(RICHE HO) Ireka Corporation Berhad - Business Turn Around

RicheHo

Publish date: Fri, 21 Oct 2016, 03:30 PM

Ireka Corporation Berhad (“IREKA”)

IREKA was founded in year 1967 by Datuk Lai Siew Wah. It was listed on Ace Market of Bursa Securities on Jul 1993, and subsequently transferred to Main Market on June 2002.

As to date, IREKA’s current activities can be divided into 3 core businesses, as below.

- Construction (90%)

- Property Development (10%)

- Technology - provides IT consultancy, hardware fulfillment as well as data centre service (<1%)

Within its real estate business, aside from direct property development activities, IREKA also initiated the listing of a property company, Aseana Properties Limited (“ASEANA”), on the London Stock Exchange on Apr 2007. IREKA owned 23% equity stake in ASEANA. This paved the way for IREKA to undertake property development activities not just in Malaysia, but also in Vietnam.

Divestment of ASEANA – IREKA entitled capital distribution of USD23m!

ASEANA was set up as a property investment fund with the objective to invest in property projects in Malaysia and Vietnam.

In this property investment fund, there is an investment timeline and upon maturing, the Group will realize the investment and the gains distributed to its shareholders. Everything in ASEANA’s portfolio is to be divested at the right price, at the right time in a controlled, orderly and timely manner.

As ASEANA started to dispose and realize its assets and investment, ASEANA will return capital to its shareholders.

As at Apr 2015, ASEANA’s revalued net assets value was almost USD264m. With IREKA owning 23% of that, the value was USD61m for its investment in ASEANA. The management looked forward, over time, to have this USD61m or more value come back to the Group.

The disposal of the assets will be done over the next three years.

ASEANA will eventually dispose of all the assets in its portfolio, which included

- SENI Mont' Kiara

- 1 Mont' Kiara offices and retail mall

- Sandakan Harbour Square

- Aloft Kuala Lumpur Sentral hotel

- RuMa Hotel and Residences in KLCC

In Apr 2016, ASEANA disposed of the Aloft Kuala Lumpur Sentral Hotel to Prosper Group Holdings Limited for MYR418.7m. The transaction was completed on Jun 2016.

ASEANA recorded a gain of about USD118.7m upon completion of sales. The hotel cost ASEANA about MYR300m to develop.

Following the disposal, ASEANA will do a capital distribution of about USD10m to shareholders. Besides capital distribution, proceeds from the sale will be used to repay the medium-term notes issued for the Aloft Hotel and to partly repay the medium term notes issued for the Harbour Mall Sandakan and Four Points Sheraton Sandakan Hotel.

Its first intended capital distribution was still in the pipeline. Even though consents from certain lenders remain outstanding due to the unfavorable market condition in Malaysia, the capital distribution of USD10m is just the matter of time.

During year 2016, ASEANA had also divested its 55% stake in ASPL PLB-Nam Long Ltd Liability Co, the developer of the Waterside Estates residential project in Vietnam, for a cash consideration of USD8.2m.

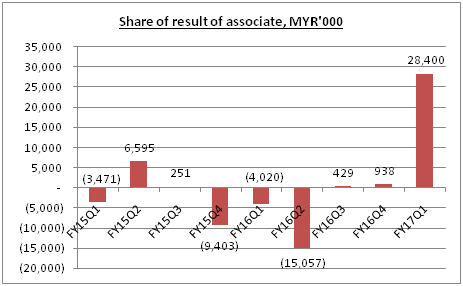

After the disposal of Aloft Kuala Lumpur Sentral Hotel, it contributed MYR28.4m to IREKA in FY17Q1.

Overall, ASEANA was not doing well in FY15 and FY16. It had incurred losses 2 years consecutively, which mainly attributed to operating losses and financing costs of City International Hospital, Harbour Mall Sandakan and Four Points by Sheraton Sandakan Hotel.

In addition, ASEANA had an impairment loss relating to Four Points by Sheraton Sandakan Hotel.

Looking forward, IREKA will be waiting for its first capital distribution from ASEANA.

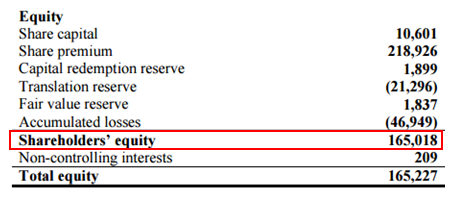

As extracted from ASEANA’s interim report 2016, ASEANA had USD165.02m shareholders’ fund as at Jun 2016.

Based on IREKA’s 23% equity stake in ASENA, once ASEANA fully divest, IREKA will get back capital distribution of USD38m (MYR158m), which equivalent to USD0.22 (MYR0.92) per share!

Property Development - ASTA Enterprise Industrial Park launched in FY17Q2!

Even though IREKA was involved in property development, it did not launch anything in the last 1.5 years. However, the time was right now.

In Aug 2016, IREKA expected to turn around its business, moving forward, following the launch of several projects with a gross development value of more than MYR1b.

IREKA had been focusing on its Rimbun Kasia project in Nilai over the past few years. This was IREKA’s first project in Nilai and overall, there will be five phases of development, which will keep the group busy for the next five years.

FYI, IREKA had completed and handed over the first phase development, Kasia Greens project in Jun 2015. Currently, it was focusing on developing the second of Nilai land development, which consists of 6 parcels of lands measuring 30.6 acres which will be developed into courtyard apartments, condominiums, town villas and commercial centre.

