The Must-Knows Before Market Opens (27/11/2016)

Taurus Brown Research

Publish date: Sun, 27 Nov 2016, 02:15 AM

News Highlights:

- AirAsia plans two IPO; to sell leasing arm in 2017

- Proton retreats from some foreign markets

- Australian banks admit to "cartel conduct"

AirAsia Bhd (Last price: 2.71)

AirAsia plans two IPO; to sell leasing arm in 2017

AirAsia Bhd posted its fourth-straight profitable quarter in the third quarter ended Sept 30, 2016 (3QFY16). Bids are also coming in for its leasing arm Asia Aviation Capital Ltd, valued at US$1 billion (RM4.46 billion), with eventual sale of the unit to take place in early 2017. This is part of its plans to dispose of non-core businesses. It has been revealed that the largest low-cost carrier (LCC) in Asia will go to the markets with two potential initial public offerings, namely its flight crew training centre, AirAsia Academy, on Bursa Malaysia and Asean Holding Co in Hong Kong. – The Star

Automobile industry

Proton retreats from some foreign markets

Proton Holdings Bhd is retreating from several of its existing international markets amid intense competition within the automotive industry, as the national carmaker strategises for better growth and presence in its next export markets. Though Proton has been applauded for aggressively turning itself around by launching four new models this year alone, and being one step closer to selecting its foreign strategic partner, Ahmad Fuaad said the group is not resting on its laurels just yet as it strives to reaffirm its presence internationally. Proton currently exports its cars to at least six countries. – The Edge

Manipulation of MYR?

Two Australian banks admit to “cartel conduct”

Macquarie Group Ltd and Australia & New Zealand Banking Group Ltd offered to pay fines totalling A$15 million for their “cartel conduct” when trading foreign exchange contracts for the Malaysian ringgit in 2011. Their traders communicated in private online chatrooms about their daily submission in regards to the benchmark rate for MYR to Association of Banks in Singapore. Their submission would then set the daily exchange rate for contracts of MYR in Singapore. However, there were no confirmation from Australian Competition and Consumer Commission (ACCC) on whether the 2 banks managed to influence the exchange rate and how much profit they made. – The Edge

Domestic Market

Still in sideways amid lack of trigger

Technical Rebound at ~1621.75. The Malaysian stock market has not seen significant development in the past one week. The FTSE Bursa Malaysia KLCI index is still indecisive of a clear direction, with the bulls and bears having a tug of war at the support line (1627.26). We reiterate the view that the index will continue trading in a sideways trend before any significant market trigger. That being said, we expect KLCI to rebound from the support at 1621.75, with the first notable resistance at 1691.07 and the next at 1724.96. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

