(Icon) AWC - An Undervalued Stock About To Get Even More Undervalued

Icon8888

Publish date: Fri, 18 Sep 2015, 08:56 AM

Executive Summary

(1) AWC is principally involved in facilities management (part of it backed by Government concession), enviromental and engineering services

(2) It has consistent profit track record and strong balance sheet (net cash per share of 23 sen, while share price is only 34 sen)

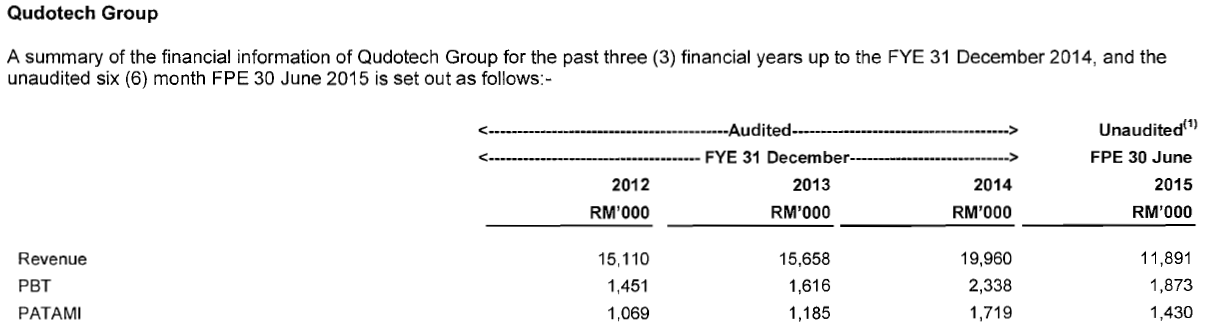

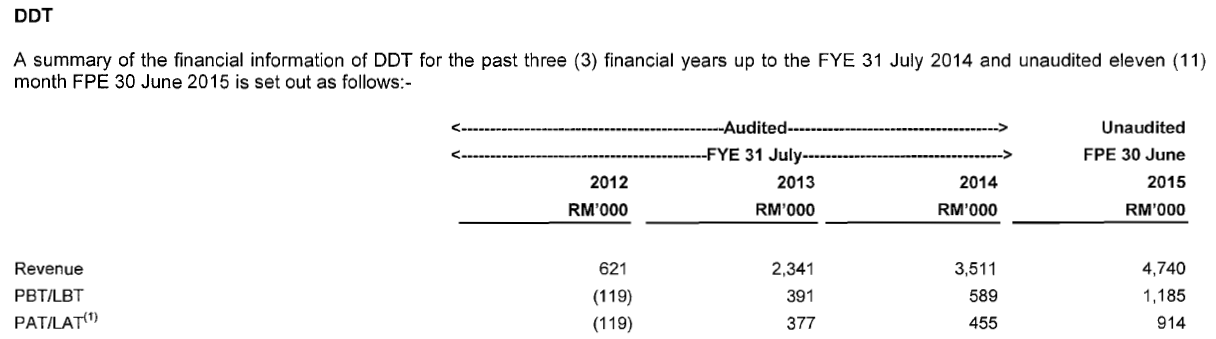

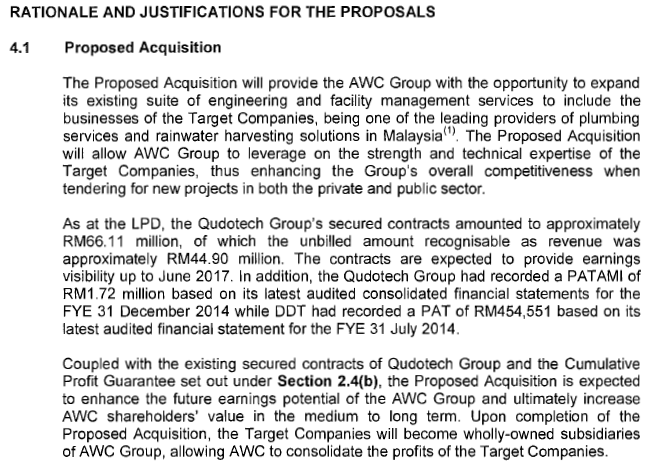

