Has Yinson Found the Yellow Brick Road?

Neoh Jia En

Publish date: Fri, 21 Jan 2022, 09:13 AM

- Some perpetual bonds are required to be classified as equity mainly due to the accounting concept of going concern. However, how should an issuer’s profit be allocated to this class of non-ordinary equity owners?

- IAS 1/MFRS 101 only requires the allocation of profit or loss between equity owners (as a group) and non-controlling interests in the income statement.

- IAS 33/MFRS 133 further distinguishes ordinary equity holders from owners of other equity classes, mandating that only profit or loss attributable to ordinary equity holders be used in the computation of earnings per share (EPS).

- Yet, Yinson seems to have not excluded profit or loss attributable to equity-classified perpetual bond holders from its EPS.

- This unusual method of computing EPS is also adopted by Malakoff, PESTECH, and Dialog.

For every corporate there is always a trade-off between bankruptcy risk and financing cost: debt is cheaper to raise but may lead to financial distress if used excessively; equity lowers the leverage but is more costly to existing shareholders due to earnings dilution.

Yinson Holdings Berhad (Yinson) is no exception. As the sixth largest independent floating, production, storage, and offloading (FPSO) unit leasing company in the world, the group builds, owns, and leases out these offshore units, often worth billions of ringgit, to oil producers. In return for steady lease income, the group shoulders the heavy capital expenditure on constructing such units.

During the financial year ended January 31 2012, Yinson secured the charter agreement for its first offshore unit that was subsequently named FSO PTSC Bien Dong 01. Since then, the group’s equity and debt level have each grown 28-fold. Juggling between the two financing modes is obviously not an easy task for Yinson.

The new way

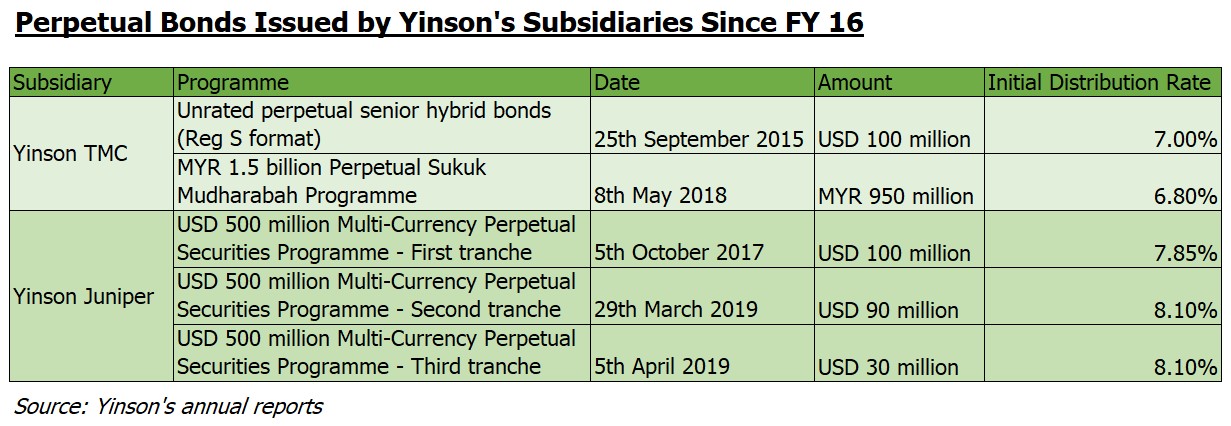

On 17th September 2015, Yinson TMC Sdn Bhd (Yinson TMC), a wholly-owned subsidiary of Yinson, launched the offering of its USD100 million perpetual senior hybrid bonds. This represents the first foreign-currency denominated hybrid bonds in Malaysia.

Yinson served as the guarantor of the perpetual bonds, which came with an initial coupon rate of 7% per annum. While having no fixed maturity date, the bonds were callable by Yinson TMC five years after issuance. More importantly, Yinson TMC could elect to defer coupon payments at its sole discretion; perpetual bond holders could not institute bankruptcy proceedings against the group for non-payment of coupons.

Following its initial success with perpetual bond issuance, Yinson TMC established a RM1.5 billion Perpetual Sukuk Mudharabah Programme in February 2018, through which RM950 million worth of senior perpetual sukuks have been sold. Back to Yinson, the group further launched a USD500 million multi-currency perpetual bond programme via another wholly-owned subsidiary Yinson Juniper Ltd (Yinson Juniper) in July 2017, under which three tranches of perpetual bonds collectively amounted to USD220 million have been issued.

A free lunch?

