(RICHE HO) Mieco Chipboard Berhad - Indication on Current Trend Reversal?

RicheHo

Publish date: Sun, 14 Aug 2016, 02:46 PM

Mieco Chipboard Berhad (“MIECO”)

Background

MIECO was the manufacturing division of the Bandar Raya Developments Berhad Group of Companies, which incorporated in 1972. It was listed on the Main Board of Bursa Malaysia in year 1998. MIECO was principally involved in manufacturing and sales of wood based products, to be precisely, particleboard and chipboard.

MIECO commissioned its first production line in year 1976, making it the pioneer in particleboard manufacturing in Malaysia using rubber wood, or now known as tropical oak wood. Currently, it had 2 factories located in Gebeng and Kuala Lipis. MIECO had relocated its Semambu operations to Gebeng following the sale of the Semambu land and buildings in year 2015.

MIECO’s products were commonly used as core material for home and office furniture, interior decoration applications.

Financial Result

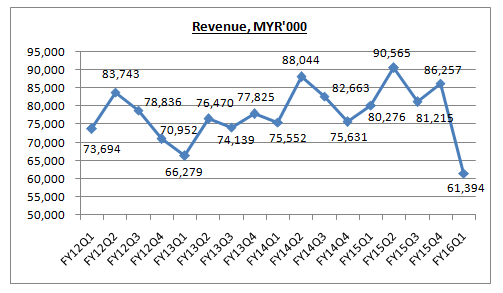

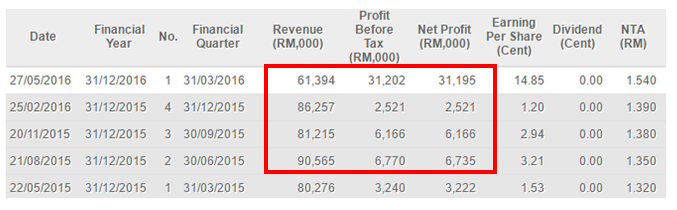

MIECO’s business operation was generally seasonal and was also affected by global economic conditions. Its revenue in second quarter of each financial year was traditionally the highest in each year.

MIECO’s sales were averagely in the range of MYR75m to MYR85m over the past 4 years. However, in FY16Q1, its revenue had dropped tremendously to MYR61m, the lowest since FY12, which dragged down the Group’s financial performance. It was mainly due to lower production output at its Kuala Lipis plant due to a fire that damaged certain machinery. MIECO had submitted an insurance claim for these losses. The amount of losses was not disclosed.

Having said so, its weak performance in FY16Q1 was just temporary and its Kuala Lipis plant was expected to recover in FY16Q2 or FY16Q3. It was just an exceptional weak result.

There was 3 exceptional items which had excluded from its original result:

- Non-cash impairment loss of MYR45.8m on its Lipis Plant in FY13Q4

- Gain of MYR16.1m on disposal of land and buildings in Semambu, Pahang in FY14Q4

- Gain of MYR35.0m on sale of wholly-owned subsidiary, Mieco Wood Products Sdn Bhd in FY16Q1

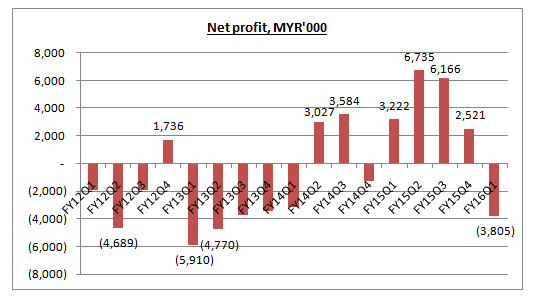

Overall, MIECO had been making losses for several years after year 2008 economic crisis. It had finally made a comeback in FY14 and marked a second consecutive year of profitability for the Group in FY15.

It was not an easy year for MIECO in FY12 and FY13 for the past few years, as it faced intense competitive supply, following by a drop in selling prices of particleboard and related products. MIECO had also shut down its Gebeng plant in FY13 for replacement of major plant components and operational maintenance which led to inefficiency in operation. Besides, MIECO was hit by unrealized foreign exchange currency losses arising from translation of MIECO’s USD term loans and losses on forward sales contracts.

In FY15, particleboard prices had started to recover steadily, driven by increased demand from local furniture exporters, as a result of growing demand and recovery in global export markets. MIECO was benefited from this business condition and it had finally turnaround in second half of FY14.

In FY16Q1, MIECO’s loss making was mainly due to lower production output at its Kuala Lipis plant due to a fire. As mentioned above, it was just temporary.

