(Icon) Unimech - An Interesting Indonesian Recovery Play

Icon8888

Publish date: Wed, 07 Sep 2016, 12:17 PM

1. Introduction

This article that you are reading now was first written by me back in February 2016. However, I did not publish it because I was waiting for the company to turn around (no point writing about a company with low profitability).

That moment has finally arrived. Unimech reported net profit of RM4.6 mil in the latest quarter. All were operating profit, no exceptional items.

According to the company's announcement, EPS was 3.86 sen. However, that was based on ordinary shares of 119 mil. After factoring in 30 mil ICULS outstanding, fully diluted EPS should be approximately 3.1 sen.

Based on existing price of RM1.12 and annualised EPS of 12.4 sen, the stock is trading at PER of approximately 9 times.

2. Background Information

Unimech is principally involved in manufacturing and trading of valves and fittings for instrumentation and other purposes.

A valve is a device that regulates, directs or controls the flow of a fluid (gases, liquids, fluidized solids, or slurries) by opening, closing, or partially obstructing various passageways. Valves are technically fittings, but are usually discussed as a separate category. In an open valve, fluid flows in a direction from higher pressure to lower pressure.

(Source : Wikipedia)

(Industrial valves) (Marine valves) (Control valves)

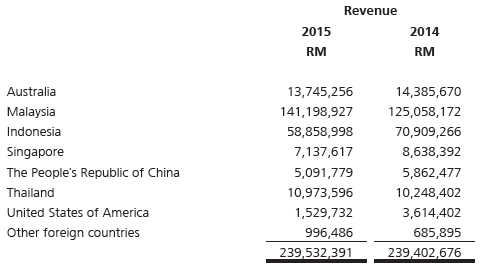

Apart from Malaysia (its primary market), the group also sells its products to Indonesia, Thailand, Australia, etc.

The group has net assets of RM244 mil, loans of RM125 mil and cash of RM34 mil. As such, net gearing is approximately 0.37 times.

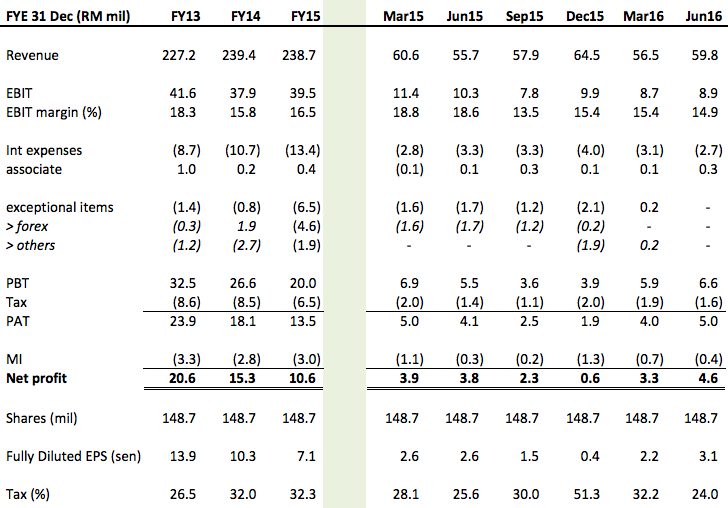

3. Historical Profitability

Key observations :-

(a) FY2015 was a difficult year as forex losses and impairment of receivables caused earnings to drop by closed to 33% from RM15.3 mil to RM10.6 mil.

(b) However, if the exceptional items are removed, the group's performance was actually quite stable and resilient, with EBIT of approximately RM40 mil per annum over past three years.

(c) With the absence of exceptional items, the group's latest profitability almost returned to its 2013 level of approximately RM20 mil per annum (if RM4.6 mil is annualised).

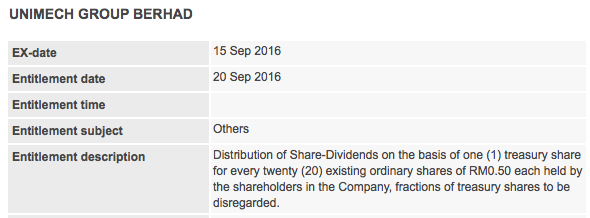

4. Distribution of Treasury Shares

Unimech has been consistently buying back shares. On 1 September 2016, the company announced that it will be distributing the treasury shares to shareholders on the basis of 1 share for every 20 shares held. Based on latest price of RM1.12, that amounts to distribution of 5.6 sen (dividend yield of 5%).

The distribution will go ex on 15 September 2016.

