(Icon) Evergreen Fibreboard - Sizeable New Capacity Coming Onstream Soon

Icon8888

Publish date: Sun, 25 Jun 2017, 11:03 AM

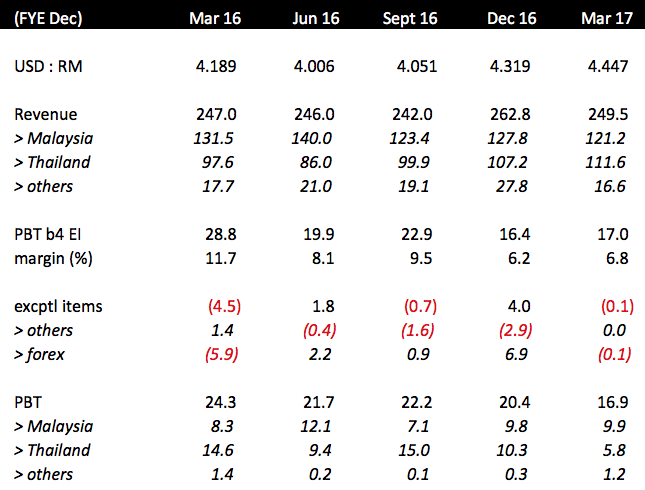

1. Recent Performance

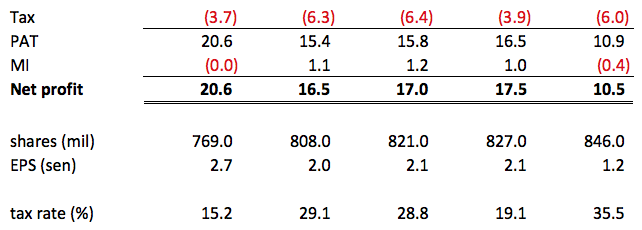

On 23 May 2017, Evergreen released a weak set of result for the quarter ended 31 March 2017. As a result, share price declined from more than 90 sen to the current around 80 sen.

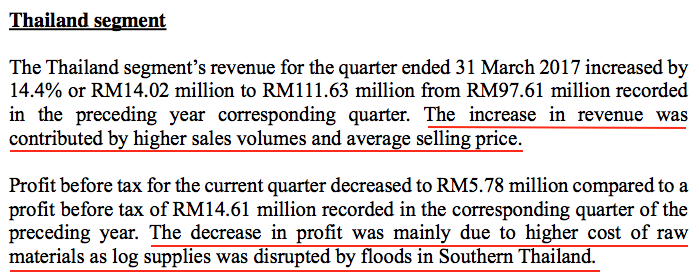

The weak result was mostly caused by its Thailand operation, which saw PBT declined from previous Q's RM10.3 mil to RM5.8 mil. Thailand division's revenue remained strong (an indication of favorable market condition), but its profit margin was adversely affected by high rubber log price caused by flood disruption.

However, the worst should be over. According to the company, rubber wood supply has more or less normalised.

(Source : March 2017 quarterly report)

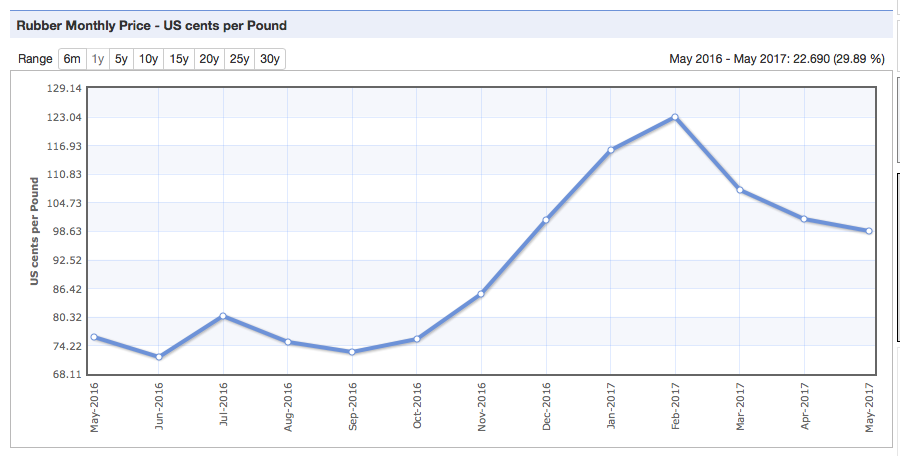

To have a better feel of the timing, I did a quick check of international rubber price. As shown in chart below, rubber price peaked in February 2017. I believe that reflects the timing of the flood receding and normalisation of operation for rubber plantations. If that is the case, the coming quarter from April to June 2017 should be largely free of the negative impact of the flood (just my estimate).

