(Icon) Priceworth (1) - Approaching Inflection Point. 2018 Will Be A Very Good Year.

Icon8888

Publish date: Sat, 30 Dec 2017, 04:49 PM

1. How I Came Upon This Company

I have been studying Jayatiasa and WTK recently. Their timber division has been badly hit by regulatory changes by the Sarawak State Government which took effect on 1 July 2017 :-

(a) logging premium increased from 80 sen to RM50 per cu m; and

(b) logs export quota reduced from 30% to 20%, so as to provide more supply to local wood industry.

This should have benefited Sabah timber companies. Furthermore, log prices had been strong since early 2017 (one of the factors is Japan 2020 Olympic). So I decided to find out which listed timber companies are based in Sabah.

That is how I ended up with Priceworth. After a brief study, I realised that I have stumbled upon a potential gold mine. Priceworth could be the dark horse for 2018.

2. Transformation Into Timber Concessionaire

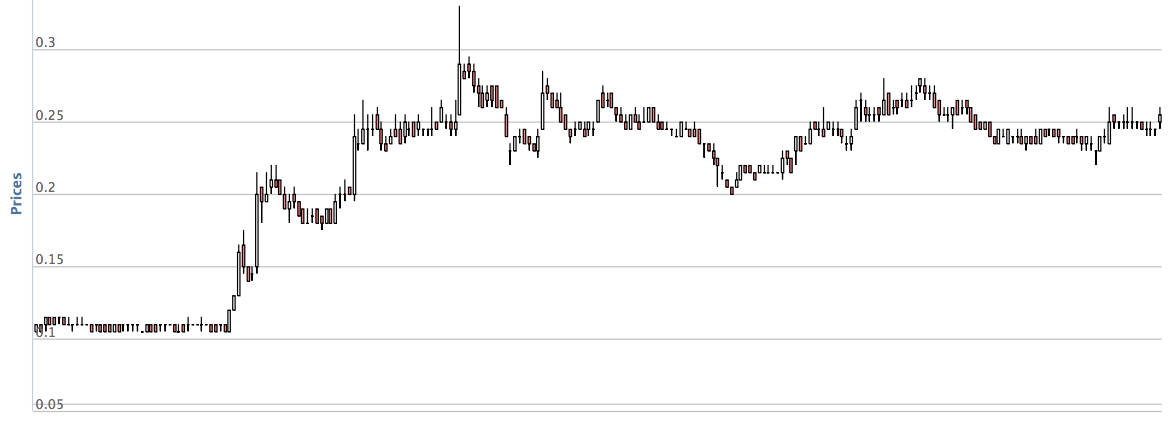

Priceworth has been in the timber industry for a long time (logging as well as plywood manufacturing). Due to lack of forest concession, it has not done well in the past. Most of the time, it only managed to break even.

