Malaysia Strategy: Have we hit the bottom before GE13?

MercurySec

Publish date: Fri, 22 Feb 2013, 02:48 PM

A Market Strategy Report by Mercury Securities

The KLCI index has fallen 4.8 percent after reaching a record on Jan 7 as concerns over the imminent election is taking over as the main macro risk. Despite a commendable GDP growth of 5.7% in 2012, Malaysia’s KLCI index has been the worst performing index this year in Asia. Given that a shocking poll outcome in 2008 caused a plunge of more than 9% on a single trading day, we are not surprised to see the broader market underperforming relative to its regional peers since investors are pricing in the election risk. Hence, Mercury sees equities continue to be highly correlated in the short term, therefore, we advocate a bottom-up approach to fish for value stocks in the market.

- Mercury advises investors to focus on value and buy on weakness when the market “overreacts” in the run up to the election.

- The General Election (GE) is the key macro risk and Mercury sees Malaysian equities to be highly correlated in the short-term.

- Mercury favours stocks with strong fundamentals, attractive valuations and presence outside Malaysia.

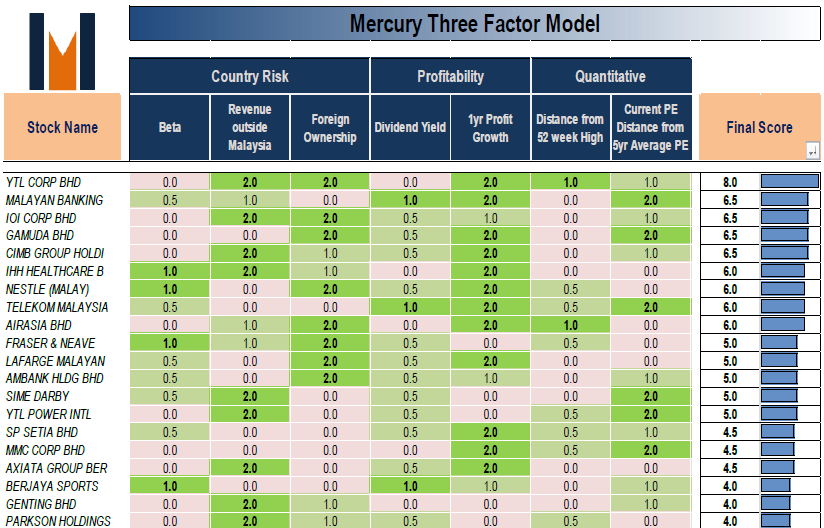

- Filtered by our Three Factor Model, we present a list of 6 Malaysian stocks intended for the impending GE13.

Commentary:

Before the filtering, we have chosen companies with at least RM 5 billion market capitalization because of liquidity concerns. Mercury believes companies with a final score of 6 and above will weather the election storm better and come out stronger come year end of 2013 than the rest of the market.

Using a blend of quantitative screening, fundamental analysis and news flow monitoring, Mercury has selected a basket of 6 stocks that we think offer good value to investors. The basket consists of YTL Corp, IHH, IOI Corp, CIMB Group Holdings, Gamuda and AirAsia.

Mercury has an Overweight (OW) call for these stocks as we expect the stocks’ total return to exceed a relevant benchmark’s total return by 10% or more over the next 12 months. A more in-depth analysis of these companies is available on the following pages.

YTL Corp Berhad

Sector: Conglomerate | Last Price: RM 1.60

Investment Thesis

International Presence: Less than 30% of YTL’s revenues are from Malaysia, therefore, YTL’s earnings is less vulnerable to any potential instability in the local political landscape.

Inexpensive Valuation: YTL current PE of 11.8 times is well below its historical 5 years average PE of 14.3 times. In addition, the current share price is 24% below its 52 week high of RM 2.12 last June.

Key Value Drivers

- Profitability continues to improve for its construction and cement divisions.

- Initial losses sustained by its subsidiary YTL Communications Sdn Bhd have narrowed as they continue to aggressively expand their YES! 4G network subscriber base.

