(RICHE HO) Yee Lee Corporation Berhad - New Red Bull Distributor

RicheHo

Publish date: Fri, 25 Mar 2016, 06:25 PM

YEE LEE CORPORATION BERHAD (“YEELEE”)

Background

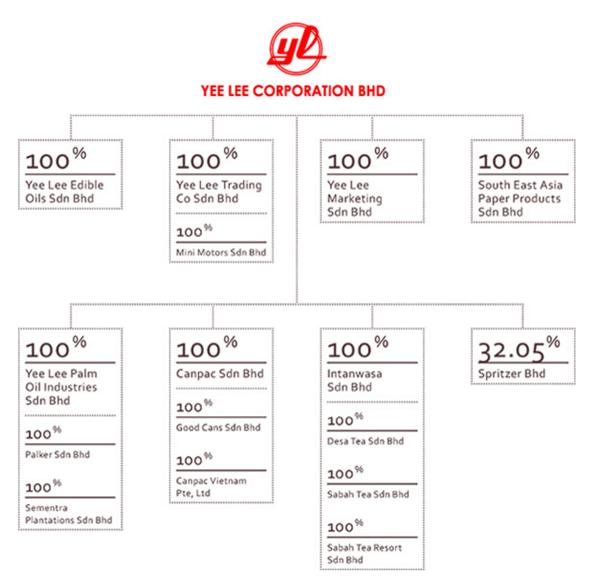

YEELEE was established in Malaysia in year 1968 with its core business as an edible oil repacker. Since then it had grown into a fully integrated manufacturer and distributor.

Currently, YEELEE are involved in various sectors such as manufacturing, marketing and distribution of fast moving consumer products, plantation and eco-tourism.

Core Businesses

1. Manufacturing

- Packaging division – Aerosol can & Corrugated carton boxes

Its corrugated carton boxes division is carried out by its 100%-wholly owned subsidiary, South East Asia Paper Products Sdn Bhd

While its aerosol can division is carried out by its 100%-wholly owned subsidiary, Canpac Sdn Bhd. It is the only company specializes in manufacturing aerosol cans in Malaysia. The aerosol production is more of specialized products manufactured for paints, cosmetic (hair sprays/moose), air fresheners, insecticide, butane gas, car care products and etc.

- Palm oil refinery division

It is carried out by its 100%-wholly owned subsidiary, Yee Lee Edible Oils Sdn Bhd, which involved in refinery of palm oil and in the manufacturing of high quality cooking oils, margarine and shortening.

- Palm oil mill division

It is carried out by its 100%-wholly owned subsidiary, Yee Lee Palm Oil Industries Sdn Bhd, which primarily involved in the crushing of Oil Palm fresh fruit bunches (“FFB”) for Crude Palm Oil (“CPO”) extraction and palm kernel.

2. Trading

This division is carried by its 100%-wholly owned subsidiary, Yee Lee Trading Co. Sdn Bhd. Its principal activity is the marketing and distribution of fast-moving, high quality consumer products.

Its wide range of products include

- ‘Red Bull’ energy drink

- 'Red Eagle' & 'Vesawit' palm-based cooking oil

- 'NeuVida' omega-9 cooking oil

- 'Spritzer' range of beverage

- Oral care products, household products and laundry products.

3. Plantation & Others

YEELEE has oil palm plantation business with estates in Gopeng and in Tapah, Perak. It also involved in the plantation, manufacturing and distribution of tea.

Besides, it involved in tourism activities as well. It had a Sabah Tea Garden, which situated within the single largest tea plantation in Borneo in the highlands of Mount Kinabalu.

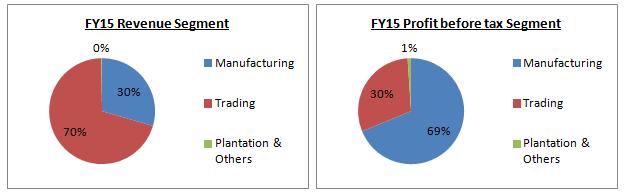

YEELEE FY15 revenue is mainly contributed from trading division 70%, followed by manufacturing division 30%. In term of profit before tax, it goes the other way, whereby its manufacturing division contributed 69% of the Group profit and trading division contributed the remaining 30%.

It means that trading division has a much lower profit margin as compared to manufacturing division.

Basically, its contribution from plantation and others division are insignificant.

