The Must-Knows Before Market Opens (04/12/2016)

Taurus Brown Research

Publish date: Sun, 04 Dec 2016, 08:45 PM

News Highlights:

- Mudajaya gets RM810mil job for road projects

- Scanwolf partners Japanese firm to make luxury vinyl tiles

- Standard Chartered to Cut Hundreds of Staff in Cost-Cutting Drive

Mudajaya Group Bhd (Last price: RM0.78)

Mudajaya gets RM810mil job for road projects

Mudajaya Group Bhd has bagged a RM810mil contract from Consortium Zenith BUCG Sdn Bhd for road projects on Penang island. The infrastructure company said it had received the letter of award for package two which involves building the Ayer Itam to Lebuhraya Tun Dr Lim Chong Eu by-pass of Penang major roads and Third Link project in the state. – The Star

Scanwolf Corp Bhd (Last price: RM0.28)

Scanwolf partners Japanese firm to make luxury vinyl tiles

Plastic extrusion manufacturer and property developer Scanwolf Corp Bhd is teaming up with a Japanese company to produce plastic related goods. The goods would include luxury vinyl tiles and related products, calendar moulding related products and construction materials. Its wholly own sub Scanwolf, Plastic Industries Sdn Bhd signed the joint venture agreement with Tokyo-listed Nissha Printing Co Ltd’s unit, Nissha Industrial and Trading Malaysia Sdn Bhd. – The Edge

Standard Chartered PLC (Last price: £645.52)

Standard Chartered to Cut Hundreds of Staff in Cost-Cutting Drive

Standard Chartered PLC is laying off hundreds of people working in corporate and institutional banking as it steps up its drive to cut costs. The Asia-focused bank will reduce overlapping roles in servicing customers, as part of a rejig of its structure and activities since raising fresh capital a year ago. The job cuts are the result of changes in the way it handles client relationships, and that it also needs to free up money to make planned technology investments. – The WSJ

Domestic Market

Have bears bowed down to the bulls?

Rebound at ~1621.76. The Malaysian stock market has not seen significant development in the past three weeks. The FTSE Bursa Malaysia KLCI index is still having a tug of war between the bulls and bears around the support line (1621.76). However, we note that the index closed above the EMA10 for the first time in more than three weeks, indicating investors may have finally come to a consensus that the index is to head upward. That being said, we expect the KLCI index to climb its way to the first notable resistance at 1691.22, or even to the next resistance at 1724.44. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

