(Icon) Hexza Corp - Manufacturer of Formaldehyde Based Adhesive and Resins

Icon8888

Publish date: Sun, 15 Feb 2015, 08:37 PM

Hexza Corp Bhd (HEX) Snapshot

|

Open

0.80

|

Previous Close

0.80

|

|

|

Day High

0.82

|

Day Low

0.80

|

|

|

52 Week High

08/19/14 - 0.88

|

52 Week Low

12/17/14 - 0.63

|

|

|

Market Cap

163.3M

|

Average Volume 10 Days

242.0K

|

|

|

EPS TTM

0.06

|

Shares Outstanding

200.4M

|

|

|

EX-Date

11/24/14

|

P/E TM

12.7x

|

|

|

Dividend

0.04

|

Dividend Yield

4.94%

|

Hexza Corporation Berhad is engaged in the manufacture and sale of formaldehyde, and formaldehyde based adhesive and resins for timber related industries primarily in Malaysia under the Norphen, Noramin, Norres, and Normel names.

The company also offers ethyl alcohol, liquefied carbon dioxide, and kaoliang wine to pharmaceutical companies, wine and beverage bottlers, and paint and consumable products manufacturers, as well as for industrial applications.

In addition, it manufactures natural fermented vinegar for various manufacturers that produce sauces, as well as flavoring and other food industries.

Further, Hexza Corporation Berhad is involved in marketing and distributing consumer products and industrial chemicals, as well as developing residential and commercial properties. The company was formerly known as Norsechem (M) Sdn. Bhd. and changed its name to Hexza Corporation Berhad in July 1986. Hexza Corporation Berhad was incorporated in 1969 and is based in Ipoh, Malaysia.

