(RICHE HO) Malayan Flour Mills Berhad - Good Day Ahead? (2)

RicheHo

Publish date: Sat, 01 Oct 2016, 01:57 PM

For those who don’t understand MFLOUR, may refer to my earlier post dated 25th July, as the link below:

http://klse.i3investor.com/blogs/rhinvest/100671.jsp

MFLOUR is the pioneer wheat flour milling company in Malaysia. Its business segments can be divided into two:

- Flour and trading in grains and other allied products

- Poultry integration

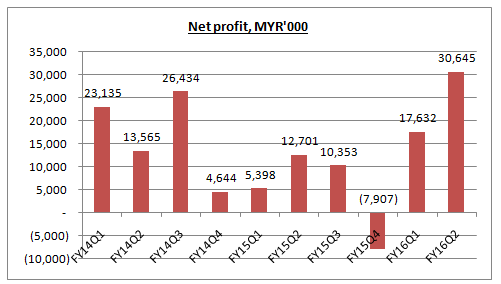

In Aug 2016, MFLOUR had delivered an excellent FY16Q2 result. Its net profit had surged by 141% and 74% respectively, as compared to YoY and QoQ. At the same time, it was the highest since establishment of MFLOUR.

A summary & review on MFLOUR’s FY16Q2 result was done.

MFLOUR’s excellent result was mainly attributable to higher sales recorded in flour and trading in grains and other allied products segment, coupled with lower share of loss of equity accounted joint venture.

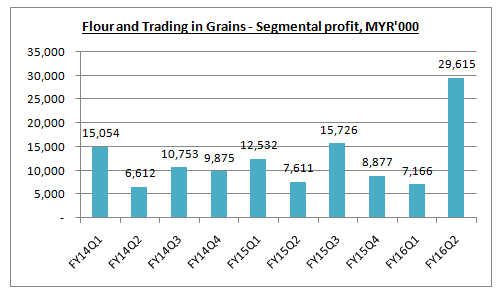

In the first two quarters of FY16, flour and trading segment contributed 70% of the Group’s revenue while poultry integration segment contributed the remaining 30%.

In term of net profit, flour and trading segment and poultry integration segment accounted 59% and 41% respectively.

MFLOUR’s segmental profit in flour and trading segment had increased significantly in FY16Q2, mainly due to higher sales volume and better margin which contributed by unrealized gain on foreign exchange. It was an improvement of 289% as compared to FY15Q2!

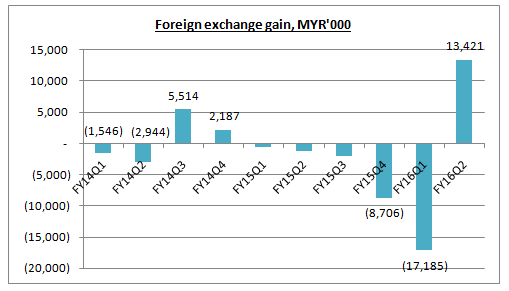

As extracted from its quarter report, MFLOUR had accounted foreign exchange gain of MYR13.4m as compared to huge foreign exchange loss in FY15Q4 and FY16Q. The foreign exchange loss had hit MFLOUR severely previously.

MFLOUR are exposed to foreign currency risk on sales, purchases and borrowings that are denominated in foreign currency, primarily USD.

If we exclude all the foreign exchange gain/loss in recent three quarters, MFLOUR’s segmental profit from flour and trading segment will be the following:

- FY15Q4 – MYR17.6m

- FY16Q1 – MYR24.3m

- FY16Q2 – MYR 16.2m

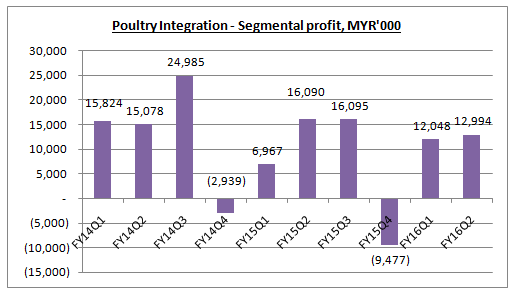

As for MFLOUR’s poultry integration, the performance was relatively stable and consistent as compared to flour and trading segment.

However, its FY16Q2 result was mainly contributed by one-time off non-operating income, insurance recoveries MYR5.6m and net fair value gain on biological assets MYR5.4m.

Currently, there is no excitement in MFLOUR’s poultry segment. However, in the long run, MFLOUR is in a well-positioned to benefit from the synergies derived from an integrated poultry business and the Group is working on further expansion in this segment.

As part of the expansion, in FY15 MFLOUR had increased stake in its subsidiaries, Dindings Poultry Processing and Dindings Soya & Multifeeds.

Other than that, MFLOUR owned 30% equity stake in PT Bungasari Flour Mills Indonesia, an Indonesia flour milling company.

Bungasari Flour Mills involved in the business of flour milling and distribution of flour products and by-products.

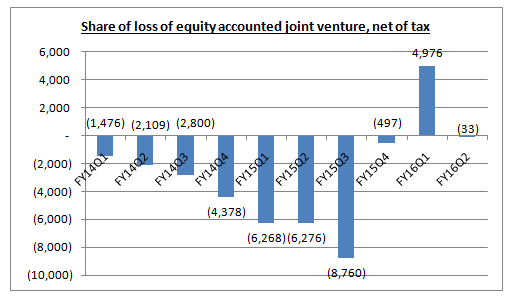

As in FY16Q2, MFLOUR recorded share of loss amounting to MYR0.03m. Even though it was not able to contribute positively to the Group, at least this associate company no longer is a burden for MFLOUR.

Bungsari Flour Mills was in the red in FY15 due to lack of economies of scale in its operations and intense price war.

MFLOUR expects to see sustainable profit growth for the remaining quarters in FY16 from its joint-venture business in Indonesia.

Besides, in FY16Q2 had declared a first interim dividend of 3 cent per share, 1 cent higher as compared to FY15Q2. It was a good sign.

Despite the uncertain global economic environment, volatile commodity prices and foreign exchange rates, the Board expects MFLOUR’s performance in 2016 to remain positive.

Currently, MFLOUR’s earnings per share in FY16Q1 and FY16Q2 are 3.20 cent and 5.57 cent respectively. Let’s assume it will be able to deliver the same result in the second half of FY16. Its annualized earnings per share will be 17.54 cent.

With an estimated PE of 10, MFLOUR will have an intrinsic value of MYR1.75 per share.

Technical wise, MFLOUR’s uptrend momentum was still very intact.

It had formed a flag pole position with support at 1.49.

Perhaps, soon it will continue another wave of uptrend after its consolidation/correction period.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Ya, strip off all the forex gain or loss, the core profit is improving, lead by the improvement with indonesian sub Bungasari.

2016-10-03 11:48

the wheat price had drop to 10 year lowest. during july and august the wheat price had drop 14.7% and 4.28 respectively. During july to september is a festive period we had hari raya haji and mooncake festival which i think will boost up the sales of mflour!!!

2016-10-07 10:12

May I know what is the fair value? what is the driving force for better profit ?

2016-10-20 18:48

nickychang

macam ok woh

2016-10-02 13:27