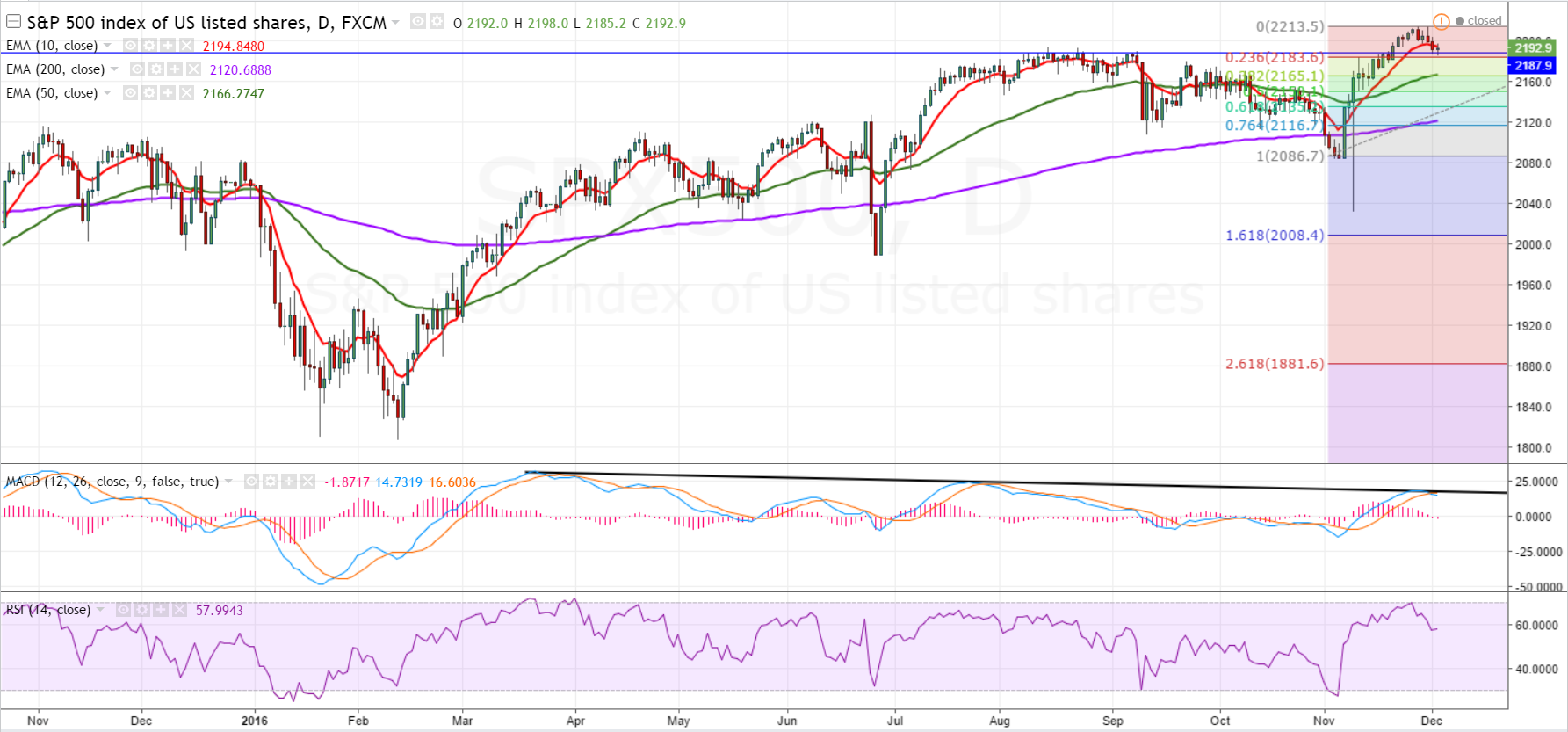

Can this hot-headed bull cut loose the anchor heaving it?

Bullish trend resumption. As correctly anticipated in our previous report, the S&P500 index retraced from an RSI reading of 70, in tandem with a downtrend resumption in the MACD (indicated by the black line). We have also expressed views that the index would rebound from the 23.6% Fibonacci level (2183.6), which is coincidently the index’s immediate support. This week, we reiterate that the index would resume its bullish trajectory, in conjunction with a “Santa Claus Rally” as well as a “Trump bump”. However, we note that the MACD bearish divergence continues to be a stumbling block to the index’s upside, as it indicates an unhealthy uptrend. Therefore, we reckon that a breakout above the MACD’s trendline resistance would serve as a confirmation of the trend resumption, and prompt the index to a more momentous rally. For now, we foresee a modest rebound at the 2183.6 (23.6% Fibonacci level), but remain conservative on the upside potential before stronger catalysts surface. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

U.S. GDP rose at an annualized rate of 3.2% in the third quarter, beating both the advance estimate of 2.9% and consensus of 3.0%. Tepid business spending and residential fixed investment were primarily offset by the positive contribution from strong labor market and consumer spending ahead of the holiday shopping season.

This week’s labor market in detail exhibits an upswing in non-farm payroll in tandem with a fall in unemployment rate. Employers added 178,000 workers last month while unemployment rate was held at a nine-year low of 4.6%. Notwithstanding that, average hourly earnings MoM for all employees on private nonfarm payrolls declined by 3 cents to $25.89 after an 11-cent increase in October. Over the year, average hourly earnings have risen by 2.5 percent. Unemployment claims increased by 17,000 from previous week’s unrevised level of 251,000 to 268,000 (seasonally adjusted). With the shortened workweek resulted from the Thanksgiving holiday, unadjusted claims totaled to 250,377, a 13% decrease from previous week.

US manufacturing grew for the third consecutive month, beating estimate with a reading of 53.2. Of the 18 manufacturing industries, 11 reported growth in November including Miscellaneous Manufacturing; Petroleum & Coal Products; Paper Products and Computer & Electronic Products. Six industries reported contraction in November, including Printing & Related Support Activities; Wood Products; Apparel, Leather & Allied Products and Electrical Equipment.

This week’s change in crude oil inventories held by commercial firms lowered by 0.9mil barrels, surprising forecast which estimated an increase of 0.7mil barrels. OPEC has finally come to an agreement to have a first-in-8 years production cut of 1.2mil barrels per day by January 2017. However, OPEC still needs to rely on non-OPEC members’ cooperation to have another 600,000 barrels cut to achieve an overall of 1.8mil barrel cut in order to see significant improvement in oil prices. Unsurprisingly, Crude and Brent oil prices rallied by 5.47% and 5.84% to close at $51.65 and $54.39 respectively post OPEC meeting on 30 November in Vienna.

China’s economy continue to show signs of stabilisation in November with the manufacturing Purchasing Managers’ Index (PMI) which measures large state-owned factories that came in at 51.7, beating estimates of a 51.0 reading.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016