Holistic View of OCK with Fundamental Analysis & iVolume Spread Analysis (iVSAChart) - 4-2-16

Joe Cool

Publish date: Fri, 05 Feb 2016, 01:21 AM

Is OCK Group Berhad a Company Worth Lookout For?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on iVSA Stock Review

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Nov 14, 2016

Created by Joe Cool | Nov 03, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 17, 2016

Discussions

It is obvious that this company requires a lot of capital to grow its present Telecommunication Network Services. It is expanding in this region fast. Its capital expenditure will be high and the present cash generated by its present operations is not enough to fund this. Accordingly, you can expect it to raise capital through equities (leading to dilution of your shareholdings) and through borrowings. Its Free Cash Flow should be negative for many more quarters and it is not surprising and also understandable that it has stopped paying dividends.

2016-02-05 11:21

Effective Change Date Stock Name Buyer / Seller Name [Classificationa] Security Bought / (Sold) Price Closing Price(MYR)d

(Notice Date) Types b ['000]

Direct Deemed Total

27 Jan 2016 - 27 Jan 2016 OCK Low Hock Keong [DIR/CEO] S/U -1,250 RM0.630 0.665

(29 Jan 2016)

08 Dec 2015 - 08 Dec 2015 OCK Chang Tan Chin [DIR/CEO] S/U -100 0.725

(15 Dec 2015)

11 Nov 2015 - 11 Nov 2015 OCK Chong Wai Yew [DIR/CEO] S/U -280 0.810

(12 Nov 2015)

04 Nov 2015 - 04 Nov 2015 OCK Chang Tan Chin [DIR/CEO] S/U -40 0.805

(04 Nov 2015)

08 Oct 2015 - 08 Oct 2015 OCK Chang Tan Chin [DIR/CEO] S/U -40 0.835

(02 Nov 2015)

21 Oct 2015 - 21 Oct 2015 OCK Low Hock Keong [DIR/CEO] S/U -340 0.790

(23 Oct 2015)

08 Oct 2015 - 08 Oct 2015 OCK Chang Tan Chin [DIR/CEO] S/U -40 0.835

(09 Oct 2015)

04 Sep 2015 - 04 Sep 2015 OCK Abdul Halim Bin Abdul Hamid [SSH] S/U 0.735

(04 Sep 2015)

27 Aug 2015 - 27 Aug 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U 50 0.720

(01 Sep 2015)

05 Aug 2015 - 05 Aug 2015 OCK Chang Tan Chin [DIR/CEO] S/U -100 0.915

(05 Aug 2015)

25 Jun 2015 - 25 Jun 2015 OCK Ooi Chin Khoon [DIR/CEO] S/U -155 0.840

(06 Jul 2015)

25 Jun 2015 - 25 Jun 2015 OCK Ooi Chin Khoon [SSH] S/U -155 0.840

(06 Jul 2015)

13 Apr 2015 - 14 Apr 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -300 0.940

(17 Apr 2015)

09 Apr 2015 - 09 Apr 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -368 0.930

(15 Apr 2015)

08 Apr 2015 - 08 Apr 2015 OCK Chang Tan Chin [DIR/CEO] S/U -165 0.935

(10 Apr 2015)

10 Mar 2015 - 10 Mar 2015 OCK Chang Tan Chin [DIR/CEO] S/U -85 0.890

(17 Mar 2015)

10 Mar 2015 - 10 Mar 2015 OCK Chang Tan Chin [DIR/CEO] S/U -100 0.890

(16 Mar 2015)

27 Feb 2015 - 02 Mar 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -3,300 0.930

(09 Mar 2015)

13 Feb 2015 - 13 Feb 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U 50 0.870

(23 Feb 2015)

09 Feb 2015 - 11 Feb 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -200 0.905

(13 Feb 2015)

19 Jan 2015 - 19 Jan 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -112 0.870

(21 Jan 2015)

08 Jan 2014 - 08 Jan 2014 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -594 0.770

(14 Jan 2015)

30 Dec 2014 - 05 Jan 2015 OCK Lembaga Tabung Angkatan Tentera [SSH] S/U -185 0.790

(09 Jan 2015)

Insiders selling since Dec 2014

2016-02-05 16:22

New business that will contribute significantly in 2016 and 2017 from build and lease back (12 years) with Telenor of Myanmar up to RM1.0 billion contract. Payback period is 5-7 years. This project will easily double the current profit in two to three years time. A high growth stock, with great biz model on build and lease back towerco.

2016-02-09 12:08

3iii

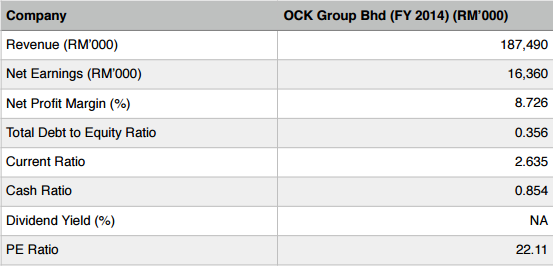

Telecommunication Network Services; Green Energy and Power Solution; Trading and M&E Engineering Services. Its main business is Telecommunication Network Services. This sector requires a lot of capital expenditure to build up the infrastructure. Let us understand more of this business segment.

2016-02-05 11:04