(Icon) Air Asia (14) - Bloomberg's Bullshxt Article

Icon8888

Publish date: Sun, 27 Nov 2016, 05:25 PM

1. Introduction

On 24 November 2016, Bloomberg published an article called "Air Asia's New Lease of Life".

https://www.bloomberg.com/gadfly/articles/2016-11-24/airasia-s-new-lease-of-life

The article is basically a repitition of GMT's earlier wild talks about how Air Asia's profitability was artificially inflated by leasing income earned from associate companies.

First of all, I did not find the 2015 GMT allegations credible (will briefly explain in Section 4 below). In my opinion, it was a biased piece of work written by conspirators to enrich themselves at others expense. Its objective was to create panic in the market to cause Air Asia share price to tank, thereby benefiting their own short selling position.

Even though written by a different author, this latest Bloomberg article went along the same line. It paints a picture of how the bulk of Air Asia's profit is derived from aircraft leasing, and the ultimate disposal of it will leave behind an empty shell struggling to survive.

As a shareholder of Air Asia, it is my responsibility to examine the validity of the article and speak up against it if I find that it is trying to paint a false picture to mislead.

To nip the problem in the bud, that is the objective of this article.

2. Trying To Mislead Again

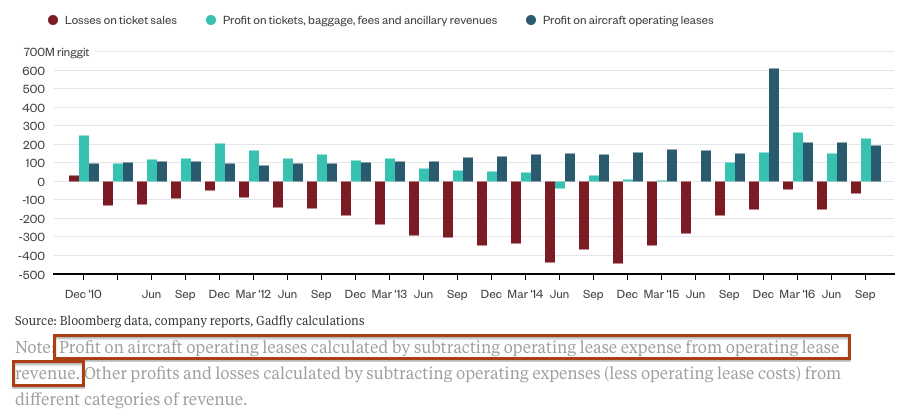

The gist of the Bloomberg article can be summed up in the following chart :-

Basically, the author claimed that Air Asia's profitability comprises mostly lease income, and that the actual passenger operation was not profitable at all (note how the deep blue bars of leasing income are higher than the light blue bars of passengers derived profit most of the time).

Why did I say that it is a bullshxt article ? Why did I say that it is trying to paint a false picture to mislead ? Can I justify my claim ?

Yes, I can.

The major flaw of the article is the way it tries to overstate the leasing division's profitability. According to the author, Leasing Division's Profitability = Operating Lease Revenue - Operating Lease Expense.

This is absoluately not true. It shows either how mischievous the author is or how little he knows about aircraft leasing.

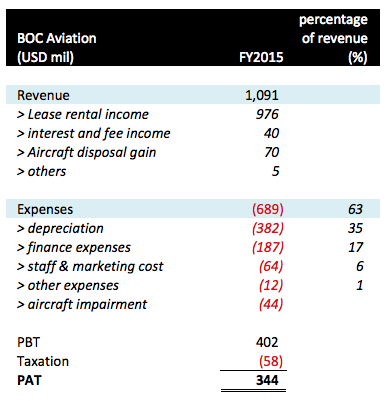

Let's take a look at BOC Aviation's P&L, which I discussed in my earlier article dated 21 September 2016 ("Asia Aviation Capital : Sale or No Sale, Air Asia Is The Winner") :-

As you can see in table above, apart from Operating Lease, an aircraft leasing company also incurred costs such as depreciation charges, interest expenses, etc.