- Contribution from YTL Cement to YTL Corp to grow as domestic demand for cement material is expected to increase.

- Strengthening balance sheet with net gearing levels currently at 1.36 times compared to 1.42 times in June 2012.

Potential Catalyst

- Announcement of new major infrastructure projects by the government will increase demand for cement and building material.

Downside Risks

- A surprise election outcome might delay execution of current infrastructure projects. YTL

IHH Berhad

Sector: Healthcare | Last Price: RM 3.35

Investment Thesis

Defensive Nature: With only around 40% of IHH’s revenues from Malaysia, coupled with its defensive business model IHH shall not be affected much by the current bearish market sentiment.

Operational Efficiency: IHH possesses a relatively wide network of hospitals. This could potentially result in significant cost savings from better economies of scale compared to its regional peers.

Key Value Drivers

- A pipeline of new beds to be delivered through new hospital developments and expansion of existing facilities.

- Future year-on-year profit growths are expected to stay strong.

- Strong presence in fast growing medical tourism markets, such as Singapore and Penang.

Potential Catalysts

- Its defensive characteristic might attract investors’ interests during times of uncertainty.

- Better than expected contribution from its Turkey subsidiary, Acibadem.

Downside Risks

- Earning volatility due to fluctuations in foreign exchange rates.

- Unexpected delay in expansion plans.

IOI Corp Berhad

Sector: Plantation | Last Price: RM 4.90

Investment Thesis

Hammered Share Price: With IOI’s current PE trading at 14.6 times, its valuation is well below its historical 5 years average 19.53 and its regional peers.

Low Political Risk: No single business is concentrated in Malaysia. This translates to a lower political risk in the upcoming General Election in Malaysia.

Key Value Drivers

- CPO price is at the trough currently and normalization of CPO price will boost IOI’s earnings in the future.

- Growing property portfolio in China.

- Lowering export taxes on CPO might give an additional boost to exports.

Potential Catalysts

- Better than expected margin from the property and downstream divisions.

- Escalating demand for property market after the election will benefit its property division.

Downside Risks

- Labor costs escalation could exert pressure to its bottom line.

- CPO price stays at the current or drop further to lower level.

- Competition in the downstream business intensifies.

CIMB Group Holdings Berhad

Sector: Banking | Last Price: RM 7.07

Investment Thesis

Robust Profit Growth: CIMB Niaga has just reported a 42% y-o-y growth in 4Q12 net profit. So we expect CIMB Group profits for FY2012 will at least meet estimates or beat them.

Growing Regional Presence: CIMB Niaga is expected to contribute at least 35% to the group’s bottom line this year. This highlights CIMB’s perceived political link and overdependence on Malaysia is unjustly overplayed.

Bargain Purchase: CIMB’s current price is close to trading at its 52 week low due to its perceived political risk.

Key Value Drivers

- Growing presence in key markets across the ASEAN region, which is expected to grow 6-7% in 2013.

- CIMB Niaga continues to generate capital and high ROE from Indonesia.

- An excellent proxy to the ongoing rollout of projects under the ETP, PPP and various economic corridor projects.

Potential Catalysts

- A Barisan Nasional (BN) victory in the imminent election this year.

- Earnings from Malaysia normalize to former level.

Downside Risks

- A surprise outcome in the upcoming election.

Gamuda Berhad

Sector: Construction | Last Price: RM 3.72

Investment Thesis

Earnings Visibility: With a record high outstanding construction order book at RM 10.5b, Gamuda has recorded a healthy annual EPS growth of 27.39% in 2012 as well.

Depressed Valuation: Gamuda is currently trading at 13.6 P/E, far from its 5 year average P/E of 20.64 despite having an outstanding construction order book.

Decent Dividend Play: Gamuda now offers a decent 3.44% dividend yield to investors and could pay out a cash receipt of RM 0.79 per share if Gamuda decides to dispose its matured toll roads.

