Is it time to look for long term opportunity?

roundnsurge

Publish date: Thu, 03 Nov 2022, 03:53 PM

There are many stocks going through a rebound in the past few weeks. But many of us still worry about the uncertainty in the market such as the election & other external macro factors.

We will look into the overall KLSE to understand better about the market condition. Our view is not limited to KLCI or other indices only, because there are some stocks that are not listed in KLCI components that might show signs of rebound too.

What to look forward to in the pre-election market?

Up to date, we see KLSE is not affected in a bad way after the election is announced. It is more towards a choppy market having some stocks up & down.

But there are a few stocks showing signs of markup after accumulation & some sectors are showing a rebound with high volume. This shows the market isn’t that bad to us, where big boys are back to the market for accumulation & high volume rebound with short term price up.

Like in the previous election, you will see some stocks skyrocket before the election.

We believe there will be stocks with trading opportunities despite everyone saying the market is quiet or negative based on the KLCI price movements. But before we identify which stocks have a trading opportunity, we will need to find out the short term trend in the market to make sure we don’t enter at the high side or catch the falling knife.

Short term stock price movement

After the market rebound in the past 2-3 weeks, we find most of the stocks (small caps & big caps) starting to peak in the past few trading days. This is a bit unusual in the stock market, because if there is a sideways market trend, between the stocks, the price direction usually moves separately. Example, when big caps go up, small caps go down or vice versa (not always the case, but atleast from our observation.).

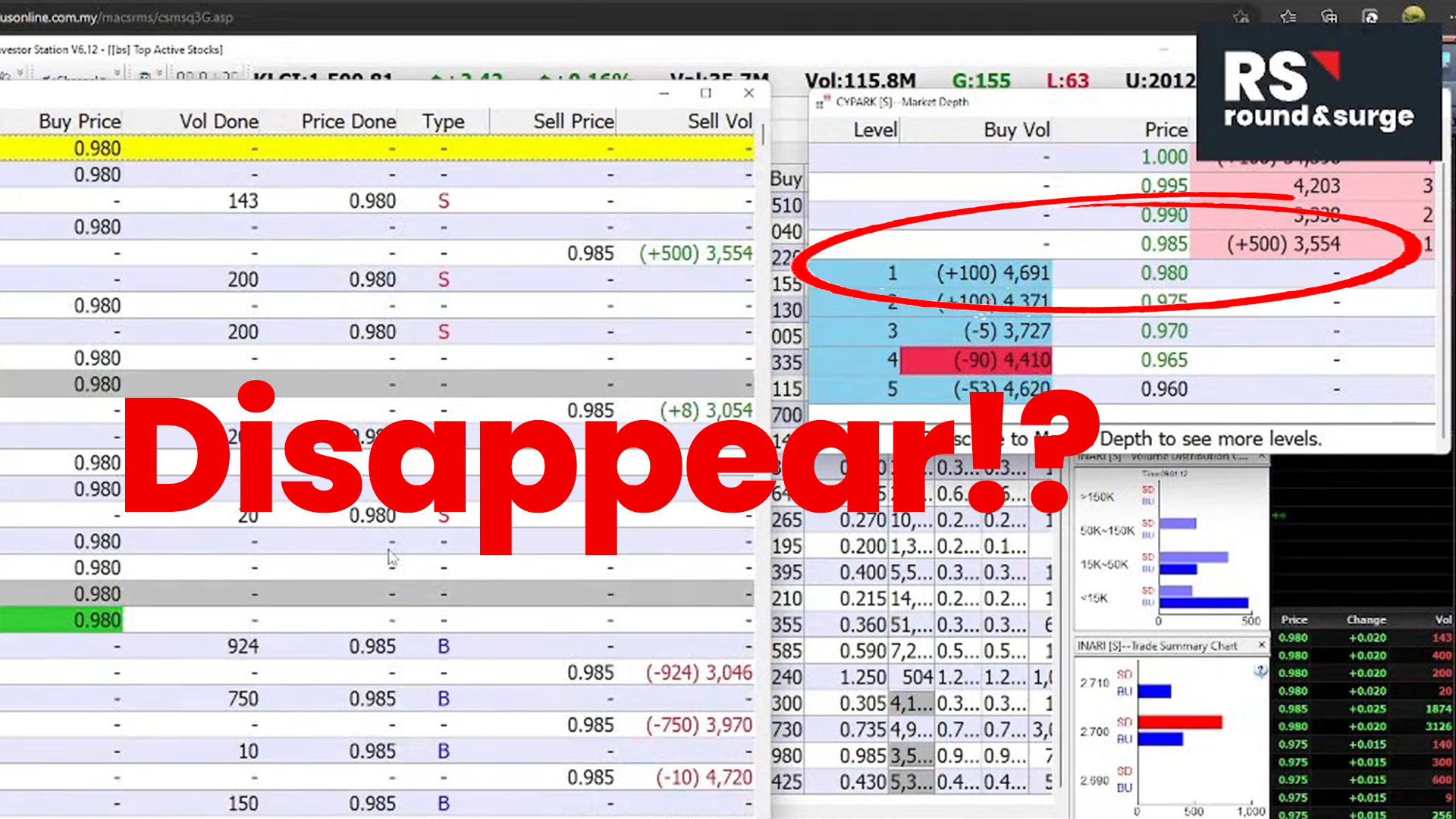

The price & volume of these stocks shows signs that the big boys are starting to sell some shares in the market after the retail investors’ confidence increases after seeing the stock's price markup. You can see prices are not marking higher after a huge volume comes in the 5 mins chart & some are price down with high volume during the day. If these volumes are bullish or real-buying volume, the price should mark higher instead of going down or maintaining at the same price.

