Losing Confident in Your Investment? Solved

roundnsurge

Publish date: Fri, 15 Apr 2022, 07:37 PM

Have you ever felt that the more you trade, the more you feel lost? It seems like you get it at first, then the number of losses incurred later and start to question, why your strategy is not working anymore?

Until a point, you feel like giving up on investing in the stock market. Seems like all the strategy or analysis you’ve learned is not helping you to achieve your initial goal of making profits in the stock market as a secondary income.

If this is what you feel right now, don’t give up yet. Because we have something to show you that is more reliable than the analysis that you have learned before this. Once you know about this, you will know when & which stocks will be marked up by the big boys and the traditional analysis that is commonly used in the stock market is not capable of doing it.

The #1 lesson to follow the big boys: never use our ears to choose stocks

Every investor knows the stock market is the big boys' game. Many investors hope that the big boys will tell them which stocks they are operating & they could follow them in. However, the big boys will not share this information with anyone, especially during the accumulation stage. It is because the big boys are trying to acquire a significant amount of shares at the low & sell them on the way up.

If the information is leaked, everyone will be going in & taking profit at the same time as the big boys. Which will reduce the profit they could’ve made. Therefore, we will not get this information & if we get it, it is usually the time they want us to know. So that they can make a profit by selling the shares to us. Rumours or news in the financial market is there because they want us to be aware of it.

If you have heard or tried entering into a stock based on these rumours or so-called “insider news”, usually the stock price will be trading at the high side or being thrown down from the high side. Or is always before the news & listing new shares, you’ll never get to make a profit from it, because the price will jack up in the morning when the news is published & thrown back down closing lower than the opening price of the day the news is published. Entering before new listed shares will not help you to make more profit, because listing new shares doesn’t indicate the price will move higher. Often your funds will be trapped in those stocks for a very long time before they move higher, it can be 1 - 2 years.

CASE STUDY:

