(Icon) Looking Forward To A Turbulent 2016, The More Messy The Better

Icon8888

Publish date: Fri, 15 Jan 2016, 09:03 PM

These two days many people were very scared. RBS said 2016 is end of the world, everybody should go and hide in the cave.

http://money.cnn.com/2016/01/12/investing/markets-sell-everything-cataclysmic-year-rbs/

I read one paragraph and threw away that article.

Optimus Prime also ran around like headless chicken. He said George Soros said it is the end of the world. We should all go and hide in the cave.

http://www.bloomberg.com/news/videos/2016-01-07/is-george-soros-right-that-we-are-in-a-crisis-

I didn't even bother to read that article.

Why Icon8888 so gung ho ?

I wasn't always like that. In 2015, when the bear came, I ran around like headless chicken as well.

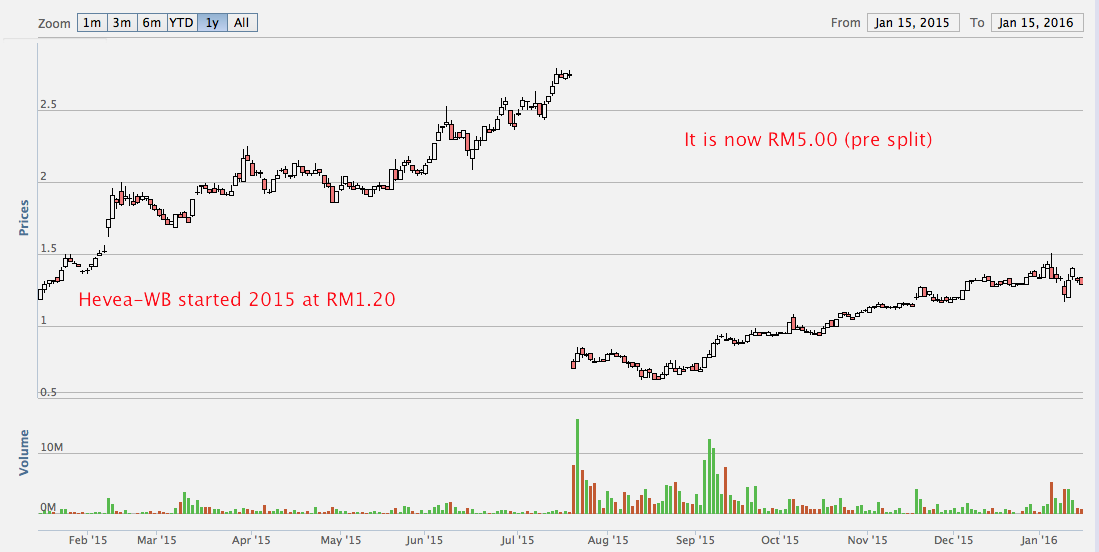

But if you look at the charts below, you will also feel that there is nothing to be afraid of.

What do all these stocks have in common ? They are all export stocks.

2015 was a horrifying year. Malaysia experienced massive currency devlaution. Many stock price plummeted.

However, this turned out to be a golden opportunity.

Have you heard of a saying "Have your cake and eat it too ?"

2015 was such a year. Financial panic caused the price of many export stocks (togther with many other stocks) to plummet. At the same time, the sinking Ringgit acts like a pump that keep pushing steroid into the P&L of export companies.

Stock price kept dropping while corporate profit kept ballooning.

When the dust settled down and calmness returned, all those export stocks experienced massive re rating. Many people laughed all the way to the bank.

As I look into 2016, I saw a high possibility of history repeating. There are three big mountains weighing down on Ringgit :-

(a) US is expected to raise rates by as many as 4 times.

(b) Chinese Yuan is likely to be weak in 2016.

In 2015, China artificially propped up the Yuan to curry favor with IMF to gain political support for inclusion in Special Drawing Rights (a currency basket that grants it Reserve Currency Status).

China did that by actively selling USD to buy Yuan. As a result, even though with month after month of trade surplus, China experienced a massive outflow of US Dollars (USD500 billion), causing Dollars reserve to drop from USD3.9 trillion to USD3.4 trillion in 2015.

