(Icon) Mmode - Cash Rich Mobile Content Provider

Icon8888

Publish date: Wed, 22 Jul 2015, 09:46 AM

M-Mode Bhd (MMB) Snapshot

|

Open

0.42

|

Previous Close

0.42

|

|

|

Day High

0.42

|

Day Low

0.41

|

|

|

52 Week High

07/24/14 - 0.82

|

52 Week Low

06/16/15 - 0.39

|

|

|

Market Cap

66.7M

|

Average Volume 10 Days

181.6K

|

|

|

EPS TTM

0.05

|

Shares Outstanding

162.7M

|

|

|

EX-Date

06/1/15

|

P/E TM

9.1x

|

|

|

Dividend

0.01

|

Dividend Yield

2.44%

|

M-Mode Berhad is principally involved in provision of mobile content and data application services in Malaysia. The company offers digital content such as music, entertainment, lifestyle, sports, education, applications, etc.

Over the past 12 months, the group reported aggregate net profit of RM7.34 mil. Based on existing market cap of RM66.7 mil, historical PER is 9.1 times.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-12-31 | 2015-03-31 | 20,204 | 2,174 | 1,952 | 1.20 | - | 0.4181 |

| 2014-12-31 | 2014-12-31 | 21,187 | 846 | 546 | 0.34 | 0.50 | 0.4062 |

| 2014-12-31 | 2014-09-30 | 18,406 | 2,021 | 1,740 | 1.07 | - | 0.4079 |

| 2014-12-31 | 2014-06-30 | 24,154 | 3,469 | 3,103 | 1.91 | - | 0.4022 |

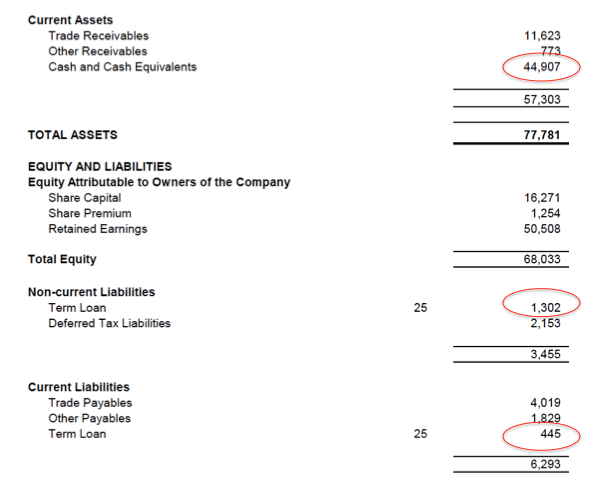

The group has very strong balance sheets. With 163 mil shares, loans of RM1.8 mil and cash of RM44.9 mil, net cash per share is 26 sen.

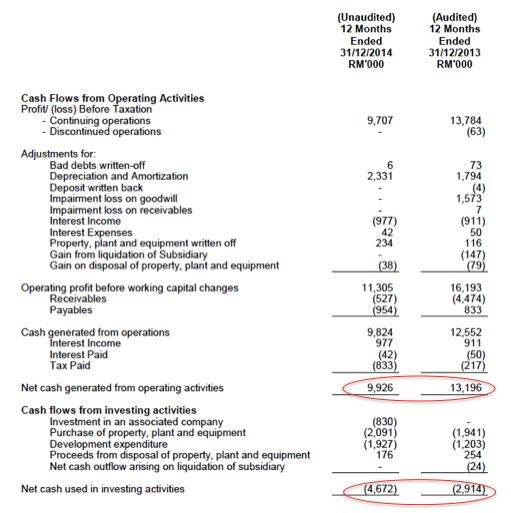

The group has strong operating cash flow and minimal capex requirement. That is why cash position built up over the years.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

In FY14, Mmode's revenue was higher compared to FY13 but the net profit was dragged down by the higher cost of sales and operating expenses, and hence it's share price.

The recent Q2 FY15 result showed significant reduction in cost of sales and operating expenses. Thus, if Mmode management can sustain the improvement in cost/expenses, FY15 net profit is going to recover even if the revenue stays flat.

In past few quarterly reports, the management stressed that they wanted to reduce the cost of sales and operating expenses, seems like the efforts are starting to bear fruit now.

If net profit recovers, I expect the share price would follow.

2015-08-30 23:17

sephiroth

where got cash rich new media co, oredi so long cash rich, round 1 bot 0.46/0.475/0.49 sold 0.69 but went up to 0.80 pulak

round 2 hantam kaw kaw 0.3933, c how lah

2015-07-23 15:25