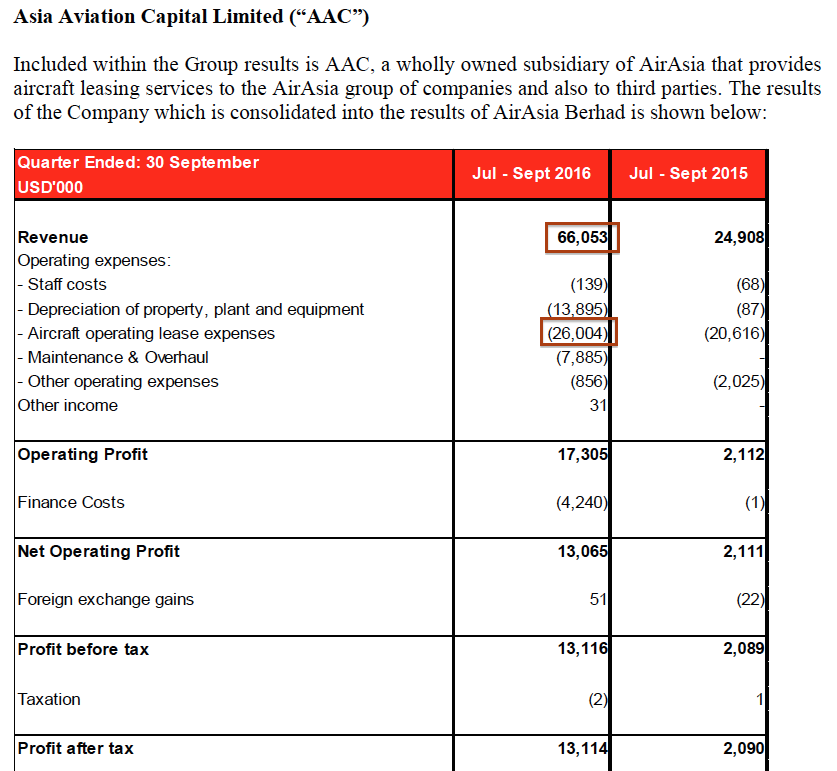

The same also applies to Asia Aviation Capital :-

If you use the author's method, Asia Aviation Capital's profit will be USD66 mil - USD26 mil = USD40 mil. Based on exchange rate of 4.05, its profitability will be RM162 mil, consituting a staggering 46% of Air Asia's latest quarter net profit of RM354 mil.

However, we all know that this is not true. Asia Aviation's latest quarter PAT was only USD13.1 mil, or RM53 mil, as presented in the account based on internationally accepted accounting principles. The difference is RM109 mil, folks.

In a nutshell, the Bloomberg article deliberately excludes depreciation, interest expenses, etc from the P&L of Air Asia's leasing division. The end result is that leasing division's profitability was inflated, while all those cost items are kicked over to the passenger division, making its profitability lower than the actual figure. This helps the author to achieve his objective of painting an alarming picture.

3. The Real Picture

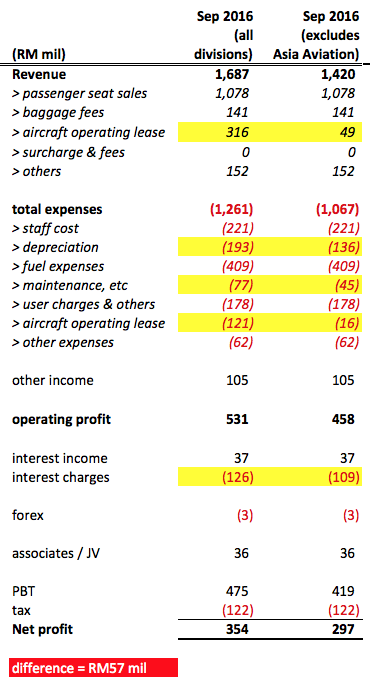

So, how much did the passenger divsion actually make in September 2016 quarter ? To answer the question, I made adjustments to Air Asia's P&L by excluding Asia Aviation's contribution :-

As shown in table above, it will cause Air Asia Group's net profit to delcine by 17%. Not a small amount, but hardly the end of the world scenario as per the Bloomberg article.

4. Concluding Remarks

Since buying into Air Asia, I have studied the group in details. I don't claim to be an expert, but I think I do know a thing or two about the company.

In my opinion, there is some truth that Air Asia makes money by leasing aircrafts to associate companies. However, I don't subscribe to the view that the group survives and thrives because of that :-

(a) Firstly, as much as Air Asia wants to exploit its associate companies / JV entities, will its partners allow it to do so ? Will they allow Air Asia to charge them exorbitant fees for the aircrafts they lease ? NO, THEY WILL NOT. Everything will be done based on commercial rates. They have their own interest to take care of as well.

(b) Secondly, whenever Air Asia squeezes exorbitant profit from its associate companies through leasing (assuming it can do so), the negative impact will flow down to those associate companies' bottomline, out of which 50% of it (roughly) will flow back to Air Asia by virtue of its equity interest. How can you convince me that this is an effective way to boast profit artificially ?