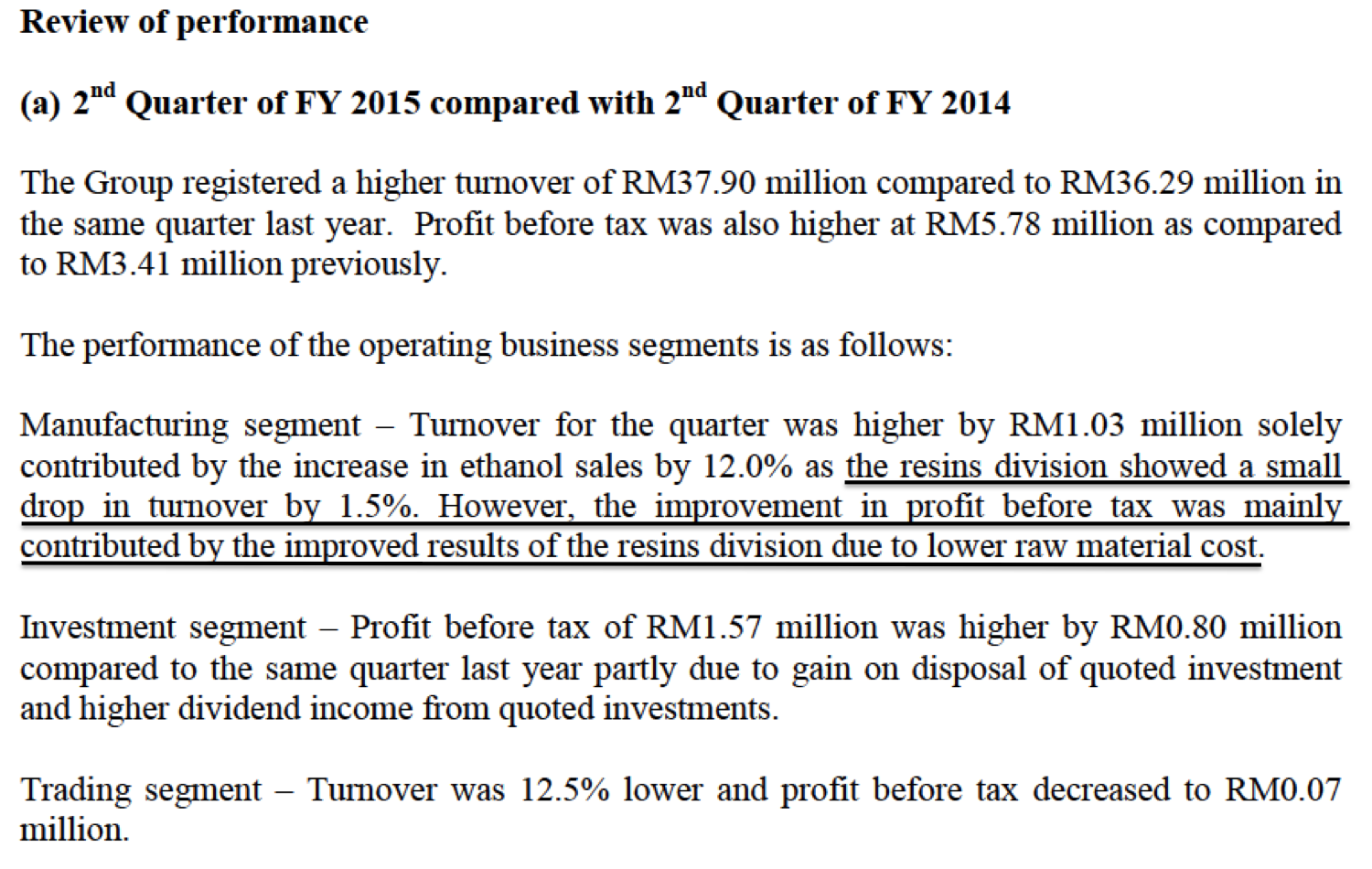

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-06-30 | 2014-12-31 | 37,897 | 5,785 | 4,266 | 2.10 | - | 1.0600 |

