(RICHE HO) 股息投资法 - 低风险,求稳定

RicheHo

Publish date: Sat, 09 Jul 2016, 06:19 PM

股息投资法 - 低风险,求稳定

每个人的投资模式都不一样。有些人追求高风险高回酬,有些人则追求低风险求稳定。现在的年轻投资者往往都倾向第一种,因为第二种投资法实在太沉闷了,没有激情【EXCITEMENT】。

换个说法,笔者认为追求低风险和稳定收入的投资者都是想要让财富累积”成长”,而追求高风险高回酬的投资者则想从股市里“赚钱“。这两者虽然都是投资于股市,但出发点却不一样,所以效果当然也不一样。

低风险稳定回酬的投资法往往都是选择高股息的公司为投资对象。只要公司每一年持续稳定赚钱和派息,投资者都会继续持有。很多人都低估了这类投资法的威力,因为他们认为靠股息回酬实在太少和太慢了。只要选对公司,一年10-15%的回报绝对不是问题,然而重点是这个方法所冒的风险其实不高,可以说是保守地稳赚的。

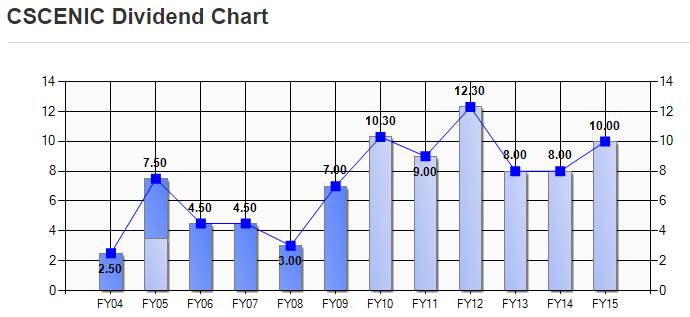

举个例子,假设你在2012年以每股RM1.00买入【CSCENIC】。FY12 – 12.30 cent,FY13 – 8.00 cent,FY14 – 8.00 cent,FY15 – 10 cent

这4年里,你总共已获得每股38.30 cent 的股息。目前,CSCENIC的股价是RM1.37。因此,你的纸上盈利是每股37 cent。总结来说,你的总回酬是75.30%,相等于15.06%的复合年增长率【CAGR】。

这样的投资法胜在够稳定,无需频密交易。15%或许对有些人来说太少了,但是对不能承受太高风险的投资者来说,这样稳定的生钱法的确是很适合,起码比FD高出不少。短期来说,也许看不到成绩,但长期而言,威力是非常强大的。如果几年后【CSCENIC】提高派息至每股15cent,以你RM1.00的买入价,你的股息率将会从目前的10%,提升到15%。或许到时候你将永远都不会卖出【CSCENIC】了。此外,你也可选择把股息再投资于同一支股票。

所谓的财务自由,就是希望有一天无需再工作了,而每个月都有足够的被动收入来维持自己想要的舒适生活。其实,只要你懂得理财以及提早开始,就算你不创业也可以提早达到财务自由。股息投资法虽然是比较慢,但却可以稳定地将你送到目的地。

很多人都会问,到底一个人需要多少钱,才能退休或达到财务自由呢?如果你是单身又没什么负担的,可以考虑把目标设在RM1m。以每年6%的股息回酬,每一年你将得到RM60,000,相等于每个月RM5,000的被动收入。如果你是有家庭,开销也挺大的,可以考虑把目标设在RM3m。以每年6%的股息回酬,每一年你将得到RM180,000,相等于每个月RM15,000的被动收入。当然,这只是供大家参考。

笔者大略筛选了20支目前超过6%股息率的股票,和大家分享。至于值得长期投资吗,则交给你们自己研究。

(以7/8日收市价为准)

1. LIIHEN 8.64%

2. FLBHD 8.57%

3. BJAUTO 7.68%

4. TASEK 7.48%

5. HUAYANG 7.47%

6. YTLE 7.41%

7. CSCENIC 7.30%

8. UCHITEC 7.24%

9. MEDIA 7.19%

10. ECS 7.14%

11. CYL 7.02%

12. MAGNUM 6.96%

13. UOADEV 6.88%

14. STAR 6.79%

15. SHL 6.71%

16. MAYBANK 6.59%

17. CENTURY 6.51%

18. TEXCHEM 6.37%

19. PERSTIM 6.35%

20. TAMBUN 6.29%

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Dividend investing-low risk, stability

Investment patterns are not the same for everyone. Some people pursue high risk and high returns, while others pursue stability at low risk. The younger investors tend to tend to the first, because the second law is too boring without passion "EXCITEMENT".

Change the argument, I believe that the pursuit of low risk and steady income investors want to make wealth accumulation "growth", and to pursue high risk high return for investors from the stock market "to make money". Both of which are invested in the stock market, but the starting point is not the same, so the effect is not the same, of course.

Method of low risk and stable investment returns tend to choose high dividends of companies for investment. Each year as long as the company continues stable profit and dividend, investors will continue to hold. A lot of people are underestimating the power of this kind of investment law, because they believe that dividend returns are too little and too slow. Choosing the right company, rising returns a year is definitely not the problem, but focuses on the risk is not high, can be said to be a conservative make.

For example, if you buy in 2012 at RM1.00 per share "CSCENIC". FY12 – 12.30 cent,FY13 – 8.00 cent,FY14 – 8.00 cent,FY15 – 10 cent

CSCENIC DIVIDEND CHART - XX

These 4 years, you have been getting 38.30 cent per share dividend. At present, the CSCENIC stock is RM1.37. Therefore, your paper profit was 37 cent per share. In summary, your total return is 75.3%, equivalent to a compound annual growth rate of 15.06% "CAGR".