As per my analysis in Section 3 above, on pro forma basis, divestment of Asia Aviation Capital will lead to 17% decline in Air Asia's profitability. Different people might have different view, but I don't find that to be too alarming.

On top of that, there is another mitigating factor - it is unlikely that the entire RM4.6 billion will be distributed to shareholders. If some of the proceeds are used to pare down borrowings, there could be reduction in interest expenses. So, the actual earning decline might not be as much as 17%.

Based on preliminary calculation, the divestment will deconsolidate closed to RM2 billion Asia Aviation Capital debts from Group balance sheets. Plus the RM1 billion to be received from private placement, the improvement in gearing ratio and dividend payment capacity will enhance Air Asia Group's risk profile. There is room for re-rating through PE Multiple expansion.

To sum it all up, there is no need to unduly worry about earning dilution pursuant to Asia Aviation Capital divestment. Always bear in mind that Tony Fernandes is in same boat as you. There are still many things that can be done to unlock value (for example : dual listing in HK). Afterall, current PER of approximately 8 times is not demanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

As always, thanks Icon8888 for clearing the air. I was honestly quite confused after reading that Bloomberg's article.

2016-11-27 17:43

Icon8888....this latest write up of yours....harap can mke me sleep better leh....tq

2016-11-27 17:43

Icon don't want to see share price drops to 70 cents started tomorrow. Can he rescue the scenario? Let's wait and see.

2016-11-27 17:57

I would only start collecting again when it drop to something below 1.00

:)

Buy queue at 1.00, 0.90, 0.80, 0.70...

May be it would come before the 2017 end

2018 sound like a very bad year to me

2016-11-27 18:01

Snipers on position, to run the pressure test for T.F ...

Bigger field , bigger game .

2016-11-27 18:02

From your table, passenger seat sales in Sept '16 Q were RM1.078 bil while total expenses, excluding Asia Aviation, were RM1.067 bil, ie ticket sales barely covered expenses.

But that's not a bad state, as it makes a lot from ancillary income and leasing.

Like selling newspapers at RM1.20 doesn't cover production cost.

The problem the Bloomberg writer pointed out is the effect on total operating income after a sale of Asia Aviation. He did say ancillary income's growing.

After all, Tony said "Don't look at us as an airline. We are a supermarket." (quoted in edgemarkets).

2016-11-27 18:10

The bigger and more threatening accusation is that the leasing income in the PL for all these years is not leasing income but actually borrowings disguised as income.

How does it work?

AA through bulk purchases got discounted planes. It sells these planes to a lessor ( international lessors , not associates) for a profit , do a sale and lease back.

AA got financing, got cash, profits and lease commitments. ...an off Balance Sheet obligation , the profits credited as leasing income.

The accusation is that AA have been doing this for years , financing AA while it grows up. ..and more seriously, jacking up the PL to boost share price.

Now, the baby has grown up, can stand on its own feet....and time to stand on its own feet.

but really......can someone artificially propped up can really stand on its own feet....this is the real question the Bloomberg article wants asked.

2016-11-27 18:27

hallo hallo...apa macam sekarang ??? Bloomberg atau Icon8888 betul ??? any neutral party care to comment ??

2016-11-27 18:37

Common lah, Stocknanny .

U hardly differentiate what gender of Felix, now talking about Aviation / plane ?

2016-11-27 18:45

http://klse.i3investor.com/blogs/icon8888/87883.jsp

chantp88 dolmite in red last QR...i guess dynamite blown in our faces.... :((

25/02/2016 22:44

After Dolomite the Dynamite that blasted will be AAX & AirAsia

Air Asia?

Catching "Air" in Asia?

Great the Depression,

Global the Recession;

Many a millionaire

Jumped, clutching the air.

Millions flown away

Fortunes gone astray,

Bursa in retreat,

Bulls by bears were beat.

Hard the lessons learnt;

Fingers - more - were burnt;

Conman has done his job

All are finally robbed!

2016-11-27 18:52

Go read the Bloomberg article., ven.....

Bolo berg accuses AA for reporting borrowings as income.

What is Tony's response?

Will Tony respond only when share price go below $2 ?

2016-11-27 18:53

I would love to cacth this A.A. flight, since i missed it before.

Census given from DBS to A.A. is $3.40 if my memory correctly.

2016-11-27 18:57

if tony were to answers all the articles (good and bad) out there abt airasia then he wouldn't have the time to manage the company!

2016-11-27 19:07

As always, very insightful and technical. I had this same line of thinking on AAC disposal but in no way could I put it in such an eloquent and technical writing. Thank you indeed.