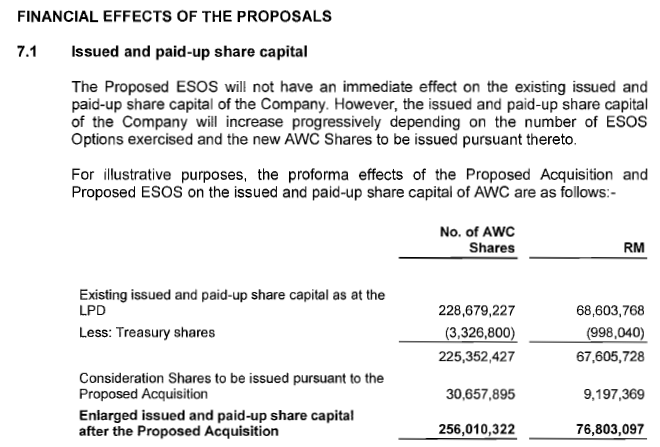

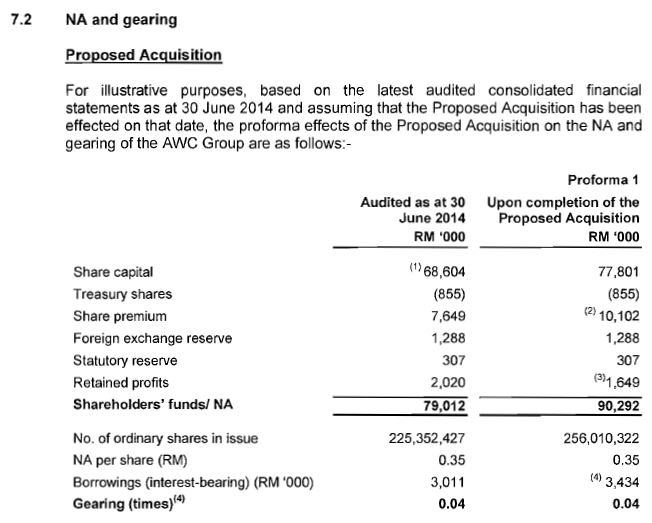

(3) Few months ago, it announced the proposed acquisition of Qudo Tech Sdn Bhd and DD Technique Sdn Bhd for purchase consideration of RM26.5 mil to be satisfied by issuance of 31 mil new AWC shares at 38 sen and cash of RM14.8 mil.

(4) Qudo is principally involved in Mechanical and Electrical Engineering, with specialty in plumbing services. DD's specialty is in design and installation of rain water harvesting systems.