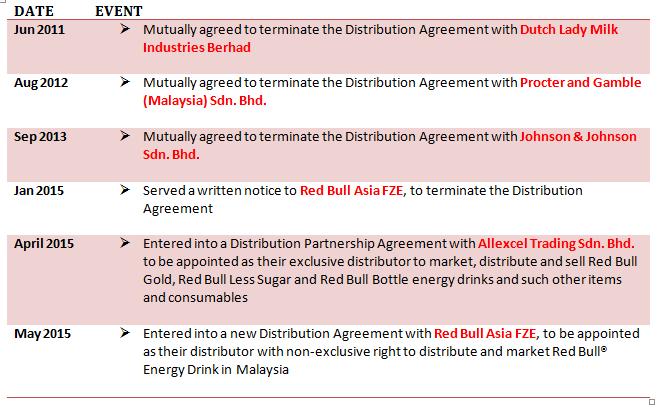

Timeline

Financial Highlights

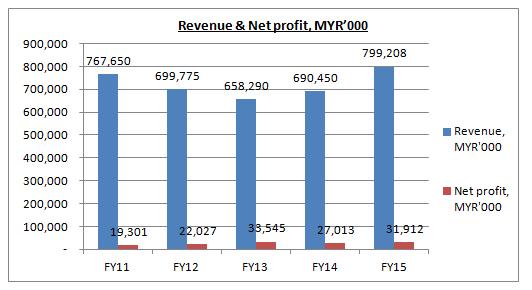

YEELEE financial performance over the past 5 years is considered good.

The drop in revenue from FY11 to FY13 was due to termination of distribution agreement with Dutch Lady in year 2011, Procter and Gamble (Malaysia) in year 2012 and Johnson & Johnson in year 2013. Having said so, YEELEE was still able to improve its profit within the three years.

In FY15, YEELEE financial result had come to a new high. YEELEE is able to deliver more than MYR10m net profit in the latest quarter, which partly contributed from its new distributorship of Red Bull Gold energy drinks.

In term of its manufacturing division, YEELEE achieved higher sales of aerosol can, palm kernel, cooking oils and bulk oils in recent two quarters. Its performance of aerosol can division in Vietnam was very encouraging after settled down at their new factory. FYI, YEELEE had built a factory in the Vietnam Singapore Industry Park in Vietnam in year 2014 to move its aerosol can operation there. The new plant has the same capacity as its previous operation, but it is equipped with more advanced machinery to improve its efficiency.

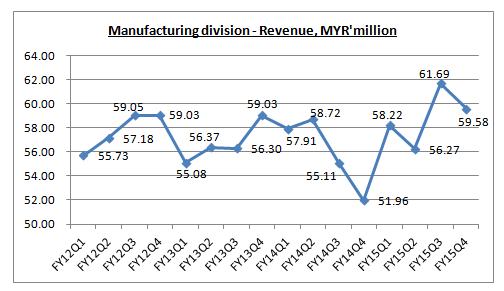

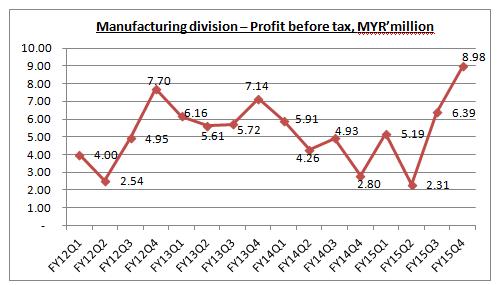

Even though its FY15Q4 revenue from manufacturing division had dropped as compared to FY15Q3, YEELEE was still able to deliver a higher profit before tax. It was mainly due to higher profit margin achieved by palm oil refinery and foreign exchange gain achieved by aerosol can division.

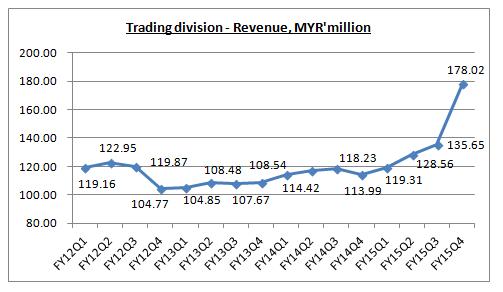

In term of its trading division, the significant improvement in its revenue was contributed from increase in sales cooking oils, Campbell products and the new distributorship of Red Bull Gold energy drinks.