2016-11-27 19:25

I would also think that to an extent they could still have some income from leasing by a minor leasing business of some planes if there is excess post AAC disposal and this might slowly grow in time as balance sheet becomes stronger and stronger and planes start to increase in number.

2016-11-27 19:28

Posted by OTB_kengchau > Nov 27, 2016 07:22 PM | Report Abuse

Why Calvin doesn't change despite OTB advise?

http://klse.i3investor.com/servlets/cube/post/tbooi1168.jsp

Hope he can improve after reading this posting. It is not an attack, I say it out sincerely from the bottom of my heart.

Thank you.

Ooi

Calvin appreciates OTB kind admonition

Last time Calvin stood aside in Regain Capital Choco Passenger Forum.

By so doing I tolerated Conman there to cheat all the water fish, sorchai, ikan bilis & sotong there

Today, more than 90% of the i3 forum members there have disappeared because they have lost all their monies!

See

http://klse.i3investor.com/servlets/discuss/608510.jsp

Again if IFCA Forum

AlphaTrader with nancytang, chrischan, orionpacific & others led so many to holland.

IFCA crashed from Rm1.87 to only 29 cts today.

And another 90% of those who went GaGa over IFCA have stopped posting in i3 Forum.

This is a big blow & loss to so many innocent people led astray buy charismatic con man in i3 forum. Today Mikekong55 @ Newman has fled!

AlphaTrader also no longer active!

My Johor Sifu warned me that Uncle KYY also got his syndicates here. Is OTB one of them? I really don't know.

And so I will continue to warn and save newbies from all overvalued & other con man stocks.

To whom shall I obey?

To my own conscience or the approval of fickle minded men? Or con man?

2016-11-27 19:36

PW will know the truth

Tony will know the truth

How about an explanation from them.?

2016-11-27 19:53

Go read the Bloomberg article., ven.....

Bolo berg accuses AA for reporting borrowings as income.

What is Tony's response?

Will Tony respond only when share price go below $2 ?

2016-11-27 19:56

Calvin, show us your valid points first.

Your points are mostly despicable, i found.

2016-11-27 20:00

Posted by VenFx > Nov 27, 2016 08:00 PM | Report Abuse

Calvin, show us your valid points first.

Your points are mostly despicable, i found.

Calvin replies:

Ok, at your service.

Will post the vital points soon.

Stay tuned...

2016-11-27 20:06

Calvin is Koon's shoe licker.

He dutifully reposts Koon's blog in i3 since the old egotist can't do it himself without losing big face.

Has he strongly criticised KYY?

He attacks all other regular bloggers at every opportunity.

2016-11-27 20:11

Posted by kpfam > Nov 27, 2016 08:11 PM | Report Abuse

Calvin is Koon's shoe licker.

He dutifully reposts Koon's blog in i3 since the old egotist can't do it himself without losing big face.

Has he strongly criticised KYY?

He attacks all other regular bloggers at every opportunity.

Calvin's response:

A BIG FLAT NO

Calvin said this before in case you all missed

1} Koon Yew Yin stands for

Koon as in "kun" kun means royalty in Chinese

Yew yin sounds like yau yi or affinity

So Koon Yew Yin means KYY has helped many poor students on scholarships

This is good

Or

2) Koon Yew Yin could also mean

Koon as in con (ha! a con man)

Yew Yin sounds like yauyi or sotong in cantonese

So Con sorchai, water fish, ikan bilis & sotong

2016-11-27 20:20

Icon, thanks for the info.

Very useful insight.

Interesting to noticed that ex-AAC, AA's operating lease expense is only RM19mil. Meaning that roughly about 4~5 aircrafts are leased from other lessor.

2016-11-27 20:35

noticed that the capital commitment off interim report is about 92,000m (clause 20 of interim report) 9month profit is about 1570m, simplyfied it say 2000m profit annually, can we say it need 42years profit just to pay off the said capital committent (assume profit growth offset by debt interest increment) ? if it is, 42yeras will be scarely, can sifu out there share your knowlegde on this?

2016-11-27 21:29

I came across Airasia stock years ago after reading a book "Airasia Story". I thought: "Wow, its really making money, amazing!" Fatt tat loh

At that time, Airasia was just about to start KL - Singapore, after Tony publicly lobbying the government for a while. At that time, they book "deferred taxation" as income, and was making roughly 800m a year. I thought: " Fatt tat loh". After KL-SG, should make at least 2b a year. But it didn't.

Then Airasia starts their regional expansion, i thought after AAT listed, fatt tat loh, but....

