(RICHE HO) Tropicana Corporation Berhad

RicheHo

Publish date: Sun, 21 Feb 2016, 10:17 PM

|

Corporate Name |

: Tropicana Corporation Berhad (“TROP”) |

|

Market |

: Main Market |

|

Sector |

: Property Development |

|

Symbol & Code |

: TROP (5401) |

|

Par value |

: MYR1.00 |

|

Price |

: MYR1.14 |

|

Financial year ended |

: 31th December |

|

No. of shares |

: 1.45billion |

|

Market cap. |

: MYR1.65billion |

|

Website |

: www.tropicanacorp.com.my/ |

Background

- Incorporated in year 1979

- Founded by Tan Sri Danny Tan Chee Sing

- One of the fastest growing property developers with diversified business interest including property and resort development, property investment, manufacturing and investment holding

- Pioneered the concept of resort-themed developments in Malaysia with the introduction of Tropicana Golf & Country Resort

- Listed on the Main Board of Bursa Malaysia in year 1995

Businesses

1. Property & Resort Development

- Core business of TROP

- Over the last 23 years, TROP's assets had increased from MYR0.5b to MYR7.2b.

- Attributable to more than 1,800 acres of quality land bank with an approximate total GDV of over MYR50b

- Core business is the resort operations of Tropicana Golf & Country Resort.

2. Property Investment

- Launched in year 2009, Tropicana City marks Tropicana Corporation’s maiden venture into property investment

- Encompasses Tropicana City Mall, Tropicana City Office Tower and Tropicana City Tropics serviced apartments

- TROP also built and manages the established Damansara Intan e-Business Park, which is located next to this vibrant development.

3. Property Management & Services

- Tropicana Corporation Management Services provides expertise in property management as well as maintenance services for both residential and commercial developments.

- TROP’s property management portfolio includes landed developments in the prestigious Tropicana Golf & Country Resort, Tropicana Indah Homes, Tropicana Danga Bay

- The Group will also manage its future luxurious developments such as Tropicana The Residences at Kuala Lumpur City Centre and Tropicana 218 Macalister at Penang Island.

Property Collection

Financial Review

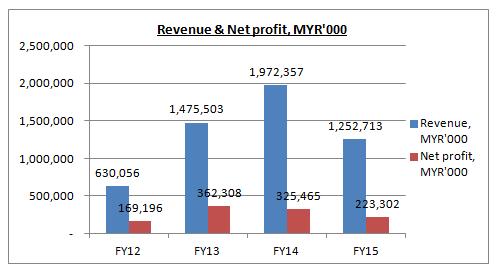

Overall, TROP revenue had been dropped in FY15 due to lower recognitions across key projects and lower gain from land sales in FY15 compared to FY14.

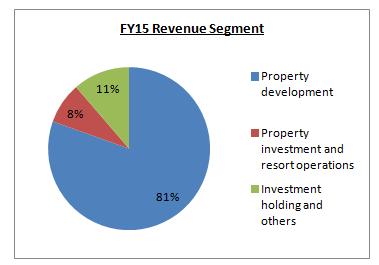

Its main contribution was property development, which contributed 81% of the Group FY15 revenue, followed by investment holding and others 11% and property investment resort operations 8%.

We will mainly focus on its property development segment.

Property development

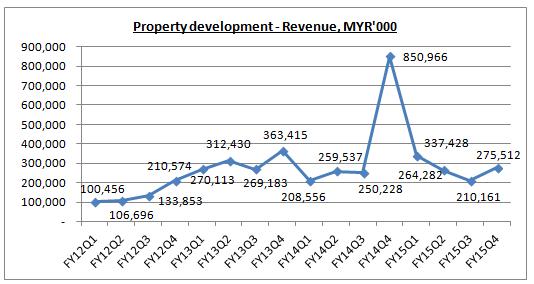

Being the core business for the Group, TROP revenue contributed from property development segment had been quite consistent, averagely around MYR250m. However, its earnings from this segment had dropped in FY15 due to lower profit margin.

FYI, the outstanding high revenue in FY14Q4 was due to land sale in Tropicana Aman, which led to a gain of MYR167.9m.

