(Icon) CI Holdings (3) - Entering A New Phase of Growth

Icon8888

Publish date: Thu, 06 Jul 2017, 12:12 PM

1. Introduction

I have written about CI Holdings few times before.

https://klse.i3investor.com/blogs/icon8888/70052.jsp

https://klse.i3investor.com/blogs/icon8888/70308.jsp

In the latest two quarters, CI Holdings' revenue and profit has been growing by leaps and bounds. However, nobody seemed to notice. I took the opportunity to snake back into the stock at aprpoximately RM2.50. More details below.

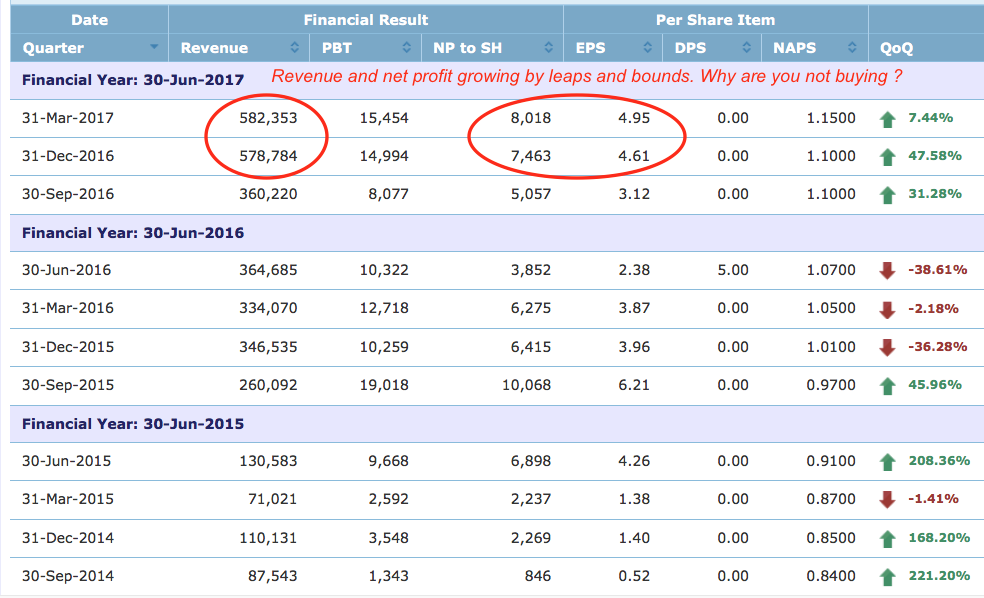

2. Strong Revenue and Earnings Growth

As shown in table below, the group's revenue registered substantial growth in December 2016 quarter. I started buying. However, as I was not sure whether it was sustainable, I decided not to write about it. In the recent March 2017 quarter, the group continued to report strong revenue and earnings. I think it is time to pay more attention to this stock.

3. My Previous Experience With Johore Tin

CI Holdings' recent spurts of growth reminded me of Johore Tin back in 2014. (yes Newbies, I have been around for a long time....)

