(RICHE HO) CAB Cakaran Corporation Berhad

RicheHo

Publish date: Thu, 10 Dec 2015, 10:55 PM

CAB Cakaran is a Main Market-listed company operating poultry farming and meat processing business in Malaysia. Currently the company has an existing capacity of 3.6 million birds per month. It has 10 breeder farms and 140 broiler farms in Peninsular Malaysia. It had 5 business segments, which are as below:

- Integrated poultry farming and processing division

- Trading/ Value added food products manufacturing

- Supermarket

- Fast food

- Marine products manufacturing

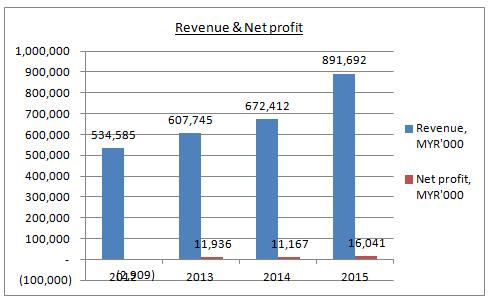

Financial Performance

CAB revenue had been increased for 3 years consecutively.

The sharp increase in FY15 revenue was due to the increase in sales of the integrated poultry farming and processing division. It was attributed mainly to inclusion of the results of the newly acquired subsidiaries in Singapore, namely Tong Huat Poultry.

FYI, Tong Huat Poultry had just started to contribute on FY15Q3. In other words, the net profit MYR16m in FY15 is not a full financial year contribution from Tong Huat Poulty yet. The rest will be discussed further below.

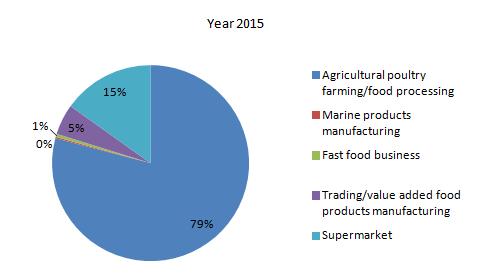

In year 2015, CAB revenue contribution is mainly from poultry farming segment 79%, followed by supermarket segment 15% and value added food products manufacturing 5%. Its contribution from marine products manufacturing segment and fast food business are very insignificant.

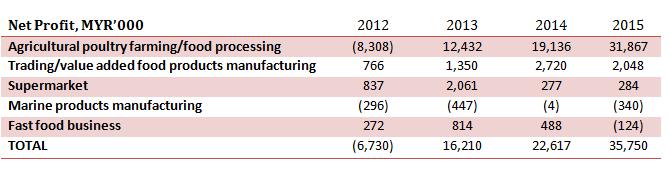

However, in term of net profit, after take out the loss making segment from marine products manufacturing and fast food business, poultry farming contributed 90% to the Group net profit.

Since supermarket, marine products manufacturing and fast food business are either loss making or insignificant profit, it will not be discussed deeply. Its fast food business had turned into losses in FY15. I believe this is because of a huge drop in consumer spending power in FY15.

The drop of contribution from value added food products in FY15 was partly attributed to the weaker consumer sentiment and increase in the cost of imported raw materials due to the weakness of the MYR.

This can be further supported by the currency sensitivity analysis which extracted from CAB annual report 2014, as below:

A weakening of MYR against USD by 7% theoretically will drag down CAB net profit by MYR160k.

For its marine products manufacturing, it had been making losses for 4 financial years consecutively. Perhaps, CAB should discontinue this business line and stop wasting money on it?

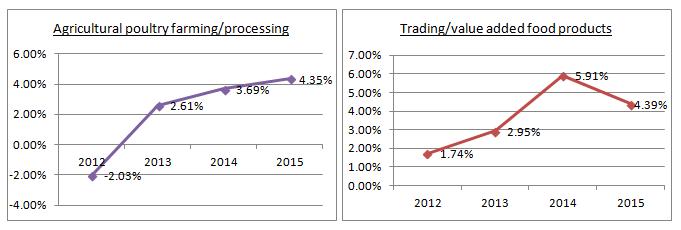

Regarding its two main business line, poultry farming and value added food products, please refer its net profit margin for the past 4 years, as below:

Both of the main revenue contributors showed an improvement from the past few years. It is a very good sign for poultry farming division, especially when it contributed 90% out of the total revenue! 1% increase in net profit margin is very significant for the Group. However, both segments net profit margin is still very low, which less than 5%!

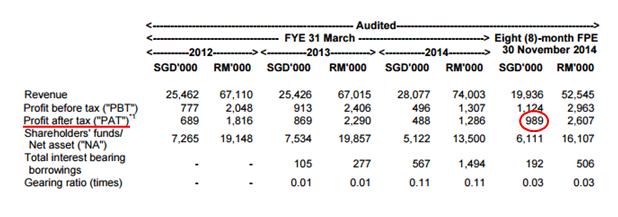

Acquisition of Tong Huat

On Oct 2014, CAB entered into a heads of agreement to acquire a 51% stake in Tong Huat for MYR19.2m. FYI, Tong Huat is one of seven licensed chicken slaughtering houses in Singapore. It has a market share of 15% in Singapore.

Tong Huat net profit for the first 8 months of financial year ended 30 Nov 2014 is SGD989k. After conversion in MYR, it will be MYR2.97m, based on SGD1.00= MYR3.00.

