(Icon) Sam Engineering (3) - Excellent Results. All Divisions Doing Well

Icon8888

Publish date: Thu, 18 May 2017, 09:05 PM

1. Introduction

SAM released its March 2017 quarterly result this evening. Due to recent strong share price and news of booming semicond industry, I have more or less anticipated results to be good. True enough, the result is indeed very good. Net profit jumped by a massive 90% to RM18.4 mil.

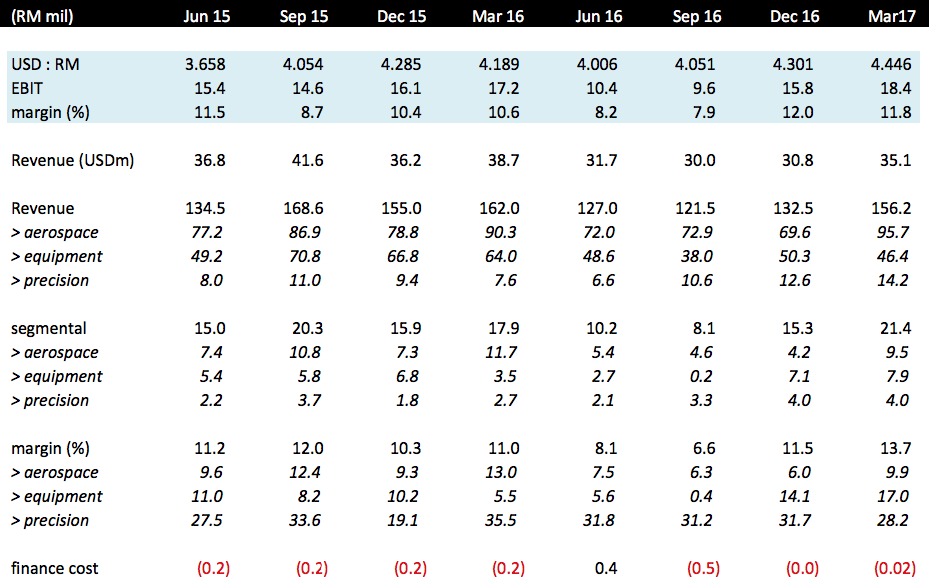

2. P&L Analysis

Key observations :-

(a) Q-o-Q, revenue grew by 18%. Both aerospace and semicond equipment divisions' revenue grew due to stronger demand and better product mix. Revenue of precision engineering division was down slightly.

(b) When come to segmental profit, all three divisions did well, either matching or surpassing previous quarter performance.

(c) Lower tax rate of 13.9% (vs. 36.2% in previous quarter) also played a role in boosting bottomline.

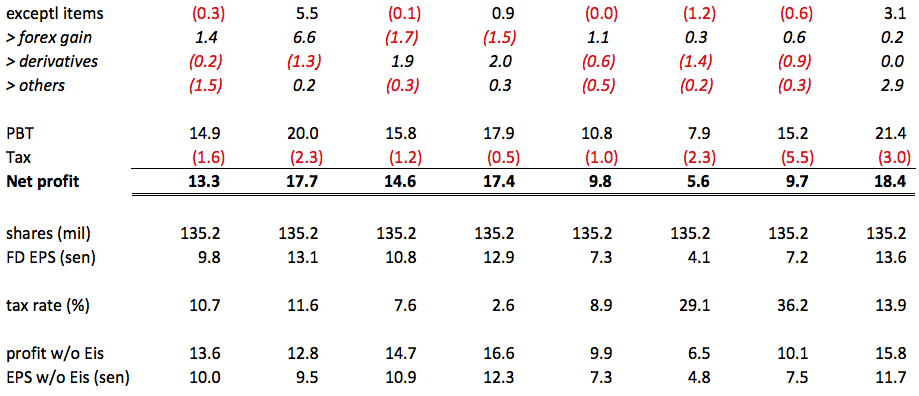

3. Prospects

Management sounds quite positive about next financial year's prospects (the company's year end is March).