At the first glance, the financing cost of 6.8-8.1% on these perpetual bonds compares unfavourably to the average interest rate of 3.5-5.8% that Yinson paid on its loans and borrowings over the past five financial years. The rationale for issuing these perpetual bonds lies in their accounting classification as equity, which does not raise Yinson’s gearing ratio.

Interestingly, in page 86 of Yinson’s 2021 annual report, the group further mentioned that perpetual bonds “are classified as equity yet do not dilute our existing shareholders.” Since the cost of equity financing via the issuance of ordinary shares comes in the form of larger share base, which reduces earnings per share (EPS), how does the cost of perpetual bonds affect Yinson’s EPS if it does not result in dilution?

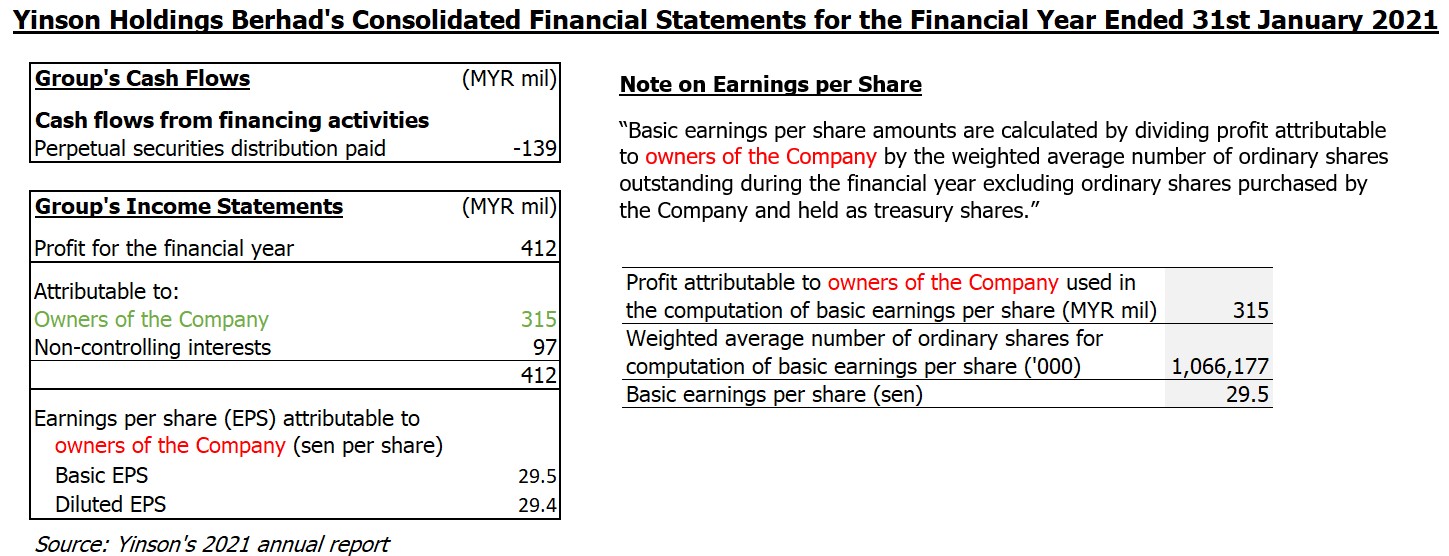

Taking Yinson’s financial year ended January 31 2021 (FY 21) as an example, the group paid RM139 mil as distribution to perpetual bond holders as shown in its statements of cash flows. This amount did not affect the group’s profit for the financial year, unlike debt financing cost which was deducted from the gross profit before arriving at the profit before tax.

More importantly, Yinson’s basic/diluted EPS of 29.5/29.4 cents for FY 21 was calculated based on profit attributable to “owners of the Company” of RM315 mil, which was the profit after tax of RM412 mil less profit attributable to non-controlling interests of RM97 mil. In this sense, the distribution to perpetual bond holders did not affect EPS at all!

Since EPS is the basis for calculating price-to-earnings ratio – a popular equity valuation method – should Yinson’s shareholders be overjoyed that the group has found a costless way to fund its capital-intensive business? Is there really a free lunch?

In page 37 of Yinson’s 2019 annual report, management mentioned that “… perpetual securities is gaining importance as a capital strategy for Yinson. … While there may have been debates on how perpetual securities should be viewed or accounted for in the capital structure of a company, the specific terms and conditions for each instrument determines its accounting classification as debt or equity.”

It seems while Yinson concedes that there are controversies surrounding the accounting for perpetual securities, the group is increasingly dependent on these financing instruments. However, does the issue really lie in the accounting classification of perpetual bonds as claimed?

