Malakoff Corporation Berhad – Part 2: A Gap in Understanding the Gap

Neoh Jia En

Publish date: Thu, 05 May 2022, 12:11 PM

- The accounting standard setters acknowledge the permissibility to classify some perpetual bonds as equities, and this status quo will likely remain into the near future.

- Although IFRSs and MFRSs allow flexibility in financial reporting, any deviation from stated requirements is justifiable only if it better meets the reporting objectives.

- The lack of understanding the distinction between profit computation and profit allocation might have led to EPS miscomputation by some issuers of equity-classified perpetual bonds.

As a follow up to my discussion on how Yinson Holdings Berhad (Yinson), Malakoff Corporation Berhad (Malakoff), PESTECH International Berhad (PESTECH), and Dialog Group Berhad (Dialog) might have miscalculated their earnings per share (EPS), I have planned to get clarifications from the respective management. The best, and arguably the only, opportunity for a retail investor to do so is during those companies’ annual general meetings (AGMs), when the management is obliged to discuss their annual financial statements in the presence of external auditor.

The 16th AGM held by Malakoff on 28th April hence presented the first opportunity to solve the mystery. In preparing for the event, I have further prepared a writeup on how distributions to perpetual bonds (perps) reduce Malakoff’s retained earnings and pose risk to its future dividend payout.

Surprisingly, three days before Malakoff’s AGM, The Edge Malaysia published two articles related to the issue: “Revisiting perpetual securities” and “Will perpetual sukuk affect Malakoff’s generous dividends?” Hereby I would like to review insights provided by those two articles as well as the explanation given by Malakoff’s management.

First, the closed case (for now)

In the article titled “Revisiting perpetual securities,” the author explored the view of various stakeholders and concluded that perps should be treated as liabilities. Referencing the concept of faithful representation and the definition of liability in the Conceptual Framework for Financial Reporting (the Conceptual Framework), they opined that the classification of perps as equities is a misrepresentation.

As stated in paragraph 4.27 of the Conceptual Framework, a liability is a present obligation to transfer an economic resource, and this obligation arises from past events. The author noted that the timing to transfer economic resources does not matter, and hence accountants’ rationale to classify perps as equity due to its being an obligation that arise only during liquidation is invalid.

Unfortunately, the author has overlooked the concept of going concern as provided in paragraph 3.9 of the Conceptual Framework. Since financial statements are prepared assuming that the reporting entity will not be liquidated, classifying all perps as liabilities will violate this assumption.

Thus, clarification clauses for obligations that arise only during liquidation have been provided by the International Accounting Standards Board (IASB), the standard setter of the International Financial Reporting Standards (IFRSs). In the Conceptual Framework, this clause is rather obscure as seen in paragraph 4.33:

“A conclusion that it is appropriate to prepare an entity’s financial statements on a going concern basis also implies a conclusion that the entity has no practical ability to avoid a transfer that could be avoided only by liquidating the entity or by ceasing to trade.”

In IAS 32 which formally defines the presentation of financial instruments, however, paragraph 25 clearly clarifies the matter: “… [a financial instrument that acts like a financial liability during specific uncertain future events that are beyond the control of both the issuer and the holder] is a financial liability of the issuer unless: … (b) the issuer can be required to settle the obligation … only in the event of liquidation of the issuer…” Paragraph BC18 of the Basis for Conclusions on IAS 32 explains that this clause arose from potential inconsistencies with the going concern assumption.

What about faithful representation?

As observed by the author, it is true that perps are often treated as liabilities. Pursuant to its 2018 discussion paper “Financial Instruments with Characteristics of Equity,” IASB noted that “many” respondents acknowledged the debt-like features of perps, and that some users of financial statements, standard-settlers and regulators agreed that a liability classification better reflects the economic substance.

Yet, responses to IASB’s proposal in the same paper to change its liability classification approach, that would have resulted in all perps being classified as liabilities (the “amount feature”), were one-sided. Most respondents disagreed with the proposed change, due to the resulting inconsistencies with the going concern assumption, the lack of a need for classification change, and disruptions to the market. While agreeing with IASB’s proposal, the Malaysian Accounting Standards Board (MASB) has also expressed concerns on its unintended impact to the classification of perpetual bonds.