2. Capex

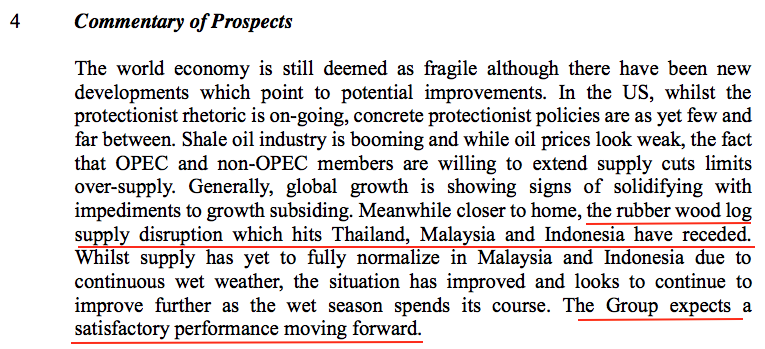

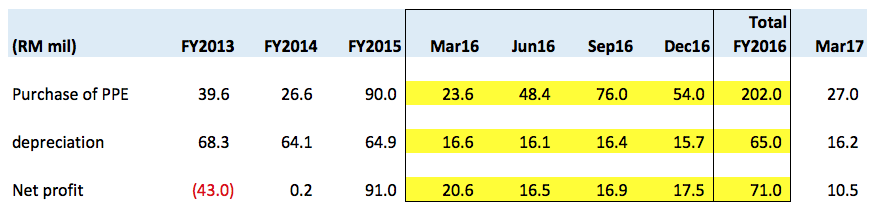

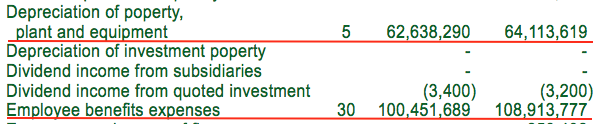

In FY2016, Everygreen invested a total of RM202 mil to purchase new machineries. However, profit has not improved at all. (please refer to table below)

This has caused certain investors to become uneasy and suspect that the company has been siphoning money out. Is that really the case ?

CKCS The HIGH CAPEX for YEARS ended with DISAPPOINTING RESULTS. HIGHLY SUSPECT THEY SIPHONED MONEY OUT OF THE COMPANY THROUGH HIDEOUS MEANS THROUGH CAPEX AND FLOW TO THIS FATTY HENRY S KUO IN THE USA! It's impossible that its MASSIVE CAPEX COULD NOT EVEN ABLE TO LIFT UP EARNINGS FOR YEARS ALREADY WAW?!?! Seriously?

Do u expect this company to be well managed? If so, it wouldn't turned itself into such poor state! Wake up!