Accounting rules on the classification of perpetual bonds

As a background, Malaysian public companies comply with both Malaysian Financial Reporting Standards (MFRS) and International Financial Reporting Standards (IFRS), with the former mostly being word-for-word replications of the latter after a full convergence on 1st January 2012. Hence, discussions of accounting issues by International Accounting Standards Board (IASB), the standard setter of IFRS, should also be relevant in the local context.

Despite their names, perpetual bonds or perpetual sukuks (shariah-compliant bonds) are not necessarily classified as debts/liabilities. This is provided in paragraph 18 of IAS 32/MFRS 132: “The substance of a financial instrument, rather than its legal form, governs its classification in the entity’s statement of financial position. Substance and legal form are commonly consistent, but not always.”

For equity-classified perpetual bonds, including those issued by Yinson TMC and Yinson Juniper, the key features that they share include a lack of maturity dates and clauses that allow the issuer to defer coupon payments at its sole discretion until liquidation. These mean that the issuer will have no unavoidable obligation to pay perpetual bond holders as long as the company is operating. There is no characteristic of liability, as defined in paragraph 11 of IAS 32/MFRS 132, attached to these perpetual bonds.

What about the obligation for issuer to pay perpetual bond holders during liquidation? The concept of going concern applies. Since financial statements are prepared assuming that the reporting entity will remain in operation, obligations that arise only during liquidation do not affect the classification of financial instruments. This is emphasised in paragraph BC18 of the Basis for Conclusions on IAS 32/MFRS 132.

Examining the details of Yinson’s perpetual bonds, there are a few features that encourage Yinson TMC and Yinson Juniper to pay rather than deferring distributions. Should distributions be deferred, the issuing subsidiary and Yinson itself are not allowed to discretionarily pay any dividend/distribution or repurchase any obligation ranked junior or on par to the perpetual bonds. Deferred distributions will also accrue distribution, that is they are compounding. Furthermore, Yinson TMC and Yinson Juniper have the rights to redeem their perpetual bonds based on prespecified formulae after certain years, and if they elect not to do so, the distribution rates will be raised.

Do these features affect the classification of Yinson’s perpetual bonds? The conclusion about these so-called ‘economic compulsions’ – economic incentives that strongly induce certain actions – was reached by IASB back in June 2006, with the board stressing that IAS 32 does not permit factors not within the contract to be considered in classifying a financial instrument. As long as there is no term forcing a perpetual bond issuer, as a going concern, to settle the principals or coupons, the perpetual bond should be classified as equity.

Hence, it seems that IAS 32/MFRS 132, which specifies the presentation for financial instruments, is sufficient in deciding the classification of Yinson’s perpetual bonds. In fact, IFRS Foundation, the organisation that oversees IASB, has noted that “the classification requirement in IAS 32 is clear in regard to these types of instruments (involving obligations that only arise on liquidation of the issuer)” in page 3 of its staff paper prepared for IASB meeting in February 2021.

What might be the accounting issue, if any, that led to the lack of impact from financing costs for perpetual bonds in Yinson’s EPS? The problem is likely more straightforward than perceived – it stems from the computation of EPS itself.

Barking up the right tree

IAS 33/MFRS 133 governs the computation of EPS by Malaysian public companies. Since Yinson’s perpetual bonds are not convertible into any other securities including ordinary shares, implications from accounting rules on basic EPS would be the same as those on diluted EPS.

Paragraph 10 of IAS 33/MFRS 133 sets out the computation of basic EPS: “Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (the denominator) during the period.”

Since paragraph 5 of IAS 33/MFRS 133 defines ordinary shares as equity that is “subordinate to all other classes of equity instruments,” equity-classified perpetual bonds are clearly not considered ordinary shares and hence, there is indeed no dilution from these instruments in the sense that they do not raise the denominator of EPS like ordinary shares do.

However, the computation formula given in IAS 33/MFRS 133 also makes evident that the numerator of EPS should not include profit or loss attributable to perpetual bond holders. This is reinforced by paragraph 11 of the standard, which states that: “The objective of basic earnings per share information is to provide a measure of the interests of each ordinary share of a parent entity in the performance of the entity over the reporting period.”

The differentiation between ordinary equity holders and holders of other equity classes by IAS 33/MFRS 133 differs from the approach specified in IAS 1/MFRS 101 which guides the presentation of information in financial statements.

IAS 1/MFRS 101 lumps all equity holders as “owners,” which is defined as “holders of instruments classified as equity” in paragraph 7; there is no requirement to attribute/allocate profit or loss among holders of different equity classes other than between “owners” and non-controlling interests in the statement of profit or loss as provided by paragraph 81B.

