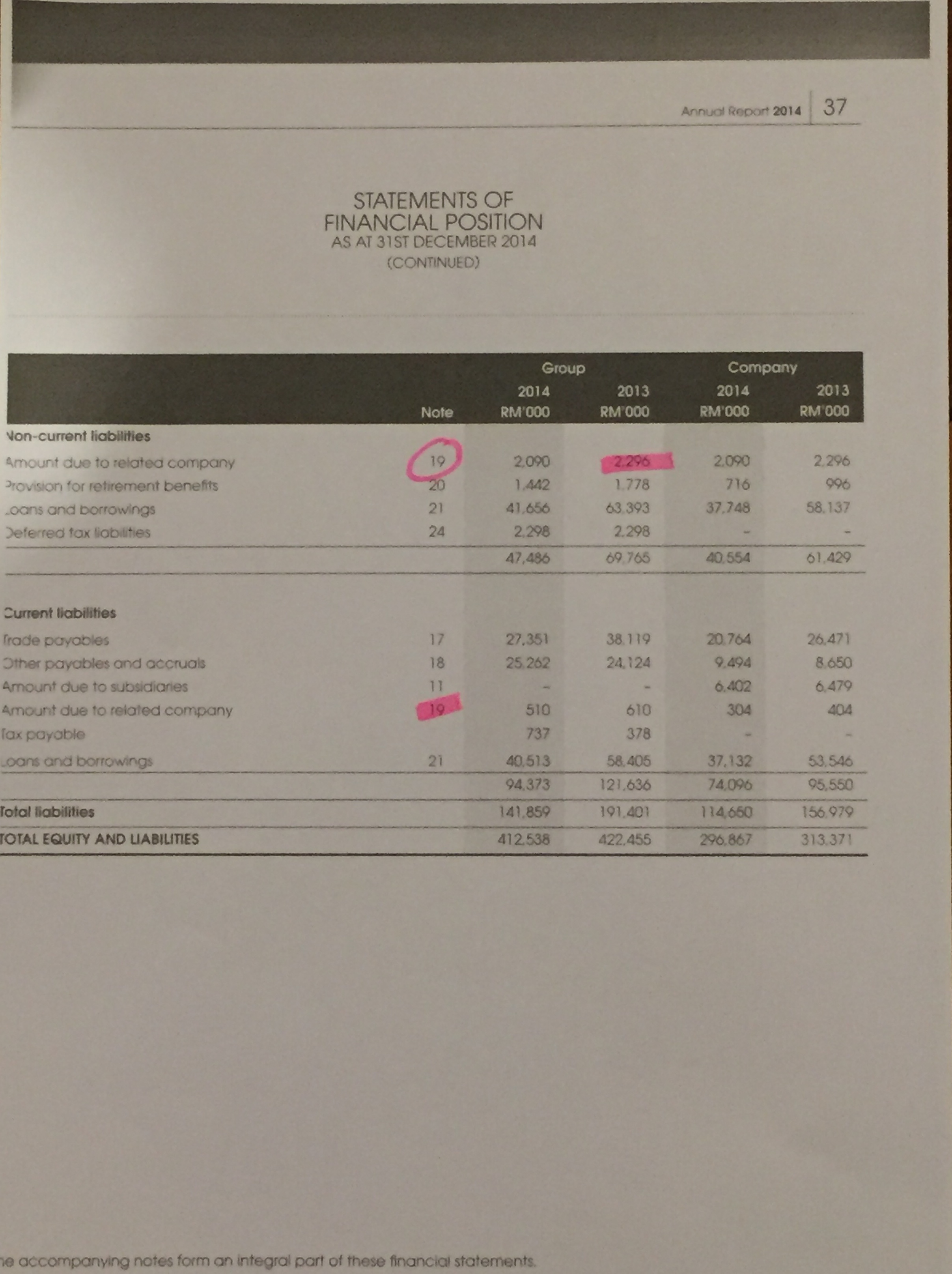

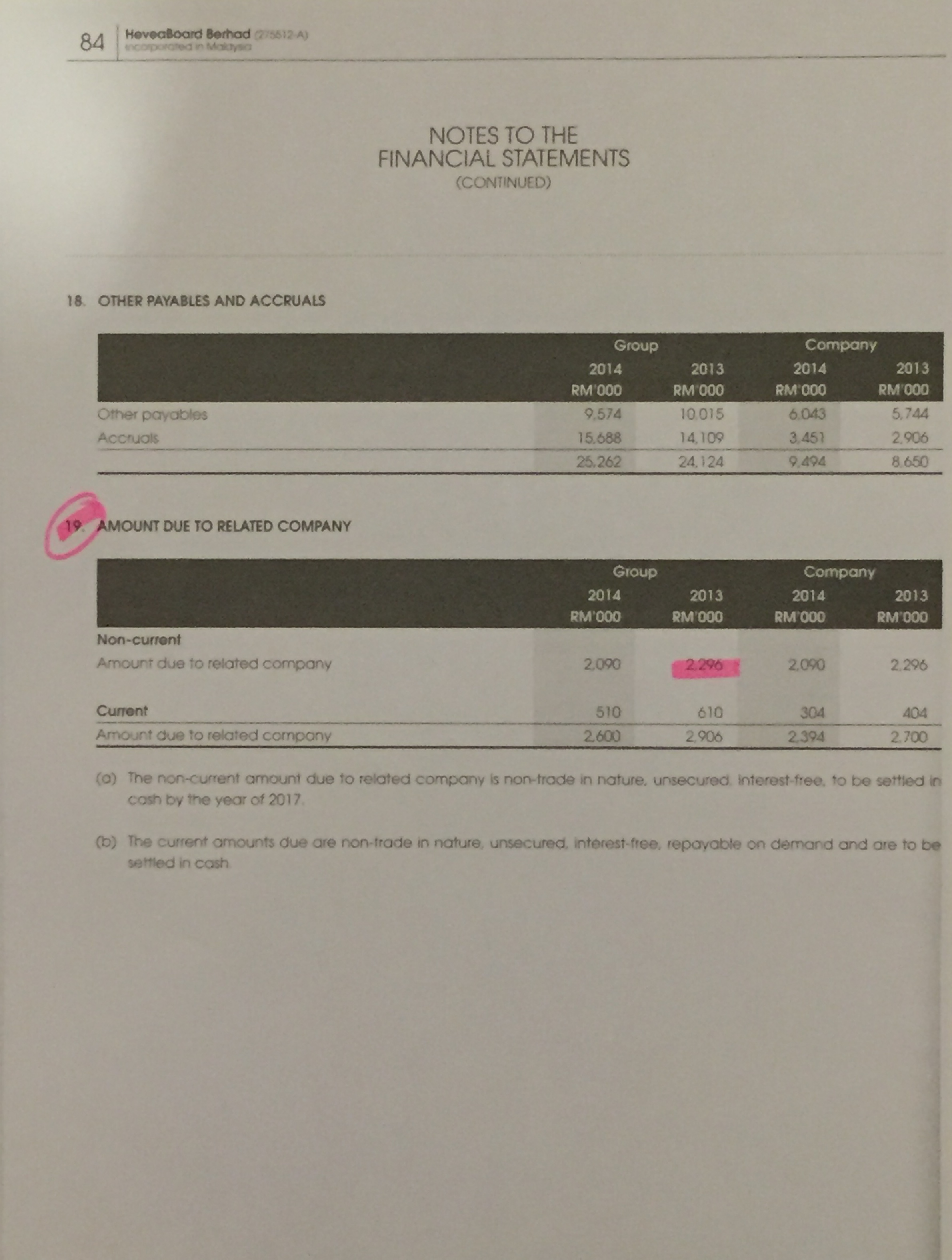

First, as you can see from Page 5 of Heveaboard Berhad's Annual Report 2013 below, Heveaboard reported an amount due to a related party (Heveawood Industries Sdn. Bhd. in this acse) of RM 2,296,000.00. This is in stark difference to Heveawood's own Annual Report 2013 claimed amount that is due from a related party (Heveaboard Berhad in this case) of RM 4,204,733.00.

The peculiar thing here is both Heveaboard Berhad and Heveawood Industries Sdn. Bhd.'s substantial shareholders are essentially the same group of peoples ie Dato' Loo Swee Chew, Liang Chong Wai, Sung Lee Timber Trading Sdn Bhd, Yong Kian Seng @ Yoong Tein Seng, Yoong Hau Chun, Tenson Holdings Sdn Bhd and Firama Holdings Sdn Bhd.

