(Icon) AAX (1) - Is This Stock A Good Buy ?

Icon8888

Publish date: Wed, 23 Mar 2016, 02:51 PM

(Hmmm....)

1. Investors Apprehension

Despite announcing an impressive set of results recently, investors seemed to be a bit apprehensive about AAX. Even though both Air Asia and AAX had gone up by more or less the same percentage, it is obvious that Air Asia attracted more interest. Very often, it is the strong buying in Air Asia that drags AAX price up with it.

Do a quick check of AAX's latest quarterly results and you will know why.

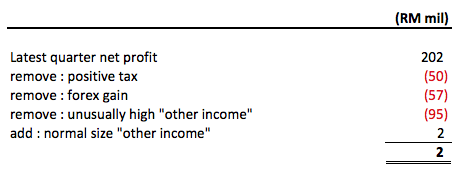

As shown above, the group reported net profit of RM202 mil in latest quarter. However, after making adjustments, core operating profit dropped to RM2 mil only.

One thing that upsets me is that all these were achieved with average fuel cost of USD 62 per barrel. Why is it that the group can only break even when fuel cost is so low ? What are the drivers and inhibitors ? Will things improve going forward ? It is with all these questions in mind that I decided to undertake a detailed study of the group.

2. Historical P&Ls

Key observations :-

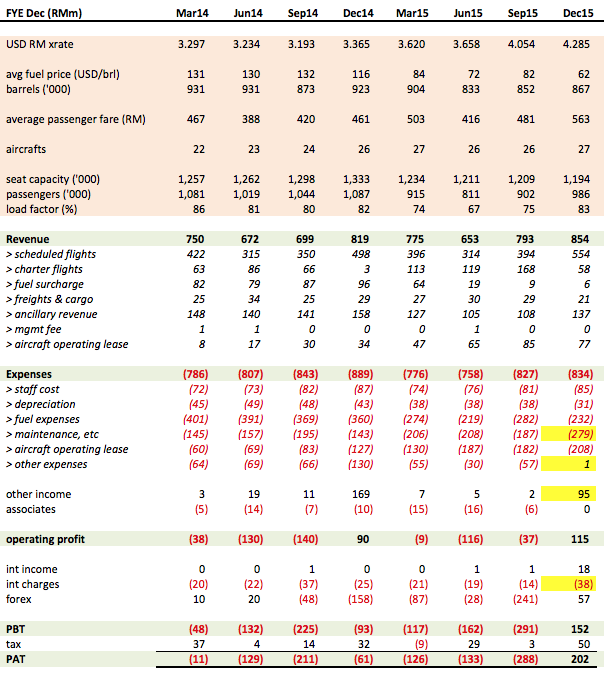

(a) Fuel Cost

In Q4 of 2015, AAX Group's average fuel cost was USD 62 per barrel (note : Air Asia's cost was higher at USD 75 per barrel). I did a quick check to see whether my formula works.

Fuel cost = 866,453 barrels x USD62 x 4.285 (Q4 2015 average exchange rate) = RM230 mil.

This is very closed to the RM232 mil in the quarterly report. Great.

I understand that Air Asia has hedged some of its FY2016 fuel requirement at USD59. Lets use that to run a simulation for AAX.

By applying the same formula, adjusted fuel cost per quarter = 866,453 barrels x USD59 x 4.10 = RM210 mil.

(note : I use exchange rate of 4.10 to be consistent with my earlier Air Asia article. Anyway, no harm to be a bit conservative)

Fuel Saving per quarter = RM230 mil - RM210 mil = RM20 mil

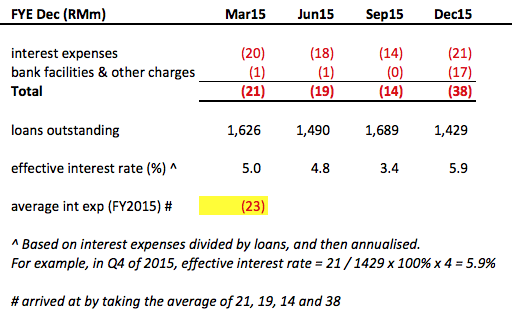

(b) Interest Expense

This is one of the major item that distorted latest quarter earnings.

