(RICHE HO) Genetec Technology Berhad

RicheHo

Publish date: Wed, 02 Dec 2015, 03:26 PM

GENETEC was incorporated as private company in year 1997 under the name of Genetax Technology Sdn Bhd.

In year 2004, it converted to a public limited company and changed its name to Genetec Technology Berhad. In the following year, it listed on MESDAQ Market of Bursa Malaysia.

GENETEC core business is to provide assembly automation and engineering services to various industries. It is able to provide engineering service to customize design the industrial automation system to suit individual needs, build to print, customizable conveyor and transportation system and vision system

Currently, its core revenue industry segment is hard disk drive (“HDD”), which contributed 84% of total revenue, followed by automotive industry 9% and pharmaceutical, semiconductor 7%.

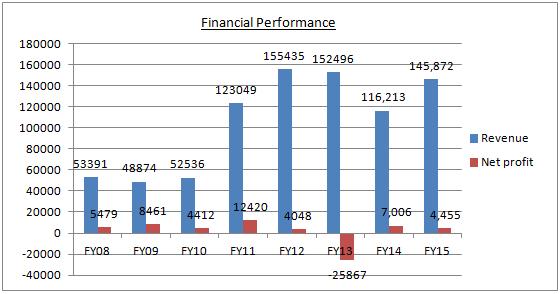

Have a look with its past financial performance.

GENETEC doesn't have a stable or outstanding track record.The net loss in FY13 was mainly attributable to one-off goodwill written-off in USA business which is a discontinued operation unit. So, in year 2014, the financial result had excluded USA business, which lead to a drop in revenue.

FYI, Genetec Global Technologies, Inc., a wholly-owned subsidiary of Genetec, was incorporated in USA in year 2010. System's South, Inc. and IP Systems, Inc. were the subsidiary of Genetec Global Technologies, Inc.

However, their business in USA was not doing well; revenue had increased significantly but net profit did not seem to have any improvement. Hence, they discontinued the operation in USA in year 2013.

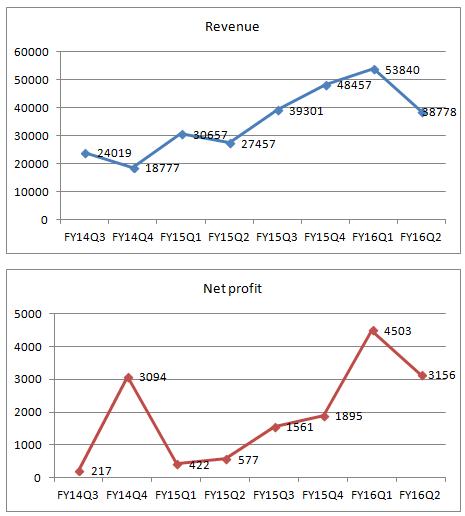

Let’s look at its past 8 quarters revenue and profit.

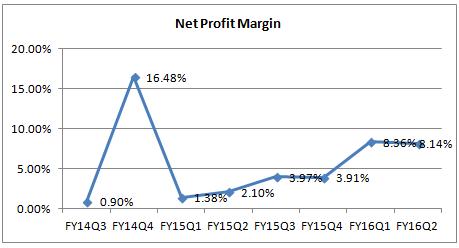

FY14Q4 net profit margin 16.48% is an outlier. Without taking into account of profit from discontinued operation, actually GENETEC made losses on that quarter. So, let’s just ignore this.

Overall, GENETEC net profit margin had been improve from 1% to current 8% in the past 8 quarters. It was mainly contributed by recognition of foreign exchange gain!

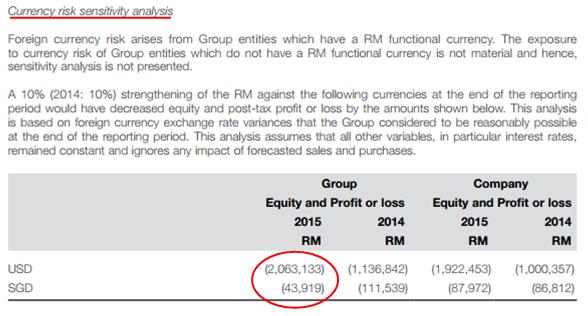

The below is the currency risk sensitivity analysis which extracted from GENETEC annual report 2015.

