(RICHE HO) Pentamaster Corporation Berhad - New Rising Star & Happy Chinese New Year!

RicheHo

Publish date: Fri, 05 Feb 2016, 04:33 PM

Before I start my post here, just to wish every readers in i3, a happy chinese new year 2016!

May your life be free of worry and fear; Instead, may you have happiness, good health and success all the year!

Once again, wishing you all a happy and prosperous happy chinese new year 2016 :)

Pentamaster Corporation Berhad (“PENTA”)

PENTA is a leader in providing advance, world-class manufacturing automation solutions and services, which based in Penang.

Its principal activities are as below:

- Manufacturing of automated and semi-automated machinery and equipments

- Designing and manufacturing of precision machinery components

- Design, assembly and installation of computerized automation systems and equipments

Financial Highlights

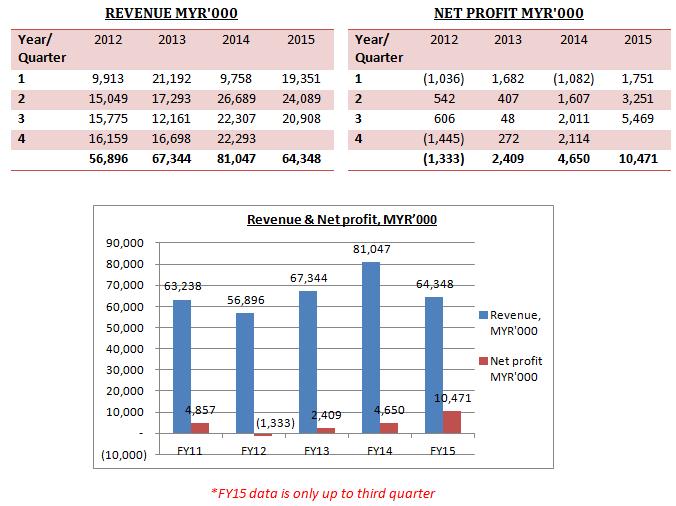

Over the past 4 years, PENTA had shown a significant improvement in revenue with a compound annual growth rate (“CAGR”) of 8.62%.

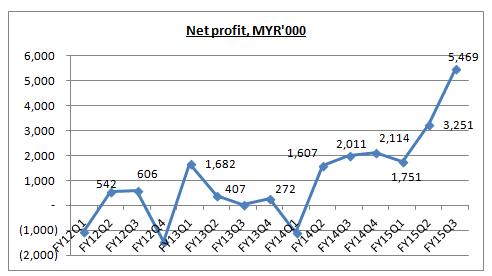

In term of net profit, PENTA was able to turn from net loss in year 2012 to net profit of MYR4.65m in year 2014. In FY15, PENTA had surpassed its 2014 whole year net profit in just 2 quarters. With remaining one quarter, its net profit is expected to triple up in the current year!

The improvement in its financial performance is mainly because smart electronic devices are the key driving force behind the semiconductor growth in recent years. Therefore, more sophisticated test solution is required for the manufacturing of these smart devices. Besides, semiconductor sector is still growing robustly even though it had slowed down the pace. This is why PENTA was able to do well in these two years.

In its latest quarter, the good result was because of other income of approximately MYR2.6m in negative goodwill arising from the acquisition of Origo Ventures (will discuss further below). After excluded this MYR2.6m, PENTA FY15Q3 net profit still stand at MYR2.8m.

It is still considered good. Based on its explanatory in latest quarter report, it was due to better product mix with higher margin achieved coupled with the foreign exchange gain from the sharp appreciation of USD against MYR.

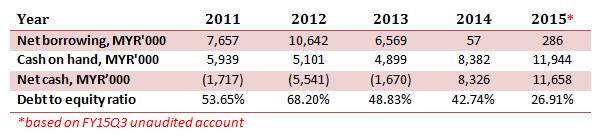

Financial Strength

PENTA financial strength had turned strong after year 2013, following the footstep of its financial result. Currently, it had almost zero borrowing with MYR11.94m cash on hand. It is a good sign as PENTA doesn’t need to worry about the interest rate burden. Definitely, it is able to meet its short term obligation.

In addition, its debt to equity ratio had dropped from 68.20% in FY12 to current 26.91% only!

PENTA may continue to find good opportunities to expand or diversify its business with its excess cash on hand.

Weakening of MYR

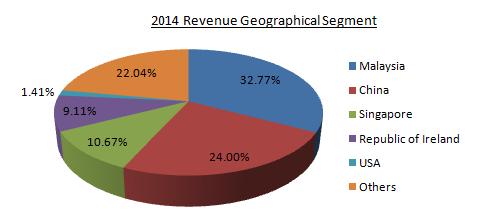

In year 2014, revenue contribution from Malaysia was only 32.77% and the rest were exported to other countries. It means that most PENTA’s revenue was came in other currency.

As extracted from its Annual Report 2014, it stated that a 5% strengthen of MYR against USD and SGD theoretically will decrease PENTA profit by MYR667k.

In other words, PENTA is benefited from weakening of MYR! In year 2015, MYR had been weakening against USD and SGD for more than 20% So, theoretically PENTA will have additional MYR2.67m if other factors are constant.

FYI, 20% of its raw materials used were imported from the US and Japan, while the rest was sourced locally. Other than that, 90% of the group’s earnings are in USD.

Venture into Property Project Management

On end of Sep 2015, PENTA acquired 100% equity interest in Origo Ventures (M)Sdn Bhd (“ORIGO”) for MYR5.78m.