Then oil price starts falling, RM2.9x is the highest.

i went to a AAX IPO, Tony said Airasia should worth RM6. Bullshxt.....

Now MYR starts to fall again, next quarter figure will look less than satisfactory.

風緊,扯乎!

2016-11-27 21:51

YLR, capital commitment is not a loss by default.

For example, I have a commitment with Petronas to buy 1m barrel of oil at 50usd per barrel, that's 50m USD for a guy who earn maybe 50k per year. I would need 4000 years of income to pay it.

However, let say at 2020 oil price is USD1000, then actually I make profit of 50mil by selling it.

So it's not a correct way to see capital commitment as loss.

In AA's case, do you think Airbus will agree for the contract if they think >50% chance AA can't pay for it?

10 years ago, AA is just a small LCC have less than 20 aircrafts and they make a 150 aircrafts order. They make it today.

400 aircrafts order for a 173 aircrafts LCC today is just a merely 2 times their current size, and AA have a 3bil population market to grow.

2016-11-27 21:53

VLR, to add,

1. your 42 years is base on AA has a fixed annual avenue of 2000m and will never grow. In actual fact, AA's revenue is growing at CAGR rate of 10%, at this rate it will take 18 years.

2. when AA take delivery of an aircraft, they will recognise the asset and borrowing in Balance Sheet, but in Income Statement, they will recognise this cost as depreciation, probably over 20 years.

3. For AA, Tony Fernandes prefer to sell the aircraft when it reach about 12 year old, before maintenance cost start to raise dramatically. At this time, there will be a one-time gain. (note that AA get a big discount for their aircraft purchase, which mean even if they sell an aircraft even at delivery, they will actually make a few million USD gain.)

Hope above help for your study.

2016-11-27 22:23

Hi VLR, my appologise, please ignore #1 above which is a mistake.

AA is taking aircraft delivery as borrowing and they are repaying it with cash flow. In other word, net profit we get from IR is inclusive of those repayment.

2016-11-27 22:46

.

Aviation is capital intensive..... borrowing... goes without saying

It is just whether it is by way of loan or off balance sheet by way of operating lease

So... it is not surprising if Tony has operating leases from 3rd party lessors.... this can see from the operating lease expense

Then.... the next question is...

Where does the airplane in question come from??

The 3rd party lessor got it from airplanes ordered by Malindo?

The 3rd party lessor got it from airplanes ordered by itself?

The 3rd party lessor got it from airplanes ordered by AirAsia?

Must be airplanes ordered by AirAsia isnt it... got discount because AirAsia orders a lot.... powerful

And... so lie the contentious point raised by the article...

How many airplanes have AirAsia sold to 3rd party lessors??

How much were the profits made in selling the airplanes to these lessors?

The article says... A LOT A LOT.... till AirAsia is dependent on it... and this profit will be out of the window.. will follow AAC when it is sold....

.

2016-11-28 14:01

thts why my sifu always said, avoid aviation stock....i am lucky to earn 100% from aviation.......hehe

2016-11-28 14:02

I have 50 stocks on my watch list 4 only green today so AA or AAX is not an isolated case so lets stop worrying lets buy some more

2016-11-29 20:46

Posted by calvintaneng > Nov 29, 2016 08:48 PM | Report Abuse X

WHOA! PBA GOT FANTASTIC RESULT!!

EPS MORE THAN 6 CTS THIS QUARTER

HAPPY FOR ALL HERE!!

CHUN CHUN CALL OF CALVIN TAN RESEARCH

PBA IS A TSUNAMI SHELTERED COUNTER!!

HIP HIP HOORAY!!!!

YAHOOOOOOOOOOOO!!!!!!!!!!!!!!!!

2016-11-29 20:50

I ran through the numbers again. Looks like next quarter is still going to be fine. I think the real problem with Airasia is the ticket price too low, i would suggest management to increase the lowest fare by 10-20% but i know they won't listen. I.e. if you book early, charge RM85 lah, doesn't have to be RM49.90, stupid!

You need a lot of big brains to be able to maximum revenue, or else they need something else (say, big data). Also, they did a few things to correct the past management mistakes which is really superb.

I checked Southwest has gross margin of 50-70%, Airasia just selling too cheap, with gross margin of 20-30%.

Calvin, you did raise an interesting question. But if only 70+ airplanes on book, cost less than 400m each, 12 years straight line depreciation, the figure (2000m +-) is correct then.

say 75*400m/12= 2500m+-. Some planes are done depreciation, plus the some discount on purchases, ngam bah.

2016-12-04 22:34

PlsGiveBonus

Fast fast abandon this falling ship

:)

2016-11-27 17:39