(Icon) Nylex - Looking Good. Time To Make A Bet ?

Icon8888

Publish date: Tue, 02 May 2017, 11:35 AM

1. Introduction

Nylex has two major divisions :

(i) Polymer division - manufacturing of PVC and PU leathercloth, films and sheets, geosynthetics and rotational moulded products.

(ii) Industrial chemical division - Trading and distribution of petrochemicals and industrial used chemicals.

2. Historical Price

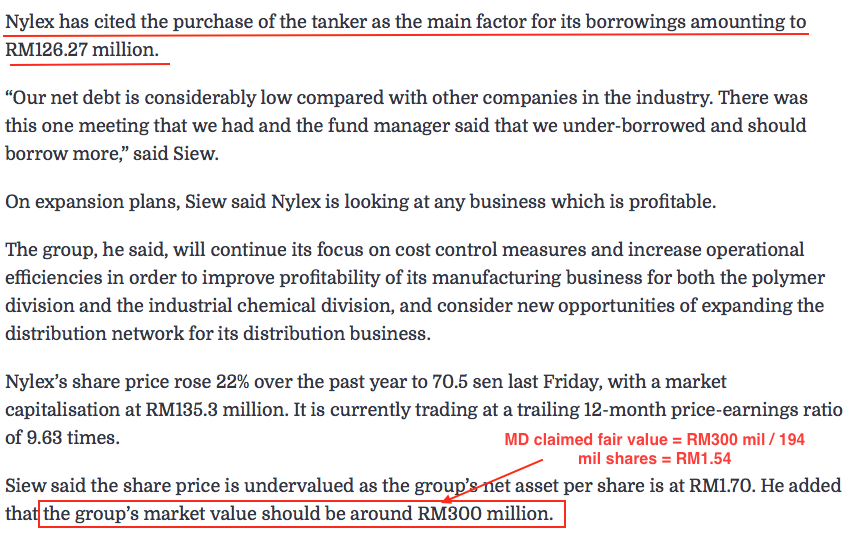

Based on 194 mil shares, Nylex's market cap is now RM189 mil.

3. Recent Strong Quarterly Performance

The reason Nylex share price has gone up is because it did very well in its latest quarter ended 28 February 2017.

Key observations :-

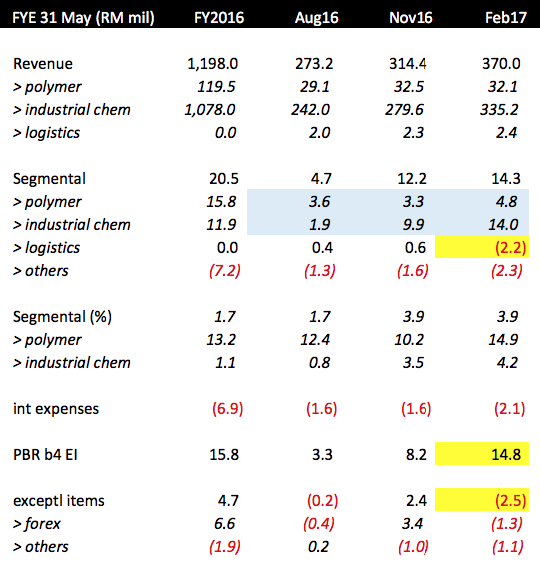

(i) Being a manufacturing operation, Polymer division's profitability is quite stable. Industrial chemical's profitability is volatile. This was especially true in past few quarters as its margin declined, influenced by weak industry trend (blue highlighted figures).