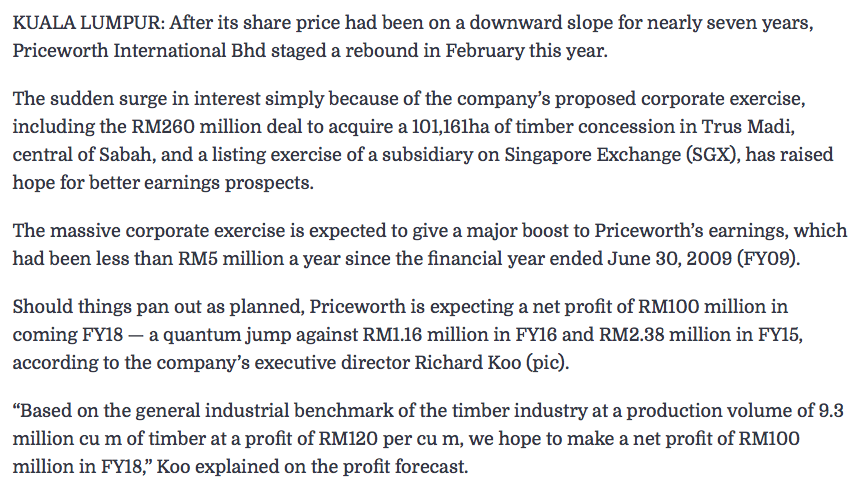

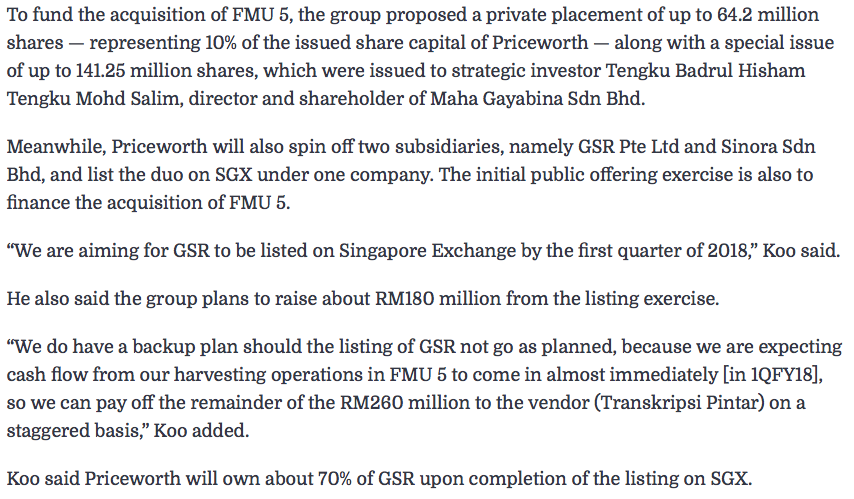

However, the breakthrough came in October 2016. The company announced that its wholly owned subsdiary GSR had entered into conditional sale and purchase agreement to acquire 100% equity interest in RCSB for cash consideration of RM230 mil (originally RM260 mil, but discount subsequently granted to expedite payment). RCSB holds an 80 year (remaining) logging concession of an area of 80,000 hectares (it is a lot, folks) called Forest Management Unit 5 ("FMU5") located at Trus Madi, Sabah (the red pin in the map below).

(I did the map check to ensure that it is far from the Pinoy pirates)

The cash consideration of RM230 mil is proposed to be funded by a combination of the following :-

(a) private placement and special issue, which since the October 2016 announcement, has been implemented few times to place out to various investors.

Tan Sri Rashid Hussein (8% equity interest) and an independent Bumiputra investor Mahagaya Bina Sdn Bhd (15%) had been the subscribers. Together with Priceworth director Lim Nyuk Foh (9%), these three parties collectively hold 32% equity interest in Priceworth.

(Implication : in my opinion, the 32% block will provide check and balance to ensure management handle their job properly, especially when the CEO does not hold much shares)

(b) a massive rights issue of 1.7 billion shares (I know you hate cash call, but don't panic, read the details first) at 5 sen per share (first call 5 sen, second call of 5 sen via capitalisation of share premium). Every 2 rights shares subsequently entitled to 1 bonus share (850 mil bonus shares).

How should you view the rights issue ? Well, it is pretty harmless. Due to the deep discount and limited amount raised (RM85 mil), it is more like a massive bonus issue.

A back of envelope calculation produces the following theroetical ex all price :-

RM mil (850 x 0.25 + 1700 x 0.05 + 850 x 0) / (850 + 1700 + 850) mil shares =

RM298 mil / 3,400 mil shares = RM0.088.

Discount = RM0.05 / 0.088 = 57% (equivalent to 43% discount).

The calculation above is based on the October 2016 announcement (apart from the prevailing market price). After the rights and bonus, market cap will balloon to RM298 mil.

However, subsequently, the company announced finetuning of the funding proposals. More special issues and private placement had been introduced. They also mentioned that the rights issue will be adjusted accordingly (no details provided).

It is too complicated for me to simulate the various potential scenarios. For discusssion sake, let's assume market cap will balloon further to RM400 mil post proposals. I am not simply plucking from the air. Their cash call is not meant to be limitless, it is determined by their proposed utilisation. The ultimate market cap of RM400 mil should be sufficient to address their financial need (in my opinion), and hence is a reasonable assumption.

So now what ? Well, it tells us a lot whether the stock is worth buying now. Even though market cap now is only RM250 mil, it will eventually balloon to RM400 mil (based on my estimate above). The question to be asked is whether Priceworth post proposals will be able to deliver at least RM40 mil net profit. If the answer is "yes", then the stock now is trading at prospective PER of about 10 times : a reasonable valuation considering the size and length of the concession as well as the increasingly valuable status of timber due to scarcity. If the company delivers more than RM40 mil net profit (or market likes it so much, there is expansion of PE multiple a.k.a "Goreng"), there is upside to this stock. Please refer to below.

(c) Listing of the concession holding company GSR in SGX. The company has appointed UOB Kayhian to undertake the corporate exercise. According to news report, GSR will be listed based on market cap of RM600 mil (based on CEO's statement that Priceworth will raise RM180 mil from the listing and yet retain 70% equity interest). The listing application was targeted to be submitted to SGX by second half of 2017 (no update on this) and completed in first quarter of 2018.

(Source : same article as per (b) above)

3. Deal Progress

The story sounds pretty compelling. But the deal has yet to be completed. What is its status now ? What is the chance of it falling through ?

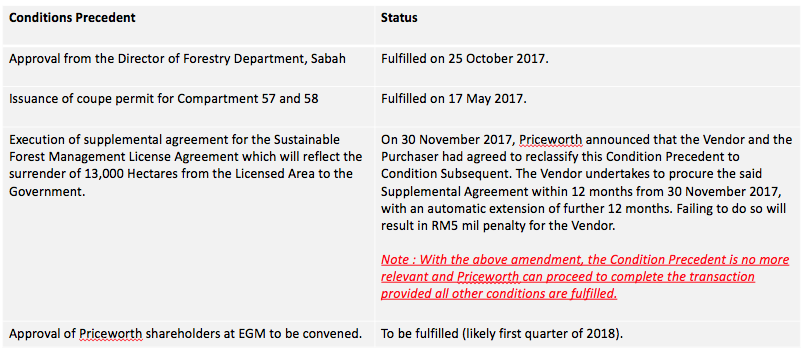

According to the October 2016 announcement, the proposed acquisition is subject to certain conditions, the details of which are as set out below :-

As shown above, out of 4 major conditions, 2 had been fulfilled while 1 had been made irrelevant. The only condition remained is shareholders' approval, which carries almost zero risk as the major shareholders (and minorities) are likely to vote in favor of such a value creating corporate exercise.

