The Must-Knows Before Market Opens (07/01/2017)

Taurus Brown Research

Publish date: Sat, 07 Jan 2017, 10:44 PM

News Highlights:

- TNB to venture into UK solar power

- Donald Trump threatens Toyota through Twitter

- Ekovest to take part in Pan Borneo Highway project

Tenaga Nasional Berhad (Last Price: RM13.94)

TNB to venture into UK solar power

TNB will be buying 50% stake of Vortex Solar S.a.r.l. for about RM477million to venture into UK’s electricity-generation market. TNB signed a subscription and funding agreement with Beaufort Investment S.ar.l. to subscribe for the new Vortex Solar shares. Vortex Solar is a vehicle formed to acquire TerraForm UK 2 Intermediate Holdings Ltd and TerraForm UK 3 Intermediate Holdings Ltd. The two companies own and operate Solar photovoltaic (PV) projects in UK with capacity of about 365MW. TNB expects the transaction to complete in third quarter of 2017 and will be earnings-accretive. – The Edge

Toyota Motor Corp (Last Price: 6,930 JPY)

Donald Trump threatens Toyota through Twitter

U.S. President-elect Donald Trump threatens Toyota that a hefty fee will be imposed if Toyota builds its Corolla cars for U.S market in Mexico. Toyota’s plan to build small cars in Mexico was originally announced in April 2015. Further to Trump’s threat, Toyota states that production in Mexico will not take away from U.S. employment and Toyota looks forward to collaborating with the Trump administration to serve in the best interests of consumers and the automotive industry.

Toyota’s shares fell around $1.2million in value following the negative tweet. – Independent

Ekovest Bhd (Last Price: RM2.40)

Ekovest to take part in Pan Borneo Highway project

Ekovest Bhd will participate in the construction of the Pan Borneo Highway by entering into a joint venture (JV) with Miri-based Samling Resources Sdn Bhd to develop a 95.4km Sarawak stretch under a RM2.11bil contract. The stretch was reported to be the longest of the 11 stretches for the Sarawak portion of the toll-free highway under phase one. The work package was one of two Pan Borneo Highway packages clinched by Samling Resources last year. Ekovest Construction will hold a 30% stake in the JV company while Samling Resources will own the rest. Based on this, Ekovest’s share of the contract value is RM633.8mil. – The Star

Domestic Market

A bull market awakens in early 2017

Reversal: Bullish entry. Recently, the FBMKLCI index rebounded from its support at 1613.35 and rallied above the EMA200 line (purple). In our view, this is a strong signal of an entry into a bullish trend. Meanwhile, the EMA10 (red) line is also on the verge of crossing above the EMA50 line (green), coupled with an upward crossover above the signal line seen in the MACD. Collectively, we believe signs are pointing toward a bullish rally in the immediate term with the first notable resistance at 1691.22 (dotted blue) and the next at 1724.44. All in, we believe the index is on track to re-enter the 1700 territory and eventually come to test the strong resistance seen at 1724.44. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

