(Icon) YKGI Holdings - Conditions Are Ripe For Turnaround

Icon8888

Publish date: Mon, 15 May 2017, 10:37 PM

1. Background Information

YKGI, previously known as Yung Kong Galvanizing Industries, is principally involved in the following business activities :-

(a) manufacturing of steel coils (Pickled and Oiled Hot Rolled Coil, Cold Rolled Coil, Galnanizd Steel and Pre-Painted Galvanized Steel)

(b) Steel Services Centre, which provides slitting services to customers (cutting big roll into narrow width).

YKGI has 348 mil shares outstanding. Based on latest price of 25 sen, market cap is RM87 mil.

As at 31 March 2017, the group has cash, borrowings and shareholders' funds of RM39 mil, RM166 mil and RM190 mil respectively. As such, net gearing is 0.67 times.

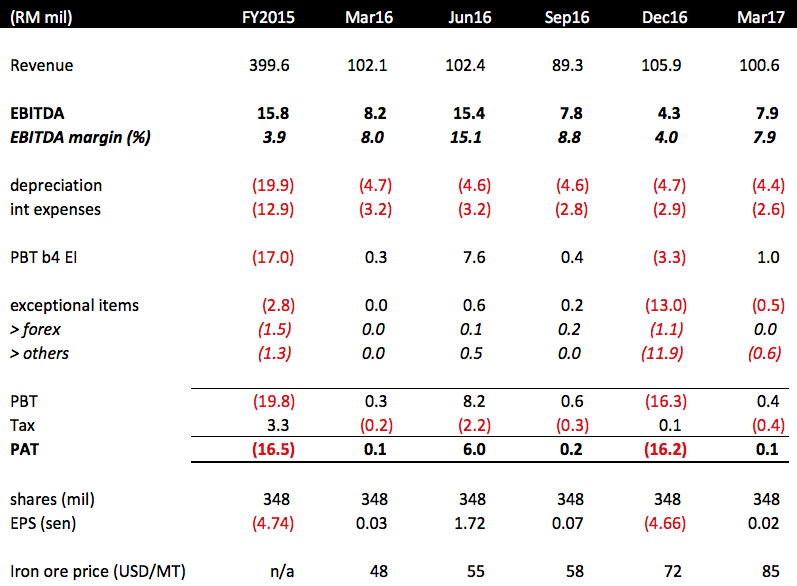

2. Historical Profitability

Key observations :

(a) FY2015 was a typical difficult year. Before 2016, Cold Rolled Coil manufacturers such as YKGI were forced to source Hot Rolled Coil from Megasteel. Megasteel was not an efficient producer. Its HRC was of poor quality and also more expensive than imported HRC.

At the same time, foreign players dumped CRC on Malaysia market, resulted in depressed selling price.

With high cost and low selling price, Malaysia CRC manufacturers were caught between a rock and a hard place.

This was reflected in FY2015 results. The group reported a loss of RM16.5 mil.

(b) Things started improving in second half of 2015, caused by Megasteel's curtailment of production (to minimise losses). As a result, CRC manufacturers started obtaining approval from government to source HRC from overseas. This changes showed up in March 2016 quarter's performance, which saw EBITDA margin improved from 3.9% in FY2015 to 8%.

(c) In May 2016, MITI imposed anti dumping duties on foreign import of CRC (will last until 2021). This has resulted in stronger CRC price domestically. Together with lower input cost pursuant to closing down of Megasteel, the group staged a decisive turnaround in June 2016 quarter.

(d) According to management's explanation, September 2016 quarter's drop in revenue was due to, inter-alia, disruption of galvanizing line due to revamping exercise. Profit margin was lower compared to June 2016 quarter due to increase in raw material cost by 23%.

(Note : my iron ore figure in the table above did not show such huge increase. Not sure what is the reason)

(e) December 2016 quarter result was adversely impacted by higher raw material cost, disposal loss of RM9.35 mil, inventories write off, etc. As shown in table above, average iron ore price was approximately USD72 per MT, USD14 higher than previous quarter.

(f) Iron ore price remained high in March 2017 quarter, went up to more than USD80 per MT at one point. As a result, the group only managed to break even.