The project, dwi@Rimbun Kasia, consists of a 9-storey, 328 units apartment block with sizes ranging from 650 square feet to 980 square feet in line with the demand for such accommodation in the surrounding education hub in Nilai. The project was expected to retail between MYR200k and MYR400k per unit.

Besides, in Sep 2016, IREKA had launched the phase 1 of its maiden freehold ASTA Enterprise Industrial Park with 18 units in Kajang. At a preview three months ago, 45% of units were already sold.

FYI, the whole ASTA Enterprise Industrial Park consists of 57 units semi-detached & detached multi-functional industrial unit.

This freehold development is located at a thriving neighbourhood south of Kuala Lumpur and consists of semi-detached and detached light industrial factories in a guarded environment.

Overall, IREKA were looking forward to its foray into the mid-market property sector in Nilai and Kajang.

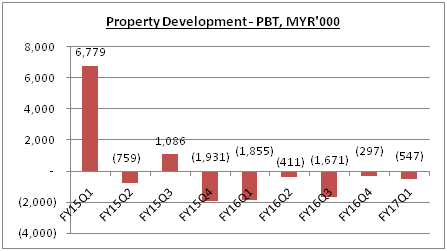

On the whole, IREKA’s profit contribution from property development segment had been severely impacted by the delay in launching of a few projects in FY15 and FY16, due to the unfavorable market conditions.

IREKA had not been launching any project in the last 1.5 years. As such, it made losses in FY16. However, the losses were insignificant.

With the launching of ASTA Enterprise Industrial Park in Sep 2016, IREKA’s FY17Q2 result will take this contribution into account.

Construction - Significant portion of outstanding work will be performed in FY17!

As at Jun 2016, IREKA’s order book stood at about MYR960m, of which about MYR450m remained outstanding.

IREKA had tender for about MYR4b worth of contracts over the past 1.5 years.

IREKA also expected construction works worth MYR700m to be generated internally from its property development division over the next few months, such as Phase 1 of ASTA Enterprise Park Kajang and the RuMa Hotel and Residences.

Looking forward, IREKA is planning to bid for projects in the public and private sectors. For the public sector, infrastructure projects implemented by the Government such as MRT and LRT 3, while in the private sector, IREKA will still be looking at high-rise building projects from developers like UEM Land and SP Setia.

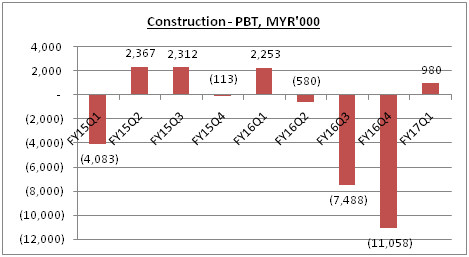

IREKA’s construction segment incurred significant losses in FY16Q3 and FY16Q4.

Its lower revenue in FY15 had adversely affected the margin due to certain fixed costs, in particularly salaries and wages, not being reduced proportionately to the drop in revenue and order book.

In addition, no new contracts were secured by IREKA in FY16 as the Group was anticipating the commencement of a number of planned internal projects over the next 18 months, with a construction value of MYR700m.

Having said so, according to IREKA’s FY17Q1 quarter report, a significant portion of outstanding work will be performed in the current financial year which will improve the result of the construction segment.

As such, IREKA’s financial performance in FY17 is expected to be good.

Potential Privatization

In Jan 2014, the majority shareholder and managing director of IREKA, Datuk Lai Siew Wah, failed in his attempt to take IREKA private after the resolution was voted against in a landslide victory for minority shareholders yesterday.

Datuk Lai, together with parties acting in concert who collectively hold a 64.7% stake in Ireka, had in Jun 2013 offered to take the company private via a proposed selective capital reduction and repayment exercise.

![]()

However, in EGM, more than 73% of minority shareholders voted against the majority shareholders' offer, as the offer price of RM0.90 by Datuk Lai was lower than its fair value of RM1.20. Besides, as at Feb 2014, IREKA’s NTA per share was RM1.45.

Do note that, IREKA’s shares had jumped to as high as RM1.20 from the RM0.68 level at the time the proposed selective capital reduction announcement.

So far, it had been 2.5 years since the proposed selective capital reduction rejected by minority shareholders.

Is that possible Datuk Lai makes a second attempt to take IREKA private? If he does, the offer price should not be too far from IREKA’s NTA, RM0.98. I strongly believe Datuk Lai saw the value in IREKA; else it will not attempt to privatize a loss making company previously.

Based on current share price 0.68, it will be a potential upside of around 40%.

Technical Chart

As at 18th Oct 2016, IREKA closed at MYR0.68.

Recently, IREKA had breakout from its major trend line, supported by huge volume, which indicated a change in trend. In other words, IREKA had found its bottom around MYR0.50 and it had strongly rebounded from that level.

Technically, IREKA was very bullish. It was looking forward to test its resistance level MYR0.69 in short term.

Conclusion

According to IREKA’s group managing director, he hoped to balance out construction segment and property development segment to 50:50 ratio by next year.

Over the last 1.5 years, IREKA had not launched any project, which caused a small setback to it. However, in FY17Q1, IREKA will start to factor in the sales of dwi@Rimbun Kasia.

Besides, a significant portion of outstanding work will be performed in FY17 which will improve the result of the construction segment.

It is also expected that IREKA will continue to benefit from the profit and cash realization from ASEANA as the company successfully divest its portfolio of assets over the next 2 years.

Based on the factor above, IREKA is very likely to turn profitable in FY17.

Technically, it is very bullish as well. Perhaps, it is a good timing to collect?

Just for sharing!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

香川律

hopefully i can get a piece of the cake

2016-10-21 17:48