SFP Tech Holdings Berhad – An Inquiry Into Its 66.7%-Discount on Pre-IPO Shares Issued

Neoh Jia En

Publish date: Thu, 23 Jun 2022, 02:58 PM

- While they appear similar, the two pre-IPO acquisitions by SFP have been accounted for as different types of business combinations.

- Since both SFP and SFP Technology Sdn. Bhd. were controlled by the same parties, management have presented the former’s acquisition of the latter as a merger, under which the accounting for consideration paid is highly subjected to management’s discretion.

- SFP’s purchase of EST Exhibit Automation Sdn. Bhd., however, is an arm’s length acquisition for which the consideration must be recorded at its fair value.

- Unfortunately, SFP has not explained well on how it arrived at the fair value of consideration shares issued for acquiring EST Exhibit Automation Sdn. Bhd., which has resulted in an unusual gain on bargain purchase.

Having gone through the aborted initial public offering (IPO) of Ranhill Energy and Resources Berhad in 2013 and the lacklustre IPO of Lotte Chemical Titan Holding Berhad in 2017, investors in Malaysia have surely adapted to reading the fine print in IPO prospectuses. This encouraging trend is evidenced by say, investors’ scrutiny of the dividend recapitalisation done by MR D.I.Y. Group (M) Berhad before the company’s IPO in 2020.

More recently, the steep discount on pre-IPO shares issued by SFP Tech Holdings Berhad (SFP) has caught the eye of some investors. While acknowledging that SFP’s IPO price of RM0.30 per share is cheap in terms of fundamental valuation, those investors are concerned that SFP had issued equities at RM0.10 per share in March. Why did the value of SFP shares differ so much over a span of just three months?

The transactions in question

As per its prospectus, SFP has indeed issued ordinary shares at RM0.10 per share to acquire its subsidiaries in two separate transactions on 18th March 2022. The larger transaction pertained to SFP’s acquisition of SFP Technology Sdn. Bhd. (STSB) for RM55.1m satisfied by the issuance of 550.8m SFP shares, while the smaller transaction involved SFP’s acquiring EST Exhibit Automation Sdn. Bhd. (EEASB) for RM4.2m in SFP shares valued at RM0.10 per share.

Although these two transactions look similar in that they both implied a fair value of RM0.10 for each SFP share on 18th March 2022, technically they could not be more different.

SFP’s acquisition of STSB was actually accounted for based on the merger accounting/pooling-of-interests method/predecessor approach, while its acquisition of EEASB was accounted for using the acquisition/purchase method. It is the latter that most investors are familiar with.

The “A” in M&As

With the replacement of IAS 22 by IFRS 3 – both were/are standards that guide on accounting for business combinations – in 2004, all acquisitions of third-party businesses by non-investment entities that comply with the International Financial Reporting Standards (IFRS) are required to be accounted for using the acquisition method. This applies to Malaysian public companies at least since 2012 and private companies, with some minor differences such as the amortisation of goodwill, since 2016.