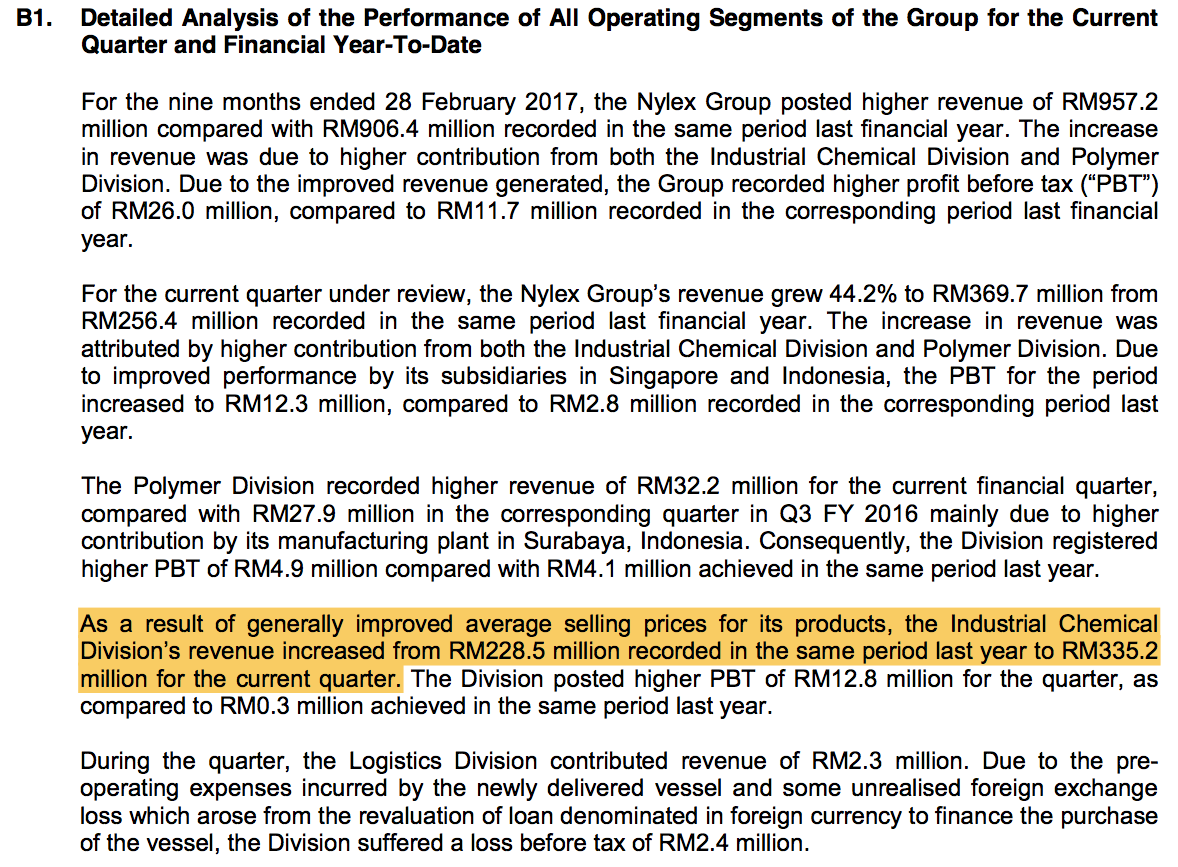

(ii) In the latest quarter, industrial chemical division staged a dramatic turn around. Both revenue and operating profit increased substantially. The company explained that this was due to more robust selling price for their products. Please refer below.

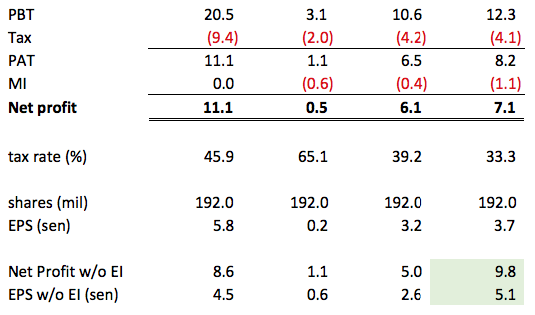

(iii) In the latest quarter, the group reported net profit of RM7.1 mil, translated into EPS of 3.7 sen.

Actual result was much stronger. There was exceptional items of RM2.5 mil (forex, impairments, etc) (yellow highlighted figures). Without those items, net profit would be RM9.8 mil, or EPS of 5.1 sen (green highlighted figures).

That is not the end of it. The group has just commissioned a new chemical tanker, which incurred start up losses of RM2.2 mil at its logistic division (yellow highlighted figures). Without that, pro forma net profit would be around RM11.25 mil (after factoring in 33% tax), or EPS of 5.8 sen.