From the statement above, 10% strengthening of MYR against USD will decrease GENETEC profit by MYR2m! In other words, GENETEC is a beneficiary from weakening of MYR.

To recall back, on the first quarter of 2016, the conversion for USDMYR was around 3.7 while on FY16Q2, it had appreciated to around 4.1. Compared to year 2014, USD had strengthened by more than 15% against MYR.

Since we are not able to track its operation profit margin, I believe weakening of MYR is the main reason why GENETEC net profit margin suddenly surged from 4% to 8% in FY16.

Financial Strength

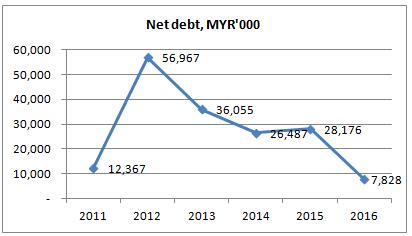

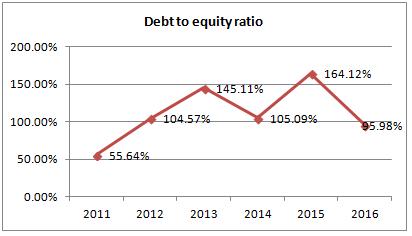

*FY16 data was referring to GENETEC latest Q2 unaudited account

Net debt = Total borrowing – Cash and cash equivalent

GENETEC net debt had been decreasing from year to year. I believe sooner or later, GENETEC cash on hand will be more than its borrowing, based on its current consistent quarter earnings. However, its debt to equity ratio is not good, which is around 100%! GENETEC definitely need to improve its financial strength.

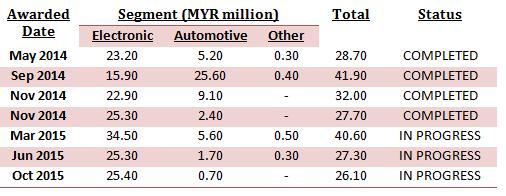

Book Order

In year 2014 and 2015, GENETEC had been awarded 7 orders, based on its announcement in Bursa. Its orders obtained in year 2014 worth MYR130.3m while orders in year 2015 worth only MYR94m. Theoretically, GENETEC 2015 revenue supposed to be lower than year 2014 but it came the opposite way.

GENETEC book orders were to complete within 3 to 9 months. Assume the orders are to be complete by maximum 9 months, GENETEC still have 3 orders in hand.

Let’s have a brief calculation on its next coming quarter earnings. MYR94m divided by 3 quarters, equivalent to approximately MYR32m per quarter. With a profit margin of 8%, GENETEC is expected to deliver MYR2.5m profit in next quarter. This is just a brief estimation to know roughly how much GENETEC can deliver.

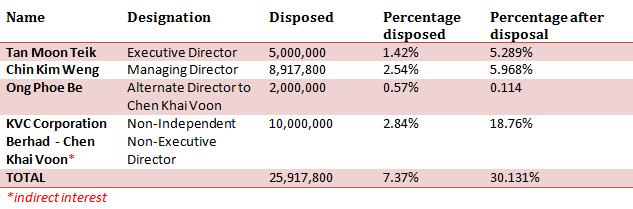

Directors Shareholdings

GENETEC issued and paid up share capital is 351,738,000.

However, do take note that, since October 2015, GENETEC directors had been disposed their shares quite aggressively.

For me, there are only two reasons for the disposal.

1. In Nov 2015, GENETEC shares price had surged from MYR0.20 to current MYR0.30. Maybe, it is the best time for time to take some profit. FYI, over the past 2-3 years, the highest GENETEC reached was only MYR0.24; it was just a very short time before it dropped again.