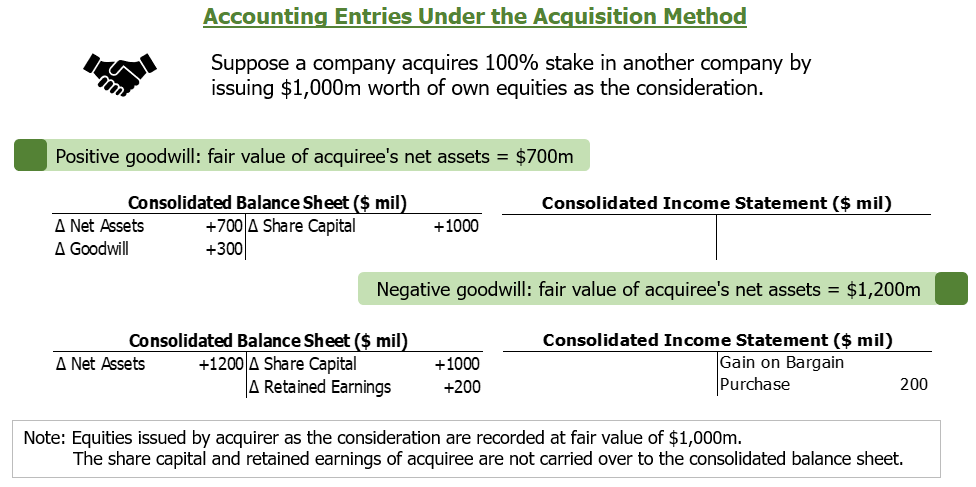

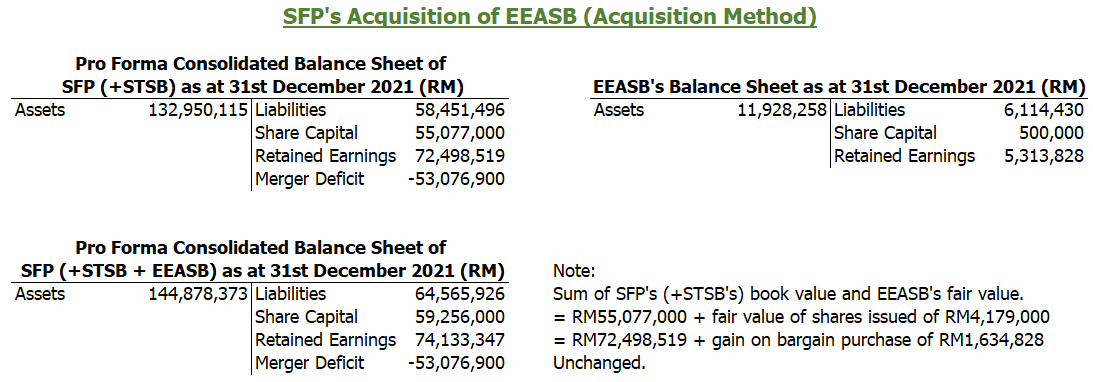

Under the acquisition method, business combinations must involve an acquirer and acquiree. The acquirer would need to identify and revalue all assets and liabilities, with limited exceptions, of the acquiree to their fair value at the acquisition date and bring them to the consolidated balance sheet; the consideration paid, which could be in cash, shares, or other assets, by the acquirer must also be valued at its fair value at the acquisition date, as provided by paragraph 37 of IFRS 3/MFRS 3. Retained earnings of the acquiree is not carried over to the consolidated balance sheet, since those earnings were not attributable to new owners.

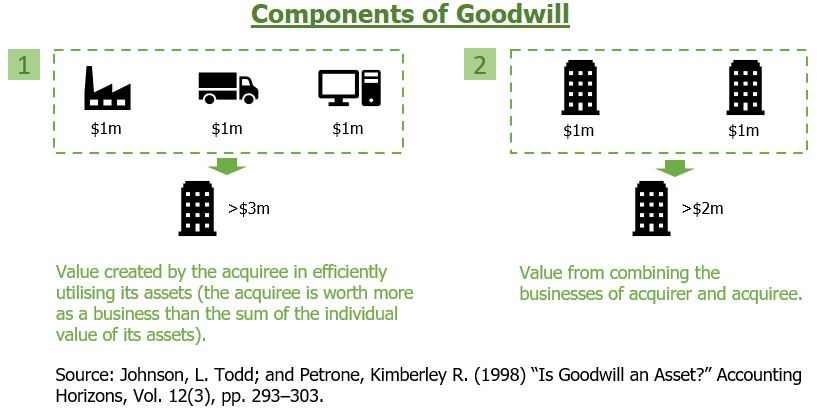

Assuming no transaction cost and that the acquiree has no minority interests, the difference between the consideration paid and the revalued net asset of the acquiree is the goodwill. Normally, goodwill is positive i.e., the consideration paid is more than the revalued net asset of the acquiree. This represents the value of synergies among assets as previously created by the acquiree, and of synergies expected between the acquirer and acquiree. Qualitative disclosures of such factors are required by paragraph B64 of IFRS 3/MFRS 3.