WINS in such investment law is stable enough, without frequent transactions. 15% for some people, perhaps too little, but too high risks for investors unable to bear, so that stable money is indeed very suitable for, at least, a lot higher than the FD. The short term, may fail to see results, but in the long term, it is a very powerful force. If after a few years of "CSCENIC" the dividend per share to 15cent to you the purchase price of RM1.00, your dividend rate will be from the current 10%, the ascent to 15%. Perhaps you will never sell "CSCENIC". In addition, you can also select the reinvested dividends in the same stocks.

The so-called financial freedom in the hope that one day no longer work and have enough passive income every month to maintain the comfortable life they want. In fact, as long as you know how to manage your money and start early, even if you don't venture can in fact achieve financial freedom. Dividend investing is relatively slow, but stable to get you to your destination.

Many people will ask, how much a person needs, to retire or to achieve financial freedom? If you are single and there was no burden, you can consider target in RM1m. An annual dividend of 6% return, each year you will receive RM60,000, equivalent to RM5,000 per month passive income. If you have a home, cost is also quite large, you can consider targets RM3m. An annual dividend of 6% return, each year you will receive RM180,000, equivalent to RM15,000 per month passive income. Of course, this is just for your reference.

Author filter 20 is currently over 6% of Western Ontario dividend yield stocks, and share with you. Do as good long-term investments, to your own research.

(The 7/8 closing price shall prevail)

1. LIIHEN 8.64%

2. FLBHD 8.57%

3. BJAUTO 7.68%

4. TASEK 7.48%

5. HUAYANG 7.47%

6. YTLE 7.41%

7. CSCENIC 7.30%

8. UCHITEC 7.24%

9. MEDIA 7.19%

10. ECS 7.14%

11. CYL 7.02%

12. MAGNUM 6.96%

13. UOADEV 6.88%

14. STAR 6.79%

15. SHL 6.71%

16. MAYBANK 6.59%

17. CENTURY 6.51%

18. TEXCHEM 6.37%

19. PERSTIM 6.35%

20. TAMBUN 6.29%

2016-07-09 21:02

what about FAVCO?

On those list above, we have to be careful on evaluating the Dividend yield based on very recent payouts as it could be only to sustain the price from dipping too low when poor earnings are released due to foreseen temporary unfavorable business prospect in the near future.

2016-07-09 21:17

At the same time, also be aware that some even though can deliver a good dividend last few years, there is no guaranty that it will continue to do so as the market is constantly changing, for example the commodities industry might able to give a good return in the good old day, but not now.

2016-07-09 23:13

Tom...no use commenting or criticizing...

coz u know CP Teh..

has now become even stronger...thick skin like hippo.

he does not need to disable comments like KYY!lol..

2016-07-09 23:17

2. FLBHD 8.57%

will they still distribute the same dividen while earning decrease???

2016-07-10 11:28

股息投资法 - 低风险,求稳定 unfortunately, dividend payout is depend on company performance. Nobody can guarantee company will good every year. So the risk still there. if really want min risk but higher than FD, only reit is the good way to go.

2016-07-10 11:41

One of the thing that you missed out is the FCF generation power and sustainability.

Some company, like previously MAXIS declared 40cent dividend per year, by taking loan.

So we still need to check their FCF, profit sustainability to ensure that the dividend will continue flow back to investors.

2016-07-10 13:10

UCHITEC was the best example for your method. The FCF is superb, the dividend payout ratio is sustainable, and the EPS is sustainable - for currently.

2016-07-10 13:11

Should be all rounded when choosing a stock. Good and sustained dividend payout year in year out of course is good but like someone mentioned here even past years result will not guarantees the same for the next 3-10 years for example.

Then the share price appreciation should be considered at the same time in choosing the stock to supplement the dividend income. Touch wood if the company somehow due to whatever reasons no longer able to perform (likely dividend and share price will start to dwindle) then is time to move on to another stock. The price appreciation and the dividend combined together than should be much better compared to FD or just targeting high dividend alone stock.

2016-07-10 14:00

Lol, even if you are employed you still facing the risk of getting fired. Lol, this is life, bro.

2016-07-10 14:13

there is a difference between losing future potential earnings compared to losing what has already been earned.

Future is still yet to be written ( you can always get a new job - perhaps even better pay)...but you can never rewrite your past damage.

2016-07-10 20:19

probability, I used to recommend GKENT for it's 5 year earning visibility + 50% dividend payout, but at current price, I think the MOS is become thinner already, hence I'm not recommending it anymore.

UOADEV was my case study 3 years ago. Looking back at UOADEV, it shows FCF, EPS is able to sustain. You can try to look into UOADEV.

PERSTIM is mentioned by our Star sifu - kcchongnz.

HUAYANG investor please take note. The previous Busy Weekly reported Huayang had adjusted their minimum dividend payout rate to conserve cash.

MAGNUM and BJTOTO and STAR ... people do like them for dividend, but to me it's sunset industry.

I might be wrong, and any company I mentioned is NOT a recommendation to BUY or SELL. Thank you.

2016-07-10 21:55

I dont mind winning every football match by 1-0. But I hate scoring 3 goals and concede 5 goals at the end.

2016-07-16 10:42

Actually this article from RICHE HO is one of the most beautiful posting I have ever seen....

2016-07-19 20:19

hpcp

What about inflation?

2016-07-09 20:59