After due consideration (see agenda paper 5E and 5F), IASB has, in February 2021, tentatively decided not to change the classification of perps but to enhance the presentation and disclosure requirements with regards to such securities.

These discussions by IASB and MASB have two implications: (1) the standard settlers acknowledge the equity classification of some perps, and (2) they do not plan to change this status quo anytime soon. Hence, issuers of equity-classified perps should not worry about the risk of reclassification anytime soon, so long as they have properly assessed the lack of obligation before liquidation in the first place.

First view into the experts’ view

In the article titled “Will perpetual sukuk affect Malakoff’s generous dividends?” also published on 25th April, the author interviewed two accounting professionals mainly on whether there is differentiation between profit attributable to owners of the company as reported in the income statement and profit attributable to ordinary shareholders used as the numerator of EPS. This is the key issue surrounding Yinson, Malakoff, PESTECH, and Dialog that I have raised in January.

While clarifications by professionals are much welcomed, comments provided in that article were true but not helpful.

The first expert mentioned that “owners of the company are usually holders of ordinary shares of a company,” and proceeded to describe the difference between ordinary shares and perpetual bonds.

As per the hierarchy of accounting rules prescribed by IAS 8, the accounting treatment for any item should first follow the IFRS that specifically applies, and only in the absence of such IFRS that management should exercise their judgement by referring to the Conceptual Framework.

Since IAS 1, which guides the presentation of financial statements, and IAS 33, which deals with EPS, have clearly defined owners of the company and ordinary shares, whether owners of a company are usually holders of its ordinary shares does not matter, even though non-ordinary equities such as preference shares and perps are indeed rare. To add on, both definitions do not contradict each other (holders of ordinary shares is just a subset of owners of the company), and the Conceptual Framework does not define either of these items.

The second interviewee emphasized that Malaysian Financial Reporting Standards (MFRSs) are principle-based and hence MFRS 133, which governs the computation of EPS, allows companies “the flexibility to achieve transparency and understandability for their investors.”

To recap, MFRSs have fully converged with IFRSs in 2012, and MFRS 133 is equivalent to IAS 33. Unlike the US accounting standards, both MFRSs and IFRSs are principle-based and hence deviations from written rules are allowed if compliance would instead mislead users of the financial statement due to circumstances faced by the reporting entity.

Still, any deviation must be disclosed and explained, as provided by paragraph 20 of IAS 1/MFRS 101, and more importantly, it should serve to better meet the presentation and disclosure objectives, as per paragraph 7.2(a) of the Conceptual Framework.

Ignoring the fact that all four companies in question have not indicated departure from IAS 33/MFRS 133, it is tough to justify how their approach of not excluding profit distributed to perps holders from EPS would fulfil the objective of disclosing EPS, which is “to provide a measure of the interests of each ordinary share of a parent entity in the performance of the entity over the reporting period” as spelled out in paragraph 11 of IAS 33/MFRS 133. With its negative impact on retained earnings, distributions to perps clearly affect the interests of ordinary shareholders.

An irrelevant reply from Malakoff

During Malakoff’s 16th AGM (the minutes of which will be available online within 30 business days from 28th April), I posted the following question to the management of Malakoff:

(To explain the lack of differentiation between profit attributable to owners of the company and profit attributable to ordinary shareholders.)

Paragraph 7 of MFRS 101 define owners of the company as holders of all equity instruments while MFRS 133 requires that only earnings attributable to ordinary shareholders be used in EPS computation.

May I know why is the profit attributable to ordinary shareholders of RM 260.416 mil used in computing EPS, as shown in p.232 of the annual report, is the same as the profit attributable to owners of the company of RM 260.416 mil as shown in the statement of profit or loss in p.143? If those two profits are equal, then where did profit distributed to perpetual sukuk holders of RM 47.2 mil, as shown in p.145, come from?