Under IFRS, (positive) goodwill is recorded as an asset on the acquirer’s consolidated balance sheet and tested for impairments annually. “Occasionally,” goodwill may be negative i.e., the fair value of the consideration paid is less than the revalued net asset of the acquiree, for example due to a fire sale by the acquiree (see paragraph 34-35 of IFRS 3/MFRS 3). In this case, the goodwill is recognised as a gain on bargain purchase in the income statement of the acquirer, and the acquirer must provide reasons why the transaction resulted in a gain, as per paragraph B64(n)(ii) of IFRS 3/MFRS 3.

It should be noted that paragraph 36 of IFRS 3/MFRS 3 has specifically required acquirers to reassess their accounting procedures laid out above before recognising any gain on bargain purchase, likely due to the unusualness of negative goodwill.

Business combinations under common control

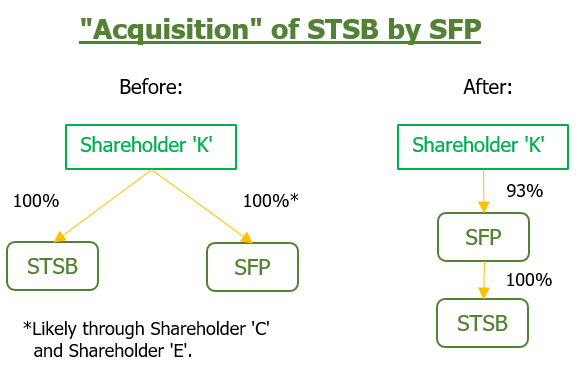

SFP’s acquisition of STSB, however, fell outside the scope of IFRS 3/MFRS 3.

As disclosed in the company’s prospectus, both SFP and STSB were and are controlled by the same shareholder before and after the acquisition transaction. This made the acquisition a “business combination under common control” (hereinafter BCUCC), to which neither IFRS 3/MFRS 3 nor any other IFRS/MFRS is applicable.

Notwithstanding, the exception provided by paragraph 2(c) of IFRS 3/MFRS 3 does not mean that the acquisition method is not allowed in accounting for BCUCC’s.

As mentioned in the discussion paper titled “Business Combinations under Common Control” issued by the International Accounting Standards Board (IASB) in November 2020, the role of general-purpose financial statements is the reason why IASB has not specified a standard for BCUCC’s. Since IFRS-compliant financial statements are prepared for stakeholders who must rely on those financial statements for their information needs, controlling shareholders are not the targeted users as they could obtain the information required from both companies that they control in a BCUCC.

Due to the absence of applicable IFRS’s/MFRS’s, companies have the discretion to choose the relevant accounting treatments for BCUCC’s, subject to IAS 8/MFRS 108 which guides the selection of accounting policies in such situations. As observed by IASB, some companies have chosen the acquisition method to account for BCUCC’s, and some have opted for merger accounting which is otherwise forbidden by IFRS’s.

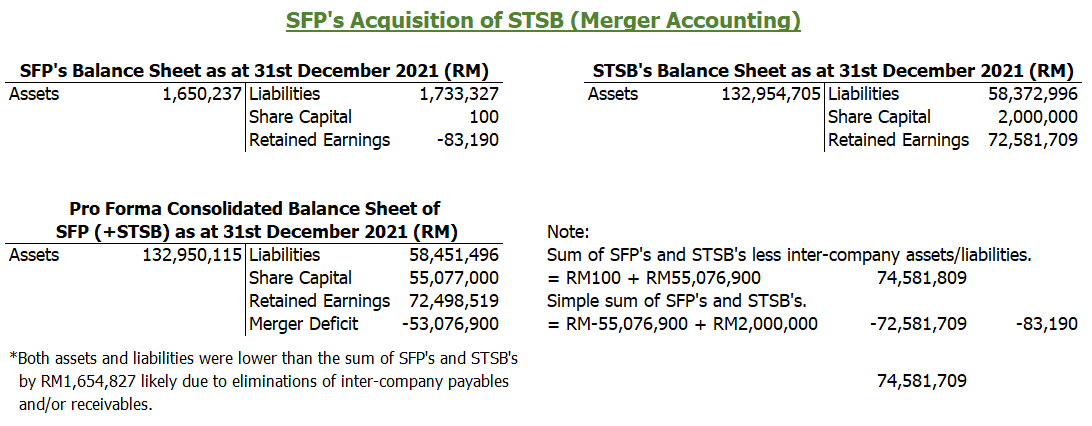

Likely due to cost-saving from not needing to revalue each asset and liability acquired, merger accounting has been used for all BCUCC’s in Malaysia that I have come across so far, including for SFP’s acquisition of STSB. Considerations are not required to be recorded at their fair value under merger accounting, of which workings are explained below.