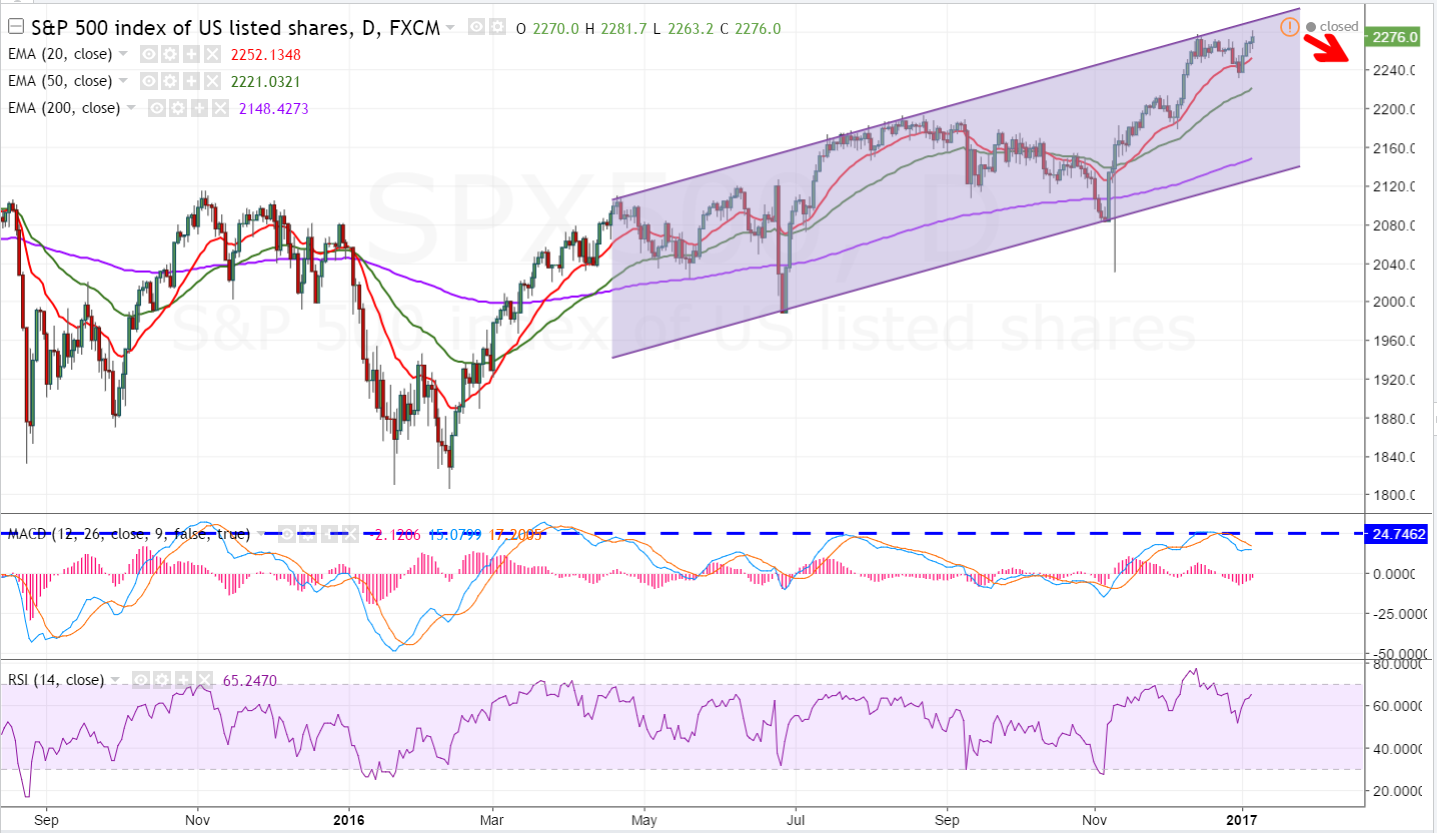

Realism beats optimism

Retracement in the immediate term. Recently, the S&P500 index retraced from the upper boundary of the channel (purple) to the EMA10 line (red). Subsequent to that, the index has resumed its rally to its previous record-high level. This is in conjunction with the recovery in crude oil prices and optimism spurred by Trump’s administration. This week, the MACD exhibits a downward bias after it retraced from its resistance (dotted blue). In addition, readings from the RSI are flashing signs of an overbought situation (RSI: 65). To sum up, we believe the index will see a rally pause in the immediate term, but maintain that the overall trend technically remains bullish. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