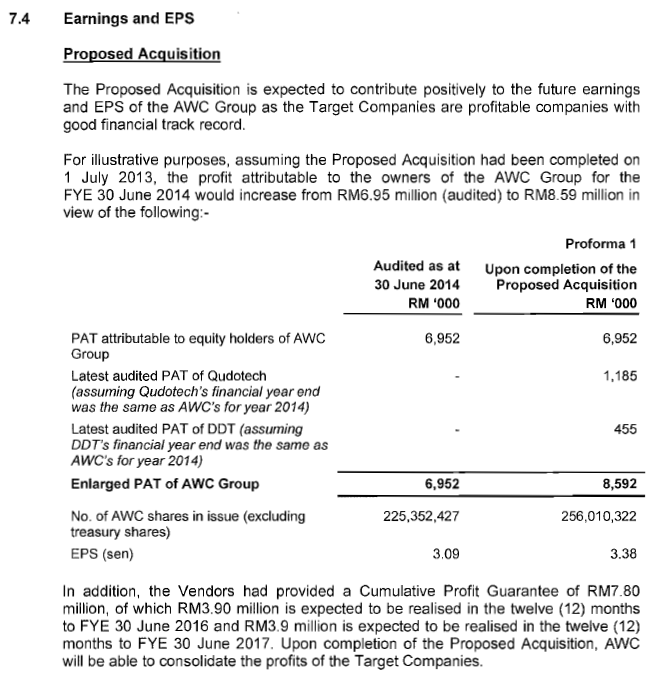

(5) The vendors of Qudo and DD have agreed to provide a profit guarantee of RM3.9 mil each for FYE June 2016 and 2017 respectively. The amount is considered quite substantial as AWC reported net profi of RM7.8 mil in FYE June 2015.

(6) Circular to shareholders was issued on 8 September 2015. EGM will be held at 10 am, 1 October 2015 at Bukit Kiara Equestrian and Country Resort, Jalan Bukit Kiara, Off Jalan Damansara.

Awc Berhad (AWCF) Snapshot

|

Open

0.33

|

Previous Close

0.33

|

|

|

Day High

0.34

|

Day Low

0.33

|

|

|

52 Week High

04/13/15 - 0.50

|

52 Week Low

12/15/14 - 0.27

|

|

|

Market Cap

76.6M

|

Average Volume 10 Days

1.8M

|

|

|

EPS TTM

0.03

|

Shares Outstanding

225.4M

|

|

|

EX-Date

03/19/13

|

P/E TM

9.8x

|

|

|

Dividend

--

|

Dividend Yield

--

|

1. Principal Business Activities

AWC provides integrated facilities management, environmental and engineering services.

AWC's facilities management services is mainly from the government concessions on the maintenance of the federal government buildings. Previously, AWC had a 9 year concession to provide management and maintenance services of the federal government building in the southern zone and Sarawak.

AWC is handling 23 building complexes in Sarawak alone, which includes the Bintulu Port Authority building.

Other leading corporation and clients of AWC includes OCBC Bank, Telekom Malaysia, Bangunan KWSP, KLCC, KL Tower and PPB Harta Bina. AWC services also extends to the public sector such as Ministry of Works, Public Works Department, Prime Minister's Office, and Bank Negara Malaysia.

With the plans to expand their services to penetrate more into the private sector, AWC had seen breakthrough with the cornerstone foray into the healthcare sub-segment involving provision of biomedical and facilities engineering maintenance services in Hospital Rehabilitasi Cheras, and also secured new contracts to extend integrated facilities management services to telco stores and outlets of Celcom Axiata and the new Heriot-Watt University Malaysia campus in Putrajaya.

Another boost came for the group as AWC had secured a new 10 year concession with higher revised prices from the federal government in providing their facilities management and maintenance services in southern zone and Sarawak.

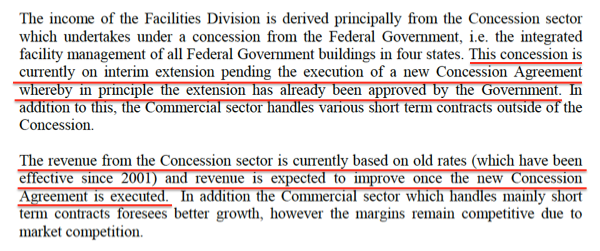

The follwoing is extracted from its latest quarterly report :-

2. Consistent Profit Track Record

The Group has consistent profit track record.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | NAPS |

|---|---|---|---|---|---|

| 2015-06-30 | 127,642 | 7,778 | 3.45 | 10.44 | 0.4030 |

| 2014-06-30 | 119,506 | 6,952 | 3.09 | 8.58 | 0.3510 |

| 2013-06-30 | 145,000 | 4,555 | 2.00 | 12.00 | 0.3200 |

| 2012-06-30 | 111,225 | 4,128 | 1.80 | 13.89 | 0.3200 |

3. The Proposed Acquisitions

As mentioned in executive summary, Qudo and DD are principally involved in plumbing and installation of rainwater harvesting systems.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Rubbish or not now too early to judge mah! How know if 10 yrs later all return over 1000%

2015-09-19 14:15

Anyway u dun own i3 forum right? We have right to critics right? U critise Asdion I also can critise awc mah! Dun be like najis, red shirt can go street yell, but yellow shirt illegal mah!