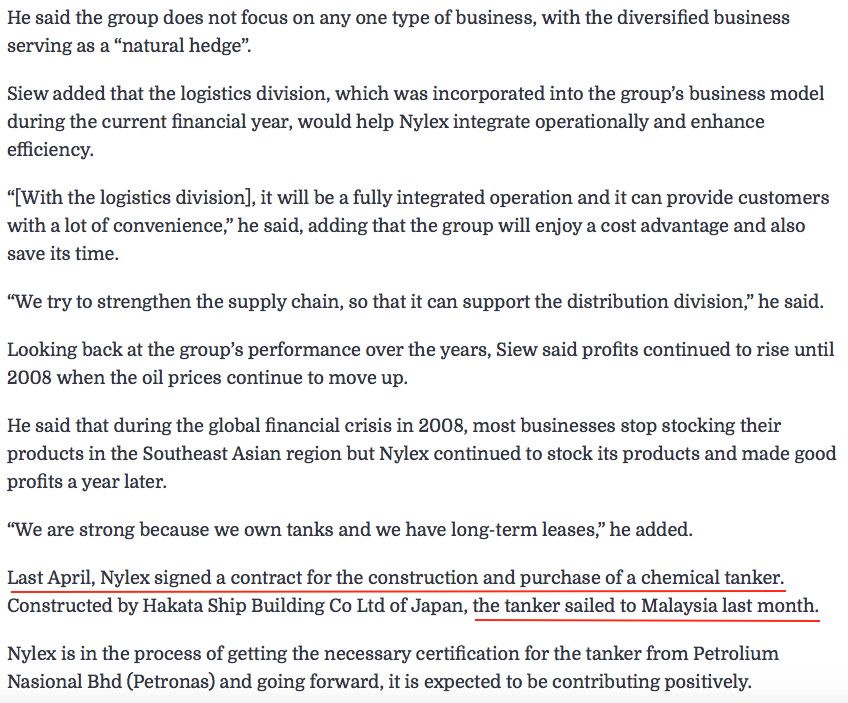

4. Chemical Tanker

On 30 April 2015, Nylex anounced that it has placed order with a Japanese contractor to build a new chemical tanker for RM65 mil (ballooned from initial RM58 mil due to currency changes), to be 70% funded by borrowings (RM45.5 mil). The vessel was delivered in January 2017.

The chemical tanker will be used to transport and distriute Nylex's own chemical products to customers, resulting in cost saving (from 2017 onwards).

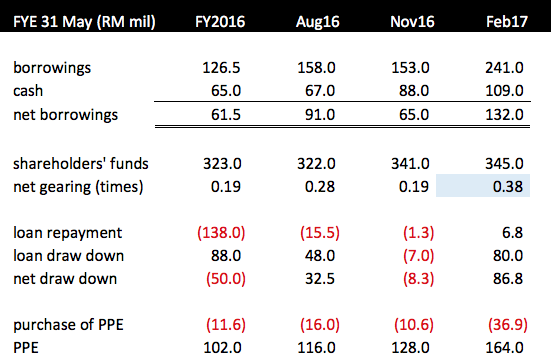

5. Don't Worry About Balance Sheets

The group's gearing has been increased by the vessel purchase, but overall still very healthy.