It is also noteworthy that this profit allocation required by paragraph 81B of IAS 1/MFRS 101 is presented “in addition to the profit or loss (section),” implying that profit computation and allocation are two distinct exercises even within the statement of profit or loss. Hence, even though distributions to equity-classified perpetual bond holders are recognised not “in profit or loss” but rather “directly in equity” as per paragraph 35 of IAS 32/MFRS 132, it does not mean that profit allocation is not applicable to perpetual bond holders, at least during the computation of EPS.

Therefore, while Yinson complies with IAS 1/MFRS 101, the group may find it challenging to meet the requirements of IAS 33/MFRS 133 by ignoring the impact of distributions – which are profit attributable – to perpetual bond holders on EPS, as it has done so since the financial year ended January 31 2016 (FY 16).

The norm

How should distributions to equity-classified perpetual bonds be accounted for in the EPS?

It is true that IAS 33/MFRS 133 does not lay out the accounting treatment of distributions to equities other than ordinary shares and preference shares.

Nonetheless, paragraph 10 and 11 of IAS 8/MFRS 108 provide guidance on choosing accounting policy when there is no specific standard or interpretation that applies; paragraph 11 specifically mentions that standards that deal with similar issues should be considered first.

Taking into account their characteristics, equity-classified perpetual bonds are most similar to preference shares: both are non-ordinary equities with limited but preferred claims during the liquidation of their issuer.

Thus, paragraph 12 and 14 of IAS 33/MFRS 133, which provide for preference share dividends in EPS computation, may also apply to equity-classified perpetual bonds: the numerator should be adjusted for after-tax amounts accrued to perpetual bond holders, assuming the more common case of cumulative perpetual bonds.

This is, in fact, the accounting practice by most (at least 14) Malaysian companies that have issued equity-classified perpetual bonds, including those that were issued directly by listed companies such as Malaysia Airport Holdings Berhad, UMW Holdings Berhad, DRB-HICOM Berhad, and AEON Credit Service (M) Berhad; as well as those that were issued under subsidiaries of listed companies including IHH Healthcare Berhad, Top Glove Corporation Berhad, IJM Corporation Berhad, and Cypark Resources Berhad.

It is hence, intriguing that Yinson has chosen to walk its own path.