20/06/2017 12:38

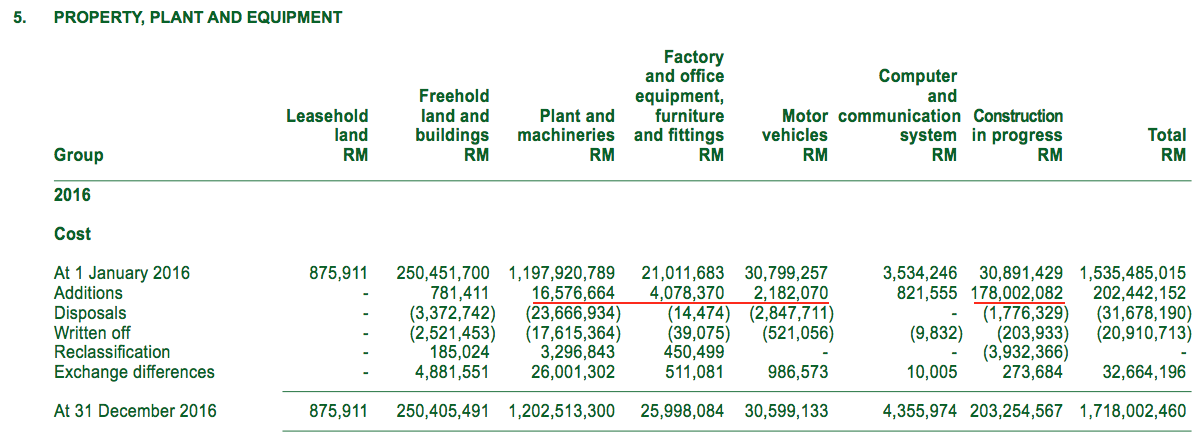

I was suspicious too. So I decided to take a closer look. In the recently released FY2016 annual report, I found this piece of interesting information which might explain why profit has not been going up despite heavy capex over past 12 months.

As shown above, the bulk of the RM202 mil invested (amounting to RM178 mil) is still "Construction in Progress". The remaining RM24 mil spent on machineries and equipment was apparently for replacement purpose since group depreciation is approximately RM65 mil per annum.

I hope this is sufficient to put the issue to rest. The new capacity has not started production, so there is no positive impact on earning yet.

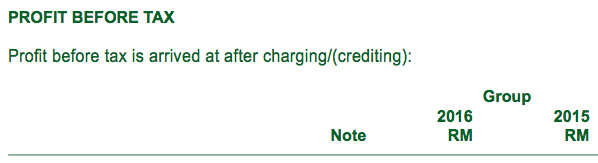

Another piece of interesting information I picked up from FY2016 annual report was the reduction in wages from RM109 mil to RM100 mil (with no corresponding increase in depreciation charges).

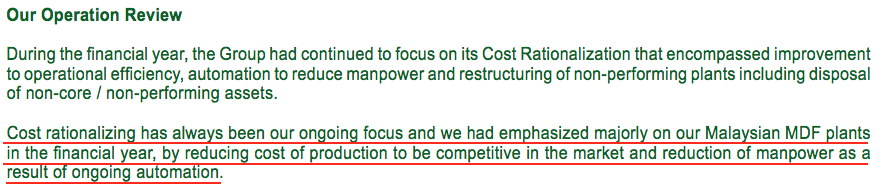

This is no small feat as our government has been busily increasing wages in 2016 for foreign workers. The company has this to say in the annual report :-

I am happy that the company has been investing in new machineries. Without the RM9 mil cost saving, earnings could have been worse with the ever rising wages.

The group's balance sheet remains strong despite heavy capex over past two years. As at 31 March 2017, the group's borrowings, cash and shareholders funds is RM207 mil, RM137 mil and RM1,144 mil respectively. This translates into net gearing of 6%.

According to the company, the capex programme is at its tail end and spending will revert to normal level soon.

3. Industry Prospects

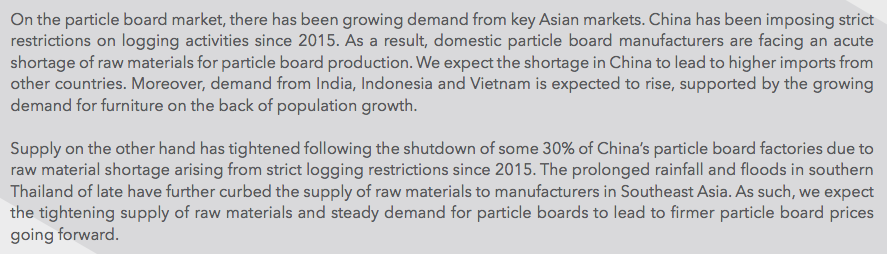

Since 2015, China has imposed restriction on logging. That caused many particle board and medium density fiber board manufacturing plants to shut down. In 2016, the Chinese government further tightened up the screw by imposing more stringent environmental regulation (this round it hits paper manufacturers, which caused paper price to go up substantially).

(Source : Mieco 2016 annual report)

The curtailment of capacity caused China to import more boards and wood products from overseas. In my opinion, this latest changes are structural in nature and should be permanent. Things will only get worse for China based manufacturers going forward as the government gets more and more serious about cleaning up the environment.