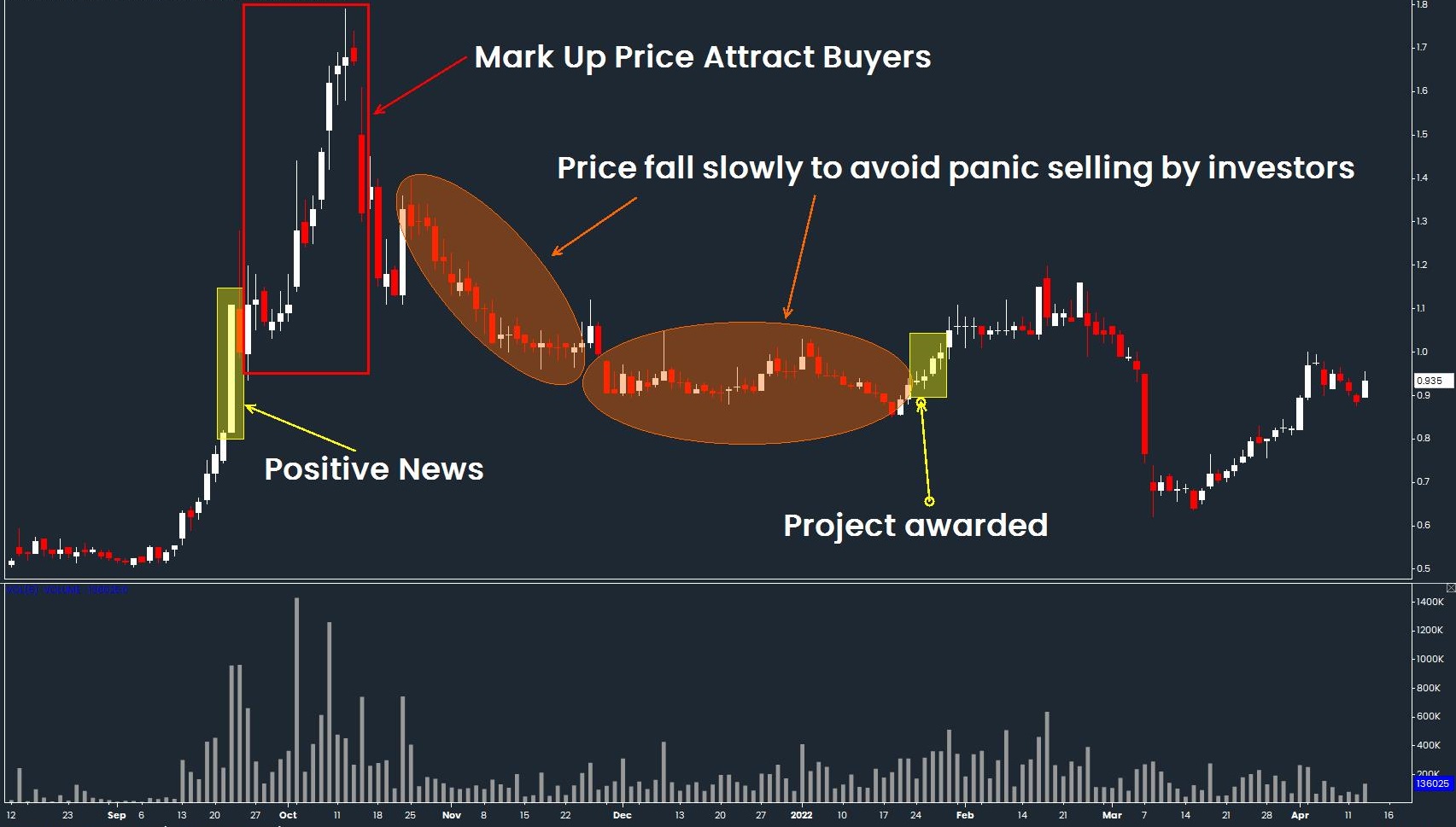

*Positive News Released* Prices moved higher before the news was published. Prices continue to move higher, but retail investors will not enter after the news, because they will think that is too high & rather wait for the price to retrace to their own calculated “intrinsic value”. That’s where the big boys sell the shares to retail investors who park their price at a lower buy order. The big boys will carefully sell their shares & make sure the price doesn't go down too much each day to avoid creating panic among the retail investors.

*Get projects to boost the company revenue* Even with the good news released, the share price moving up gradually at first & falls lower. This is one of the reasons why retail investors always get trapped at the high price & difficult to make consistent profit in the stock market.

Lesson #2 to follow the big boys: Transacted price & volume don’t lie

The only thing we can trust in the financial market is our own analysis & understanding of the transacted price & volume. Imagine, you are monitoring a stock’s transaction data & found the transacted volume increases when the price reaches a low. Then, when you look further into the transaction type at the high-volume price, it shows the buy transaction increases to the same level as the sell transaction. The stock’s price starts to move sideways after it reaches the low and whenever there is selling pressure pressing the price down, there will be demand supporting the price at the same level.

When we spend a little bit more time looking into these transactions in detail, we will know whether the stock price is going to bottom in the short term. Then we can monitor the transaction data again for the entry timing!

All these transaction data are available to everyone on our trading platforms! But most of us don’t know how to make good use of this free data to our own advantage. In fact, this data is able to inform us much faster & more reliably than the news or traditional analysis.

It is difficult to put the transaction analysis in words, join our upcoming FB/YouTube livestream on Sunday, 17th April at 8:30pm to find out more about our analysis on the big boys' transaction.

Follow the link below to register:

Facebook: https://fb.me/e/1ORWGgbn2

YouTube:

https://youtu.be/hLEqgRZ5A-w

Give us a LIKE to support our contribution if you find this blog helpful to you. Thank you!

To find out more about our Operator Analysis Pro-Trader Course, visit this link : https://bit.ly/3NVMHfS

Website : www.roundnsurge.com

Facebook: www.facebook.com/roundnsurgeofficial

Youtube: www.youtube.com/c/RoundSurgeoperatoranalysis

Instagram: @roundnsurge

Kelvin's Instagram: @kelvinnny810

Malaysia stock market is a unique market, hence it requires a customized trading approach to tackle & swerve. Many existing traders in Malaysia apply a plug-and-play strategy from the overseas stock market, but it is not necessarily the best strategy to trade in KLSE. This is due to the difference in local and overseas stock market regulation and the size of market participants of institutional funds & retail investors.

“True traders react to the market.” is the backbone of our trading method. Our findings and strategies are developed through years of trading experience and observance of the operating style in Malaysia’s stock market.

Trading Account Opening

They are offering an IntraDay trade brokerage rate at 0.05% or RM8 whichever is higher for day trading stocks RM 50,000 & above-transacted volume (buy sell the same stocks on the same day). Buy & hold at 0.08%or RM8 whichever is higher.

Open a cash account now at the link below :

https://registration.mplusonline.com/#/?drCode=R311

As Kelvin’s trading client, you will be exclusively invited to join Kelvin’s weekly webinar and telegram group. Click here to join.

For more inquiry contact him by email: kelvinyap.remisier@gmail.com or 019-5567829

If we have missed out on any important information, feel free to let us know and feel free to share this information out but it will be much appreciated if you can put us as the reference for our effort and respect, thank you in advance!

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for your own trading decision. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.