As at 31 December 2015, the group has RM1,429 mil borrowings. However, Q4 interest expenses was RM38 mil. Interest rate works out to be 10.6%.

Closer examination showed that actual interest expense was only RM21 mil (translating into a more reasonable 5.9% per annum). Total financing cost was inflated by bank facilities fee and other charges amounting to RM17 mil.

Even though the RM17 mil figure inflated quarterly interest expense, I decided not to treat it as a one off item. According to quarterly reports, as part of its financing structure, AAX group repays and draws down loans regularly. There is a possibility that the RM17 mil constitutes arranger and facility fees payable by AAX to financial institutions for those financial transactions. If that is the case, it might be a regular feature that happens at least once per annum. To accomodate this item, I keep the RM17 mil but took the average of 4 quarters as the interest expense figure to be used in the financial model (please refer below).

(c) Maintenance Charges

I am highly suspicious of this item. In the previous quarters, its average was RM200 mil (being average of 206, 208 and 187). However, in Q4 of 2015, it increased by RM79 mil to RM279 mil.

The RM79 mil spike has a material effect on overall group earnings (RM316 mil, if you annualise it).

Is RM279 mil per quarter the new norm ? Or it contains certain one off items that will not re appear in subsequent quarters ? I don't have the answer for that.

However, I notice that in Q4 of 2015, AAX's aircrafts increased by only 4% (from 26 to 27 units). During the period, USD appreciated against the Ringgit by 5.7% (from 4.054 to 4.285).

After factoring in all these changes, by right maintenance charges should be RM220 mil instead of RM279 mil (a difference of RM59 mil).

(Note : RM200 mil x 1.04 x 1.057 = RM220 mil)

(d) Other expenses

During Q1, 2 and 3, average figure for this item is RM47 mil (being the average of 55, 30, 57). However, in Q4, it has become positive RM1 mil.

The company did not provide explanation. However, since it has always been there historically, I will add back RM47 mil to the financial model.

3. Financial Model

The model will now look like this :-

4. Concluding Remarks

(a) Not too long ago, I did a similar analysis for Air Asia. I have to say that compared to AAX, Air Asia's case gave me more comfort - it required me to make less assumptions and adjustments.

(b) Among the so many items in AAX P&L, the unusually high maintenance charges in latest quarter posed the biggest challenge for me to build a convincing financial model. Due to the sheer size of this number, it will have a huge impact on earnings should it swing either way. We can only find out more in next quarter results.

(c) As a result of the above, I don't think I am in a position to give a meaningful call for AAX. However, due to the following two factors, I am in general quite positive about the group's prospects :-

(i) low fuel price; and

(ii) strengthening of Ringgit, as closed to 70% of expenses are denominated in USD.

(d) Last but not least, I would like to point out that my financial model assumes zero deferred tax. However, in past 2 years, average deferred tax was positive RM20 mil per quarter. If you add the RM80 mil per annum back to P&L, that would provide buffer for achieving the RM184 mil net profit churned out by the model.

Different investors have different way of making assumptions. You have to decide what your expectation should be. Only time can tell whether you are right or wrong.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

you good in making stories, see Genting WA, MMCCorp. go make some stories

2016-03-23 15:10

Who you think you are icon?

What is all these assumptions you have?

Ever heard of garbage in garbage out?

Applies perfectly to your wasted time.

Bottom line is this........even with AAX making zero profits for the rest of this year, the share price will be at least 30 sen....as long as it is not a loss.

Now with oil price at 40 and ringgit stronger....I chop it off if AAX do not make great profits for the rest of 2016.,,,, does not need much to support a share price of 30 sen......

But needs a lot of certain profits to support a share price of $ 1.80,

Icon...you no analyst.....you are a story teller.