4. Middle East Turmoil ?

In FY2016, Evergreen exported 42% of its products to Middle East. Recently, Saudi Arabia and several other countries imposed sanctions on Qatar. Certain investors fret that Evergreen will be adversely affected by the "Middle East turmoil".

Don't think so lah.

The Middle East is always in trumoil. We have seen worse than this before. War, violence, embargoes... all these things are a permanant feature of the Middle East. The recent sanctioning of tiny Qatar looked like a storm in tea cup.

Anyway, the best way to gauge whether Middle East is in turmoil is by looking at oil price. Recently, oil price has been sliding all the way down to USD 45 per barrel. This does not look like a Middle East in turmoil.

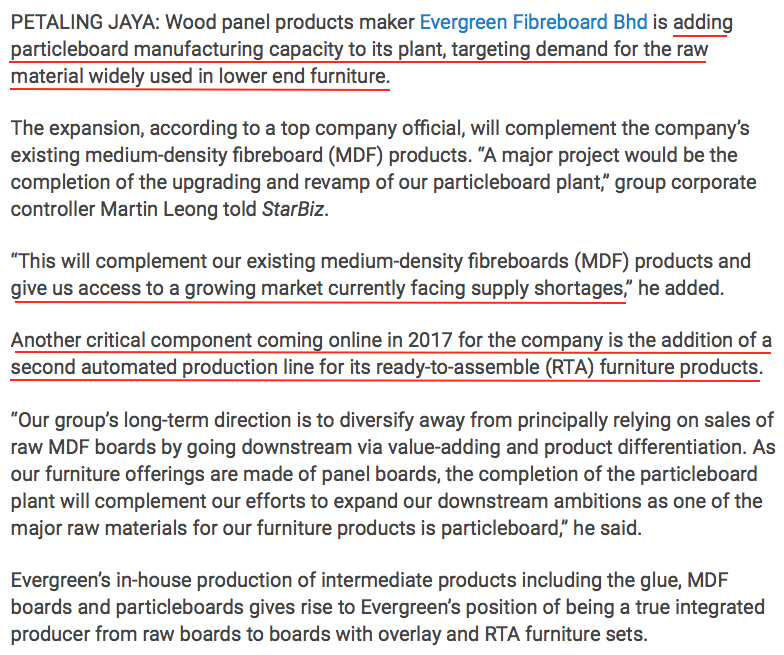

5. Group Prospects

(Source : FY2016 Annual report)

6. Concluding Remarks

I believe the worst has been over for Evergreen.

Log price has come down, industry condition remains favorable, new capacity coming onstream, lower oil price will lead to cheaper glue cost.

All these factors combined should lead to stronger profitability going forward. Keep this stock on your radar.

Appendix - The Star Article Dated 10 April 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

THanks for the article. I've been trapped here for a while. Hopefully, your article will boost up more buyers and I just want to get out and get back my capitals

2017-06-25 13:05

Thanks for the work you did for us. There are many information can be found in annual report, but no many are willing to read and analyze it for the future business potential. Too few people are investing stock like investing as their own business. Glad to find one like you!

2017-06-25 13:19

"oil price has been sliding all the way down to USD 45 per barrel". This is mostly due to the unstoppable expansion of US shale oil operation.

2017-06-25 13:39

thank again , Icon8888 bro

to keep us update before the pottentially huge improvement show up.

2017-06-25 13:46

I am also waiting to buy this stock after release Q2 at Aug which around Sept or Oct.

2017-06-25 13:46

Not so soon recover. Buy now drop further. Another two quarters to confirm.

2017-06-25 15:18

SYF, MIECO also expanding... i do not except much on MDF industry indeed.

2017-06-25 15:37

Good article icon8888. How do you look at recent surge of rubberwood prices? Rubberwood prices had increase quite a lot these four months to due to supply problems, maybe will impact q2 results but going forward expansion capacity and mdf , particle board strong demand could overcomes these problems?

2017-06-25 20:41

Rubber wood price surge in 4th & the latest 1st qtr and now on the decline mah...!!

2017-06-25 20:49

Substantial production in progress at Segamat plant for particleboard.