ORIGO is principally involved in property project management activities. It is headed by an experienced General Manager that has more than 14 years of architecture & property project management experience that span across major Malaysian property companies, namely Sunway, TRC Development, Talam Corporation and IOI Properties.

ORIGO had been awarded a Project Finance and Management Contract by Maarij Development Sdn Bhd for the project management of a mixed development project in the new township of Tunjong, Kelantan. The GDV is approximately MYR164m. Total remuneration for the project management agreement shall be 60% of the net profit generated from the development.

As of 28 Sept 2015, OVSB has an outstanding billing of approximately MYR3m upon the completion of stages of work done.

FYI, the acquisition was only completed on 30 Sept 2015. In other words, PENTA was using MYR5.78m to acquire a company with current outstanding billing of MYR3m.

Most investors thought PENTA is venturing into property development and hence they are not looking good at it. But, actually it is not.

The main purpose of this acquisition is to venture into Smart Home and Building Solutions’ offerings by providing with requirements of the Property and Construction sectors. PENTA may take this opportunity to expand their business and market. It may offer and sell its smart home solution products for other development projects via ORIGO’s project contracts.

For more understanding, have a look at the below smart home solution.

Acquisition of Land - Expansion

On March 2015, PENTA had proposed to acquire a piece of land at Seberang Perai, Penang for MYR5m.

As extracted from PENTA circular, the acquisition is to build a new plant to increase in production activities which require bigger space for assembly and testing activities

The proposed acquisition is expected to be completed in FY15Q4.

By using the land, PENTA will invest MYR20m in a new manufacturing facility in Batu Kawan in year 2016 despite the global economic downturn.

The plant would be located on 3 acres to manufacture a new generation of test and robotic equipment for the semiconductor industry. Construction work is expected to start next year and the plant is scheduled to start operations in year 2017.

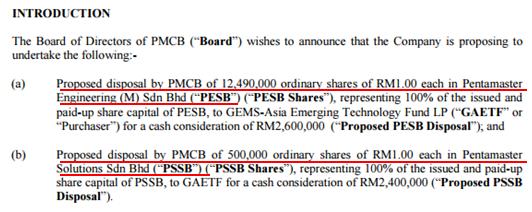

Disposal of Loss Making Subsidiaries

On July 2015, PENTA had proposed to dispose 100% equity interest in two of its subsidiaries, which are Pentamaster Engineering and Pentamaster Solutions.

PENTA mentioned in its circular that these two subsidiaries had been incurring losses for the past few years. So, they wanted to dispose it. Its two subsidiaries year 2014 net profit is as below:

- Pentamaster Engineering – net loss MYR3.76m

- Pentamaster Solutions – net profit MYR0.52m

Since the disposal had been deemed completed at July 2015, PENTA quarter result onwards will not be taken Pentamaster Engineering and Pentamaster Solutions net profit into account. Based on above result, PENTA probably will have additional MYR0.8m profit averagely in each quarter.

In other words, PENTA upcoming quarter report is expected to be higher as compared with the period before disposal.

Future Prospect

Based on an interview with PENTA’s executive chairman Chuah Choon Bin, he is forecasting up to a 20% rise in both its top line and bottom line, underpinned by expectations of favourable exchange rates and higher orders.

PENTA will be very bullish about the first and second quarters for FY16 due to its increased orders as well as an order deferment from a multinational smartphone maker in year 2015, which was downsizing its production by 30%. Therefore, its orders were pushed from FY15Q4 to FY16Q1.

As at Feb 2016, PENTA’s order book stands at MYR45m, which will keep it busy until end of FY16Q2, and it expects more orders in the offing for the remaining quarters.

PENTA is optimism about its outlook, regardless of the current global and domestic economic slowdowns, stems from the fact that its business strategy focuses on providing a complete ecosystem of automated products and testing solutions.

PENTA provide the complete ecosystem, meaning the handling plus testing. It writes test programme by understanding customer’s products. There is no cost involved. Its customer base is of the high-end value-added tier, where they want the total ecosystem. Hence, PENTA’s profit margin had grown. Previously, it used to sell machines for MYR300k, but now it can sell for more than MYR1m.

Besides, Origo currently manages a mixed development in Kelantan, which comprises smart building automation for lighting, air-conditioning and security. It also has a few more projects in the pipeline in year 2016, valued at some MYR20m to MYR30m.

Source: http://www.theedgemarkets.com/my/article/pentamaster-bullish-its-prospects-fy16

Conclusion

Based on its current share price of MYR0.71, PENTA had a PE of 9.76 after excluded the negative goodwill arising from Origo, and a ROE of 13.48%.

In my opinion, PENTA is still considered cheap. However, due to an order deferment from a multinational smartphone maker in year 2015, its orders were pushed from FY15Q4 to FY16Q1. In other words, PENTA’s FY15Q4 result, which will be released in end of Feb 2016, is very likely to be either flat or drop slightly.

However, it is expected to have an outstanding result in FY16Q1 and Q2.

Overall, PENTA had improved its fundamental in recent two years, by taken the actions below:

- Disposal of its loss making subsidiaries

- Acquisition of land to build a new plant for expansion

- Acquisition of Origo to diversify into property project management

It acquired ORIGO for further expansion for its Smart Home Solution market. It is definitely a huge market with less people know about this technology. It is an one-touch concept technology which interconnect all the house appliance with your phone.

Some people claimed that it is not good for PENTA to venture into property project management, but I feel the other way. With the current contract MYR3m on hand, fully acquisition of ORIGO will 100% contribute to PENTA financial result.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

i4investor

semicon industry going down this year, avoid PENTA

2016-02-06 17:15