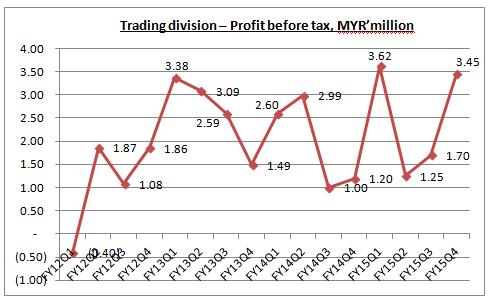

Its high revenue in trading division had resulted in a high profit before tax as well. However, due to higher operating expenses in marketing its new Red Bull distributorship, the profit margin in the latest quarter had dropped.

Overall, in FY15Q4, YEELEE’s manufacturing division had improved by MYR2.5m while trading division had improved by MYR1.7m. So, it can be concluded that its good result is mainly contributed from aerosol can division new factory in Vietnam and not solely contributed from its new Red Bull distributorship.

New Red Bull Distributorship

The five years Distribution Partnership Agreement with Allexcel Trading Sdn Bhd. which signed on April 2015 had allowed YEELEE to exclusively market, distribute and sell the latter’s products, including the well-known Red Bull energy drinks.

Currently, YEELEE had already invested MYR2m to boost its sales and distribution network after securing the exclusive rights to distribute Red Bull energy drinks in Malaysia. It will invest a further MYR5m to MYR10m over the next three years via various marketing initiatives to promote the product.

FYI, Red Bull brand is owned and founded by TC Pharmaceutical Industries Co Ltd, and has a market share of some 55% in the energy drinks segment in Malaysia.

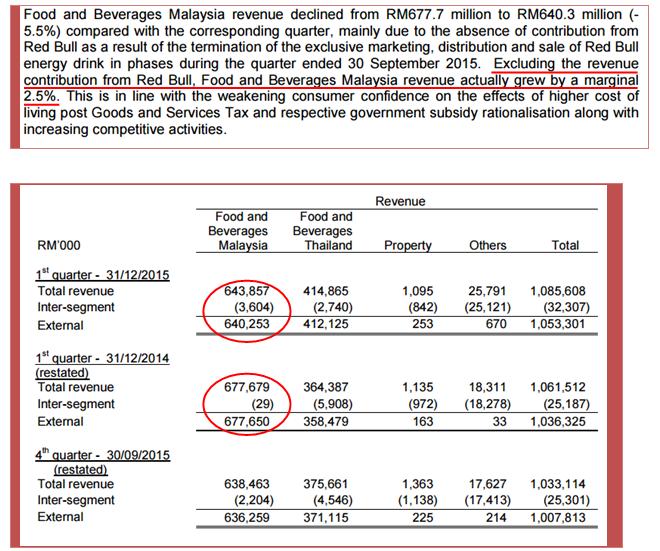

Let’s roughly calculate how much Red Bull can contribute in a single quarter. The below is the explanation which extracted from F&N FY16Q1 quarter report.

Based on F&N statement regarding the marginal growth of 2.5% after excluding contribution from Red Bull, it can be calculated that Red Bull actually had contributed MYR53m revenue on F&N FY15Q4 result.

It seems to be reasonable as YEELEE revenue from trading division had increased by approximately MYR43m in latest quarter.

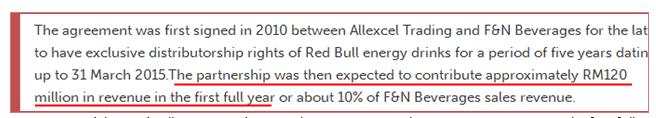

Other than that, I had extracted a short statement regarding expectation contribution of Red Bull to F&N in first full year.

It mentioned that Red Bull is expected to contribute approximately MYR120m in revenue in the first full year, which equivalent to MYR30m a quarter.

So, from all the information above, Red Bull is expected to contribute MYR30-50m revenue per quarter to YEELEE.

Technical

Currently, YEELEE is still moving above its uptrend line. It had formed a symmetry triangle lately and a breakout above this triangle will indicate a bullish signal.

Its volume in recent two days is quite high as well. I anticipate that YEELEE will break out soon.

Conclusion

With its current price of MYR2.16, YEELEE had a PE of 12.61. It is still considered cheap as it has not taken its future earnings into account yet.

Its new Red Bull distributorship had just commenced on Oct 2015 and had contributed for only 1 quarter so far. Besides, its new plant in Vietnam is not onetime contribution as well. It will continuously improve YEELEE efficiency and production.

Let’s assume YEELEE is able to deliver MYR40m in a full financial year. With its 186.42m outstanding shares, its earnings per share will be 21.46 cent. With an estimated PE of 12x, YEELEE is worth MYR2.57 per share.

Just for sharing.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Gainvestor10sai

nais write up on YEELEE~ like it~

2016-03-25 21:49