(Icon) Notion VTEC - Mr GungHo Forced To Wear A Straitjacket

Icon8888

Publish date: Thu, 31 Dec 2015, 10:13 AM

(straightjacketed by forward currency hedging)

1. Introduction

First of all, hat tip to forum member blackout87 for alerting me on this stock.

Recently, some forum members had been dropping notes to tip me off on certain stocks that they own. For those that make sense, I don't mind writing about them. However, for those that I feel don't really meet my criteria, I will just keep quiet.

2. An Illustrious Past

Notion is principally involved in the manufacturing of following products :-

(a) Hard Disk Drive ("HDD") components;

(b) Single Lens Reflex ("SLR") cameras; and

(c) Industrial and automotive parts (metal stamping, jigs and fixtures, machining of parts).

Notion is an interesting stock. It has an illustrious past. Unlike many other small cap manufacturing companies that I wrote about (Denko, Geshen, LCTH, etc), Notion used to make as much as RM49 mil net profit in a particular year. Its share price used to trade as high as RM1.30.

Now it is trading at RM0.40. What has transpired ? Is there opportunity for you and me to make money ?

(past 5 years share price)

(YTD share price)

3. A Major Misstep

To answer the first question, we need to look at their recent earnings :-

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | NPM (%) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|---|

| TTM | 239,057 | -13,497 | - | -5.03 | - | - | - | 1.0430 |

| 2015-09-30 | 239,057 | -13,497 | - | -5.03 | - | - | - | 1.0430 |

| 2014-09-30 | 194,462 | -27,736 | - | -10.34 | - | - | - | 1.0803 |

| 2013-09-30 | 222,315 | 20,088 | 10.00 | 7.49 | 10.35 | 1.00 | 1.29 | 1.1762 |

| 2012-09-30 | 308,827 | 49,264 | 16.00 | 18.25 | 6.14 | 3.00 | 2.68 | 1.1584 |

| 2011-09-30 | 236,767 | 47,464 | 21.00 | 17.56 | 5.87 | 3.00 | 2.91 | 1.7400 |

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|---|---|

| 2015-09-30 | 2015-09-30 | 54,777 | -12,006 | -10,983 | -4.09 |

| 2015-09-30 | 2015-06-30 | 62,087 | 15,323 | 7,278 | 2.71 |

| 2015-09-30 | 2015-03-31 | 63,942 | -6,634 | -4,544 | -1.69 |

| 2015-09-30 | 2014-12-31 | 58,251 | -7,817 | -5,248 | -1.96 |

| 2014-09-30 | 2014-09-30 | 50,365 | -17,148 | -11,619 | -4.33 |

| 2014-09-30 | 2014-06-30 | 52,190 | 961 | 1,265 | 0.47 |

| 2014-09-30 | 2014-03-31 | 44,201 | -8,709 | -7,379 | -2.75 |

| 2014-09-30 | 2013-12-31 | 47,706 | -9,453 | -10,023 | -3.74 |

| 2013-09-30 | 2013-09-30 | 60,178 | 2,998 | 296 | 0.11 |

| 2013-09-30 | 2013-06-30 | 62,156 | 45,323 | 40,133 | 14.96 |

| 2013-09-30 | 2013-03-31 | 50,841 | 3,571 | 2,387 | 0.90 |

| 2013-09-30 | 2012-12-31 | 49,140 | -22,380 | -22,728 | -8.61 |

| 2012-09-30 | 2012-09-30 | 88,860 | 21,311 | 18,722 | 6.94 |

| 2012-09-30 | 2012-06-30 | 95,829 | 24,022 | 19,836 | 7.35 |

| 2012-09-30 | 2012-03-31 | 84,508 | 16,595 | 15,537 | 10.06 |

As shown in tables above, Notion has been doing well until the September 2012 quarter. Since then, it has been going downhill. I didn't study in detailed. However, based on recollection, the deterioration of profit was due to lost of competitiveness to other countries, with strong Ringgit probably playing a major role.

The group remained in the doldrum until December 2014. The weakening of Ringgit finally injected a new lease of life into their operation. As shown below, only 19% of Notion's products were sold in Malaysia in FYE 30 September 2014. The rest (81%) were exported. A weak Ringgit by right should be very beneficiary for them.

Note : Notion sold approximately 55% of its products to Thailand in FY2014 and it has RM42 mil assets there. Are those sales denominated in Thai Baht ? In my opinion, it is unlikely. The Thai asset base looked a bit small. I think most likely the products were manufactured in Malaysia and exported to Thailand, which means that the Thailand revenue should be USD based (instead of Baht).

Unfortunately, the Group has a tradition of entering into huge USD forward contract to hedge against a RISING RINGGIT.

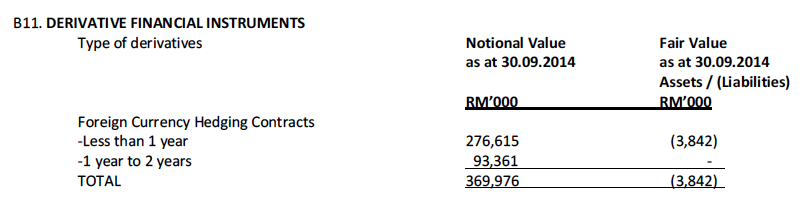

When I said "huge", it really means HUGE. The amount varied from time to time. But just to give you a feel, as at 30 September 2014 (on the eve of the recent Ringgit devaluation), the exposure was approximately RM370 mil.

(Holy molly...)

The company entered into such huge contract to protect the value of their USD receivables.