The IMF finally approved Yuan inclusion in its December 2015 meeting. With that out of the way, China is now back in the currency market to reverse the decline in USD reserves.

They did that by printing Yuan to actively buy US Dollars. This will allow US Dollars to flow back to their treasury, addressing the anxiety associated with USD depletion. However, the end result is the devaluation of the Yuan.

This augurs well for their exporters as well. So China has every reason to keep doing that in 2016.

(c) Oil price is expected to be very weak in 2016. Many people will shrug when I say this. This is because oil price has already dropped to USD30 per barrel. With Iran returning to the oil market soon, oil price is unlikely to recover in the near term, unless a massive war broke out in the Middle East to disrupt supply.

All the above factors put together will form a big overhang against Ringgit appreciation. Just imagine you are a fund manager managing billion of Dollars of currency portfolio. Do you dare to simply bet in favour of a strong Ringgit ? Please bear in mind that every 3 months the US Fed plans to raise its interest rate. Do you want to stand in the path of the tornado, which will blow at you every 3 months ?

Concluding Remarks

The current macro environment is a once in a life time opportunity to make money from stock market. Very seldom we will have such good earnings visibility for a particular group of companies. We shoud make use of the opportunities and not let them slip through our fingers.

Don't be afraid of the coming market trubulence. The more uncertainties in the financial market, the better it is for exporters. If things work out well, 2016 could be another bountiful year, provided you pick your stocks wisely and carefully.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Ah moi, according to the guest speakers, investors believe that China deliberately devalued the yuan to revive their faltering economies. It's fallacy because China is slowing down but not in danger of any recession.

The real reason is because China cannot afford to continue pegging the yuan at a certain rate and had to succumb to the huge market forces of yuan flight. When they did that the first time in Aug, they thought that it'll be enough hence they guided the market that there'll be no more but they did it again this month.

So, be prepared for currency wars though not a deliberately one by other emerging markets. Thus, expect prolonged weakening of regional currencies or at least until oil prices stabilize

It looks like export based and domestic construction companies benefiting from the slew of infra works (provided they are not cancelled - highly unlikely based on comments of a government think tank. Budget cuts expected to affect expenditure slash for all ministries instead) to be a safer bets for the year.

2016-01-16 10:53

ayoyo I agree with your view

what stocks you think are worth paying attention ?

2016-01-16 10:59

Tkp2 only 2 years old in stock mkt?seriously????if then i need to dig a hole for myself to hide.....

2016-01-16 12:23

Chonghai another low profile smart guy in i3 i like.....diam diam ubi.....sure n steady....i started to curi curi follow him lately.

2016-01-16 12:25

Ayoyo

Currency war....

I am talking about currency war... you are talking about currency war.. but different outcomes

Currency war is all about trying to gain an edge in exporting by weakening ones currency....

I am saying thanks to AhJibKor.. he has given Malaysia a head start in the game.. unintentionally.. with his 1MDB... RM will not go down more.... but RMB will be going down more soon as China is going for a deliberate devaluation.. its manufacturing companies will come alive.. US is bracing for this prospect.. Malaysian companies no need??

Prices of export companies not toppish??

IMO... Malaysian export companies play is in the 35th minute of the 2nd half...

Mr k has bailed out already.. deliberately..

sneakily... quitely...

2016-01-16 12:32

@icon, I'm a very unsophisticated speculator. I buy on chart breakouts and then a lazy check on its low PE and growing quarterly profits. Nothing spectacular. Thus, you can see me in some of the stocks you hold. I like that you give a wider perspective to your selections. Makes a better conviction

I think it's important how investors view this market panic which will determine their positions. Do they see it as a growth shock or recession? . SnP500 was trading around 15xPE prior to fall, and now it's around 13x.if you think it's a growth shock, then it's near buying levels based on historical growth multiples. If you think a recession is coming, then you wouldn't buy until at least another 10% fall. So, if what's your take?