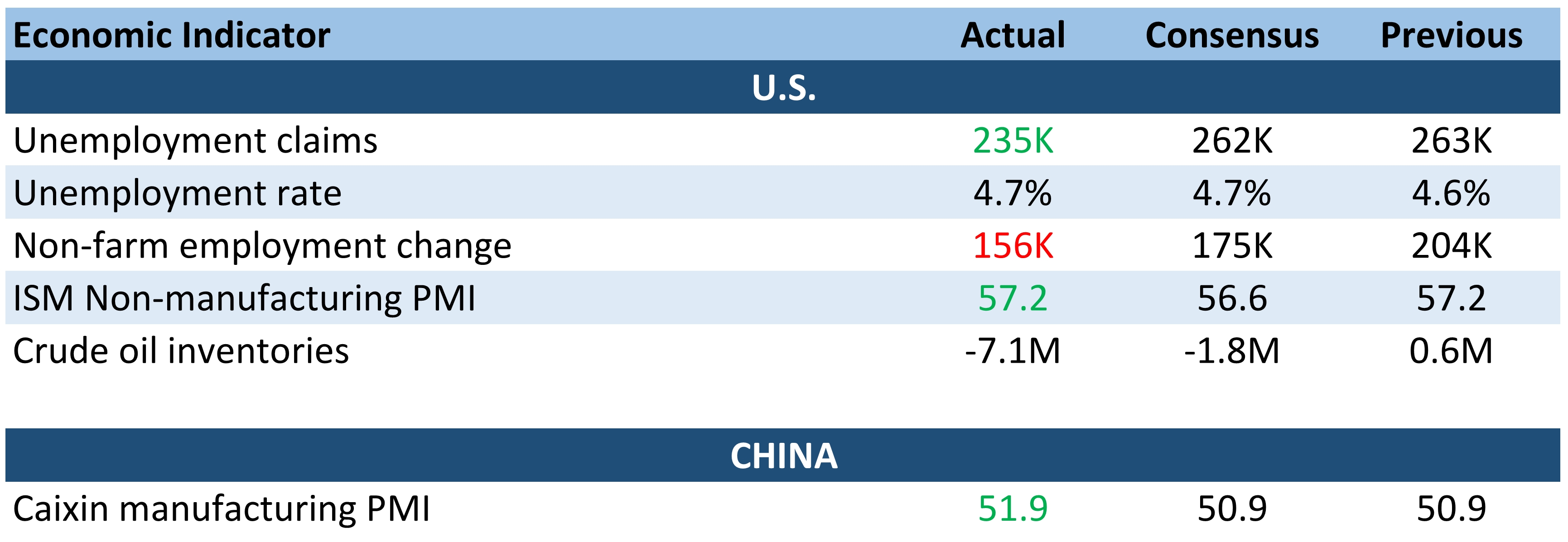

Economic Outlook

U.S. job market showed further signs of the tightening with 156,000 jobs added in December while unemployment claims falls to an eight-week-low to 235,000. The job addition was attributable to the increased hiring in health care and social assistance, whose gain of 63,400 workers was the most since October 2015. Unemployment rate came in consonance with estimates of 4.7%, an uptick from previous month of 4.6%. However, the number of long-term unemployed was unchanged at 1.8 mil. With the Fed looking for signs of inflation, wages exhibit its fastest gain since 2009. Average hourly earnings advanced 2.9% over the year. In December, average hourly earnings for all employees on private nonfarm payrolls increased by 10 cents to $26.00.

Non-manufacturing PMI in the U.S. remained unchanged from prior month of 57.2, indicating continued growth in the non-manufacturing sector for the 83rd consecutive month. This week’s change in crude oil inventories held by commercial firms saw a reduction of -7.1mil barrels. Saudi Arabia held up its end of the agreement by reducing oil output in January by at least 486,000 barrels a day to 10.06 million barrels a day. This has boosted oil price, which had slipped after U.S. reported large increase in U.S. gasoline and distillate inventories. Brent and WTI ended the up-and-down week with 2.1% and 2.3% increase respectively to close at $56.80 and $53.67.

China’s Caixin manufacturing PMI climbed to 51.9 in December, marking its fastest rate of improvement in three years. Caixin data focus on smaller and medium-sized firms. A reading above 50 indicates expansion, while a reading below signals contraction.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016

.png)