The Must-Knows Before Market Opens (19/11/2016)

Taurus Brown Research

Publish date: Sat, 19 Nov 2016, 08:45 PM

News Highlights:

- Pintaras Jaya 1QFY17 Net Profit Rise Almost 100%

- Volkswagen 30,000 Job Cuts

- Alibaba buys into China’s supermarket chain

Pintaras Jaya Berhad (Last price: RM3.45)

1QFY17 Net Profit Rise Almost 100%

The net profit of the piling and civil engineering services provider rose by close to double for first quarter ended 30 September 2016. Its net profit per share increased from RM6.72 million (4.1 cents) to RM13.2 million (8.1 cents). The higher profitability is contributed by increased construction activities and higher recognition of progress profits of ongoing projects. The group expects the future of local construction industry outlook to remain bright as the Budget 2017 continues to focus on major infrastructure projects. – The Edge

Volkswagen AG Preference Shares (Last price: €117.15)

30,000 Job Cuts

Volkswagen and its labor union has come to an agreement to cut 30,000 jobs at the core VW brand. The turnaround plan will assist Volkswagen to save 3.7 billion euros yearly by 2020. The operating margin in 2020 will improve to 4% from an expected 2% in 2016. However, Volkswagen has planned to create 9,000 new jobs in the battery production and mobility services as part of the efforts to shift towards electric and self-driving cars. – CNBC

Alibaba Group Holding Ltd (Last price: $93.39)

Alibaba buys into China’s supermarket chain

To expand its retail presence, Alibaba plans to invest 2.1 billion yuan in Sanjiang Shopping Club Co Ltd, a supermarket chain in China. Sanjiang says that it will be able to tap into Alibaba’s e-commerce platform to grow its competitive retail sector.

Alibaba will have 32% stake in Sanjiang after a share transfer and a share subscription. With above 30% ownership threshold, Alibaba is prompted by Shanghai Stock Exchange to make a full takeover bid on Sanjiang. This requirement is waivable through an approval from the shareholders of Sanjiang. – The Edge

Domestic Market

Still in sideways amid lack of trigger

Technical Rebound at ~1621.75. The Malaysian stock market has not seen significant development in the past one week. The FTSE Bursa Malaysia KLCI index is still indecisive of a clear direction, with the bulls and bears having a tug of war at the support line (1623.80). We reiterate the view that the index will continue trading in a sideways trend before any significant market trigger. That being said, we expect KLCI to rebound from the support at 1621.75, with the first notable resistance at 1691.07 and the next at 1724.65. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

Record highs in the making or double top is looming?

Wait-and-see approach. As addressed in our previous report, the S&P500 saw a MACD bullish crossover in the post-election rally. However, we are seeing investors having second thoughts as the index nears the resistance line at 2189.4. We are of the view that a breakout of the resistance line will trigger another rally to form new record highs. On the flip side, failing to break the resistance would sculpt the chart into a “double top”, which is perceptibly a bearish signal. All in, we recommend to wait for a trend-setting signal before entering into a position. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