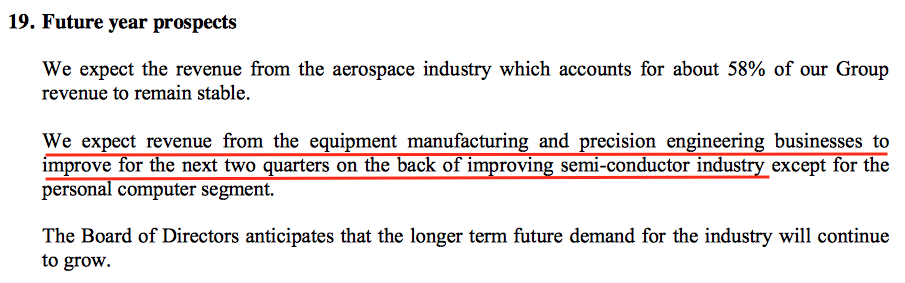

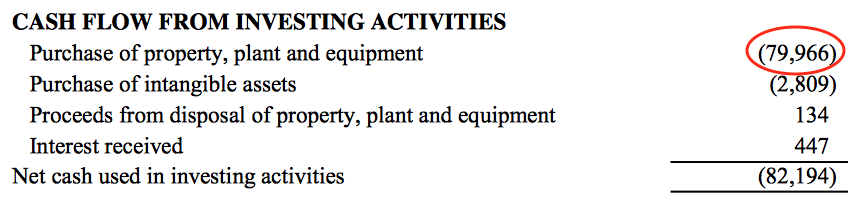

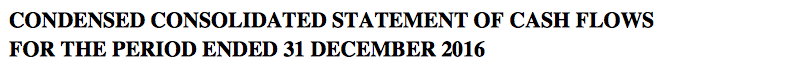

4. Capex

In the three months ended 31 March 2017, the group incurred massive capex of RM67.5 mil (being RM80 mil in March 2017 quarter less RM12.5 mil in December 2016 quarter).

I am very pleased with the abovementioned spending. As we all know, SAM is attractive because of its plan to expand the production capacity of its aerospace division by spending RM100 mil. In the December 2016 quarter, I noticed that the capex so far (9 months) was only RM12.5 mil. Where is the capacity expansion that everybody has been talking about ? Well, in this latest quarter, it finally came through. I heaved a big sigh of relief.

5. Concluding Remarks

In my previous article, I mentioned Target Price of RM7.00 by end 2017. Looked like things are moving faster than anticipated. As at todate, SAM is already trading at RM6.90. With this latest quarter's impressive result and continued positive earning momentum (as per management guidance), I believe the stock can possibly touch RM8.00 by end of this year.

Fasten your seatbelt and enjoy the ride. The choo choo train is leaving the station.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-04

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAM2024-07-03

SAMMore articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Oredi up a lot la from rm4.80... How to buy wo... I guess good result almost discounted

2017-05-18 22:26

Result so so only but the price has gone up so much, high expectation but was it delivered? We will see tomorrow.

2017-05-19 00:16

a good effort.

now...what is the X factor? why buy?

from a low PE stock, it has become a high PE stock due to disappointing results in preceding quarters. This quarter, the results more normalised and as you say, anticipated by the market.

very good financial analysis.....the X factor, if there is one is the new capital investments and expansions. But it is difficult to bet without more information....lets see what the analysts say.

ideally, it will be like KESM, isn't it? small cap and suddenly found favor in the new plans.

2017-05-19 00:16

Icon promote so many counters like betting in Casino?

hit one then earn Big

LOL

2017-05-19 00:39

icon

It is easier to buy earlier ...on anticipation of more normalised q resuts. when the stock was thrashed down on bad resluts.

My message in this forum has been consistent. Successful investors have to look outside value investors hat / framework....and look for turnaround situations after bad results....just like Sendai and Jaks.

2017-05-19 00:45

I find this forum has paid too much respect to value investors kc and otb...thus skewing this forum into a forum for zombies and value investors. ...all the warren buffalo wannabes and their margin of safety.

If everybody wants strong Balance Sheet and low PE.....when strong Balance sheets and low PEs exists, what you call those? I call them, left overs, ...like wall flowers in a dancing party.

2017-05-19 00:54

icon..you and that kc and your dog, the ks.............

you better rein them in and stop calling me fake accountant.

and by the way, what happens between me and KYY is none of your business.

2017-05-19 01:02

stockmanmy, you were working as account clerk for less than 2 years at the beginning of your working career and now you call yourself accountant? What the F-U-C-K.

2017-05-19 01:11

flying

the 3 musketeers cannot touch?

I purposely want to touch the 3 musketeers because it is more challenging to me.

2017-05-19 01:29

that ks and that flying are best suited to be JJPTR members.

morons in short...beneath contempt.

2017-05-19 02:15

Tan Sri Nathan holds 70% of Sendai...He has to be a miracle worker to built up the Sendai empire in 15 countries , 15,000 staff. ...involved in practically iconic project in Asia. (outside East Asia)..He is very hard working, and right now, very bullish about its prospects.

KYY is right to target Sendai.

2017-05-19 02:36

forget OTB,..............My focus is on attacking value investors ofe the maths/ physics sorts without business sense. , and I will continue to do so...If OTB is collateral damage, that is not my concern.

2017-05-19 02:39

We can see Sam is expanding the factory beside north south highway near Penang bridge.

2017-05-19 12:42

You can't ask dog not to eat shit & that's the reason stockmanmy's mouth always smell shit, he lives with purpose of attacking others for his own sickening agenda & jealousy. stockmanmy is his own father. Want to know why? Ask his mother lol

stockmanmy forget OTB,..............My focus is on attacking value investors ofe the maths/ physics sorts without business sense. , and I will continue to do so...

2017-05-20 14:27

Change profile photo from airasia to steel bar, Icon8888, sold all your airasia already? Now jump into steel waves?

2017-05-20 14:29

Buy Anzo Holdings. You are expected to gain a 100 % return in one or two months if you buy it on Monday.

2017-05-20 21:26

Haiya, this money game kiddies

must have burnt their cheated money from aunts & uncles into Anzo .

2017-08-12 20:22

cckkpr

The prospects for the next few quarters will be limited at best.

2017-05-18 21:20