(Icon) Muda Holdings - My 2018 Sailang Stock

Icon8888

Publish date: Mon, 23 Apr 2018, 10:57 AM

1. Stock of The Year

In March 2016, I nominated Air Asia at RM1.66 as the Sailang Stock.

In July 2017, I nominated Hengyuan at RM6.90 as the Sailang Stock.

In 2018, I am nominating Muda Holdings as the Sailang Stock.

2. Massive Expansion of Profit Margin

Muda Holdings is principally involved in manufacturing of carton boxes by using recycled paper as raw material. Its manufacturing plants are mostly located in Malaysia.

Carton box manufacturing is not a glamorous business. However, something positive happened to the industry recently.

In mid 2017, China announced that it will stop importing foreign wastes for recycling purpose (plastic bottles, old newspaper, etc) because those things can cause massive pollution to its air and rivers. The ban came into full force by end 2017.

Pursuant to the above, China's paper making industry experienced severe shortage in raw material supply. This has caused paper product selling price to skyrocket as manufacturers passed on the cost to consumers.

In this globalised world, whatever happened in the Factory of The World will spill over to other economies. As a result, the selling price of Muda's carton boxes had also gone up, boosting its revenue.

On the other hand, due to China's import ban, developed countries such as Australia, Europe, US and Japan suddenly found that their market for waste products had disappeared overnight. There is currently an oversupply of waste products all over the world. Plastic bottles and old newspaper are piling up in developed countries.

As a result, Muda's raw material cost has also dropped substantially.

To sum up all the above in simple mathematical term :

Increase in Revenue + Decrease in Raw Material Cost = PROFIT MARGIN EXPANSION

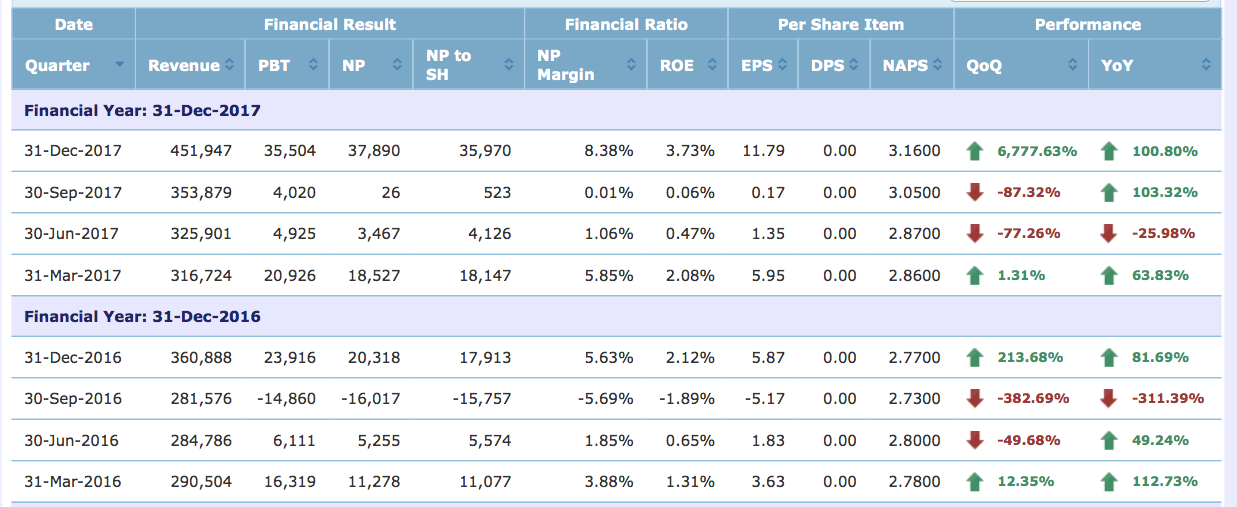

The effect of this positive development in the industry has already started to show up in Muda's December 2017 quarterly result.

Note : Muda's strong profitability in Q4 of FY2017 contains certain exceptional items. Please study its accounts to find out more.

All eyes on coming quarters. Hopefully the company can continue to deliver strong profitability.

3. Concluding Remarks

By nominating Muda as the Sailang Stock for 2018, I am not saying that its share price will skyrocket in the future. All I am saying is that the abovementioned positive developments have made the domestic carton box manufacturing industry relatively defensive in this uncertain time. As a result, the company's earning visibility looked good.

Success in stock market is 50% about skill, 50% about luck. There is no guarantee that we can make money by punting Muda, but this is one stock that I think gives us a decent chance.

For further information, please refer to the following excellent research article by our fellow forum member :-

http://klse.i3investor.com/blogs/david_masteel/151327.jsp

Have a nice day.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Aiyo...two great sifus already recommend....what u all waiting for? kiki

2018-04-23 13:01

Equation below need to be added with "Increase in product Selling Price"

too..if i am not wrong:

.........................................................

As a result, Muda's raw material cost has also dropped drastically. To put it in simple mathematical term :

Increase in Revenue + Decrease in Raw Material Cost = PROFIT MARGIN EXPANSION.

2018-04-23 13:12

...i mean for PROFIT (bottom line) instead of PROFIT MARGIN on the right side of the equation.

2018-04-23 13:15

Assuming best case scenario, 2018, all quarters give record break 35m earnings each.