So why the discrepancy in accounting?

I can only conclude that the accounting in Heveaboard Berhad may have been 'tweaked' to look better. (Let me throw you the bombshell in my next article HEVEA : Ingenuity Accounting (Bomb No. 2) 亿维雅之"超乎完美"会计 (第二炮) about this)

Second, why didn't Heveaboard Berhad make any accounting revelation that there is an amount of € 890,000 to be paid to Heveawood Industries Sdn. Bhd. according to the covenant, in addition to the RM 2,296,000 as reported?

Again, I can only conclude that it is a calculated effort by Heveaboard Berhad to shield it from public eyes that it actually owed an additional amount of € 890,000 (or RM 4,254,200 based on Euro rate of 4.78 on 8/1/2016). Nevertheless, they will still pay Heveawood Industries Sdn. Bhd. this amount, once all bankers and creditors have been fully paid under the Settlement Agreement of 2009.

And all shareholders of Heveaboard Berhad (beside the substantial shareholders themselves as they will be paid wholesomely) will eventually be 'robbed' of an amount of RM 4,254,200.00, along the way.

(Page 1) Heveawood Industries Sdn. Bhd. Annual Report 2013

(Page 2) Signed and declared true accounting by Heveawood Industries Sdn. Bhd.'s main directors.

(Page 3) wherein Heveawood Industries Sdn. Bhd. has booked the € 890,000 advance it extended to Heveaboard Berhad as an amount due by a related party, with the outstanding of RM 4,204,733.00 remaining unpaid in its book as at Dec 31, 2013.

(Page 4) Note 10 depicting the description of the unpaid amount by Heveaboard Berhad to Heveawood Industries Sdn. Bhd.

(Page 5) Contrary to Heveawood Industries Sdn. Bhd.'s Annual Report 2013, the amount due to a related party (Heveawood in this case) by Heveaboard Berhad was recorded as RM 2,296,000 and not RM 4,204,733

(Page 6) Note 19 of Heveaboard Berhad's Annual Report 2013 depicting the outstanding amount owed by Heveaboard Berhad to Heveawood Industries Sdn. Bhd.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Hevea, Time to Alight 亿维雅,是时候下车了!

Created by robertl | Jan 27, 2016

Created by robertl | Jan 25, 2016

Discussions

Wonder how many more companies in bursa are like hevea! This is really worrying!

2016-01-10 21:18

Amount due by related parties can be party A + party B +....More proof needed like loan agreement between Heveawood Industries Sdn Bhd and Heveaboard Bhd.

2016-01-10 21:25

Suddenly all become accounting expert

I will remain silence until the part 10 if it existed

2016-01-10 21:34

First whack you quietly Euro 890,000, then bungkus like Transmile before you even realize

2016-01-10 21:43

Give Robert some claps. We can see that he did put in some effort. Nevertheless, I am not selling.

2016-01-10 22:12

Don't think a share can unlimited up , hevea arealy fair value . Market stock still got undervalued share

2016-01-10 22:13

Group Company

2013 2012 2013 2012

Amount due TO related parties 2,296 2,641 2,296 2,641

-Annual Report 2013 (page 35)

===================================================================================

Group

2013 2012

Amount due BY related parties 4,204,733 5,111,519

-(Page 4) Note 10 depicting the description of the unpaid amount by Heveaboard Berhad to Heveawood Industries Sdn. Bhd.

===================================================================================

So that mean FY2012 also got problem?

2016-01-10 22:17

Now already 2016. Robert still in lived in year 2013. Become history still want to talk nonsense i3. No matter how hevea going to pay off all the debts in 2016.

2016-01-10 22:56

veln82k6, he bought hevea in 2014 and now he searched the history in 2013.

2016-01-10 22:59

Yeow Yeow I am ONLY a small shareholder, when I saw your article (rumours), I too were afraid.

I've asked a few seniors of mine, they're not sure as well. Therefore I would say your initial tactics worked successfully!

However to me, a hidden coward behind the screen, writing a few articles could invoke such massive reaction from the market, indeed your plan has worked beautifully. Even if the news are fake, part of the shareholders has sold their stake under the influence of your articles.

Nevertheless, i3 readers are not blind, after much reading they could sense your intentions, your inner hatred? nobody knows.