| 2015-06-30 | 2014-09-30 | 39,261 | 6,173 | 4,157 | 2.10 | - | 1.1000 |

| 2014-06-30 | 2014-06-30 | 42,077 | 4,429 | 3,118 | 1.50 | 4.00 | 1.0800 |

| 2014-06-30 | 2014-03-31 | 35,539 | 1,717 | 1,332 | 0.70 | - | 1.0500 |

| 2014-06-30 | 2013-12-31 | 36,285 | 3,408 | 2,609 | 1.30 | - | 1.0500 |

| 2014-06-30 | 2013-09-30 | 31,440 | 1,193 | 1,020 | 0.50 | - | 1.0700 |

| 2013-06-30 | 2013-06-30 | 32,594 | 6,547 | 6,030 | 3.00 | 4.00 | - |

| 2013-06-30 | 2013-03-31 | 30,482 | 1,304 | 773 | 0.40 | - | 1.0400 |

| 2013-06-30 | 2012-12-31 | 30,146 | 1,823 | 1,000 | 0.50 | - | 1.0400 |

| 2013-06-30 | 2012-09-30 | 31,335 | 399 | 672 | 0.30 | - | 1.0700 |

| 2012-06-30 | 2012-06-30 | 37,396 | 2,225 | 1,491 | 0.70 | 4.00 | - |

| 2012-06-30 | 2012-03-31 | 37,196 | 2,046 | 1,025 | 0.50 | - | 1.0100 |

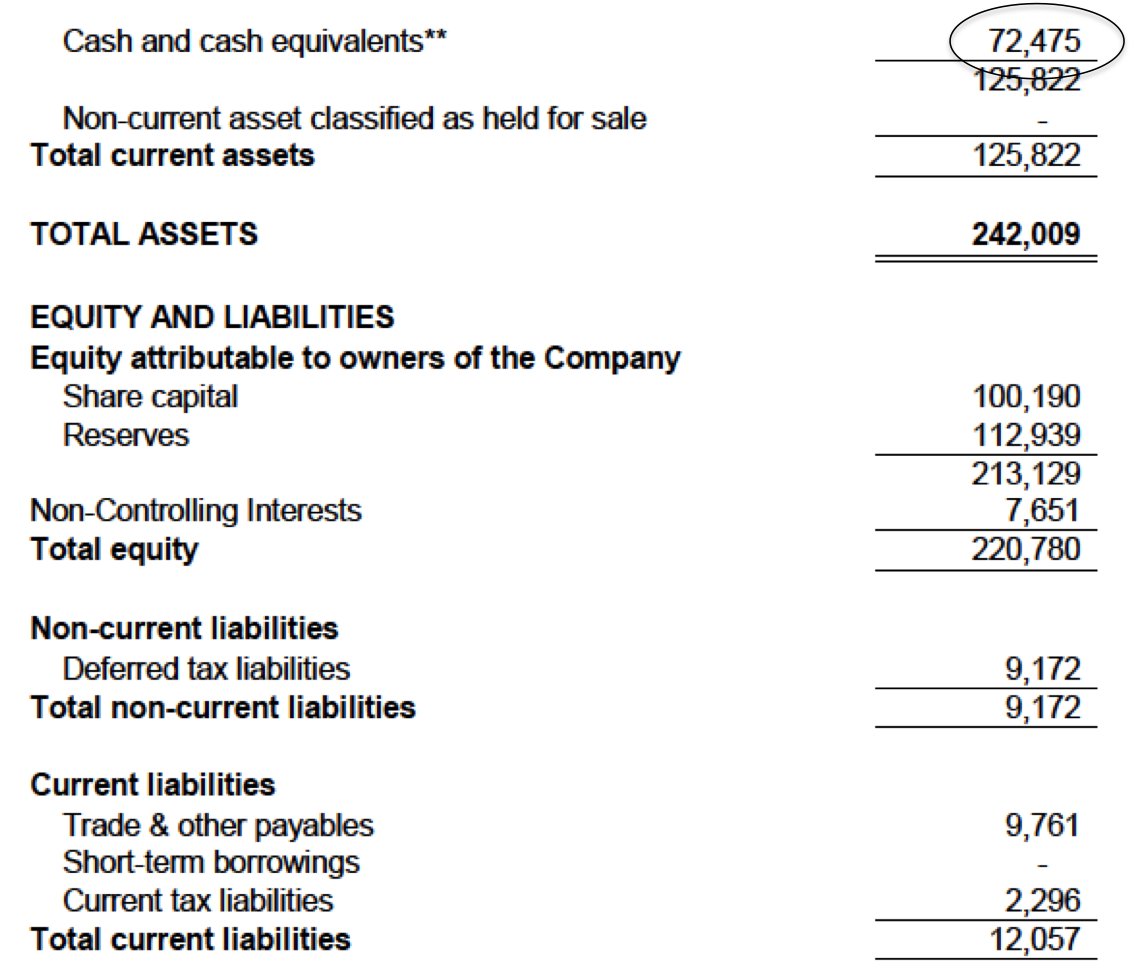

Strong balance sheets. The group has net cash of RM72.5 mil, equivalent to 36 sen per share (share price now 80 sen).