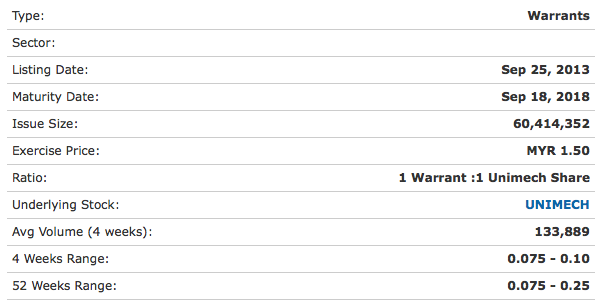

5. Evil Delicious Warrants

Unimech's Warrants is currently trading at 9 sen. Its exercise price is RM1.50. Expiring in September 2018 (two more years to go).

6. Concluding Remarks

(a) I first noticed Unimech back in February 2016. I like their business. I wrote an article but decided to withhold from publishing as the group's profitability was still weak.

(b) The stock used to trade as high as RM1.75 back in 2013. It retraced to approxmiately RM1.10 recently.

At current price, the stock is not really significantly undervalued (prospective PER of 9 times).

However, the Warrants did look interesting. When I first looked at it in early 2016, it was trading at approximately 13 sen. With two more years to go, I felt that there is a reasonable chance of making money (I am very comfortable with their business in the first place).

During a period of 6 months, I consistently bought the Warrants from 13 sen all the way down to 9 sen. My average cost now is approximately 11 sen.

(c) One recent positive development is the recovery of Indonesian economy. Indonesia is one of the most important markets for Unimech, accounted for closed to 25% of its revenue.

It is widely expected that Indonesia's economy will further strengthen in 2H of 2016. I hope that will spill over to benefit Unimech.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

This stock up jor few sen after sifu icon posted article, even warrent oso... btw hv to thx sifu icon 4 sharing ...lolx

2016-09-07 15:08

Icon8888 likes Indon play, I like Indon play too. For inexpensive exposure to Indonesian consumer, take a look at SGX listed Japfa. It supplies poultry, milk and processed food operation in Indonesia. It also supplies pork and poultry in Vietnam, poultry in Myanmar and India as well as beef and dairy in China.

2016-09-07 16:11

icon8888 u sure kah ? Volume traded oso like infected by Zika ? Izzit your long term play ... maybe consider to pickup when Affin start to run ?

2016-09-07 16:13

This warrant is super penny size. All I am saying is that within next two years (expiring in Sept 2018), all you need is one round of positive re-rating for the mother shares, and the Warrants can go crazy.

What is the chance of positive re-rating for the mother shares ?

Very healthy chance - the PLC is profitable, reasonable Balance Sheets, moderate PER of 9 times, potential excitement from Indon recovery, resilient industry (its products are used for manufacturing and infrastructure, not some bubble blowing property companies or concept plays) and illiquidity (works in your favour when price goes up)

I have very favourable experience playing Zika Warrants. I bought IJM Land WA at 12 sen during 2008 Lehman brother crisis. Few years later when mother shares performed, the Warrants went up to more than RM1.00

My gut feeling tells me that this Zika Warrant has the chance to do that (Smell of Money is there). But of course everything comes with risk, you money your risk your reward

2016-09-07 17:26

true, one round run like Johotin-wa, from 0.16 to 0.9 will do, worth a bet, high return with reasonable risk, go for it

2016-09-07 17:27

I don't simply recommend Warrants because of their Zika size. There were many Zika Warrants trading at few sens in Bursa. However, they usually have problems. The mother company is likely losing money, highly geared or in a very difficult industry with no light at end of tunnel.

That kind of Zika Warrants I won't touch with a ten feet pole.

I only play Zika Warrants with healthy prospects.

As Unimech is healthy, the moment I look at the Warrants at around 10 sen, my antenna immediately send signals to me already

2016-09-07 17:30

thanks soojinhou for your tips. I will take a look.

Read your Triyard article recently. I not buying, but the concept is very interesting. I super like it

==============

soojinhou Icon8888 likes Indon play, I like Indon play too. For inexpensive exposure to Indonesian consumer, take a look at SGX listed Japfa. It supplies poultry, milk and processed food operation in Indonesia. It also supplies pork and poultry in Vietnam, poultry in Myanmar and India as well as beef and dairy in China.

07/09/2016 16:11

2016-09-07 17:33

you want to sailang also difficult lar, not many seller want to sell to you. Today, i keep buying but still not enough, tomorrow will continue buy buy buy, this risk is reasonably low, as this warrant still have 2 years of life.

If the mother can also move up (we all should support buy the mother as well), then 0.2-0.3 for warrant in short is not impossible, whether or not to go to 0.9-1.0 like Johotin is depend of luck and the next 2-3 quarters QR, last Q EPS is 3.86 cents, all we need is slight better better EPS let say 5 cents, then the mother can go up to 2.0, then is possible for warrant to run wild like Johotin-wa.