Some stocks even have a technical chart pattern breakout to attract investors attention, but the price movement during the day shows the big boys are selling or preparing to sell. Which means a pause in price or retracement could be happening.

To learn how to avoid trading in a resistance breakout fail, follow the link below :

https://www.roundnsurge.com/news/how-to-avoid-resistance-breakout-failed

https://www.roundnsurge.com/news/identifying-the-true-chart-pattern-breakout-in-klse

Is it good to go long term?

Although there are many stocks showing signs of retracement in their price & volume action, the previous market rebound indicates a slight positive sign that the big boys are coming back to the market slowly. The rebound in the near term may not be strong enough to lead the whole market into a bull market, due to a more conservative play by the institutional big boys. They will be more selective on the stocks compared to 2020, because the market are not flooded with funds like before.

Since we know most of the stocks are showing price & volume signs of price retracement. We should stay aside & avoid getting trapped at the high price, wait for the price bottom for the long term entry at the bottom.

This doesn’t mean that traders & investors can stay aside doing nothing. We need to prepare ourselves for the bottom like how do we know the low is the lowest or bottom. To find the bottom, we can no longer rely on support lines or indicators anymore. Because the falling knife has been cutting all the support lines before.

We need to find the bottom with a better analysis to tell us “this is the bottom”. The best way to know this is to follow the big boys in the stock market, because they are the ones that have the fund to move the price. Better than playing a guessing game, wondering whether the price will hit your take profit or cut loss point.

We have shared the idea of how to identify price bottoms with a simple method, price & volume analysis in 5 mins in our blog. Follow the link below to learn how to identify stocks with price bottom in the top active list.

https://www.roundnsurge.com/news/how-to-select-klse-stocks-from-top-active-list

About Us

Malaysia's stock market is a unique market; hence it requires a customized trading approach to tackle & swerve. Many existing traders in Malaysia apply a plug-and-play strategy from the overseas stock market, but it is not necessarily the best strategy to trade in KLSE. This is due to the difference in local and overseas stock market regulation and the size of market participants of institutional funds & retail investors.

“True traders react to the market.” is the backbone of our trading method. Our findings and strategies are developed through years of trading experience and observance of the operating style in Malaysia’s stock market.

More educational blogs on our website!

Website: www.roundnsurge.com

Facebook: www.facebook.com/roundnsurgeofficial

Youtube: www.youtube.com/c/RoundSurgeoperatoranalysis

Instagram: @roundnsurge

Subscribe to our YouTube Channel for more trading video!

https://www.youtube.com/c/RoundSurgeoperatoranalysis

If we have missed out on any important information, feel free to let us know and feel free to share this information but it will be much appreciated if you can put us as the reference for our effort and respect, thank you in advance!

Disclaimer :

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons do not warrant, represent, and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever. No reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for their own trading decision. The author of this blog is not liable for any losses incurred from any investment or trading.

More articles on Round & Surge Operator Analysis

Created by roundnsurge | Aug 09, 2023

"Master Support & Resistance: Trade Hang Seng with Big Player Insights. Learn to spot levels using price & volume analysis. Trade smarter, minimize risks. Watch YouTube for examples.

Created by roundnsurge | Jun 27, 2023

Discover the differences between Callable Bull/Bear Contracts (CBBCs) and structured warrants on the Hang Seng Index (HSI) to maximize your day trading returns.

Created by roundnsurge | May 22, 2023

Discover the incredible profit potential of Callable Bull/Bear Contracts (CBBC). The ability to profit in rising and falling markets, and lower entry barriers make CBBC the superior choice for trader.

Created by roundnsurge | Apr 17, 2023

Identify profitable rebound stocks by following big players' support during downtrends & retracement understanding their marking of price levels in this short-term trading strategy for KLSE & SGX.

Created by roundnsurge | Apr 05, 2023

Unlock your financial potential with investment and trading strategies for building current and future income.

Created by roundnsurge | Feb 04, 2023

Being able to accept our losses is the first step in being able to learn from them and turn that into future profit!

Created by roundnsurge | Jan 29, 2023

We're going to give you an insider's look at how the big boys get their info and make trades, so that you can do it too!

Created by roundnsurge | Jan 12, 2023

We can’t avoid big boys in the stock market, so we learn how they operate & take advantage of their price movement for our better entry & exit.