(Icon) Harbour-Link : A Very Profitable Logistic Company From Bintulu

Icon8888

Publish date: Tue, 03 Mar 2015, 08:50 PM

Executive Summary

(a) Harbour Link has been consistently profitable over past few years. It reported EPS of 7.1 sen in latest quarter ended December 2014. Based on latest 12 months EPS of 22.9 sen, PER is approximately 7.5 times only. In my opinion, the stock is undervalued.

(b) Dividend yield is not very impressive at 1.4%.

(c) With lower fuel cost, will profitability improve further in coming quarters ? Or the company has to share the resulting savings with its customers ? We can only find out when the next quarter result is released.

(d) The company is a proxy to SCORE. For the uninitiated, SCORE stands for Sarawak Corridor of Renewable Energy. Basically it invovles making use of Sarawak's abundant water resources to generate electricity and attract energy intensive industries (such as aluminium smelting) to set up operation in the State.

Of course, Bintulu is also a major oil and gas production base. The recent decline in oil price might have a dampening effect on Bintulu's economic activities, which in turn might adversely affect the group's buiness operation. So please take this into consideration before you invest in this company

Harbour-Link Group Bhd (HALG) Snapshot

|

Open

1.70

|

Previous Close

1.65

|

|

|

Day High

1.76

|

Day Low

1.68

|

|

|

52 Week High

04/1/14 - 2.00

|

52 Week Low

01/7/15 - 1.35

|

|

|

Market Cap

313.0M

|

Average Volume 10 Days

24.0K

|

|

|

EPS TTM

0.23

|

Shares Outstanding

182.0M

|

|

|

EX-Date

11/26/14

|

P/E TM

7.5x

|

|

|