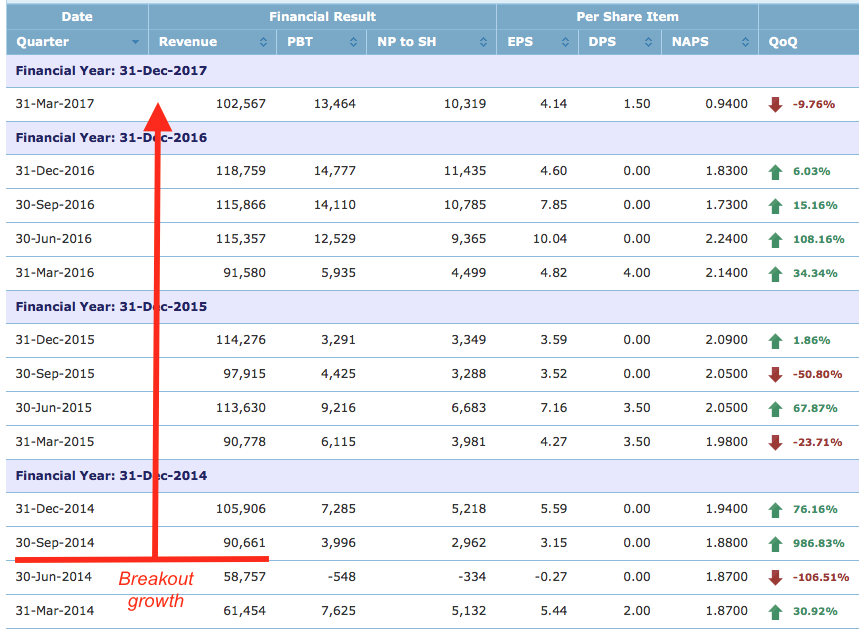

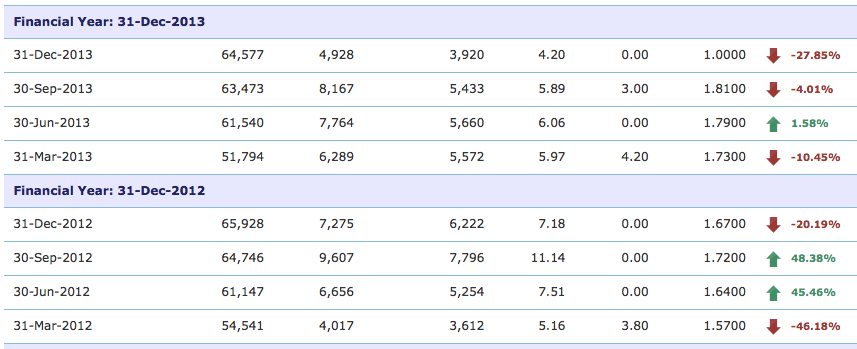

As shown in table below, Johore Tin's revenue was originally RM60 mil plus per quarter. However, in September 2014 quarter, revenue made a quantum leap to more than RM100 mil. It has remained at that level since then. Net profit was dragged higher along with it. Johore Tin's latest quarter net profit of RM10.3 mil was approximately 100% higher than that in 2014 and earlier. Maket cap has also increased from around RM200 mil to the existing RM400 mil plus.

(Johore Tin's historical financials)

There was nothing mysterious about Johore Tin's growth. The group is principally involved in manufacturing and distribution of condensed milk. They attended trade fairs held in various countries regularly. This allowed them to get in touch with the distributors and retailers. Do that often enough, sooner or later they will get new customers who are interested in their products. Shipment of cargoes will lead to higher revenue and profitability (if I remember correctly, Johore Tin's growth was due to penetration of new market in South America).

The same principle works for CI Holdings. Instead of condensed milk, CI Holdings manufactures and distributes edible oil made from palm oil. Their business model is very simple - manufactures the oil, ships them all over the world, constantly seeks out new customers by attending trade fairs, etc. The group started operation in 2014 (after they disposed of Permanis at an extremely good price and paid out huge dividend. Please refer to my earlier articles). Revenue has grown from RM87 mil to the current RM582 mil per quarter. Net profit also grew accordingly.

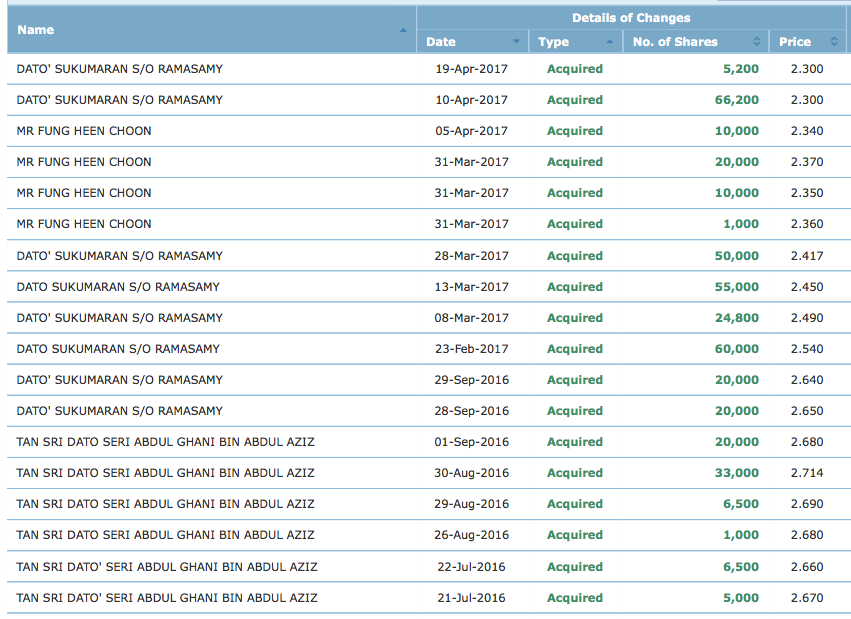

4. Directors Busy Accumulating

Please refer to table below, which is self explanatory.

5. Concluding Remarks

CI Holdings reported EPS of 5 sen in latest quarter. If annualised, full year EPS will be 20 sen. I believe this stock should trade at PER of at least 15 times due to the following factors :-

(a) consumer sector - resilient and not susceptible to economic downturn;

(b) high scalability - products are sold all over the world, especially to third world countries. These markets have plenty of potential to grow;

(c) recent growth momentum - there are signs that the Group has been able to make inroad into new markets.

Apart from the above, there is a speculative angle - CI Holdings' owner Datuk Seri Johari Abdul Ghani became Second Finance Minister last year. Maybe one day he can get some juicy deals from the government ? : )

(Datuk Seri Johari Abdul Ghani holds 32.7% equity interest in CI Holdings)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Hi Icon, how's the impact of edible oil producers to prices cut recently to CI Holding?

2017-07-06 15:28

For consecutive years, it has increased bank borrowings to the tune of hundreds of millions to finance its accounts receivable. This could be due to its surge in sales. But I still think it is a big anomaly as it remains very cash-poor despite the business growth. This, which is hugely concerning, aside, the profit increase is quite interesting, especially if it is genuine (i.e. its accounts receivable are all collectible eventually)

2017-07-07 00:20

Is the net income margin a bit low, just slightly above 1%? The bank borrowing has increased from 7Mil (since your first article) to 252Mil, should that be a concern?

2017-07-08 00:08

As highlighted above, full of debts (1.1x debt/equity) and razor thin margin (1.x%). Unless its Amazon, but this CIHLG only selling edible oil & water tap. Don't believe the growth rate is sustainable.

2017-11-26 21:21

VenFx

Noted , icon888 bro .

Thx for the head up for CiHldg.

2017-07-06 12:26