The scale of the issue

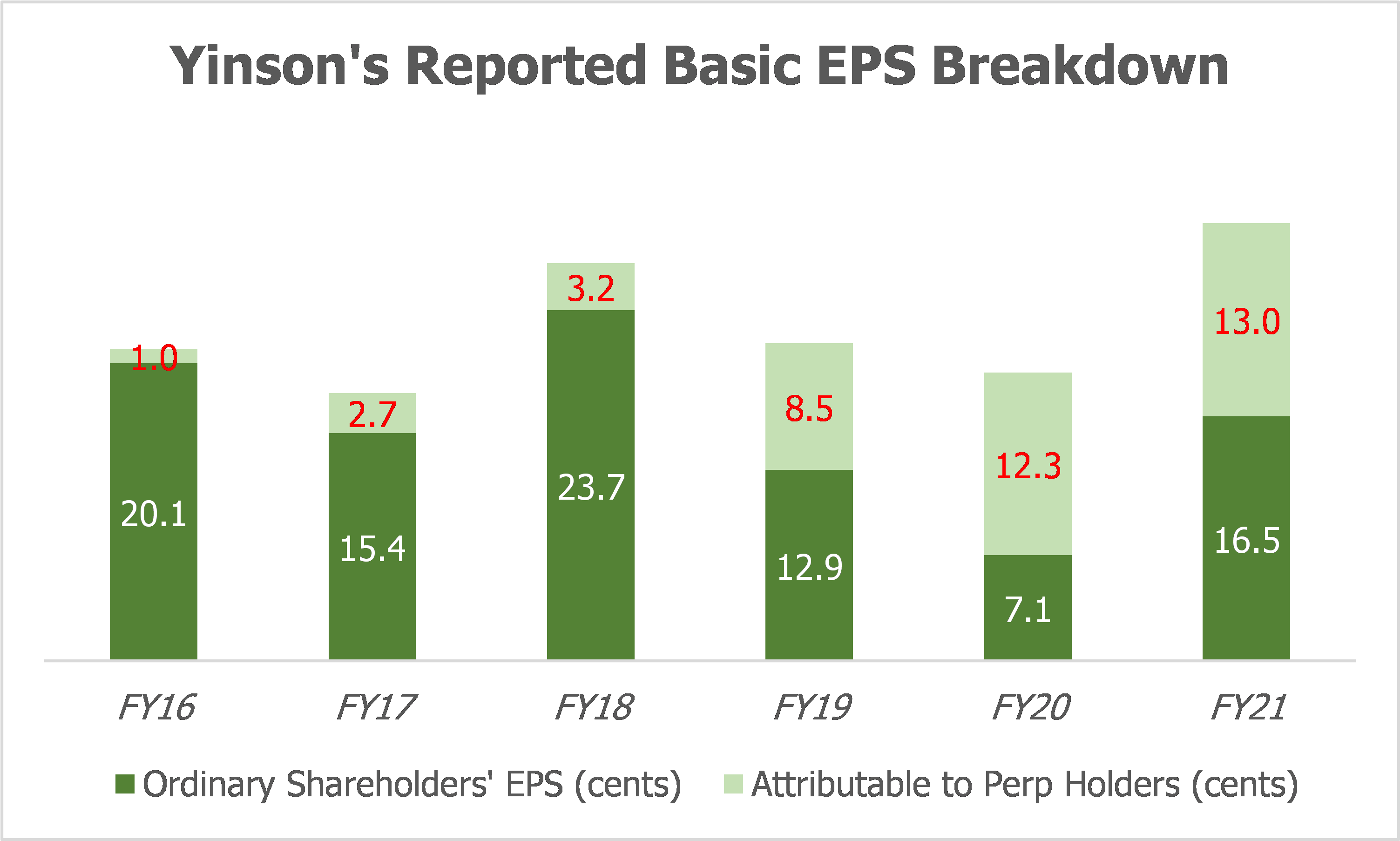

Between FY 16 and FY 21, the amount of perpetual bond distributions by subsidiaries of Yinson has grown steadily from RM10.3 million per annum to RM139 million per annum; cumulatively they amounted to RM439.7 million during the period.

As a percentage of Yinson’s reported EPS, the ‘contribution’ of perpetual bond distributions has also ballooned to 44.1% as at FY 21 (63.3% in the financial year ended January 31 2020).

Given the materiality of this issue, it may be worthwhile for Yinson to clarify any misunderstanding. This is especially true when the public money is heavily invested in the group via the Employees' Provident Fund and Kumpulan Wang Amanah Persaraan (Diperbadankan), each respectively holds a 17.6% and 9.2% stake as at 30th September 2021.

Source: Yinson’s annual reports; own computation

Afterword

In the novel The Wonderful Wizard of Oz, the protagonist Dorothy was told to follow the Yellow Brick Road to find the powerful Wizard of Oz for help in her quest of returning home. However, who awaited her at the end of the road was just a powerless, scheming old man.

Since Yinson operates in a capital-intensive industry, it is understandable that the group should constantly explore financial innovations to ensure its cost competitiveness. Hopefully the group has not been misguided by its accounting method for perpetual bonds, like how Dorothy was by the Yellow Brick Road.

Fortunately, Yinson is not alone in its computation of EPS, much like Dorothy who had three companions during her journey. Similar computation method is being used by Malakoff Corporation Berhad since 2017, and by PESTECH International Berhad and Dialog Group Berhad since 2020. There is less room for major consequences even if the described method is problematic, given that five different international auditors, including Ernst & Young, PricewaterhouseCoopers, KPMG, Grant Thornton, and BDO, have signed off on those financial statements.

With any luck, the Wizard of Oz may also no longer be able to hide behind his screen soon.

In June 2018, IASB published a discussion paper on issues pertaining to the application of IAS 32 to financial instruments with characteristics of equity (FICE), which include equity-classified perpetual bonds. While the board has subsequently walked away from its initially proposed classification method that would result in all perpetual bonds being classified as liabilities, explicit requirements for separate presentation of such instruments in the financial statements, likely through an amendment of IAS 1, are being considered. Likely, the confusion over EPS computation will be eliminated for good in the near future.

Neoh Jia En, CFA, FRM

*This post was rewritten from a coursework submitted for my current studies at Nagoya University. As at the time of writing, I have no interest in any of the securities mentioned.

*For follow-ups, see my posts titled “Has Yinson Found the Yellow Brick Road? Part 2: Common Misconceptions,” “Has Yinson Found the Yellow Brick Road? Part 3: In SC We Trust,” “Malakoff Corporation Berhad – Part 2: A Gap in Understanding the Gap,” “YNH Property Berhad – Looking Beyond the 99.998%,” “Sunway Berhad – Part 2: Above the Rising Cloud,” and "Has Yinson Found the Yellow Brick Road? Part 4: Homecoming."

*For related discussions on Malakoff and Sunway Berhad, see my post titled “Malakoff Corporation Berhad - What Do the Canaries Say?” and "Sunway Berhad – Not Just a Good Civil Engineer."