2015-09-19 14:17

I did not crticies every stock. I suggest AirAsia, kesm, lfecorp. U are the one keep promoting lousy stock like bintai high debts!

2015-09-19 14:18

U dun own bursa, neither u own i3 forum. I can say and talk whatever I like here.

2015-09-19 14:32

Icon is the one always like to quarrel when ppl disagree his stupid ideas.

2015-09-19 14:55

If u want me choose, I rather believe wikileaks than icon8888! At least ppl got better track record

2015-09-19 15:05

Haha, ppl are wise! Many now know this icon keep bringing ppl to holland

2015-09-19 22:26

paperplane2, no need to argue with someone who promoted GOB written 12 parts articles to shout strong buy at 1.20 and now 50c he never apologies.

2015-09-20 13:54

icon8888. why you deleted your "no systemic risk in all fbmklci-call warrants?

you feel shame ka? wakakakaka.

you think you are SIFU ka. aiyoyo.

2015-09-20 13:56

Base on numbers the eps only improve marginally from 3 Sen to 3.38 sen

So it's not a very good deal as existing shareholders will be diluted.

2015-09-20 16:20

With such deal, why don't AWC utilize their cash to buy over the company ?

2015-09-20 19:02

base on the 228 million share , 23 cent cash per share, it has 52.575m cash.

Why AWC must issue share instead of paying them in full ?

That's the question of thought. Cash is not good when it is not utilized ...

2015-09-20 19:04

issue shares to dilute shareholder ma. bad co. always like that, the cash, is on standby to disappear when the need arises.

2015-09-20 19:08

To make the vendors a stakeholder in the company

Posted by CFTrader > Sep 20, 2015 07:02 PM | Report Abuse

With such deal, why don't AWC utilize their cash to buy over the company ?

2015-09-20 19:32

Sometime no need urgue with him. We want to enlightenment ppl not to fall into this guy trap only! He don't own i3 forum, no need care him

2015-09-20 19:52

TQ Icon8888. 2 me u r a sifu. 2 criticise is ez. Any donkey oso can criticize. 2 prepare & present yor write-ups is not so ez. Congrats! Courage is like a third arm.

2015-09-20 20:35

paperplane2, or other fella that have prejudice towards Icon8888, I just have 1 thing to tell you.

" You tak suka Icon8888's post, you boleh keluar, you boleh avoid buying his call or such thing"

It is really an eyesore to look at some forumer attack other forumer. You all are adults, grown up, and do your things.

___________________________________________________________

To Icon8888, To make vendors a stakeholder in company. Yes.

But to me, this deal just tells me something. The CF Generation power "might" be strong (well, I assume it coz it has 23c CPS), but they are not utilize it well to generate funds to shareholder...

2015-09-20 23:13

Icon888 how about syf stock. Quarter result just comeout.. is there possibility this stock fly as what hevea mieco liihen did.

2015-09-25 20:56

After waiting for a month, I begin to wonder if the writer made a typo error - that it should be over value instead of under-value?

2015-10-13 13:56

Read with your wisdom & invest at your own risk.

Idiots are always here & there, the common characters are brainless (that's why can't read) & like to blame this & that (because always lose money, can't blame himself/themselves).

2015-11-02 12:11

If you have wisdom you won't be here reading through all the stupid talk.

A horse never knows his own face is long!

2015-11-04 15:20

kakashit

Qudotech wn to join AWC at 86cents, that's mean the fair value is at 86cents, so i would like to sell half at 86cents.

2015-09-19 10:24