==========================================================================

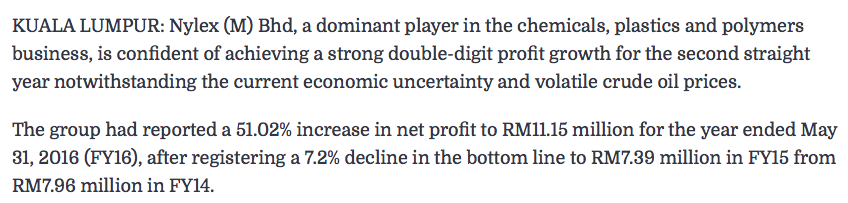

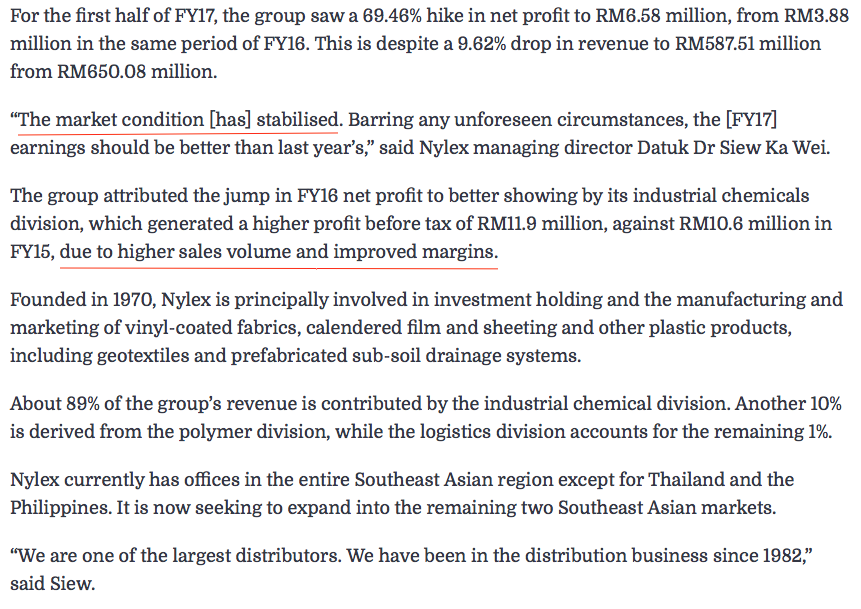

Appendix - Nylex MD's Interview My The Edge on 13 February 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

question to value investors....

I know I know.....most of i3 people want to look for under value stocks.

but question....

is a bull market time to look for under valuations when the price just doubled?

or is a bear market time to look for under valuations?

yes, yes, a rising tide will lift all boats....including of course over valued stocks......especially over valued stocks with catalysts are top favorites.

2017-05-02 13:38

Penta quadrupled.

JHM quadrupled.

Scientex quadrupled.

AA tripled.

MFCB doubled going on to triple.

Good stocks, why sell at 100%?

Just to pick a few. wasn't it your mantra that what is high now will typically move higher?

2017-05-02 13:54

good year for those hit mfcb and penta chun chun, hope aax and eg will perform likewise hehe

2017-05-02 14:24

I don't think anyone buy JHM, Scientex, AA, MFCB due to discounts of NTA.

2017-05-02 14:50

Stop harping about NTA, you're becoming as annoying as Calvin Tan.

Admit it, Nylex isnt sexy enough for you.

2017-05-02 14:55

stockmanny you keep showing how good is your crooked thinking, why not learn from icon. Show an analysis on your preferred stock. Else you should just shut up and earn your money. Dont show your ignorance here. Icon is way better than you in my opinion, perhaps majority forumers opinion too. You both same age category right?

2017-05-02 14:57

Intellect is commendable. A questioning and skeptical mindset is great to provide balanced views.

All other times, i dont see the relevance of some of his arguments.

2017-05-02 15:01

I am not saying Nylex cannot buy.

a rising tide will lift all boats....as long as got skin in the game, you get your money. Whatever inspires you to put money in the game.

but

a bull market favors the brave, the braver, the more money.

a bull market also favours the glossly over valued shares...the more over valued the better......as long as got catalysts.....look for over valued shares......hahahaha

2017-05-02 15:04

problem with under valued shares ( discounts to NTA), when the market turns south, it too will turn south.....you are not being compensated for being more conservative / prudent.

2017-05-02 15:15

the question is...time to bet?

I think it is a very good question.

when approaching a share....always ask your self....what are you betting?

once you are clear what you are betting, you automatically become a better trader / investor.

2017-05-02 16:15

when approaching a share....always ask your self....what are you betting?

when approaching a share, amateurs only ask , is it under valued?

professionals must ask...what are you betting?

2017-05-02 16:25

well, I think any freshie can speed up their learning process if they read this page properly.

certainly better than ratios and formulas....and it is also FOC.......lol.

2017-05-02 18:04

Why is it that half of the comments are from stocknanny? Does he really like to talk so much?

2017-05-02 19:54

yes...when helping Buddha, must send Buddha all the way ......

soojinhou > May 2, 2017 07:54 PM | Report Abuse

Why is it that half of the comments are from stocknanny? Does he really like to talk so much?

2017-05-02 19:56

icon

Sendai got discounts to NTA and got turnaround story too.

Nylex got what, besides discounts to NTA?

2017-05-02 20:13

Thanks for the writeup Icon. My money is on Luxchem for its lower PE, high div yield, higher ROE and net cash. Both are operating in similar industries, but Nylex comes with the OTB premium hahaha.

Stocknanny, not going to waste time talking, I'll let those who love to talk talk. But I'll let SGX listed AEM do the talking. As for you, I hope someone comes out with an app to block your comments coz you junk up the entire thread.

2017-05-02 20:17

soo

if you know any thing about stock market...any thing at all....you know mine are gems money cannot buy.

original even.