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-02

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-31

YINSON2025-01-28

YINSON2025-01-28

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-27

YINSON2025-01-24

YINSON2025-01-24

YINSON2025-01-24

YINSON2025-01-24

YINSON2025-01-23

YINSON2025-01-23

YINSON2025-01-23

YINSON2025-01-23

YINSON2025-01-23

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-22

YINSON2025-01-21

YINSON2025-01-21

YINSON2025-01-21

YINSON2025-01-21

YINSONMore articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022

Discussions

You need to strip away all those numberings and scenarios and technical mumbo jumbo

and see the ultimate objective

=> of increasing earnings by using snake oil double talk.

I do believe perpetual bondholders are mere liabilities, the intention was never to give them shareholder status.

of course, the industry businessmen wants high EPS and will object strenously just like the Goodwill/Badwill/illwill scandal in Malaysia.

walking away from defining perpetuals as mere liabilities is just like licensing opium becoz people like opium.

2022-01-21 23:44

in the Malaysian Goodwill scandal many years back.

Goodwill in Malaysia was supposed to be "all" written off.

Nobody bothered about it.

No worries, no problem, was ok, can be done. Yes Sir, if you say so.

... until some Captains of Industry found out that their PLC companies might become PN17, wink wink, as a result.

Delegations after delegations after delegations visited the Ministry of Finance

and end result is that the Accounting Bodies were asked to bend over to be publicly caned.

new solution => No need to write off Goodwill.

:)

does it not sound like why Accounting Body after public caning walked away from perpetuals as mere liabilities?

2022-01-22 00:14

@i3lurker ... that's harsh. Unfortunately Yinson's perps may indeed be required to be classified as equity. Have to take any further argument on that issue to IASB instead. @benlim yup, treating perps like preferred shares is what I argued for as well.

2022-01-22 07:39

at the end of the day.....

The Accounting Standard is what those Captains of Industry say it is.

Accounting Bodies says "Please tell me what you want and I will make it happen"

Posted by Neoh Jia En > Jan 22, 2022 7:39 AM | Report Abuse

@i3lurker ... that's harsh. Unfortunately Yinson's perps may indeed be required to be classified as equity. Have to take any further argument on that issue to IASB instead. @benlim yup, treating perps like preferred shares is what I argued for as well.

2022-01-22 08:24

Goodwill is like you are paying RM 5.00 for QL which has NAPS of RM 1.00.

What should we call when you are buying Insas at RM 0.91 which has NAPS of RM 3.23?

2022-01-22 08:36

of course

that should be called as Goodbuy aka Goodbye, a value trap

Sslee Goodwill is like you are paying RM 5.00 for QL which has NAPS of RM 1.00.

What should we call when you are buying Insas at RM 0.91 which has NAPS of RM 3.23?

22/01/2022 8:36 AM

2022-01-22 09:01

FPSO can be anchored at any part of the world unlike oil rigs. The question is when and not if tecnology advance in energy will make crude oil obsolete.

2022-01-22 09:06

Going back to Kunta Kinte, Roots

earnings per share was originally ONLY meant for Ordinary Shareholders,

telling them how much profits their investment made before issuing dividends.

Once you add a perpetrator like perps into the equation,

the inflated "extra" earnings were NOT banked into the company at all

but were paid out to those perps.

EPS without perps => X sen

EPS with perps => X + Y sen where Y had "gone out" of the company

Earnings per share was originally ONLY meant for Ordinary Shareholders had been grossly distorted by this Snake Oil Scheme.

2022-01-22 09:10

I3lurker are you saying the preps is nothing but a legal snake oil scam to syphon out the money?

2022-01-22 09:16

there is the accounting standard and the "spirit" of the accounting standard.

just like contravention of the "spirit of the takeover code" is also a major contravention.

I dun see how heaping loads of "Gone Earnings" given to perps onto EPS retained earned earnings calculations meant for ordinary shareholders can reflect a "better picture" rather than a Snake Oil picture.

2022-01-22 09:21

It is a compulsory Snake Oil scheme.

coz IASB insists that you partake of this Snake Oil scheme whether you like it or not.

Companies like Yinson have No Choice but to follow IASB accounting standards.

Yinson did not choose this treatment.

Yinson is just meekly following orders of IASB.

Non-compliance by Yinson will mean a nasty note by external auditors.

Posted by Sslee > Jan 22, 2022 9:16 AM | Report Abuse

I3lurker are you saying the preps is nothing but a legal snake oil scam to syphon out the money?

2022-01-22 09:25

Philip Palantir (USD 13.53) and Stoneco (USD 14.46) and even Netflix (USD 397.50) look very interesting now.