In other words, there is almost 100% certainty that the transaction will be completed (very soon).

4. First Taste of Success

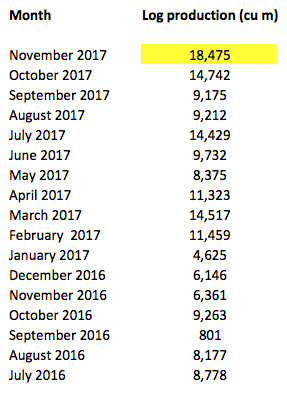

Following the issuance of coupe permit for Compartment 57 and 58 in May 2017, Priceworth (through subsidiary Sinora Sdn Bhd) has started extracting timber from the concession area. November 2017 saw all time high production of 18,475 cu m. More should come in 2018 as the group ramps up extraction.

5. Concluding Remarks

2018 should be an exciting year for Priceworth. Backed by the huge forest concession, prospect is interesting going forward. The stock is likely to attract more interest and attention as we go into first quarter of 2018. But just like any other investments, there are also potential risks. It is difficult to tell when is the best time to buy. I will leave it to you to decide.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon,just an advise to u. The guy come.to my place to ask for financing for just merely 200k. I doubt he has serious cash flows problem. Good luck anyway.

2017-12-30 18:35

And looking at the book, he seems to have problem serving the debt interests, which lead him to rashid Hussain for help.

2017-12-30 18:35

KESM CEO Sam Lim denied to predict group future earnings when asked by reporter. But this Koo.. errr.. but icon sifu is good..

2017-12-30 18:43

It's a black hole.

You can try to check the international price for log, multiply by production, see if the revenue is in the right range?

Don't play play with S* company, you must check it carefully. Last time you are supposed to tiok already guessing wrong on bornoil gold production level.

2017-12-30 19:42

As an author of an article, you should put a disclaimer there, whether you own this shares or not. This is for accountability and transparency.

2017-12-30 20:28

I highly advise you all to avoid. But end of the day your money your responsibility. Always

S remember there are still many good stocks out there to buy also.

2017-12-30 21:35

A company who can't even manage its own finance, I doubt how good it will be.

2017-12-30 21:38

First question.

If the logging rights so good until can make 100mil per year, why sell to you at 230mil? And so nice discount 50mil from the original price summore.

Secondly, even if the rights is that good, as the previous owner, the only reason i would want to sell it, is if i lazy to continue working on it.

In this case, why not sell a 51% share instead, so that i can partake in the future fantastic profits?

In addition, if they have started logging in May 2017 and say in 2018 can get 100mil profit, why the profit in the quarters Jun 2017 and Sept 2017 (1st quarter for 2018) is only RM4mil?

Even the first quarter for 2018 is only RM 1 mil, the boss going to ramp up productions 100X in the next 3 quarters (actually sooner, since he will need full production to even touch RM 50mil revenue ) to achieve RM100m profit for financial year ending 2018?

Also, in malaysia, unlike the US, states cannot willy nilly set their import restrictions etc, end of the day, all go through federal govt. Government nothing to do place tariff in sarawak but not in sabah ah?

Seems a touch fishy to me.

2017-12-31 00:09

Wow. So many insight provided.....con my bro, think twice before investing.

2017-12-31 10:57

Hi Icon8888, I would like to know where did you get the figures for logging premium? (a) logging premium increased from 80 sen to RM50 per cu m (this one). Thanks a lot ^^

2017-12-31 20:18

im from logging industry, pls bear in mind there are several factors to decide whether a logging company can be profitable or not.

-diesel -30-40% of total cost (currently keep on increasing)

-labor - 20% of total cost (minimum wages keep increasing)

-USD rate- Selling price in USD, 4.4 to 4.06

Net profit margin may less than 5%, so any of above factors have slight changes make a huge difference in net profit.

For my opinion profit margin is important than production volume. 2 years ago may make a lot of money but now.....

2018-01-01 21:01

Hi icon8888, mind to share what is the potential stocks benefit from ringgit appreciation. Thanks

2018-01-02 20:27

buy while its first start making money loorr...not after double triple profit...

2018-01-03 14:13

Pworth

Q to Q log Output

K cu/m

30/9/2016 16.8

31/12/2016 21

31/3/2017 29

30/6/2017 28

30/9/2017 32

31/11/17 33

log output increased gradually ..the last 33 k cu/m only 2 months....and target

to go for 50k cu/m one month !!!

2018-01-11 09:44

OrlandoOIL

Regret didn't buy whn Rashid Hussein appear in picture

2017-12-30 17:11