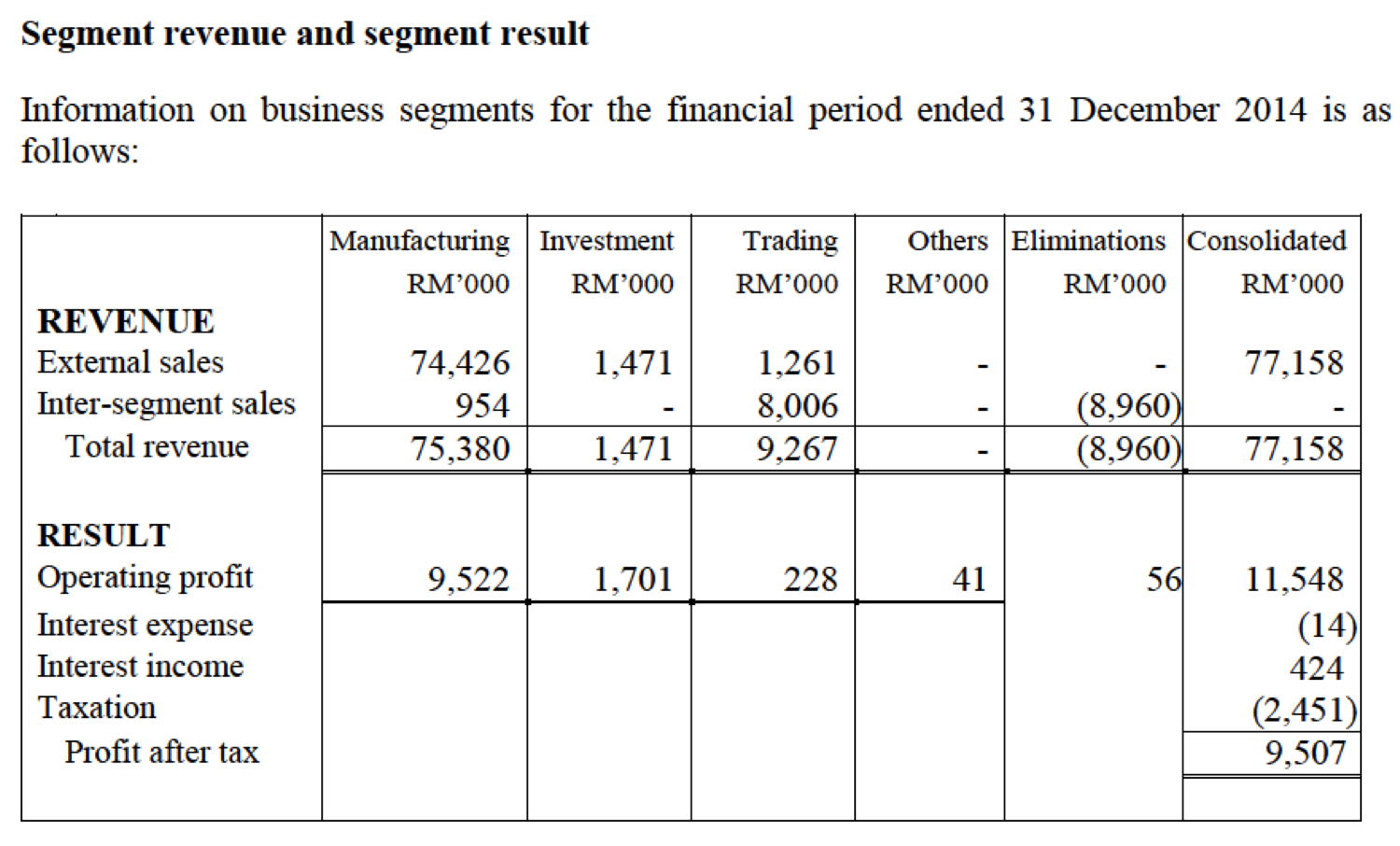

Manufactruing division is the major earnings contributor :-

Despite lower revenue, lower raw material cost results in higher profitability :-

The group sells almost all its products in Malaysia. According to the management, the weak Ringgit might have adverse impact on the group's profitability :-

On 11 February 2015, the company announced that it has entered into a buy and leaseback agreement with Tembusu (a Singaporean owned company operating in Myanmar).

Purchase consideration is RM21 mil (based on USD : RM exchange rate of 3.5). The company will be entitled to payment of USD1.56 mil per annum (equivalent to RM5.0 mil per annum based on assumed long term exchange rate of 3.2)

According to the company, the payback period is 4.5 years. If we assume payback period equals PE multiple, the company is expecting net profit of RM4.7 mil per annum (being RM21 mil / 4.5).