2022-01-22 09:26

Get out of Yinson as this is a company in financial distress

Winning lots of jobs with razor thin profit margin cannot cover borrowings and assets depreciation

Bonus and warrant are camouflage to hide it's Rights issues of Rm1.22 Billions asking shareholders for help

If so good why ask so much Rm1.22 Billions cash by veiled Rights issue from shareholders

A financially distressed company should be avoid at this time

Go for companies like Taann or Bplant or even Innoplant which give out cash rather than ask for cash

2022-01-22 09:29

taking d perpetual bond as equity nampak lebih betul.. kan dah bilang perpetual??

klau nak adjust EPS... will reduce the earning kat d numerator sama effect nya dgn increase the no of shares kat d denominator??

2022-01-22 16:05

wonder if tis thingy sebab nya Dialog jatuh sampai 52 w low apabila harga minyak kat multi year high ??

2022-01-22 16:07

@SarifahSelinder memang saya dah fikir tentang kemungkinan untuk ubah denominator, tetapi unit untuk "perpetual" tak sama dengan unit untuk saham, dan "perpetual" yang saya bincang tak boleh ditukar kepada saham. Dan sebab Dialog jatuh beberapa hari yang lalu, pergi tanya Macquarie. Laporannya memang bagus.

2022-01-22 16:27

Wil u single handedly mess up Yinson punya ongoing fund raising plan?

Kan Yinson issue a statement to clarify?

Kan Yinson issue a legal letter to u?

2022-01-23 09:02

@SarifahSelinder auditors memang perlu audit EPS juga kerana ia diikat bawah peraturan IFRS/MFRS. Dan ya, saya akan jumpa mereka hari isnin ni.

2022-01-23 09:40

@SarifahSelinder IAS 33/MFRS 133 paragraph 3: "An entity that discloses earnings per share shall calculate and disclose earnings per share in accordance with this Standard."

2022-01-23 09:51

the perpetual bond are long term loan with interests payments BUT can be recalled.

perpetual bond are likely park under non-current liabilities THAN under Equity

DID perpetual bond distorted EPS? NO

The cost of perpetual bond is deducted from Profit+Loss before EPS is calculated

2022-01-23 10:12

Put it this way ...u need to differentiate between Perpetual Bond v Preference Share mah!..!

Legally Perpetual bond....is actual borrowing with no clear repayment or maturity schedule mah!

As long they pays the interest when due...the perpetual bond have no expiry period loh!

However....to avoid the perpetual bond....exist forever...sometime the investment bankers...sometimes set certain dates for review for potential redemption at the discretion of both borrowers or lenders say every 7, 10, 15 years loh!

Legally Preference share...or are actually equity.....they pay dividend instead of interest loh!

Preference shares....can also be classified as liability when they are contractually redemption schedule period of the bond mah!

For accounting treatment of Perpetually bond & preference share....they both can classified as equity loh...!

But for the portion due for redemption say within 1 yr....that is usually classified as short term liabilities loh!

During liquidation perpetual bond rank as liabilities whereas Preference share rank lower than liabilities loh!

For investors to assess the strength of balance sheet, it is preferably to analyse the perpetual bond as a liability, since u need to pay interest on it, although the bond is perpetual with no fixed term liablity loh!

For preference share assessment....it is preferably to analyse it as a liability if it has fixed period of redemption loh!

DO NOT BE CONFUSED MAH!

LU TAU BOH ?

2022-01-23 10:58

Alsvin dah la Yinson treated its perpetual bond as equity

Byk jenis perpetual bonds depending on d terms some r loan liabilities some r more akin to equity

2022-01-23 11:05

EPS = (Net Income – Preferred Dividends) / Weighted Average Shares Outstanding

actually any announced dividend is also deducted/must be deducted from net income.

This secret info is not shown in most formulas.

Thats why some companies announce dividend after the accounts are published.

2022-01-23 11:06

Do not get complicated mah!

Profit after tax

Minus preferred dividend

Profit attributable ordinary shareholders

Total Number of ordinary shares.

Eps on enlarge ordinary share.

That is the formula to compute the potential eps for ordinary shareholders mah!

2022-01-23 11:13

They can call a "duck" as "chicken" loh!

But as an investors analysing the business potential u must not be confuse loh!

Put it this way ...u need to differentiate between Perpetual Bond v Preference Share mah!..!

Legally Perpetual bond....is actual borrowing with no clear repayment or maturity schedule mah!

As long they pays the interest when due...the perpetual bond have no expiry period loh!

However....to avoid the perpetual bond....exist forever...sometime the investment bankers...sometimes set certain dates for review for potential redemption at the discretion of both borrowers or lenders say every 7, 10, 15 years loh!