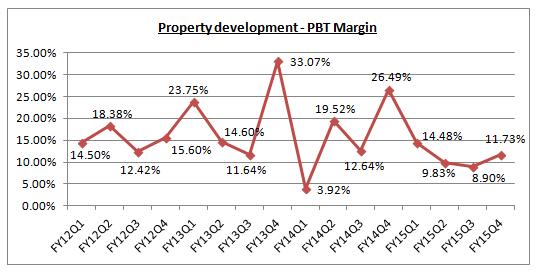

Please refer TROP’s PBT margin as below.

The profit margin of property developer had been impacted obviously after implementation of GST on April 2015. FYI, as residential property is exempted from GST, the increase in input tax cannot be claimed by the property developers or passed on to the house buyers for properties already launched and sold.

Having locked in their future sale value, these developers would have to absorb the rising costs when they commence building activities.

The effect can be seen as TROP’s PBT margin had dropped from double digit to single digit in FY15Q2 and FY15Q3. In the latest quarter, it managed to climb to 11%.

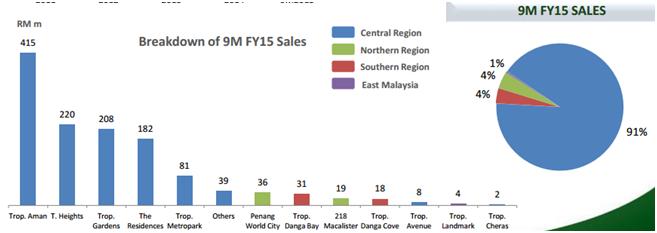

As at FY15Q3, TROP property development revenue is mainly contributed from the central region, which consists of Tropicana Aman, Tropicana Heights and Tropicana Gardens. The central region had contributed up to 91% of the total Group revenue in FY15.

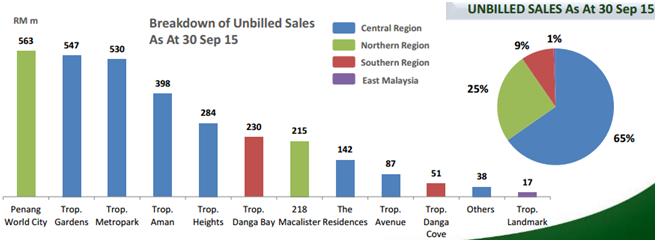

Besides, TROP unbilled sales are mainly from central region too, which up to 65%. Its unbilled sale from Penang World City is the highest MYR563m!

As at FY15Q3, TROP has record unbilled sales of MYR3.1b which places it in a position to deliver sustainable performance in the coming years.

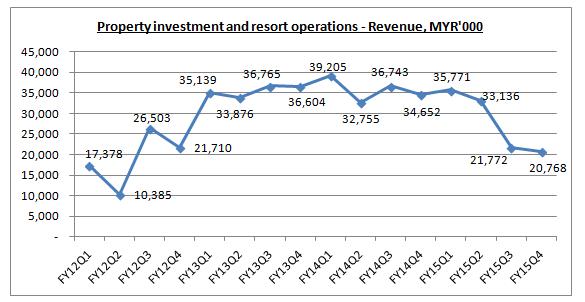

Property investment and resort operations

Financial Strength

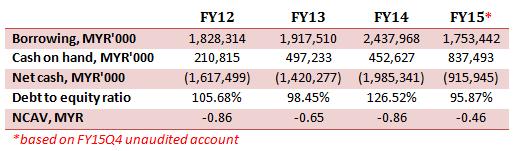

TROP financial strength was quite weak due to its nature of being a property developer. Most if its cash had been invested in properties and property development cost.

Its net borrowing had been reduced by half, from MYR1.99b in FY14 to MYR0.92b in FY15. Besides, its debt to equity ratio had also reduced to below 100%, even though it is still far above investor preference of 50%.

In addition, TROP net current asset value per share had also improved.

Overall, TROP financial strength is weak, but it had been improved compared to past 3 years.

Ratio Analysis

|

Price |

= MYR1.14 |

|

Net tangible assets per share (“NTA”) |

= MYR2.13 |

|

Earnings per share (“EPS”) |

= 15.47 cent |

|

Price earnings ratio (“PE”) |

= 7.37 |

|

Return on equity (“ROE”) |

= 7.25% |

|

Dividend |

= 7.00 cent |

|

Dividend yield (“D/Y”) |

= 6.14% |

|

Net current asset value (“NCAV”) |

= -MYR0.46 |

With its current share price of MYR1.14, TROP had a PE of 7.37, which seems to be undervalued.