Dividend

0.03

|

Dividend Yield

1.45%

|

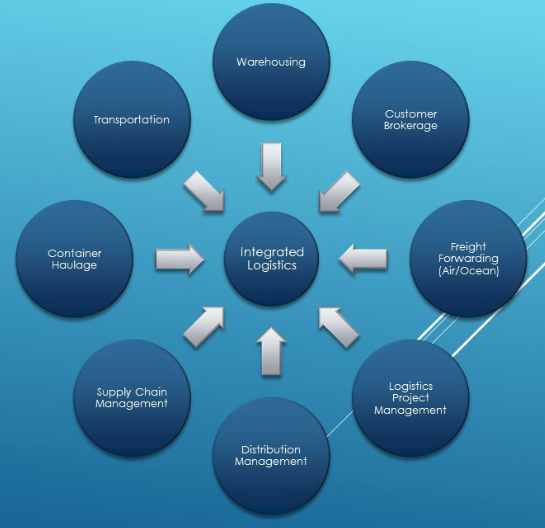

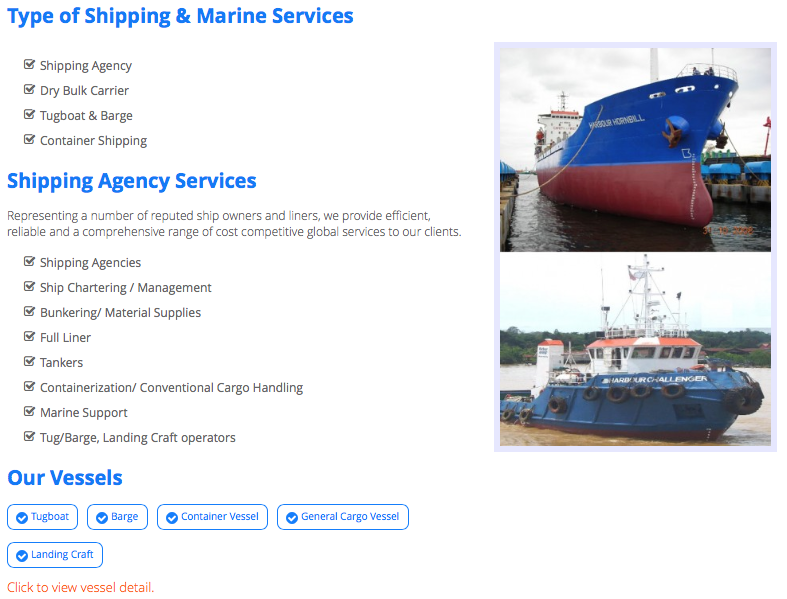

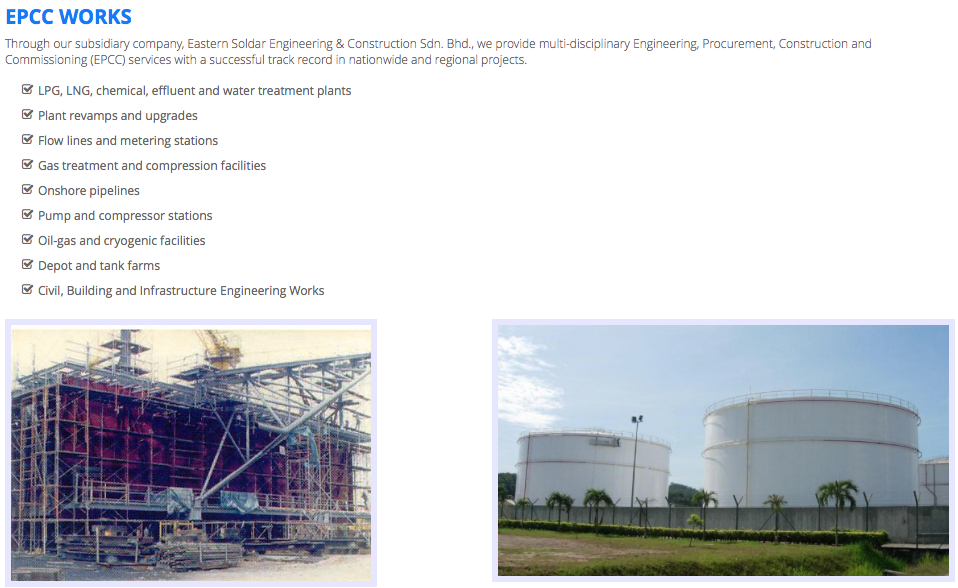

Harbour-Link Group Berhad provides total logistics, shipping and marine services, engineering & procurement, heavy lifting and haulage, property development, etc.

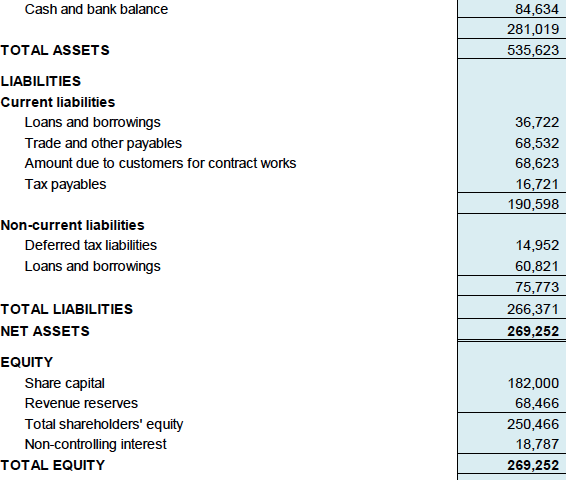

The group has healthy balance sheets. With net assets of RM250 mil, loans of RM97 mil and cash of RM85 mil, net gearing is 0.05 times only.

The group has been consistently profitable. The only time it reported a loss was in June 2013 quarter which it incurred RM25 mil impairment of goodwill.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2015-06-30 | 2014-12-31 | 128,351 | 17,547 | 12,929 | 7.10 | 1.3800 |

| 2015-06-30 | 2014-09-30 | 136,611 | 17,088 | 11,235 | 6.17 | 1.3300 |

| 2014-06-30 | 2014-06-30 | 103,170 | 17,441 | 11,932 | 6.56 | 1.2600 |

| 2014-06-30 | 2014-03-31 | 115,060 | 10,138 | 5,485 | 3.01 | 1.2000 |

| 2014-06-30 | 2013-12-31 | 107,771 | 9,384 | 6,492 | 3.57 | 1.1700 |

| 2014-06-30 | 2013-09-30 | 135,361 | 12,598 | 8,752 | 4.81 | 1.1600 |

| 2013-06-30 | 2013-06-30 | 118,791 | -8,072 | -13,597 | -7.47 | - |

| 2013-06-30 | 2013-03-31 | 102,624 | 6,828 | 5,466 | 3.00 | 1.5500 |

| 2013-06-30 | 2012-12-31 | 110,986 | 8,836 | 6,261 | 3.44 | 1.5200 |

| 2013-06-30 | 2012-09-30 | 100,796 | 9,784 | 7,242 | 3.98 | 1.5100 |

| 2012-06-30 | 2012-06-30 | 128,953 | 9,532 | 8,020 | 4.41 | - |

| 2012-06-30 | 2012-03-31 | 133,476 | 5,500 | 5,089 | 2.80 | 1.4200 |

During the December 2014 quarter, the group reported net profit of RM12.9 mil.