Legally Preference share...or are actually equity.....they pay dividend instead of interest loh!

Preference shares....can also be classified as liability when they are contractually redemption schedule period of the bond mah!

For accounting treatment of Perpetually bond & preference share....they both can classified as equity loh...!

But for the portion due for redemption say within 1 yr....that is usually classified as short term liabilities loh!

During liquidation perpetual bond rank as liabilities whereas Preference share rank lower than liabilities loh!

For investors to assess the strength of balance sheet, it is preferably to analyse the perpetual bond as a liability, since u need to pay interest on it, although the bond is perpetual with no fixed term liablity loh!

For preference share assessment....it is preferably to analyse it as a liability if it has fixed period of redemption loh!

DO NOT BE CONFUSED MAH!

Posted by SarifahSelinder > Jan 23, 2022 11:05 AM | Report Abuse

Alsvin dah la Yinson treated its perpetual bond as equity

Byk jenis perpetual bonds depending on d terms some r loan liabilities some r more akin to equity

2022-01-23 11:16

Examples of Amounts or Other Items that May Be Included in the Other

Information

The following are examples of amounts and other items that may be included in other information. This list

is not intended to be exhaustive.

Items in a summary of key financial results, such as net income, earnings per share, dividends, ....

ISA 720 (Revised), The Auditor’s Responsibilities Relating to Other Information

Other Information [or another title if appropriate, such as “Information Other than the Financial

Statements and Auditor’s Report Thereon”]

Management is responsible for the other information. The other information comprises the [information

included in the X report,7 but does not include the financial statements and our auditor’s report thereon.]

Our opinion on the financial statements does not cover the other information and we do not express any

form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information

and, in doing so, consider whether the other information is materially inconsistent with the financial

statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based

on the work we have performed, we conclude that there is a material misstatement of this other information,

we are required to report that fact. We have nothing to report in this regard

Tengok ni

Our opinion on the financial statements does not cover the other information and we do not express any

form of assurance conclusion thereon.

Klau data used to calculate EPS are derived from audited figures (yg ni auditors ok) tapi cuma formula yg diguna is arguable mcn mana ada ka auditors responsible?

2022-01-23 11:18

Coming back to MFRS, IFRS, GAAP Standard...accountant treatment are different from legal treatment and the treatment of the investor mah!

It is better to call a duck a duck instead of accountants sometime trying to be smart calling a duck as a chicken and get confuse mah!

They can call a "duck" as "chicken" loh!

But as an investors analysing the business potential u must not be confuse loh!

Put it this way ...u need to differentiate between Perpetual Bond v Preference Share mah!..!

Legally Perpetual bond....is actual borrowing with no clear repayment or maturity schedule mah!

As long they pays the interest when due...the perpetual bond have no expiry period loh!

However....to avoid the perpetual bond....exist forever...sometime the investment bankers...sometimes set certain dates for review for potential redemption at the discretion of both borrowers or lenders say every 7, 10, 15 years loh!

Legally Preference share...or are actually equity.....they pay dividend instead of interest loh!

Preference shares....can also be classified as liability when they are contractually redemption schedule period of the bond mah!

For accounting treatment of Perpetually bond & preference share....they both can classified as equity loh...!

But for the portion due for redemption say within 1 yr....that is usually classified as short term liabilities loh!

During liquidation perpetual bond rank as liabilities whereas Preference share rank lower than liabilities loh!

For investors to assess the strength of balance sheet, it is preferably to analyse the perpetual bond as a liability, since u need to pay interest on it, although the bond is perpetual with no fixed term liablity loh!

For preference share assessment....it is preferably to analyse it as a liability if it has fixed period of redemption loh!

DO NOT BE CONFUSED MAH!

2022-01-23 11:25

@AlsvinChangan These four companies classify their perpetual bonds as equity. If you check their statement of profit or loss, the distribution paid to perpetual bond holders are not deducted from profit or loss. I have even cross checked these figures in the cash flow statement, and those distributions are indeed separated from finance costs deducted from profit or loss.

2022-01-23 19:43

@SarifahSelinder Interesting info on auditors' responsibilities. Unfortunately I am not an accounting professional so I don't know the details. In the first place, it could be me who are wrong about this.

2022-01-23 19:48

i3lurker

substance over form and intention

I always find it weird that Directors/major shareholders refused to allow perpetual bond holders to have voting rights that clearly defines a shareholder as a shareholder.

However when it comes to Earnings or payments to "not shareholder" perpetual bondholders, these payments are considered as earnings of "not shareholder, now shareholder" so that the earnings per share is computed as higher.

if this is not double talk of a snake oil salesman, I dun know what is

2022-01-21 23:26