However, do note that, TROP latest 4 quarters earnings was included an one off gain in disposals of investment properties and a subsidiary which amounted to MYR161m.

Let’s assume corporate tax of 25% and profit attributable to non-controlling interest around 11%. Profit attributable to owners of the company, from one off gain in disposals, is approximately MYR107.47m. After deduct this amount, TROP net profit attributable to owners of the company is actually MYR115.83M. With its 1.45b outstanding shares, TROP earnings per share are 5.74cent. Its adjusted PE will be 19.86 only.

Other than that, TROP had a ROE of 7.25% which haven’t exclude the one off gain in disposals. It is far below the industry benchmark of 15%!

Having said so, TROP is a very generous company. It had been declared dividend since FY03 and never fail to declare in the past 12 years! Its D/Y is up to 6.14%, which is higher than the current fixed deposit rate. In addition, TROP had also declared shares dividend in FY15. For every 100 ordinary shares, you are entitled with additional 1 share.

Besides, its NTA of MYR2.13 per share indicated that TROP is healthy in term of net asset. It is currently traded 86.84% below its NTA. In term of net asset, TROP had been undervalued.

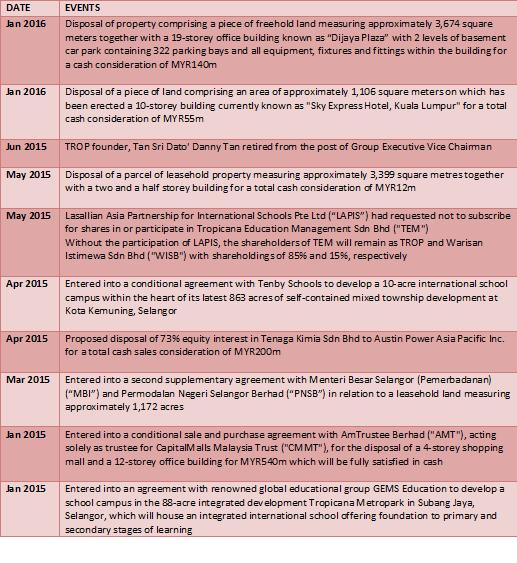

Timeline

Land/Assets Disposal

In Jan 2016, TROP had sold a office building and the 3,674 sq ft freehold land to K & N Kenanga Holdings Berhad's investment banking arm.

The property, in which Tropicana originally invested MYR110.62m, had a net book value of MYR130m as at December 2014.

On the same month, TROP sold an 11,904 sq ft land along Jalan Pudu, comprised a 4½-year-old 10-storey hotel known as Sky Express Hotel.

The property had a net book value of MYR45.09m as at December 2014. TROP had originally invested MYR54m in it in June 2012.

After talks to acquire Tropicana City Mall and Tropicana City Office Tower lapsed more than a year ago, CMMT is revisiting the acquisition of the two properties for MYR540m.

This time, CMMT and TROP had come to an agreement and the deal was completed on July 2015.

FYI, in year 2013, the price tag for the transaction was believed to have ranged between MYR550m and MYR650m but the deal fell through due to disagreement on the sale and purchase terms between CMMT and TROP.

FYI, in April 2013, TROP inked the agreement to buy the 1,172 acres from MBI unit Permodalan Negeri Selangor Bhd (“PNSB”) for MYR1.3b. It estimated that the township could potentially generate a GDV of up to MYR20b when fully completed.

In March 2015, TROP had signed a supplementary agreement with MBI that almost doubled MBI’s entitlement to a sum equivalent to 9% of the GDV from only 5%. There will also be no minimum entitlement and no minimum GDV.

Based on that forecast GDV, the boost in entitlement percentage could add MYR800m in the coffers for MBI over two decades. After deducting the interest waived, it amounts to about MYR550m.

In return for the higher MBI entitlement, interest payable estimated at MYR252m, will be waived in relation to any of the installments.

International School

In February 2015, TROP had entered into an agreement with renowned global educational group GEMS Education to develop a school campus in the 88-acre integrated development Tropicana Metropark in Subang Jaya.