If your news are really true, I thank you for your honesty. If your info are mere unfounded accusations, may I know what are your ill intentions?

This platform is for everyone to share and learn but you RObert use it to attack others, I don't think this is right!

10/01/2016 20:53

Still don't believe the Euro 890,000 hidden debt is real? Don't be so kepala keras please. Accept negative news as a lesson to hone you to be a better investor

2016-01-10 23:20

Posted by voonyoke > Jan 10, 2016 10:59 PM | Report Abuse

veln82k6, he bought hevea in 2014 and now he searched the history in 2013.

Please understand that Annual Report 2013 can only be ready in may/june 2014 for any company. Heveawood is only a Sdn. Bhd., there is no way you can get a copy of it from anywhere beside their own shareholders. And Robert has it here. That mean, this Robert guy got substance lah

2016-01-10 23:24

After using sea cucumber FA with Tilapia TA, i can summary Hevea is the biggest corporate scandal which bigger than Kenmark, Linear, Fountain, Iris, Harvest, Cybert, Repco, Aokam, Rahman Hydrolic, Omega, Union Paper, Ekran, Renong etc

2016-01-10 23:30

Posted by Icon8888 > Jan 10, 2016 06:56 PM | Report Abuse

It is difficult to get excited about RM4 mil (assuming u r correct about the irregularity) when hevea market cap is RM640 mil

Icon8888 = purveyor of theft-in-company as long as it does not 'destroy the entire shareholders value'.

So RM4m theft within Hevea is ok, but not RM640m. That is what he is talking about.

Please tell that to Ajibkor, we are ok he took RM2.6b from us, but he cannot take the entire country down. Ok Ajibkor?

2016-01-10 23:42

rm vs usd 4.41, haha, Rebortl, well done, please keep on, I belive 2015 eps must >20sen

2016-01-11 09:23

forget to thank rebortl very much, let me have chance buy more cheap Hevea....

2016-01-11 09:24

why this fellow wrote this after price fly sky high ! purposely lure ppl to sell ..

2016-01-11 13:20

Hevea has made money for so many quarters. Just pay off the debts and clear the issues. What is the problems ?

2016-01-11 13:23

1. There is no proof between the transaction of the said amount between these 2 companies

2. The whole article still mingled around words shown with some old facts

3. The facts is Coldeye and Mr Koon still holding this stock tight

4. Rumors always a great opportunity to reveal the value, if the second article is out, price dumped, which means >20% disc, this is a good buy.

5. The article so called to save ppl from buying at high, I think only the author knows well.

2016-01-11 13:37

popcorn, not the time yet. My portfolio sink 1% due to Hevea, still waiting it to hit 1 to collect

2016-01-11 13:40

Strangely all the "sifus" gone very quiet n maybe they might say something after the "match" , ha ha ...........

2016-01-11 14:04

CIMB Marcus Chan has interviewed the management:

https://brokingrfs.cimb.com/E5JRX4r-aC5m2iQUWawnNjWgz0SfPnyUAtGkWg2o3BGcQ75zhBp_npQvV4TY5N9rSk-6oPyEJrqwqvs80.pdf

2016-01-12 15:45

if the management hide the issue intentionally in the annual report, do you really think the MD will tell you the truth when so called - investment researcher - called him to clarify? dont be so naive. no wave if there's no wind. something must be wrong somewhere

2016-01-12 17:47

agree sweetkeledek.....why the writer dont include the detail explanations under note 5 and Note 10 from the respective accounts......only give half story.

anyway, these are audited accounts, and if the writer have any knowledge how auidted accounts are repared m thy he would be so quick to accuse accounts are "beautified" and mgt having a hard time to explain.

2016-01-12 18:37

Wah, rumors clear, buy in tmr

http://www.theedgemarkets.com/my/article/heveaboard-rebounds-allegations-against-it-were-dismissed-frivolous

2016-01-12 23:40

leno

Robert Ludlum has save tons of i3 members. Thank you Robert Ludlum ... thank you very much. Keep up the good work. Those who pretend to condemn u are from other forum. Their forum now got zero members because their forum contain zero substance, all KONG KONG KONG tarak isi one ... so, they come here try to defaced our forum. Dun worri Robert ... All diehard i3 members will back u up for your honest and truthful work. GAMBATEH !

2016-01-10 21:02