As we all know, in the subsequent months, the Ringgit devalued by a massive 33.5% (from 3.22 to 4.30). As such, despite improvement in operational performance, the group reported a series of losses, dragged down by derivative loss.

4. Historical Profitability

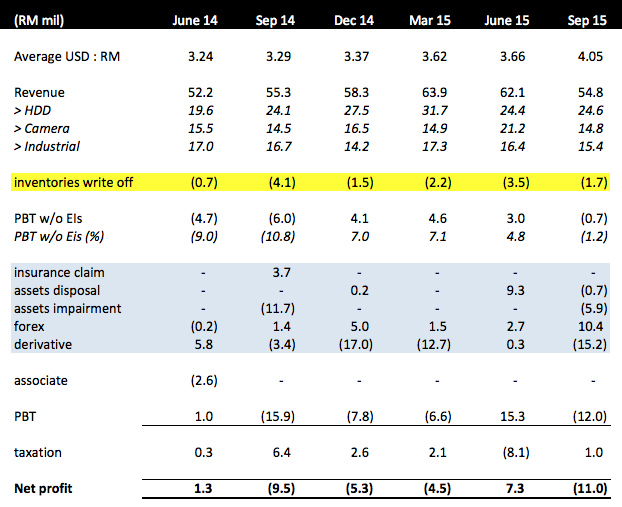

The table below sets out the group's past few quarters P&L :-

Key observations :-

(a) In the latest September 2015 quarter, the group's PBT (without exceptional items) came in at negative RM0.7 mil. This is a huge disappointment as the average exchange rate during that quarter was a very favorable 4.05.

If an export oriented company cannot perform when the USD is so strong, I really have reservation about its viability.

This is the deal breaker for me. At the beginning of my study, I was actually 90% keen about the group. The theme seemed to be that of a fallen angel - strong operational performance marred by exceptional items, waiting to turnaround. But the September 2015 quarter's disastrous result is really disconcerting. It forever changed my perception of the group.

(b) When I first started with my spreadsheet, I group "inventories write off" together with other exceptional items. However, as I keyed in more and more figures, I notice that it exists in EVERY quarter. Looked like they are not one off events, but regular feature of the group's operation.

(c) The group's balance sheet is quite strong. With net assets of RM280 mil, loans of RM38 mil and cash of RM43 mil, the group has net cash of RM5 mil. Annual interest expenses is approximately RM3 mil plus, a very small figure if compared to total turnover of approximately RM240 mil.

(d) As mentioned earlier on, derivative losses dragged down group earnings. During FYE 30 September 2015, total derivative losses was RM44.6 mil. During the period, total forex gain (arising from net exposure to USD assets) was only RM19.6 mil. In short, the wrong hedging policy resulted in net forex losses of RM25 mil.

(e) A very appropriate word to describe the group is "GungHo". Apart from the currency misstep, the group had also been very adventurous diversifying into all kind of industries.

In the early 2000s, the group was only involved in HDD. The SLR camera division was acquired in 2006 (?). It does not turn out to be a huge success.

I only went through few quarters of the group's financial results. But that alone has turned out many details of failed / aborted ventures. The RM11.7 mil asset impairment you see in September 2014 quarter was mostly due to writing off of associate company involved in mining.

They also recently aborted smartphone glass production and smartphone online distribution.

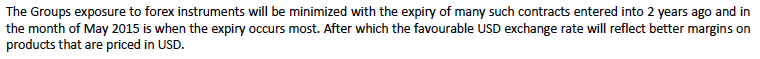

(f) It is difficult to understand and track down the group's hedging activities. In the March 2015 quarter, the company stated the following :-

However, in the September 2015 quarter, the company stated the following :-

Did the company re hedged after the contracts expired in May 2015 ?

@.@

5. Concluding Remarks

(a) As mentioned earlier, I was originally very keen about the group, but its weak September 2015 quarter spooked me.

(b) Ignore this stock ? Difficult to say... It all depends on the coming quarter result. If forex loss can be avoided (Ringgit has actually strengthened in Q4 of 2015. That could be favorable to their hedge) and they churned out two quarters of good results, many people will jump in.

As for now, I think I will give it a pass.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

that Icon, I cleared off my Notion stocks at .42 cents.

I really dun wanna deal with bad ppl liao, first was Gpharos, second was Notion

tatoally 不按理出牌的

2015-12-31 18:11

Enlightening

Very poorly managed group

Chairman selling out

My view is that. He must go

If this co is in USA he would he been sacked by activist shareholders long ago

He is gambling the group future away with all sorts of diversifications

Until he goes best to stay away

For those who have bought the shares while the coco was riding high, just like me, can only hope that a new major shareholder emerges and revamp the management

Like I said first step is for the chairman to step down

2015-12-31 18:59

Great analysis. Just to share a bit as I am a Notion shareholder and have attended a few of their AGMs to ask questions directly and to have a feel of the management and board. Icon is right in saying that they were rather "Gung-Ho" when doing hedging and going into the silver mining business. It is really a bad decision to hedge so much when there is a "natural" hedge in place, i.e. some of their inputs are imported in USD vs Sales. Instead of focusing on their HDD and Camera, they have wasted time and effort into business/investment which are not their strength. If I have the time, I will go their their AGM next month to grill the Board and management......

2016-01-04 12:24

Value investor

If only there is enough activist shareholders to get rid of the present chairman grilling is an exercise in futility

2016-01-06 22:43

noobnnew

Nice write up. Icon sifu, are you going to write for Media Prima part 2 given the falling of its share price recently. Thanks

2015-12-31 11:09