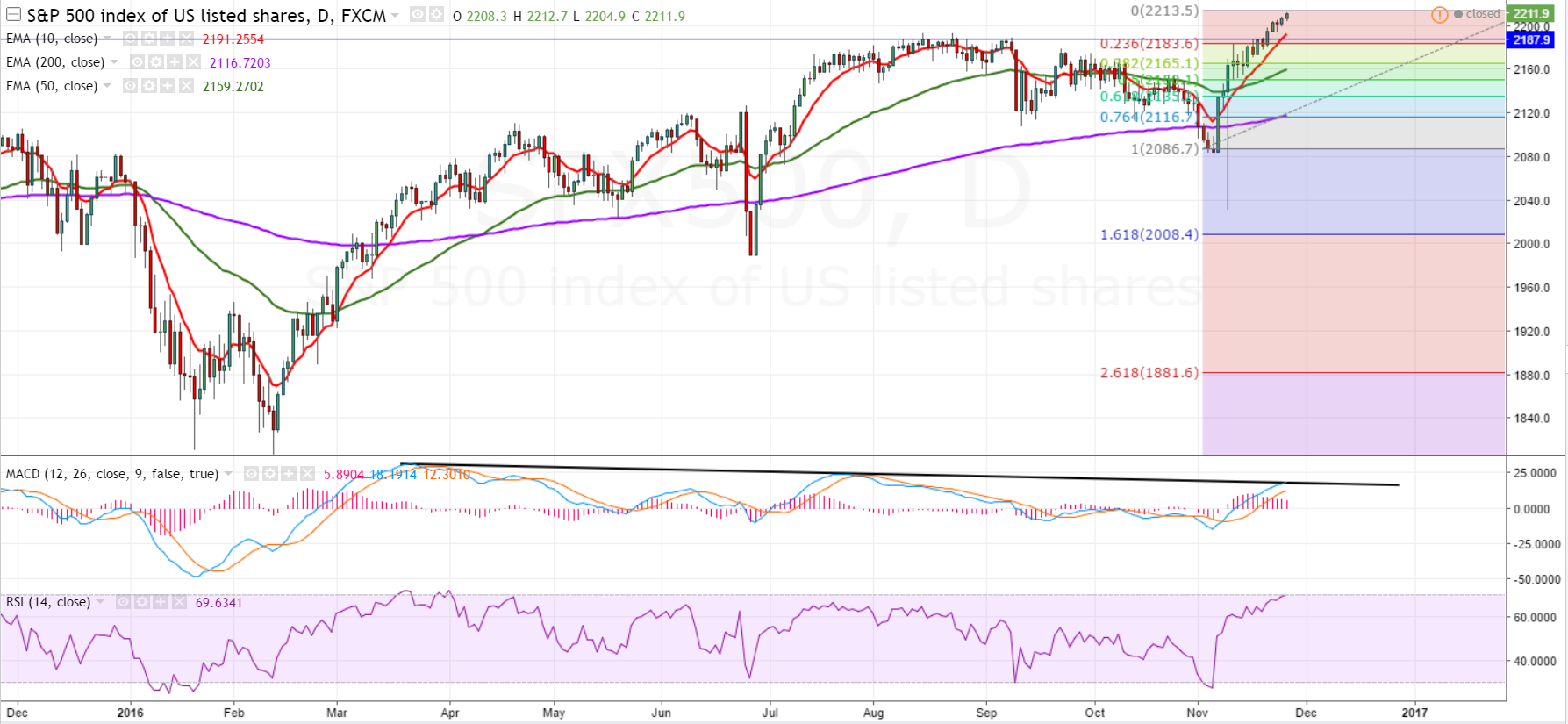

Record highs in the making or double top is looming?

Retracement in the immediate term. As addressed in our previous report, a resistance (2187.9) breakout by the S&P500 index would trigger a short-term rally on evidences of a healthy uptrend. Thus far, the index has rallied by circa 1% from the previous resistance. However, we are seeing signs of a retracement flashed by an RSI reading of 70, a level at which an instrument is deemed overbought. In addition, we note that the MACD line has reached a trendline resistance joined by its two previous highs, indicating that the MACD, and therefore the index, may retrace in the immediate term. We opine that the index is likely to retrace to the 23.6% Fibonacci level (2183.6), in conjunction with the previous resistance (which is a support now). All in, we foresee a rally pause in the immediate term, before the index continues its upward trajectory. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

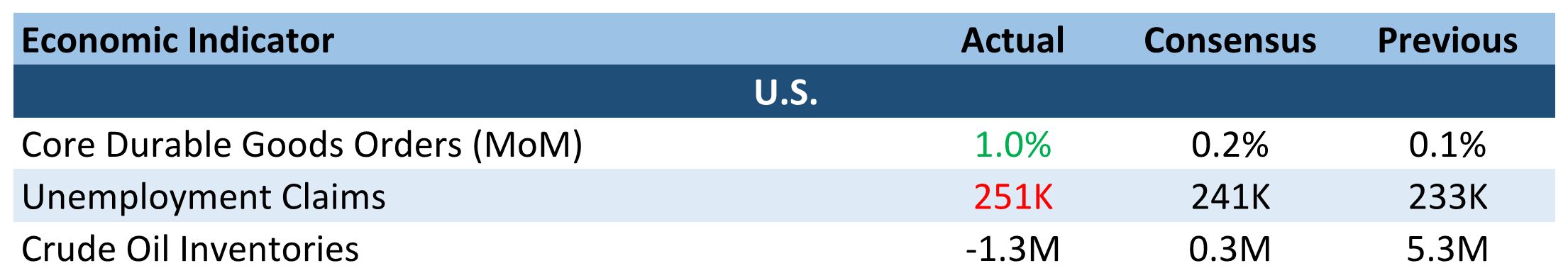

Economic Outlook

New orders for U.S. manufactured durable goods in October advanced for the fourth consecutive month. The increase of $11.0bil or 4.8% to $239.4bil was attributable to the $10.58bil or 94.1% surge in orders for commercial aircraft. Core durable goods orders (excluding transportation) increased by 1.0% to $151.2bil, beating the 0.2% estimate. Order for non-defense capital goods (excluding aircraft) – a proxy for future spending on engines, communication and computer gears rose 0.4% to $63.1bil. The figures indicates that commercial spending maybe starting to thaw as prospects for more infrastructure development heightens.

Unemployment claims filled in the U.S. during the past week picked up after reaching a four-decade-low last week at 235k. The U.S. Labor Department recorded a jobless claim increase of 18,000 or 4.2% above consensus at 251k. Notwithstanding that, fillings for unemployment benefits have been below 300,000 -- a level synonymous with a thriving labor market – for 90 straight weeks.

This week’s change in crude oil inventories held by commercial firms lowered by 1.3mil barrels, showing a 24.5% decrease over last week’s surplus. The decrease in inventories was on the back of the rise in U.S. refinery demand by 2% or 271,000bpd (barrels per day) to 16,397,000 bpd. After recording a high for November of $49.12 on Tuesday due to trader’s bet on an increased likelihood of OPEC finalising its one million barrels a day cut in production, Brent and Crude ended 3.89% and 4.88% lower this week to close at $47.09and $45.94 respectively.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016