2. The directors understand the company business well. They realize that the company will not be able to sustain its profit in coming quarter. So, they choose to sell part of it, before the share price drops.

Is there any third possibilities?

Conclusion

According to TechNavio Report Global HDD Market 2011-2015, it predicted an 8.1% annual growth rate for the global HDD through 2015.

According to Fitch Ratings’ Report on 2015 Outlook for Global Automotive Manufacturers, the global demand for new vehicles should increase modestly in 2015, despite challenging conditions in some markets.

Having said so, GENETEC books order will still be our main concern, as the report statements above are purely a research paper.

With its current price of MYR0.30, GENETEC is currently traded at PE of 9.49 and ROE of 17.55%. If it is able to sustain its first two quarter profit in the next two quarter, GENETEC is still considering cheap.

With USDMYR expected to trade above 4.00 in the next half to one year, GENETEC probably still able to deliver satisfied result, given its book order is able to sustain.

However, when the catalyst of beneficiary of weakening of MYR no longer exists, is GENETEC still able to deliver good result? It is another story.

Just for sharing

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Have a wonderful December! Hopefully all of you are doing well in investment this year :)

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

haha tc88, I am not a shareholder of Genetec and did not bought any of it before :P

2015-12-02 17:11

However, when the catalyst of beneficiary of weakening of MYR no longer exists.

Have been thinking about tis recently. What will happen to those counters that price have gone up lots due to this?. Can someone enlighten me?

2015-12-03 01:03

@tony89 - it depends on the companies itself. You must understand, weak MYR/ strong USD is a double edged sword.

If the company's business does not solely rely on the forex gain, then all should be good. Otherwise, the risk of reversal is there.

Take for example, not all of furniture stocks are riding on the weak MYR. Some companies have good business moats or good expansions stories such as Hevea, etc, which should not be affected that much even if ringgit were to rebound strongly.

Stock market is a cyclical thing, few years ago the trend is properties sector, but nowadays they are not, so picking the correct company is important.

What you want to buy, are those kind of companies which are more resilient.

2015-12-03 16:16

who is this richie Ho?

good job.

Hopes it saves some people some headaches.

all those Comintel players, have you done similar homework?

2016-01-03 00:54

Riche is a 20+ young man Actuarial Science student

If you appreciate his works, can subscribe by paying a small amount

Not expensive

He wants to earn some pocket money, to build up his cdpital base

I already subscribed

Always supportive of young people like that

2016-01-03 03:53

He started so young, with exactly the right skill sets and concept

great future

I started punting at 28

Now I am 68

Hope I can have RM100 mil when I am 84, just like Uncle Koon

2016-01-03 03:59

There is always new rules made by new people

It is nothing surprise to see a brand new rule setting by now,

some people want a rule to compare in quarter basis some in annual basic some want to see in decade basic, and they also people care about prospective basis and also longer prospective, one need to be very clear that they don't want to be in the middle of the two rules.

2016-01-03 06:53

Forex gain is the new set of rules set by new people

Most of my top pick is forex beneficiary I will expect thing to work out good when I had a good start that is stick with the same rule, a good start contribute to 50% of your chance to success, another 50% come from holding power.

2016-01-03 07:04

Make a point to see what the market is overlooking

Shutterstock

The truth about valuing stocks is that so much more is happening in subtext and behind the scenes. As we enter 2016, then, it’s worth looking deeper at what matters and what is overlooked when it comes to market valuation.

In a word, context matters most when we talk about valuation.

It should go without saying that even the most popular valuation measures are just data points in a vacuum. But we seem to have lost sight of that amid unscrupulous salesmen masquerading as “experts,” claiming the stock market is “about 80% overvalued.”

In 2016, don't let volatile markets cloud your financial plans(3:25)

How can households best manage and prepare their finances going into 2016 in the face of volatile markets? HighTower managing director Jordan Waxman joins Lunch Break to explain. Photo: Getty

Let’s look at McDonald’s Corp. MCD, -1.08% as a case study in how complicated and nuanced the market really is.