That is 150m. Or forward P/E of 4.3 and forward EV/Earnings 7.5.

They are cheaper companies with better fundamentals.

But fry-ability wise, this is one of the best.

2018-04-23 16:18

Too late to enter now. Price has doubled in just 2 months. Uncertainty in GE14 will put more risks if you enter now.

2018-04-23 16:33

If you buy at $1.20, yes, it's good stock to invest. But the price now is $2.20...

2018-04-23 17:17

Sales going up, but margin is compressing really heavily no?

Fabien Extraordinaire Have a look at SCGM. promising growth story too.

23/04/2018 17:32

2018-04-23 18:15

Posted by Jon Choivo > Apr 23, 2018 06:15 PM | Report Abuse

Sales going up, but margin is compressing really heavily no?

It's true that margin has dropped by few percentage points due to rising resin and strengthening of ringgit but still remains healthy level la, not above 20% as enjoyed previously but approx. 17% is commendable.

I believe growth in sales would more than sufficient to cover the erosion in margin.

Demand for environmental friendly packaging is growing and the potential is huge.

2018-04-23 21:15

Well, you are right!

A bit late though!

This industry is the only sure win counter, others all have doubts.

2018-04-24 00:12

I can see the potential growth for it, but its a cost based industry, and supply seem to be more than able to meet demand judging by the margin compression.

14 PE seems a bit rich for a company undergoing margin compression in a cost based industry.

Just my opinion of course, you may see differently. Let me know if you think i missed out on something

======================================================================

Posted by Fabien Extraordinaire > Apr 23, 2018 09:15 PM | Report Abuse

It's true that margin has dropped by few percentage points due to rising resin and strengthening of ringgit but still remains healthy level la, not above 20% as enjoyed previously but approx. 17% is commendable.

I believe growth in sales would more than sufficient to cover the erosion in margin.

Demand for environmental friendly packaging is growing and the potential is huge.

2018-04-24 09:26

Taking into account of projected growth, forward PE is less than 14x. Depending on risk profile, some might wait to go in say less than 10x PE, some buffer to cushion any adverse outcome.

Company has been aggressive in expanding their capacity, sales likely to grow in the next few years.

Posted by Jon Choivo > Apr 24, 2018 09:26 AM | Report Abuse

I can see the potential growth for it, but its a cost based industry, and supply seem to be more than able to meet demand judging by the margin compression.

14 PE seems a bit rich for a company undergoing margin compression in a cost based industry.

Just my opinion of course, you may see differently. Let me know if you think i missed out on something

2018-04-24 13:59

If you buy at $1.20, yes, it's good stock to invest.

But the price now is $2.20 not cantik , vry risky

2018-04-24 15:13

They are good companies trading at less than 6PE now. That's 50% cheaper. And its a bird in hand, instead of a bird in bush.

Not attacking your picks. Just pointing it out. The goal is to make money after all. Who right or wrong don't matter.

===================================================================================

Fabien Extraordinaire Taking into account of projected growth, forward PE is less than 14x. Depending on risk profile, some might wait to go in say less than 10x PE, some buffer to cushion any adverse outcome.

Company has been aggressive in expanding their capacity, sales likely to grow in the next few years.

2018-04-24 16:13

Of course in a down market, many companies trading at cheap valuations. Plenty trading less than 6x PE.

There are many better investments too.

I mentioned SCGM as im happened to look at it at that point in time, and perhaps might get some view from any i3 members here. It doesn;t mean it is the best investment, don't get me wrong here. I'm that lazy to promote any stocks that i researched on.

And by the way, i don't own SCGM yet. It is in my shortlist.

Posted by Jon Choivo > Apr 24, 2018 04:13 PM | Report Abuse

They are good companies trading at less than 6PE now. That's 50% cheaper. And its a bird in hand, instead of a bird in bush.

Not attacking your picks. Just pointing it out. The goal is to make money after all. Who right or wrong don't matter.

2018-04-24 17:24

Already up about 25% within one month, chase high sell low? buy low then sell high? Good luck.

6 April 2018: Price = RM1.61 low (Closed RM1.74)

23 April 2018: Price = RM2.22 high (Closed RM2.17)

2018-04-25 11:18

Sailang at this kind of market situation when there are pretty of uncertainties, you will either WIN BIG or LOSE UNDERWEAR later

2018-04-25 11:23

Above article-With almost zero imported waste paper cost and ever rising price of finished product, Muda will report super super profit, the only sailang stock for 2018

2018-04-27 08:56

When Icon8888 bought in himself , that the reason it was his sailing stocks. Why no one call buy and sailing when MUDA only 1.20 to 1.50. ?

2018-05-01 15:23

Muda freefloat share remain very small. If u holding at low price, u can have plenty option. Chasing higher price, anytime u will struck there.

2018-05-01 15:31

Sailang stock become limit down stock, blow too hard now burst, as normal

As I said earlier, many now LOSE UNDERWEAR.

KLCI King Sailang at this kind of market situation when there are pretty of uncertainties, you will either WIN BIG or LOSE UNDERWEAR later

25/04/2018 11:23

2018-05-30 11:17

O... Icon didn't come out to f_ck?

May be I can find him under the staircase.¯\_(ツ)_/¯

2018-05-30 15:32

Invest_Sensibly

Apa cerita orion & pworth?

2018-04-23 11:56