2017-05-02 20:21

stockman

...time 2 bet..wat is ur bet??... wen a share has doubled up (2X), triple up (3X) or mayb >= 4X n if u hv ever worked in a casino u sure r gonna bet against d hse of lucifer. Ill rather take my chances wit JAKS n mayb SENDAI. KYY entry price after u factor in his holding cost n opportunity cost aint 2 far from today's closing. NO FA, NO TA but just 2 answer ur question as above.Just my @ 1 sen

2017-05-02 20:42

oops I forgot 2 mention, Genting-WA sailang kau kau all d way from RM1.30.

2017-05-02 20:44

sniper...you don't get it....what is the bet does not mean how much you want to bet.....

what is the bet refers to what event will make this a good buy....what is the catalyst? why buy? it refers to...what you are betting on?

in the case of Sendai...the bet is turnaround.

in the case of Jaks...the bet is finishing the IPP on time and on schedule.

must have a reason for the bet.......

2017-05-02 20:47

my Genting warrant is doing well...the bet is that Genting is the best blue chip in Malaysia ..............and the warrant gives you leverage.

2017-05-02 20:49

stockman,

my genting warrant is doing well....

Wellcome 2 d hse of lucifer then. It's orite, no worries 'coz Im oledi a snr citizen here in d hse of lucifer.

2017-05-02 20:58

Just a note Icon. Tanker rates are cheap. You can get a feel of it by reading MISC's commentary. So, if rates are cheap, Nylex is actually better off leasing than buying.

2017-05-02 21:02

can never beat the House odds, but can buy the House and the sons and daughters.

2017-05-02 21:04

wat surprises n amazes me is very little is mentioned about genting-wa in tis I3 investmn blog. Well i suppose KLSE is indeed in a bull run so avryone is happy making 2x, 3x, >=4x punting penny stocks.

2017-05-02 21:28

Now is the time when stocks with low P/E have been consolidating greatly.

ENGTEX GROUP BHD is a good stock with a low P/E as well.

2017-05-02 23:54

"Make a Bet" because don't know how sustainable is industrial chemical recovery

2017-05-03 07:51

Good morning sifu icon8888, i plan to buy some jtiasa, can give some pro advice?

2017-05-03 08:00

Go for it. Still fresh in my mind what happened the last time Dumb Malaysian Managers decided to go asset-heavy (Maybulk, Daya).

A smart man learns from his mistakes. A wise one learns from the mistakes of others.

But Hey, who know's, I could be wrong.

2017-05-03 08:26

1) stockmany said buy stocks wth catalysts even though the price is high.

2) Icon888 said buy growth stocks wth still high NTA discount

3) Calvin said buy stocks wth high NTA discount

4) KCchongnz said buy undervalue stocks

5) Pussycats advocates Rebalance Weighting Asset Allocation method

Just my 2 cents thoughts

2017-05-03 09:12

if chemicals recovery is the bet ( the unique selling proposition) and don't know how good it is...then no bet can be made............

Icon8888 > May 3, 2017 07:51 AM | Report Abuse

"Make a Bet" because don't know how sustainable is industrial chemical recovery

2017-05-03 09:16

listen carefully pussy

problem with under valued shares ( discounts to NTA), when the market turns south, it too will turn south.....you are not being compensated for being more conservative / prudent.

meaning when people go up, you may get lifted up slightly

when people go down, you also go down.

not fair and not being compensated.

solution...change to my strategy.

2017-05-03 17:58

stock many, each person has their own kungfu style. I respect each person style of kungfu. But u can get your own disciples. I no need any followers bcos I am a long long long lone ranger.

;-D

2017-05-03 18:23

myongcc5, I lose sometimes but little bit only compare to my win which is 3 times biggerthan my lose. TQ for your encouragement. You (myongcc5) also win bigger than you lose, I guess.

2017-05-03 22:16

pussy

I cannot force you.

but, some will learn....

listen carefully pussy

problem with under valued shares ( discounts to NTA), when the market turns south, it too will turn south.....you are not being compensated for being more conservative / prudent.

meaning when people go up, you may get lifted up slightly

when people go down, you also go down.

not fair and not being compensated.

solution...change to my strategy.

2017-05-04 00:07

Unfortunately, some valued stocks that bought at very low level like 50Cts and sold at 1.50 for handsome profit, went all the way to 6.00+ and came down when market turned, but never reached even the price that was sold. One example was ULICORP. Take a look.

2017-05-04 21:55

stockmanmy

the bet that the tanker will make a lot of money? but that cannot be.

the bet that the nta discount will narrow? but, that is a market risk, not specific to the company.

2017-05-02 12:22