Despite the clear wording of my question, it seems like the management has failed to appreciate the difference between profit computation and profit allocation, as implied by their answer below:

“The distribution of perpetual sukuk holders is equity in nature. And hence, there is no impact to profit and loss. As such, profit attributable to ordinary shareholders and profit attributable to owners of the company are the same.”

Since the perps of Malakoff is classified as equity, distributions to holders of the instrument are not expenses and should indeed be recognised directly in equity, as per paragraph 4.70 of the Conceptual Framework and paragraph 35 of IAS 32. However, what this implies is that those distributions do not affect the profit of Malakoff as an entity; allocation of profit among different classes of equity holders is a different issue altogether.

The distinction between profit computation and allocation exercises is apparent in Appendix A14 of IAS 33:

“…, profit or loss for the period is allocated to the different classes of shares and participating equity instruments in accordance with their dividend rights or other rights to participate in undistributed earnings …”

A good example is equity-classified preference shares, dividends of which do not impact the profit of its issuer yet are required to be deducted from the profit attributable to ordinary shareholders as per paragraph 12 of IAS 33.

The gap between IAS 33 and other IFRSs

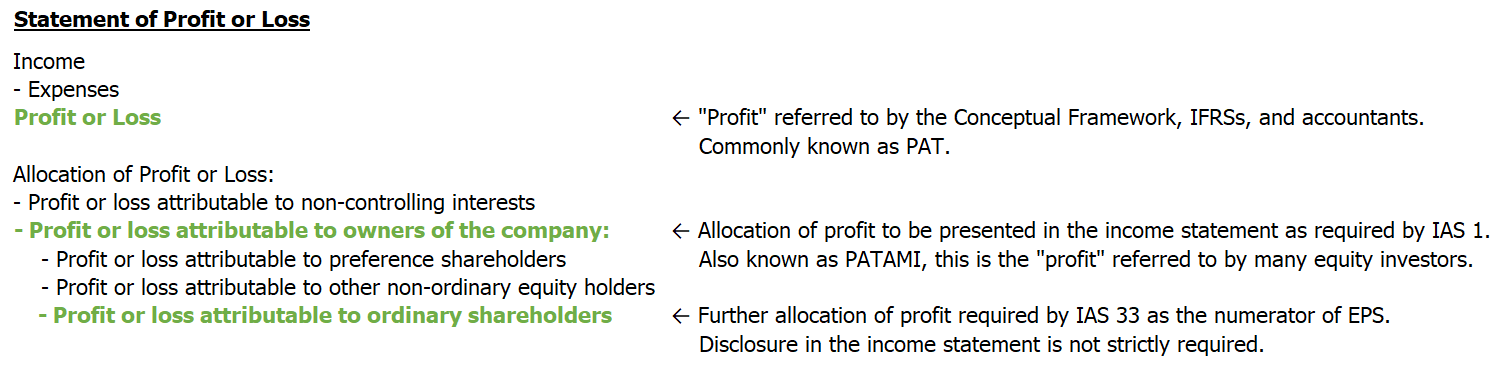

Judging from the comments by accounting practitioners, it seems that the difference in profit allocation requirements by IAS 33 and the concept of profit referred to by other IFRSs is not well known. This is further complicated by the gap in requirements between IAS 1 and IAS 33, as shown below:

If this is the case, then there is real likelihood that all four companies mentioned have misstated their EPS. In my next writeup, I shall present cases of companies’ amending their EPS due to the same mistake, and also the reason why the gap in profit allocation requirements exists.

*This post is the first (and the most technical one) of my three Golden Week writeups, and is a direct follow up to three of my previous posts titled “Has Yinson Found the Yellow Brick Road?”, “Has Yinson Found the Yellow Brick Road? Part 2: Common Misconceptions,” and “Malakoff Corporation Berhad - What Do the Canaries Say?”.

*For follow-ups, see my posts titled “YNH Property Berhad – Looking Beyond the 99.998%” and “Sunway Berhad – Part 2: Above the Rising Cloud.”

P.S.: Malakoff has made the minutes of its question-and-answer session publicly available at https://ir2.chartnexus.com/malakoff/v2/docs/agm/AGM-minutes-2022.pdf.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022