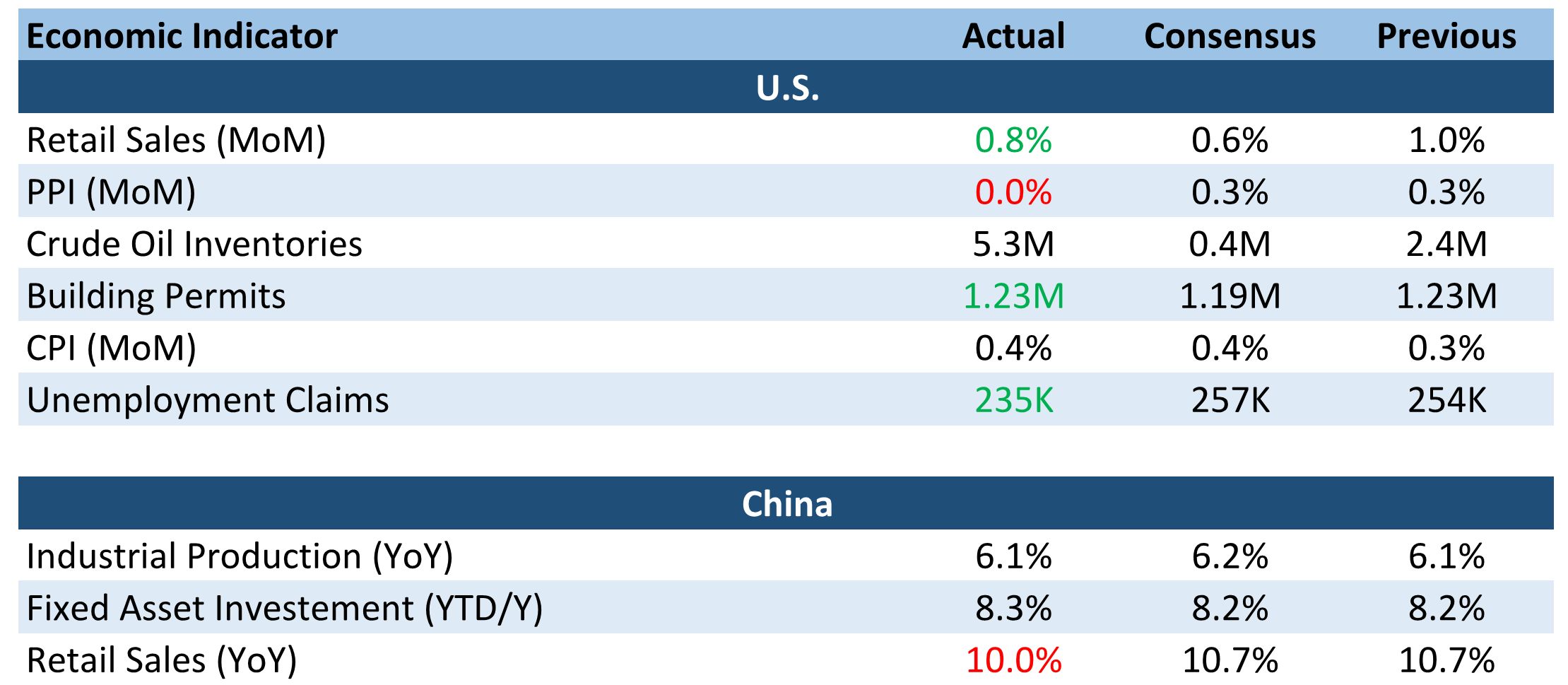

Retails sales in U.S. rose more than forecast last month at 0.8%, following the 1% uptick in the prior month. This marked the biggest back-to-back increase since March-April 2014. The cost of living in the U.S. met consensus, having increased by 0.4% this month. The rise for the third consecutive month was on the back of price increases in fuel and housing, indicating a convergence between inflation levels and the Federal Reserve’s goals.

In the labor market, the number of individual who filed for employment claims during the past week was below consensus at 235k, marking a 7.4% improvement over last week’s claim of 254k. U.S. new-home construction recorded a nine-year high in October with 1.23mil building permits issued out. The figures indicates the housing market is in a steady recovery. While demand has been driven by increased employment and healthier finances, the contractionary monetary stance in the US, which would raise borrowing cost, might discourage first-time buyers and serve as a hindrance for the industry.

This week’s change in crude oil inventories held by commercial firms showed a large gain at 5.3mil barrels, showing a 20.8% increase over last week’s surplus. However, oil prices this week were buoyed by growing expectation that OPEC will derive a plan to limit production by the end of the month. Brent and Crude ended 4.65% and 4.30% higher this week to close at $46.79 and $45.56 respectively.

China’s industrial production rose 6.1% YoY in October, compared to estimates at 6.2% and 6.1% last month. Fixed asset investment saw a gain of 8.3% for the first ten months which beat consensus. Retail sales slowed to 10% YoY, missing consensus by 0.7%. Any release of weak data in China will add to uncertainty in the global economy. Moreover, China is facing the possibility of tariffs being imposed on their imports by the U.S. President-elect Donald Trump.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016