2016-09-07 20:53

when Icon bought Johotin during 1.5 and the warrant at 0.15, not many are interested beside me and bro Murali, but look at what happen to that warrant, up to 0.9 at one time, I have a strong feeling this is another Johotin-wa.

2016-09-07 20:55

sad la...:(

first ever Icon's stock i bought...and it never move.

while all others that i did not buy...fly sky high....

next time i need to wait for his slogan 'sell your house, car and your...."

may be then only consider..

2016-09-09 21:04

Dear Hippo, no offense taken. But please allow me to politely point out that non of the stocks you highlighted above have gone Holand. Their (temporary) non performance is part of Buy and Hold strategy. One day they will go up.

Some of the stocks I pick can immediately shine (rare cases). Most require a holding period of 6 to 12 months. Some will fail (GOB). But overall, success rate is much higher than failure, if you are patient to go through the holding phase.

2016-09-10 16:46

Free tips...some more winning rates is higher than 70%....where to find.....owe u meh

2016-09-10 16:51

From my experience following Icon stock pick since 2015, i think his success rate around 70%-80% (tell me who can deliver 100%, i tiok), this is already a fantastic results. The above counter Hippo mentioned not gone holland lah, just not moving, but not dropping, please be specific or mindful when you provide such comments.

I follow Icon buy call selectively, i have been making more than 200% in 2015 and 2016, you have to do you own homework before follow anyone, is your money.

2016-09-10 16:59

hi bro murali, how are you?

This Unimech-wa i feel like got potential like Johotin-wa, can play lor

2016-09-10 17:01

I earned $$ from stock market since sifu icon posted article...especially AA, Cimb n etc...And tkps2 recommended cw oso... Reli appreciated...

2016-09-10 17:11

Yes that is very true. I find it very challenging to make more than 20% per annum.

10% is more achievable.

Hey but please don't be too pessimistic. I think you and many other i3 members are on right track. I believe Our methods of investing based on a combination of the following three components : (a) discussions and fishing for information regularly from i3, (b) buy stocks based on attractive forward PER and (c) take into consideration "momentum" (don't buy stocks that are too Cold), can put most i3 membersvin the top layer of the investing community. We might not be able to get super rich, but we should be able to earn some extra cash to eat KFC

2016-09-11 08:52

U said one day wil go up?! Then every counter oso one day wil go up ger la.. Must as well don recomend any stock

2016-09-11 09:00

hi icon8888 sifu,how about we put our fund in mutual fund or unit trust if we dont want to burdened by dilemma and stress of investing on our own.So what do you think about this leaving our money to those fund managers to handle?

2016-09-11 09:01

haha first of all pls don't call me sifu..

as for your question, I think if you are young, should try to invest on your own. If not work out then only switch to funds

if you are a retiree, maybe should check with people which fund is good (if you are uncomfortable handling your own money). You can try talk to KC for that. He should be able to guide you

wkitwing hi icon8888 sifu,how about we put our fund in mutual fund or unit trust if we dont want to burdened by dilemma and stress of investing on our own.So what do you think about this leaving our money to those fund managers to handle?

11/09/2016 09:01

2016-09-11 09:34

U think invest in mutual fund so easy to earn money ka?! Need to enter wisely n timely... Not blind blind ask ppl to invest in mutual fund

2016-09-11 09:54

Hello,icon8888,may i know why the taxation u show here is different from the financial report,the financial report shows 8.3 and urs 6.5.It leads to different net profit also.I'm a newbie in investment,still learning on how to look at financial report.Thanks in advance !

2016-09-24 14:03

The warrant exercise price is RM1.5. It means warrant currently is underwater. This valves business is quite resilient. Unless, the company has embarked a strong marketing otherwise, it will be just a gradual growth or stagnant.

I yet to study in details of the efficiency of the company. But, at least management is not stringent in rewarding shareholder. I not sure when do reference to its peak time (2013), why EBIT margin is high at 18% compared to recent around 15%?

Revenue still maintain, but market price it at 13x during FY2013. Will market rerate it now? If only if there is growth or improvement in bottomline.

TA wise, I think the consolidation yet to complete. It will be downwards or stagnant for a while.

No offence to anyone just simply my personal view. I must thank Icon for his many great articles. I have benefited a lot.

2016-09-28 17:52

I checked a bit, not in details.

It listed the indonesian arm in 2013.

I read a bit on the indonesian listed subsidiary, september results released, not very good.

Malaysian business shown improvements, probably that's where they have been putting efforts on. When business were booming (back in 93, so they go to list in Indon), they lost their focus.

2016-11-27 10:35

Icon8888 Sifu, I just bought into this stock. Time is ripe as Oil & Gas theme is now being played.

2018-10-12 20:18

tkp2

the warrant remind me of Johotin-wa during 0.16, huge potential, worth a bet

2016-09-07 12:33