@moi, currency war is a deliberate attempt to devalue to increase competitiveness. The problem now is structural. Genuine large and real outflows of yuan flight and China seems to be naive in dealing with this issue. You can try to Google effects of yuan devaluation on the US or the world

2016-01-16 14:33

Amidst the oil bloodbath, Warren buffet continue to accumulate stocks in Phillips 66. A true contrarian

2016-01-16 14:38

Philip 66 is an oil refiner... not producer... there is a big big defference

Philip 66s raw material is crude oil...

Experts are even foreseeing a drop in the prices of oil products.. not just prices of the crude oils...in near future

2016-01-16 14:46

Behind every cloud is a silver lining.

Why Warren Buffet bought Phillips 66?

Since Phillips is a Refinery the fall of Oil Price means better profit margin. With cheap crude oil as feed stocks for refineries profits will accelerate upward!

Hmmm?

I got one very good stock which beneit the most from cheap oil.

Will post soon.

2016-01-16 14:47

Chart wise, the dow is not seeing capitulation volume compared to when in August but prices falling with consistently building volume. This could mean only 2 things, that we have not seen the lows yet or the market has priced this in hence no sudden shocks (as compared to august when china's action was a surprise move)

Either way, there's always a buying opportunity for good stocks, where one has priced a fair value of PE12 or ev/ebit of 12 fair value on their fav stocks. Maybe discount that to pe 8 or ev/ebit of 8to 10 should provide some good reference to start your buying

2016-01-16 14:47

Should read as,

I got one very good stock which will benefit the most from cheap crude oil.

This one is a real bargain overlooked by the masses.

Watch out for the Next Post soon

2016-01-16 14:50

And... since export companies have benefited from the overly weak RM due to AhJibKors doing...

It is only fair that you all should help out AhJibKor with his headache from his 2016 Budget revision.... a 3% to 5% windfall tax on that extra profits that export companies made as they have benefited from the overly weak RM due to AhJibKors doing... is in order

2016-01-16 14:55

I also found one recently...

Calvintaneng Behind every cloud is a silver lining

I got one very good stock which beneit the most from cheap oil.

Will post soon.

16/01/2016 14:47

2016-01-16 15:19

Icon, how about Luxchem?

From previous history, luxchem recorded good margin and eps on 2008-2009 when oil drop heavily.

2016-01-16 15:35

Dear Mr.Icon8888,

Do u organize any talk or seminar?

Would like to learn from u :)

2016-01-16 15:47

I'm getting to believe what this investment guru Hu Li Yang mentioned, the storm is on it way https://youtu.be/WTxKH_wkfa0 . The rhythm is oil down, then share and property down.

2016-01-16 16:52

Try to understand how the Economic cycle works, ride on the correct timing, invest in good property and good stocks at low, hold it, and sell at high. Be patience, wishing to be millionaire before 30

2016-01-16 21:36

Too late to join the world of adults because of study life. Missed the boat of property and stock booming 2008 -2014. Hiassss

2016-01-16 23:43

Young Man U havnt missed anything, a bright future ahead, don't worry...

Stick with i3, sure make $$$

X D

2016-01-16 23:45

icon do u sell any stock or add recently?how about mudajaya and tecguan now

one plant havent start one cpo price not stable

2016-01-17 00:19

This article doesnt take shale bubble and lots of bad loans into account. If you are holding dollar, there isnt much investment option to choose from. So the media is right in the sense that they are talking in american perspective and dont give a fxxk to malaysian.

2016-01-17 00:30

Wah, if you continue your pace like this week, you can become no1 leh icon! From bottom!

2016-01-17 01:49

I don't mind being number 1 from bottom...

It is nice to cool down my readers. They have been a bit over enthusiastic recently, ha ha

2016-01-17 09:55

Hello icon sifu, do u still think gadang is a good buy at current price? HOld or buy?thanks

2016-01-17 11:25

only one advice from Mr Market, never fight with him and follow his trend. : )

2016-01-17 19:45

I tell u what, paperplane is only good in playing barbie doll, monopoly, UNO cards...for stock market he is -5% in 2016

2016-01-18 23:17

kakashit

0650hk lai lai lai

2016-01-16 10:11