(Note : The other three CRC producers : CSC Steel, Eonmetall and Mycron have yet to release their quarterly reports. I expect them to post weak result as well. Mycron might do better as its pipe division should be quite profitable).

3. Iron Ore Price Has Since Come Down

Since early April 2017, iron ore price has experienced a sharp decline. As at the date of this article (mid May 2017), it has declined from height of USD88 per MT to approximately USD60 per MT.

4. Why I Am Calling For Buy

(a) To be fair, YKGI is not a very strong company. I understand from articles written by other bloggers that it is less efficient than its more established peers CSC Steel and Mycron. Its balance sheet is also not that strong.

(Having said so, I have to give them credit for paring down borrowing from RM289 mil in 2012 to RM171 mil in 2016).

(b) What interests me is that its market cap is very small at RM87 mil. If things work out well, small cap stock has great potential for appreciation.

(c) In addition, unlike CSC Steel and Mycron, the stock has barely gone up.

(CSC Steel share price)

(Mycron Steel share price)

(YKGI share price)

(d) As mentioned above, iron ore price has declined substantially since early April 2017. Will that result in stronger profit in coming quarter ending June 2017 ? It is likely, but I can't tell for sure as I don't have insider information.

However, earning risk is mitigated by the fact that share price is now still closed to all time low. Even if coming quarter result disappoints, I believe downside risk is limited.

With such favorable risk reward ratio, the stock is a no brainer at current level.

BUY !

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

YKGI is definitely cheap...it will be superb investment if the current positive factor on local steel industry remains. I am just curious why its revenue did not increase despite the rise in steel price (iron ore)?

2017-05-15 22:56

Nice article and pick up, Icon8888. Chart wise, YKGI is forming support at 0.245 now. Few weakness came in along the way but the support holds firm till now. In fact, there is some higher than avg vol being traded today but unfortunately, it failed to have a nice closing at 0.255 - 0.260.

Having said that, vol done from 0.255 to 0.250 is only a mere 5k units which I normally consider it a "noise" from the market

Overall, TA wise, YKGI looks promising

2017-05-15 23:44

As a major Steel services providers in E.M. , I do hope Yung kong continue trimming off the highly competitive division (eg. Sold off SNU kote paint to KTC); perhaps bring in more value adding to the existing steel segment.

2017-05-15 23:46

with Nippon Steel & Sumitomo Metal Corp in 2010.

Japanese play, Sarawak play, steel play, turnaround play.

even discounts to NTA for kc

$ 100 million turnover per quarter....a few points increase in margin, it will repeat Q June 2016 PBT of $ 8 million....and share price 40 sen ( Sept 2016) in a less bullish environment.

2017-05-15 23:56

every out performing portfolio needs a portion in small cap turnaround play.

2017-05-16 00:49

Personally I don't have YKGI, but I have Hiap Tek,

I guess it is the same, one do well, both do well.

I prefer Hiap Tek because its turnover is about 3 X larger.

2017-05-16 02:57

Hiap Tek profit margin are abangadik to YKGI, so both either huat together or cry together

2017-05-16 17:48

Icon picks and article promote method can not works in GOreng market this year 2017.

Many good companies underperform, and many bad companies over perform

2017-05-17 01:21

Hi Icon, isn't the price of raw materials (iron ore) passed on the customers? Isn't this the typical practice in the industry?

2017-05-18 14:41

In the annual report, it was mentioned that if product price too high, demand will come down (for example : roofing material).

As such, the manufacturers will have to absorb some of the cost

This is my understanding, not sure whether correct or not

2017-05-18 20:08

Don't pick Vincent Tan stocks becoz many investors boycott him. Serious investors all know this fact.

2017-05-18 20:14

probability

for qtr ending Dec16, guess Mycron's EBITDA margin did not follow YKGI's trend.....why?

I think the significant compression of the CRC segment margin of Mycron was masked by the improvement on its Steel Tubes segment.

Now that the CRC segment margin had improved as reflected by YKGI Mar17 results, Mycron's earnings should double its preceeding qtr results (assuming its Steel Tube performance remains the same).

2017-05-15 22:54