Foreign Currency Risk

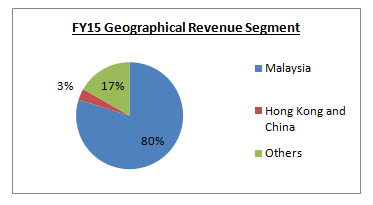

Basically, 80% of MIECO’s revenue in FY15 was contributed from local Malaysia market. It was different as compared to export-oriented company such as HEVEA and EVERGREEN.

MIECO was not heavily impacted or benefited from foreign exchange risk. Besides, in FY15, it did enter into foreign currency forward contracts to hedge its trade receivables. In short, its foreign exchange risk was very limited.

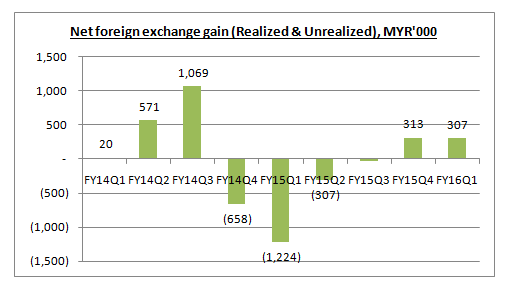

As extracted from MIECO quarter report, the net foreign exchange gain in its latest 4 quarters was insignificant. In other words, its excellent result in FY15Q2 and FY15Q3 were not because of foreign exchange gain!

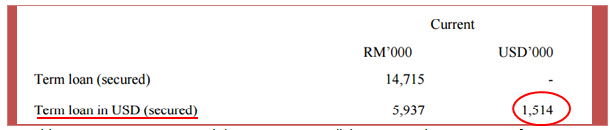

In addition, as at FY16Q1, MIECO’s borrowings were all denominated in MYR except for a USD1.5m term loan. Due to the small amount of USD loan, MIECO was unlikely to have a huge foreign exchange currency losses arising from translation.

Plant Relocation Exercise

In FY15, MIECO had started to relocate its Semambu operations to Gebeng following the sale of the Semambu land and buildings. This relocation will enable MIECO to centralize its production operations, reducing inter-plant transport costs and energy consumption thereby achieving cost savings and greater efficiency.

The first phase of the exercise involving the relocation of Melamine Impregnation Line to Gebeng was completed in Dec 2015. In Jan 2016, the new warehouse building was completed and was now pending the Certificate of Completion and Compliance. The second phase entailing the relocation of Short Cycle Press 2 was expected to be completed in the second quarter of 2016. Upon completion, this relocation will rationalize the operations of the Group and was expected to offer cost and operational efficiencies.

At the same time, MIECO had 2 scheduled shutdowns of the Gebeng plant in FY15 for major repair and maintenance to continue improving and prolonging the performance of the plant that produces higher margin value-added products for the Group.

As a result from these 2 activities, MIECO’s profit margin was expected to improve in the next few quarters onward.

Future Outlook & Growth

In FY15, MIECO had launched 14 new Melamine Faced Chipboard color designs to support its strategy of always offering customers a breadth of product choices and finishes. It streamlined and improved product quality, stepped up marketing domestically and in growing overseas market, while enhancing customer service and the overall customer experience.

As a result of these efforts, domestic demand grew, supported by higher pricing levels, and in turn contributing to overall growth in revenue. Almost all its existing Melamine Faced Chipboard production capacity was taken up by the marketplace, while demand for particleboard exceeded supply.

In FY16, MIECO was developing and planning to launch non-load bearing Melamine Faced Chipboard for use in humid conditions. It was also working on developing 2 new types of surfaces and designs which were the latest in western markets and hope to roll these out to the domestic market by end of this year.

It was considered a new product with new features.

Mandatory General Offer

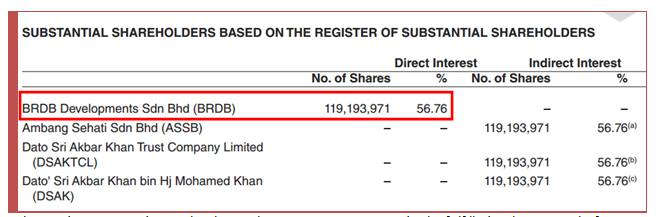

In Jun 2016, SYF Resources Berhad executive chairman and CEO Datuk Seri Ng Ah Chai was expected to launch a mandatory general offer (“MGO”) for the remaining shares he does not own in MIECO following the signing of a conditional agreement to acquire a 56.76% stake in MIECO for MYR107.27m.