The “M” in M&As

Before being banned by IFRS 3 in 2004, the pooling-of-interests method (an alternative name for merger accounting) was allowed by IAS 22 when an acquirer could not be identified in a business combination transaction. Still, BCUCC was not covered by IAS 22. Malaysian companies are likely referring to the US Generally Accepted Accounting Principles (GAAP), which mandates the predecessor approach (similar to merger accounting) for BCUCC’s, or the UK GAAP, which explicitly allows merger accounting for BCUCC’s, in selecting their accounting policies for such transactions.

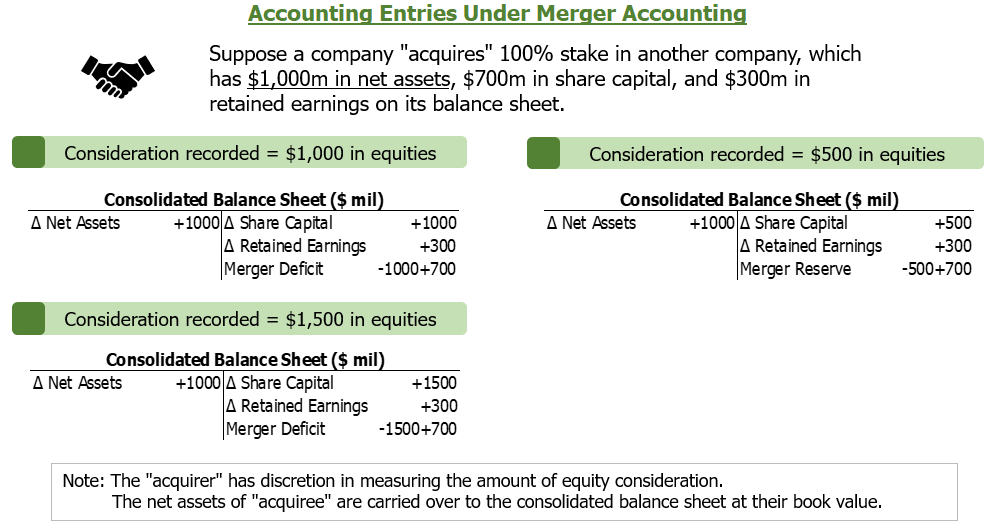

Under merger accounting, assets and liabilities of both companies are recorded and consolidated at their book value. Considerations paid always involve equities (may also partially include cash or other assets), and most national GAAPs do not prescribe the measurement of considerations since they view merger as a continuation of businesses where no acquisition of benefits and risks has occurred. The UK GAAP requires each share issued as consideration to be valued at its par value, but the par-value regime has been abolished in Malaysia when the Companies Act 2016 came into effect on 31st January 2017.

Based on few post-2016 cases such as AirAsia Berhad’s reorganisation in 2018, BIMB Holdings Berhad’s restructuring exercise in 2021, and Cnergenz Berhad’s pre-IPO reorganisation in 2021, Malaysian companies tend to value considerations for mergers at an amount close to the net asset value of acquired entities, with no explanation given on the value being assigned to each share issued.

In any case, the amount of consideration recorded under merger accounting is not meaningful. While the difference between the consideration paid and the net asset of the acquiree is recognised as goodwill under the acquisition method, such a difference under merger accounting is simply recorded as an adjustment to the consolidated equity.

Assuming no cash consideration i.e., the full amount of consideration is recorded as new share capital in the consolidated balance sheet, the adjustment to the consolidated equity usually consists of two parts: (1) retained earnings of the “acquiree” which are added to the retained earnings of the “acquirer,” and (2) merger deficit/reserve which is the difference between the amount of consideration and the share capital of “acquiree.”

Hence, ceteris paribus, the larger the assigned value of consideration relative to the book value of “acquiree,” the larger the merger deficit/the smaller the merger reserve is, which is just a balancing item with no significance of its own.