As the group registered net profit of RM14.6 mil in FY2014, the new business venture will increase it by 32% to RM19.3 mil.

Based on net profit of RM19.3 mil, the existing market cap of RM163 mil translates into PER of 8.4 times.

(Note : The above calculation is arrived at based on my assumption that payback period is equivalent to PE multiple. Please seek clarification with the company and / or its advisor in the event that you are interested in investing in the company's stocks. Personally, I don't find the stock very interesting)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

icon8888 sabar bro ... ha ha but really good write up for hexza ..

my reason to cabut from hexza malas tunggu.. while seing other fish ponds lots of jumping fishes!

hexza - cash rich... pays good dividends and a graham net net counter .. been there! nothing but good comment from me.....

hexza is a definate buy a long with

1. Homeriz

2. Willowglen

3. SkPres

4. NTPM

5. marco

all those dividend paying power machines .... cheap too..

kikikii

2015-02-15 21:48

i am flattered by your attention to this article (thanks anyway)

this article is just simple cut and paste, took me half an hour to finish

: P

2015-02-15 21:59

hexza forum my one of my earliest forum before broke into superstadom in i3.. yes, many fanatic followers like Ayam1,2,3,4,5,6, AyamJahat etc etc.. dont worry bro Hexza .... dividen sedap a good choice.......... a true definition of a cash rich company... like SKPres and the likes.. albeit it may not be appealing to some due to bikin arak sikit.. kikikiii ...

tunggu la aku nak main barang lain dulu .. then perhaps come back to my old chicken coop....... hihiihhii

2015-02-15 22:15

Hexza niche: etanol ...

Esceram Niche: Glove formers

Glotec Niche: CBM Gas

Pworth Niche: Kayu and Minyak (combo like McDonald burger)

CME Niche: JV with australian comp into property/dev or something.. almost same like Glotec partnering NuEnergy (ASX listed)

always hunt for niche ...... or a least some reasons to hold on too .. at least when things doesnt

goes as expected.. hati tak sakit ... kalau tak naik in time .. of course things will

naik.. but as usual it takes time..... hihihhhii

2015-02-15 23:02

Hey guys. I know this is off topic & I appologise to Icon888. Like to know wat is the lifespan of a ceramic glove form. Is it something tat wear & tear fast or can be used for long2 time? Who r the competitors?

2015-02-16 09:22

i didnt really read what i buy usually.. wakaka.. but i know one thing ... ESCeramics supplier to the glove maker for glove former........ and yes.. there are coverage by investment house about it uptrending potentiality ... dont worry, buy with faith..

before buy, pray first! kikikiiki

Posted by oregami > Feb 16, 2015 09:22 AM | Report Abuse

Hey guys. I know this is off topic & I appologise to Icon888. Like to know wat is the lifespan of a ceramic glove form. Is it something tat wear & tear fast or can be used for long2 time? Who r the competitors?

2015-02-16 09:24

ESCERAM could be the next TOP GLOVE ! .. buy when small not when high.. kikikiki

2015-02-16 09:25

Esceram buat former. Top glove buat glove. Can make relative comparison meh? Esceram ada buat patung2 (for fashion display)? Pls advice.

2015-02-16 09:39

@oregami: ya aku baru balik dari jamban.. you are right .

kalau baca dan kasi imagine sikit... ada potensi. tunggu masa ja.

2015-02-17 20:40

AyamTua

ya baru sekilang jadi news.. yep .. cash rich counter :-) many good reviews of this ..

now busy with other horses to bela.. kikikik

i dont want to talk more later my fanatic fans come kikikii

look into: Glotec, Esceram, CME and Pworth - mana tahu ada nasib hihihi

2015-02-15 21:19