Raw material stock up near capacity.

2017-06-25 21:25

good sharing but this stock not worth for short term invest. at least hold 2/3 years the price will shoot to rm1

2017-06-26 07:47

dream on..... wait 5 years to reach RM1..... PITY all loser in evergreen

2017-06-26 10:58

ConquestadorResearch, you have zero point in your statement. Argue with fact to fight, talk rubbish useless one.

2017-06-26 11:13

I hope to see someone use facts & figures to prove Icon8888 is wrong, any?

2017-06-26 11:13

i have 3 fact... The fact is...

1) you bought evergreen at a high price

2) you are scared that people attack evergreen

3) you want to promote evergreen to con all innocent investors

come on.... dont lie to every body here.... ok????

2017-06-26 11:18

a lot people know who you really are in real life.... dont hide behind a account Stock Kingdom ok????? you are cheapsake person that con people like money game operators

2017-06-26 11:20

middle east is indeed in turmoil. oil price dropped is bad for middle east. yet u said the other way round!!

2017-06-26 11:30

agree with kakasi123.... icon8888 and Stock Kingdom are both con man..... in fact.......... both are same person!!! THIS IS FACT!!!

2017-06-26 11:37

In fact, RUBBER pricing and RUBBER WOOD (LOGS) pricing are independent of each other

2017-06-26 11:46

monitor the FCF for nx qr.

stay at sideline for now

buy when the FCF nx qr is improve

2017-06-26 13:01

Downtrend stay away.. waiting price pullback to 0.945 above to save buy

2017-06-27 09:23

Hi Icon8888, can you adv how do you derived the historical average USD:RM for the various months? Tq.

2017-06-27 12:50

desperate attempt by Icon8888 to save his life savings that he invested in Evergreen.

2017-06-27 21:49

Someone declared before that he invested more than 4 mil or more shares in it. I'm not surprised someone will take desperate measures to save his own failed investment despite my endless warnings. Check back my past comments to understand more before Evergreen collapsed to this state.

2017-06-28 09:48

CKCS is just a typical mommy-boy loser who is crying loud like a baby now... haha... all his biased and tweaked info/statements have been fully debated and proven wrong by many of us in Evergreen's forum; yet he is not willing to admit his wrongdoings. We suspect he has his own agenda in doing such sabotage on Evergreen.

2017-06-29 10:23

Great job icon. in fact, I had mentioned all of what Icon highlighted in his article. Just that icon did a very good job in consolidating this info in one nice article.

Just to add one more point:

The Evergreen management had indicated that the CAPEX for 2017 onwards should go down to around RM40-50M a year. Having said so, most of the CAPEX had been allocated in 2015 & 2016 for the expansion of new RTA and particleboard lines. And we can expect to see much better free cash flow (FCF) down the road...

2017-06-29 11:02

CKCS and ConquestadorResearch (possibly the same person with diff ID) are just losers who cannot provide facts to counter what we said... I pity them very much

2017-06-29 11:04

6. ICON888 Concluding Remarks

I believe the worst has been over for Evergreen.

Log price has come down, industry condition remains favorable, new capacity coming onstream, lower oil price will lead to cheaper glue cost.

All these factors combined should lead to stronger profitability going forward. Keep this stock on your radar.

RAIDER ADD ON ;

1. PARTICLE BOARD BUSINESS COMES ON IN THE 2ND HALF 2017 THAT WILL ADD ADDITIONAL REVENUE & MARGIN TO EVERGREEN.

2. RTA BUSINESS WILL SHOW GROWRT AND CONTRIBUTE TO BOTTOM LINE.

3. THE COMPANY TRANSFORMATION PROGRAMME OF REDUCING COST AND RATIONALIZATION OF BUSINESS WILL COME TO FULL EFFECT LOH....!!

2017-07-01 18:51

Icon8888, thanks for good info...

Just wonder whether can help to enlighten, why drastic drop of Net Cash Flow from Operating Activities from RM33.39m (31Mar'16) to RM1.471m (31Mar'17)? (refering to page 5 of QR 31Mar'17)? Will that be a concern before buying into this counter?

2017-07-08 10:58

king36

Good one.

TQ Taiko.

2017-06-25 12:54