The missing nut

Since the value recorded for each share issued as consideration under merger accounting is unlikely to represent the fair value, investors should not read too much into the assigned value of RM0.10 per SFP share issued for the acquisition of STSB.

However, the same could not be said for the value of SFP shares issued as consideration for EEASB.

As discussed, SFP’s acquisition of EEASB is accounted for using the acquisition method, hence the consideration in the form of 41,790,000 SFP shares should be recorded at its fair value.

While SFP has attached a fair value of RM4.2m, or RM0.10 per share, to those consideration shares representing a 7.05% pre-IPO stake, the company’s disclosure on how it arrived at the fair value is far from satisfactory. As disclosed in page 206 of its IPO prospectus, SFP explained that “the purchase consideration was arrived at on a “willing-buyer-willing-seller” basis taking into consideration the audited net assets of EEASB as at 31 December 2010 of RM4,179,390.”

The key issue with this disclosure is that SFP has only described on how it agreed at the value of EEASB, but not the fair value of SFP shares issued. Paragraph B64(f)(iv) of IFRS 3/MFRS 3 requires that such disclosures should include the acquisition-date fair value of “equity interests of the acquirer … and the method of measuring the fair value of those instruments or interests.”

For acquisitions involving all-cash consideration, disclosures on the method used to determine the fair value of cash are not necessary since the fair value of cash is assumed to be the same as its face value. For public companies whose shares have been traded prior to an acquisition, the fair value of their shares to be issued as consideration is easily and usually determined based on some percentage discount to the last traded or volume-weighted average price. However, SFP shares were not traded prior to the acquisition.

“Willing-buyer-willing-seller” is not a sufficient justification for the fair value of SFP shares. Paragraph 2 of IFRS 13/MFRS 13, which guides the measurement of fair value, states that fair value is “a market-based measurement, not an entity-specific measurement.” In other words, fair value should be based on how much the market would value an asset/liability, not only the value one or few parties would pay for an asset/liability. This also explains why the issue price of SFP shares for merging with STSB is not an appropriate reference as the fair value – paragraph B4(a) of IFRS/MFRS 13 further emphasises that the transaction price between related parties may be used as an input into a fair value measurement only if there is “evidence that the transaction was entered into at market terms.”

Even if we assume that the net asset value of EEASB would sufficiently affect the asset replacement cost of SFP and hence it could be viewed as an input for measuring the fair value of SFP shares, such a valuation technique, which is known as the cost approach, is not prescribed for valuing an entity’s own equity instruments held by other parties, as seen in paragraph 38 of IFRS/MFRS 13. The management of SFP has also not provided any peer price-to-book multiple to indicate that they have adopted a market-multiple valuation based on the net asset value.

Lastly, common sense might help

In light of SFP’s unusual gain on bargain purchase of EEASB, the management should have provided a better disclosure on the method used in computing the fair value of consideration and on reasons contributing to the bargain purchase (not only because of “the acquisition method” as per page 207 of the IPO prospectus), in line with paragraph B64(f)(iv) and paragraph B64(n)(ii) of IFRS 3/MFRS 3.

Although any gain on bargain purchase will be ignored as one-offs by rationale investors, a lower-than-fair-value consideration will also inflate the acquirer’s return-on-equity measure over the long-run due to smaller goodwill and share capital on the consolidated balance sheet.

A sanity check would hence be helpful for investors. If those 41,790,000 SFP shares issued for the acquisition of EEASB were indeed fairly valued at RM0.10 per share, vendors of EEASB should be indifferent between accepting those shares and accepting an equivalent amount in cash. So, the question is: would they have sold EEASB for RM4.2m in cash which equals to 2.6x 2021 earnings?

* The audited financial statements provided in SFP’s IPO prospectus are ‘combined financial statements’ which represent historical financial information, not ‘pro-forma consolidated financial statements’ which represent hypothetical financial information. Some expected/illustrated effects from the merger between SFP and STSB, such as merger deficit and a higher share capital, would hence not appear in the combined financial statements. ‘Consolidated financial statements’ could not have been prepared since the merger was not completed prior to 31st December 2021.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022