On the surface, I suppose 26 times earnings is indeed a bit rich for a restaurant stock that saw little profit expansion in 2015 and is actually seeing a declining top line. But forward estimates show McDonald’s shares trade at around 22 times next year’s profits — more in line with what some would call “normal.”

Of course, bears may note that sales are projected to drop next year even if profits edge up — to which bulls might respond that an impressive return on equity of more than 40% means McDonald’s can do plenty even with top-line troubles.

And besides, there’s news — namely, the all-day breakfast introduced at the beginning of the fourth quarter that will probably boost performance and lead to a nice earnings surprise. Of course, longer-term this may not be a good thing, as franchisees are already in revolt over a complicated menu and other uncomfortable corporate mandates as of late.

And so it goes, with analysis and rebuttals and speculation.

Nobody said investing was easy.

Oddly enough, however, many of the same investors who pride themselves on knowing how to read a 10-Q are refusing to do the research these days. They simply throw up their hands and say “because of valuation.”

Overlooking the future

The odd thing about many valuations is that they are based on projections of sales and earnings — and therefore are inherently flawed.

For instance, is it any wonder that oil mega-caps Exxon Mobil Corp. XOM, -0.20% and Chevron Corp. CVX, -0.14% trade at 20 times next year’s earnings? That’s because there are two ways for a high P/E at Exxon to resolve itself: either earnings come in better-than-expected to justify the current premium on its stock price, or earnings come in below targets to prove the current share price is not that out of whack after all.

What do you think is going to happen to Exxon, given these choices and the current state of oil prices?

Of course, as shocking as it may seem, Wall Street can and does occasionally offer proper guidance. That makes it all the more maddening to interpret whether forward estimates are too high or too low.

Beyond the factors that will alter the trajectory of an individual company are big-picture trends that affect sectors and asset classes.

Digging deeper into crashing crude oil prices, look at the dramatic selloff across the MLP space. Sure, it’s about oil just like Exxon, but it’s also about broader forces including the quest for yield as income-seeking investors have few alternatives.

A year ago, these master limited partnerships were hanging tough as a “safe” place to find yield, even as crude oil crashed from the mid-$90s to the mid-$50s at the end of 2014. The fact that oil has soured again surely has punished MLPs, but an equally compelling reason is the end of ZIRP as the Fed looks to “normalize” interest rates and investors may start to seek income in less-risky places. At the same time, the brutalized junk bond market ironically has made distressed “high-yield” offers more favorable to some fixed-income managers because they think they are finally being adequately compensated for risk.

And so it goes: News breaks, data is digested, and investors react. Some might be right, others might be too emotional — or just too early — to profit.

Valuation metrics surely play into these moves. But they are frequently the tail of the dog, with traders willing to pay a theoretical premium or afraid to buy at a theoretical discount based on their bigger-picture views of the future.

In other words, if valuation is driving your views of the future, instead of the future driving your views on valuation, you’re doing it wrong.

2016-01-03 07:14

GENETEC is a mirror image of MQTECH. Read and see

http://klse.i3investor.com/servlets/forum/800000082.jsp

MQTECH will fly too?

2016-01-03 11:24

richie

.why don't get a job as analyst in a stockbroker?

doesn't that sound attractive?

2016-01-03 17:31

Thanks all.

Hi desa20201956, i had no CFA qualification and i don't have any experience in analyst job. Am 24 in year 2016, wish to full time by end of tis year. I do write stock analysis as well. If you are interested, may leave ur email or send an email to richeho_92@hotmail.com

2016-01-03 18:40

I will recommend you take CFA exams. SunwayTES conducts courses, twice a year exams for part 1. Only a few thousand $. So cheap because it is mainly self studies.

You have the talent and love of this industry.

2016-01-06 15:36

Since Genetec is story of the day, am commenting here so that this post came to light again. Read on.

2016-02-25 21:23

ah plane.....don't 趁火打劫 la.....

richeHO is sincere and nice guy....... paperplane...U also nice guy at least to me

2016-02-25 21:38

Tan Kin Thien

SUpport !

2015-12-02 15:35