For a full financial year, I believe Tong Huat is able to contribute at least MYR4.45m to CAB! Besides, don’t forget the strengthening of SGD against MYR will directly benefit the Group!

CAB net profit on FY14 was MYR11m. So, based on estimated full financial year contribution MYR4.5m by Tong Huat, CAB expected to deliver at least MYR15.5m net profit.

Having said so, with only two quarters contribution from Tong Huat, CAB had already achieved MYR16m in FY16!

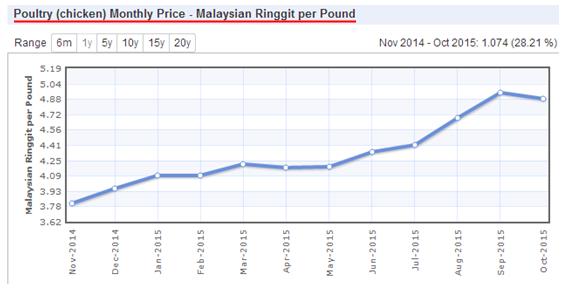

Its above expectation net profit is also contributed by higher average selling price of broilers. Have a look at poultry chicken monthly price, as below:

The poultry price had been trending up for the past 1 year, from MYR3.80 per pound to MYR4.88 per pound, an increment of 28%! As extracted from CAB latest quarter report, as below, the previous average selling price for broiler is MYR4.63.

![]()

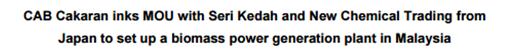

Biomass Power Generation business

On Mar 2015, CAB had signed a MOU with New Chemical Trading (“NCT”) from Japan and Seri Kedah Corporation (“SKC”) to establish a biomass power generation business which will produce fertilizer as a by-product through the incineration of chicken droppings.

This is definitely a new and exciting business venture for CAB where it is utilizing its current waste to generate recurring income for the Group going forward. CAB plans to build the plant with a processing capacity of 300 metric tonnes of chicken droppings per day. The plant, which was expected to start operation in 2017, would turn poultry litter into energy.

There will be two joint venture (“JV”) take place, but CAB will only involved in the second JV.

The second JV will be incorporated by all three parties where the business will be focused on biomass power generation and the selling of the power produced. Under this, CAB will hold 51%, while the remainder 49% will be held by Seri Kedah and JV1.

Up to date, the JV had not formed yet and it is still under progress.

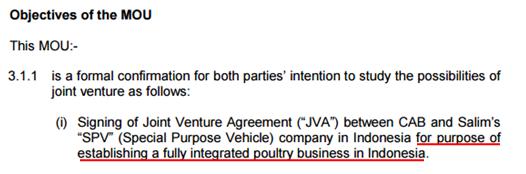

Venture into Indonesia market

On Dec 2015, CAB had entered into a memorandum of understanding (“MOU”) with Salim Group for purpose of establishing a fully integrated poultry business in Indonesia.

FYI, CAB had no revenue contributed from Indonesia so far. The main market of CAB is in Malaysia, followed by Singapore.

Salim Group is engaged in the agribusiness and consumer product sectors in Indonesia, and forming part of the group is Jakarta-listed Indofood Sukses Makmur Tbk, which are Indonesia’s largest food processing company and the world’s biggest producer of instant noodles.

If CAB poultry business is able to venture into Indonesia market, it definitely will be a very huge market!

Financial Strength

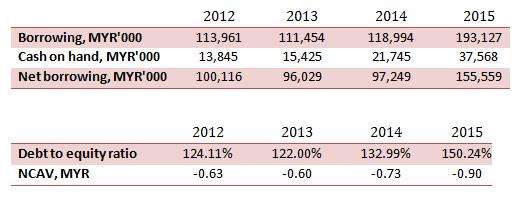

CAB’s debt to equity ratio had been increased for the past two years, from 122% to current 150%! Its net current asset value per share is also getting weaker. In other words, its current asset is not able to clear off its total liabilities and the excess liabilities are MYR0.90 per share in FY15!

Besides, its net borrowing had increased up to MYR155m on FY15! Compared to FY14, it had increased 60%!

In short, CAB financial strength is very weak!

Conclusion

With its current price of MYR1.60, CAB had a PE of 15 and ROE of 8.74%.

Let’s have a brief calculation on its price after take into account of the full financial year contribution from Tong Huat. Since the completion of acquisition of Tong Huat, CAB latest two quarter earnings per share are 11.16 cent. Let’s assume CAB is able to achieve 22.32 cent in a full financial year, with an estimated PE of 10-12, CAB share price is estimated at the range of MYR2.23 to MYR2.68.

The two business opportunities above are still at a very beginning stage. Both had just signed off with MOU. However, with a very weak financial strength, whether CAB is able to finance the project internally or bank borrowing is another question.

On the next coming quarter, I believe CAB is still able to deliver a satisfied result, due to the uptrend of broiler price and strengthening of SGD.

Just for sharing.

Hey guys, I am writing stock analysis report to earn some pocket money. If you are interested, you may email me at richeho_92@hotmail.com, for more information.

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

hissyu2

Very bad cash flow, high debt, low TIE, negative FCF, increasing inventory, increasing receiveable and trade payable are alarming. Spending a lot in PPE In an unreasonable high and continuous high amount... Company is doing borrowing to keep its daily operation... Perhaps, "high growth" but not really a good pick while we hAve so many better choice out there. I'm little timid low risk taker... This company looks really bad to me

2015-12-12 03:03