Datuk Ng was buying BRDB Developments Sdn Berhad’s entire holding of 119.19m shares in MIECO for MYR0.90 each in cash. SYF Resources was principally involved in manufacturing of furniture and property development. As to date, Datuk Ng owned 51.51% equity stake in SYF Resources.

The conditions precedent in the share sale agreement is expected to be fulfilled within 3 months from the date of the agreement.

Datuk Ng informed that upon the agreement becoming unconditional, he will undertake the MGO obligation and the MGO will be fully satisfied by way of cash at an offer price of MYR0.90 per MIECO share.

MIECO’s current shares price and NTA are MYR0.955 and MYR1.54 respectively, which higher than Datuk Ng’s offer price MYR0.90. It definitely will not be easy.

MIECO was a chipboard manufacturer while SYF was a furniture manufacturer. I believe Datuk Ng had spotted something good in MIECO and wanted to create synergies between SYF and MIECO.

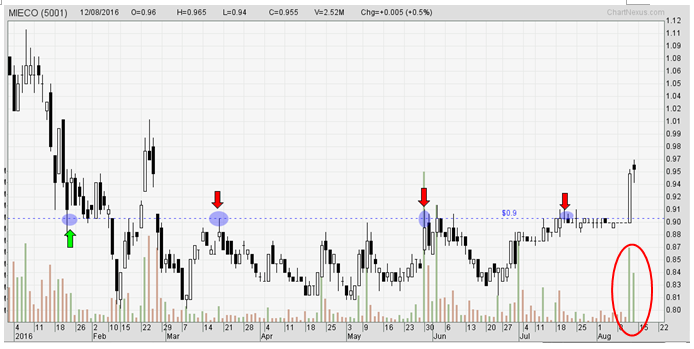

Technical Chart

As at 12th Aug 2016, MIECO closed at MYR0.955.

Technically, MIECO had breakout from its resistance level 0.90, supported by a huge volume. It indicated that MIECO’s consolidation period had come to an end. Currently, MIECO was very bullish and it was very likely to test MYR1.00 in near term.

As extracted from MIECO’s shares transaction history in 11th Aug 2016, there were some big players started to accumulate MIECO around MYR0.95. The transaction value (circle in red) was up to MYR0.55m.

Do note that, MIECO will be releasing its FY16Q2 in this month. So, it might be a hint that MIECO’s FY16Q2 result will be good and some insiders had started to buy in.

Valuation

MIECO’s net profit margin in FY15Q2 and FY15Q3 were 7.50%, the highest since FY08.

Upon completion of relocation of its Semambu plant to Gebeng plant in FY16, MIECO’s production operations will be centralized. As a result, its cost and operational efficiencies are expected to improve.

Besides, its Kuala Lipis plant will be recover soon too from fire incident in the next 1 to 2 quarters. So, its production probably will back to its previous level soon.

Let’s assume MIECO will be able to deliver MYR340m in a full financial year. With an estimated net profit margin of 6%, MIECO’s net profit will be MYR20.4m, which equivalent to earnings per share of 9.71 cent. Based on an estimated PE of 10-12x, MIECO’s intrinsic value is in the range of MYR0.97 to MYR1.17.

Conclusion

The past decade had been a challenging one for wood-based manufacturing industries, which have been plagued by overcapacity and the consequent high production somewhere around 2008. However, the bad time had over, coupled with the recovery in the US economy and growing demand from Indonesia and India, led to selling prices of chipboard increasing marginally in year 2014, 2015 and more steadily in early 2016.

MIECO’s products were commonly used as core material for home and office furniture. As a reference, we can have a look in furniture’s company such as LIIHEN and HOMERIZ. Their latest financial result was still growing.

Besides, another good indicator is to look into its peer, such as HEVEA and EVERGREEN. Both companies were still delivering good result.

So, I strongly believe the assumption above (revenue – MYR340m, net profit margin – 6%) was reasonable.

Based on its current price of MYR0.955, MIECO will have a potential upside of 10-20%. Technically, MIECO was very bullish now. It was very likely to test MYR1.00 in short term and look forward for a breakout.

Just for sharing!

richeho_92@hotmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

It was once recommended by icapital 10++ years ago but it never delivered as expected since then

2016-08-14 18:26

Even though it might be a lousy stock, i believe it still have earnings opportunity

2016-08-15 08:58

Bruce88

This is a lousy stock !

2016-08-14 18:11