The campus is scheduled to open in September 2017, with an initial intake of 300 students. This will be GEMS’ second international school in Malaysia, with its first in Bandar Tasek Mutiara, in Simpang Ampat near Bukit Mertajam, Penang.

In April 2015, TROP had entered into a conditional agreement with Tenby Schools to develop a 10-acre international school campus within its latest 863 acres of self-contained mixed township development in Kota Kemuning, Selangor.

TROP would undertake to build an international school campus with a built-up area of about 225,000 sq ft that could accommodate up to 1,800 students.

Tenby International School at Tropicana Aman is expected to have its first intake in September 2018. The agreement represents Tenby’s seventh international school campus, with five existing purpose-built campuses and one more scheduled to be launched in the country in year 2016,

This marks TROP’s third venture into the education sector. In August last year, TROP had entered into a strategic partnership with St Joseph International to build a school at the Tropicana Golf & Country Resort, Petaling Jaya.

On May 2015, Lasallian Asia Partnership for International Schools Pte Ltd (“LAPIS”) has decided not to take up an equity stake in a joint venture to build an international school in Selangor.

FYI, in February 2014, TROP entered into a shareholders’ agreement with Singapore-based school manager LAPIS, while Tropicana Education Management Sdn Bhd (“TEM”) signed a shareholders’ agreement with LAPIS and Warisan Istimewa Sdn Bhd (“WISB”) to set up St Joseph’s Institution International (Malaysia) in Sungai Buloh.

However, in May 2015, Lasallian Asia Partnership for International Schools Pte Ltd (“LAPIS”) has decided not to take up an equity stake in a joint venture to build an international school in Selangor, but it would still pay the rent, operate and manage the school.

The shareholders of TEM will remain as TROP and WISB with shareholdings of 85% and 15% respectively.

Technical Chart

TROP had been on a downtrend since beginning of year 2014. Its price had dropped from highest MYR1.65 to lowest MYR0.83 in August 2015, which equivalent to a drop of 50%!

However, since Nov 2015, TROP had been moving side way and no longer drop further down. It had moved out from the huge downtrend. This also indicated a change in trend.

As at 19th February 2016, TROP closed at MYR1.14.

Currently, TROP had climbed up to its strong resistance line of 1.17, after a breakout from its previous resistance line 1.00 with volume.

However, it seems that TROP is not able to breakout from the level of 1.17 in a short time, after its first attempt failed with a shooting star formed below its resistance line. Besides, TROP’s RSI had been in a heavily bought region and it had started to turn down.

I believe sooner there will be a short correction and retracement. If TROP is able to breakout from 1.17, the next resistance line will be 1.26.

Conclusion

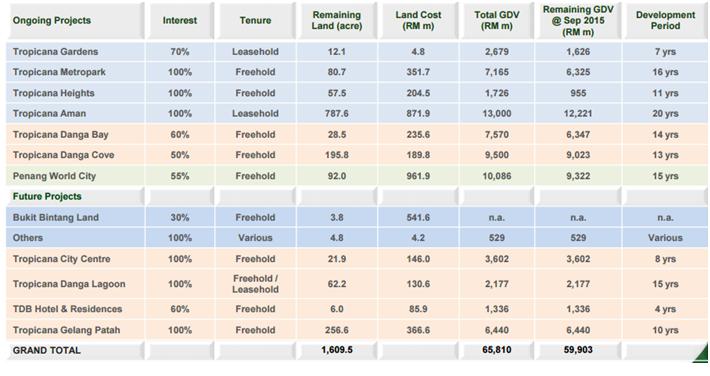

In summary, the below is TROP’s ongoing and future projects.

TROP possesses a sizeable land bank of more than 1,600 acres across Malaysia with future GDV of over MYR50b.

The largest remaining GDV is from Tropicana Aman and it probably will be the main contributor for TROP property development segment in the future.

In term of fundamental, TROP had been disposed many lands to unlock its value and improved its financial strength. After excluded the one-time gain on disposal, TROP is not considered cheap.

However, in term of net asset, TROP is still considered undervalue. Besides, its D/Y is up to 6%, which haven’t taken into account of the shares dividend in FY15.

In term of technical, TROP currently is in an overbought region, which likely to have a correction in short term after touched its resistance level.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

speakup

Danny Tan is Vincent Tan's brother.

2016-02-22 09:23