Key Value Drivers

- The only local company in Malaysia with tunneling expertise and Gamuda enjoys the strongest construction margins given its MRT Line 1 tunneling works project has a 15% Profit before Tax margin.

- Best exposure in the construction sector to the upcoming MRT Lines 2 and 3 (combined > RM 40b).

Potential Catalysts

- High chance of a cash return if toll roads are disposed, since net gearing is currently low at 14% as of FY12.

Downside Risks

- Property sales might not meet company’s expectation if the Vietnamese property market continues to weaken.

AirAsia Berhad

Sector: Aviation | Last Price: RM 2.65

Investment Thesis

Improved Profitability: AirAsia is expected to register a record net profit when they announce their 4Q12 quarterly result next week.

Attractive Valuation: AirAsia has dropped more than 30% from its 52-week high of RM 3.85 and is currently trading only at P/E of 4.43.

High Foreign Shareholding: Foreign investors have been net buyers as they look past the election jittery and focus on fundamentals. AirAsia will be relatively shielded from domestic investors’ bearish sentiments.

Key Value Drivers

- For the full year 2012, passenger carried exceeded expectations and rose 13% y-o-y.

- Ancillary revenue growth accelerates as Indo AirAsia’s and Thai AirAsia’s growth accelerated markedly.

- First-mover advantage in North Asia through AirAsia Japan.

Potential Catalysts

- Rising Earnings Contribution from Thai AirAsia.

- Potential Listing of Indonesia AirAsia.

Downside Risks

- Weaker ringgit will reduce earnings contributions from abroad.

- Worse than expected impact from the entry of Malindo Airlines.

- Rising fuel prices.

Source: Mercury Securities Research - 21 Feb 2013

L-7-2,

No.2, Jalan Solaris,

Solaris Mont Kiara,

50480, Kuala Lumpur

Tel: 603-6203 7227

Email: mercurykl@mersec.com.my

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-25

YTL2024-08-24

CAPITALA2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

CIMB2024-08-23

GAMUDA2024-08-23

GAMUDA2024-08-23

GAMUDA2024-08-23

IHH2024-08-23

IHH2024-08-23

IHH2024-08-22

CAPITALA2024-08-22

GAMUDA2024-08-22

GAMUDA2024-08-22

GAMUDA2024-08-22

GAMUDA2024-08-22

IHH2024-08-22

IHH2024-08-22

YTL2024-08-22

YTL2024-08-22

YTL2024-08-22

YTL2024-08-22

YTL2024-08-21

CAPITALA2024-08-21

CIMB2024-08-21

CIMB2024-08-21

CIMB2024-08-21

CIMB2024-08-21

CIMB2024-08-21

CIMB2024-08-21

GAMUDA2024-08-21

IHH2024-08-21

IHH2024-08-21

YTL2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

CIMB2024-08-20

GAMUDA2024-08-20

GAMUDA2024-08-20

GAMUDA2024-08-20

IHH2024-08-20

IHH2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

CIMB2024-08-19

GAMUDA2024-08-19

GAMUDA2024-08-19

IHH2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

CIMB2024-08-16

GAMUDA2024-08-16

GAMUDA2024-08-16

GAMUDA2024-08-16

GAMUDA2024-08-16

IHH2024-08-16

IHH2024-08-15

CIMB2024-08-15

CIMB2024-08-15

CIMB2024-08-15

CIMB2024-08-15

CIMB2024-08-15

CIMB2024-08-15

CIMB2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

GAMUDA2024-08-15

IHH2024-08-15

IHH2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

CIMB2024-08-14

GAMUDA2024-08-14

GAMUDA2024-08-14

GAMUDA2024-08-14

GAMUDA2024-08-14

GAMUDA2024-08-14

IHH2024-08-13

CIMB2024-08-13

CIMB2024-08-13

CIMB2024-08-13

CIMB2024-08-13

CIMB2024-08-13

CIMB2024-08-13

GAMUDA2024-08-13

GAMUDA2024-08-13

GAMUDA2024-08-13

GAMUDA2024-08-13

GAMUDA2024-08-13

IHH

.png)