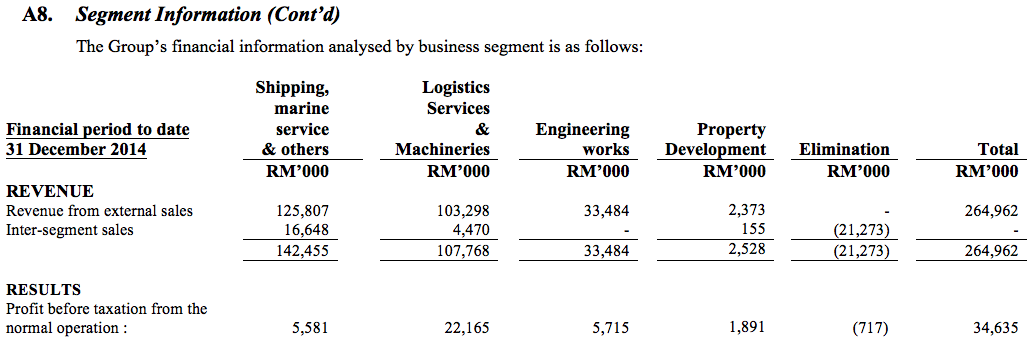

Logistic Services & Machineries Division is the largest contributor, accounting for 64% of group PBT.

The company paid 2.5 sen dividend in past two years. Yield is 1.45%.

Appendix - Company Background

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Voon Choon Foo

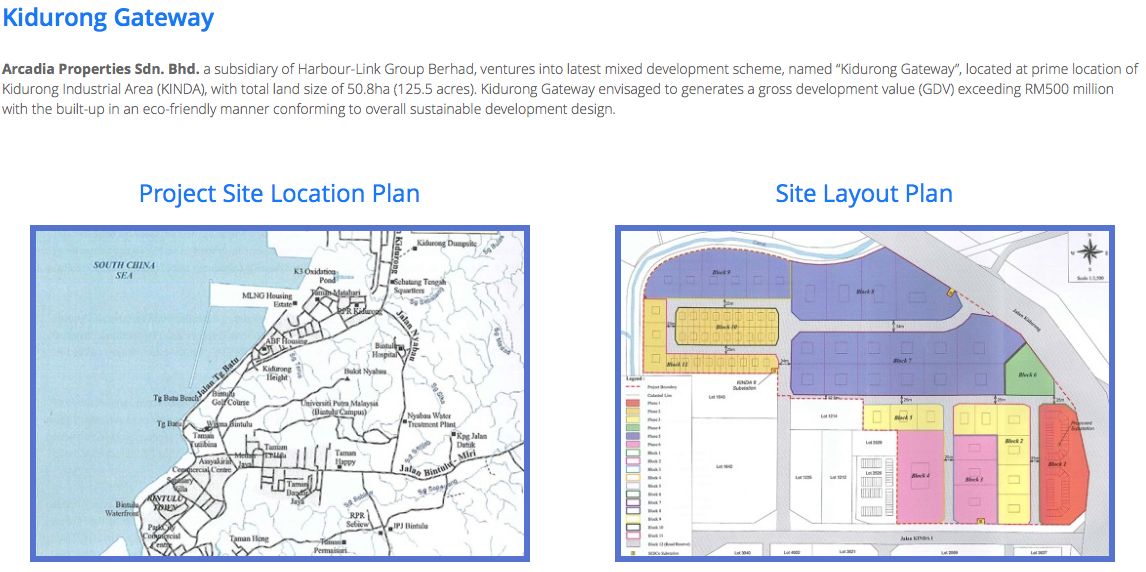

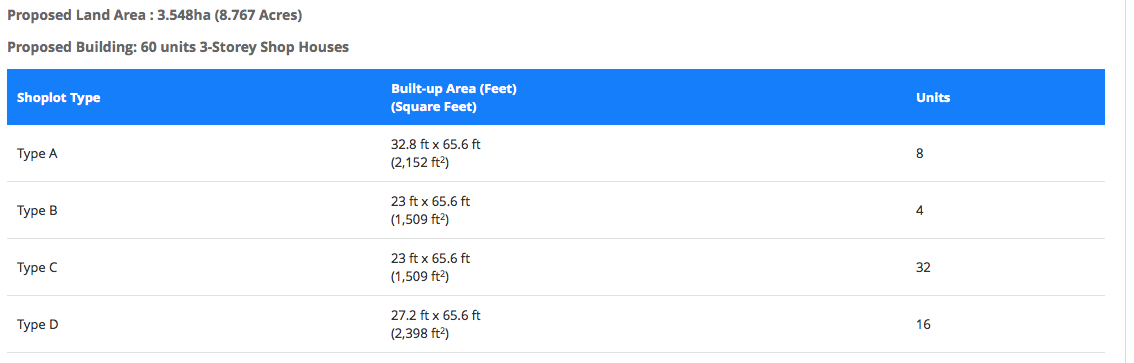

the property should can increase the company profit this year.. looking good.. icon action again..

2015-03-03 21:59