2016-03-23 15:12

What I hate most is all these amateurs making adjustments to audited accounts without having spoken a single word with management....this out, this in, this ......this green, this red, this recurring, that not recurring.

Icon......you think you are picking fruits in a market?

For your info, even a simple thing such as realized forex gain is not for you to throw away....it just as reliably a sales item for that period. Far from as simple you amateurs think.

Silly ladies may be impressed with you. Certainly, I trust PW partner who are paid a million$ to audit the accounts, to be more familiar with the company than an outside blogger.

2016-03-23 15:26

If they indeed achieve 4.4 sen EPS, target price will be 44 sen, 50% upside from now

yktay1 Hi Icon, it is right for you to be apprehensive of AAX. However, isn't the breakeven a good improvement over the huge losses recorded previously? If you are forecasting eps of 4.4sen, what would your target price be? Do you think it is justified?

23/03/2016 14:58

2016-03-23 15:42

I already know the silly ladies who gets impressed by con con superficial stuffs.

Superficial stuffs., , not superman stuffs.

2016-03-23 16:19

Mau beli..cepat lo...still left 10 minutes to Grab...tomorrow will gap up once opening as no more road block...

2016-03-23 16:49

AAX 12 % of Klia traffic . AA 24%. Market cap $1 billion vs $5.2 billion.

AAX long haul service higher revenue per flight.

Easy to see who got more potential to improve and share price to perform on a relative basis.

No need to pick and amend audited accounts....just use some common sense.

2016-03-23 17:25

refer to the pie chart here.

http://klse.i3investor.com/blogs/kianweiaritcles/93606.jsp

2016-03-23 20:06

Icon8888, Greetings!

It's always a pleasure to read your article, another good analysis!

I think AAX's books is really cleaner than Airasia, it doesn't have so many things like AAI, AAP to drag it down.

What i like most is the average fare is going up @RM563, signals good pricing power.

(By the way, if you look at how AA price its fare, fare starts at low level, after a certain % of tickets sold, price increases a little bit. Fare at dec and jun are basically the same if you book early. In fact, fare for high season should be more expensive. They should have better prediction system to do that. )

AAX is slightly different than AA, as they have limited capacity and often harder to add frequency.

(By the way, for the ordinary people, deep breathing press against the pancreas and release 50% more blood from storage into blood circulation. More blood makes your heart work less, so your heartbeat slows, plenty of oxygen to your brain = less stress).

2016-03-23 20:46

much effort put into your assumptions on aax's accounts.appreciate your deductions n conclusions.time will tell true,good luck to all.

2016-03-23 23:21

Very good & detailed analysis Icon. I have been waiting for AAX write up for a while. Thank you & keep up the good work always.

2016-03-24 08:10

supersaiyan3

Are you sure about this??

I think AAX's books is really cleaner than Airasia, it doesn't have so many things like AAI, AAP to drag it down.

supersaiyan3 Icon8888, Greetings!

It's always a pleasure to read your article, another good analysis!

I think AAX's books is really cleaner than Airasia, it doesn't have so many things like AAI, AAP to drag it down.

2016-03-24 08:31

Will keep my holdings. Bog between 18 - 0.24 averaging up till last month's. Wakaka... Thanks for the good write up.

2016-03-27 10:51

Thx icon for your analysis. Analysis of a company as complex as aax needs certain assumptions n real operating profits are more important than one off items like forex gains n extraordinary gains. Fuel costs are the top priority.

Only empty shadows without real knowledge of what is important in the world of financial analysis keeps saying this or that...without pratical knowhow to back it up. Falsified self glory...sigh

With eps of 4.4 sens its definately good. However again we must see how it goes. Investing is an art n needs judgement .

Thx icon

2016-03-27 13:04

We all must give credit to icon8888. He made a very good call.

Icon8888 i m proud of you.

2016-05-17 22:54

yktay1

Hi Icon, it is right for you to be apprehensive of AAX. However, isn't the breakeven a good improvement over the huge losses recorded previously? If you are forecasting eps of 4.4sen, what would your target price be? Do you think it is justified?

2016-03-23 14:58