The Must-Knows Before Market Opens (10/12/2016)

Taurus Brown Research

Publish date: Sat, 10 Dec 2016, 11:52 PM

News Highlights:

- Pos Malaysia plans up to RM200m expansion

- Apple investing into wind turbines?

- China is upset with the European Union (EU)

Pos Malaysia Berhad (Last price: RM3.64)

Pos Malaysia plans up to RM200m expansion

The wholly owned subsidiary of Pos Malaysia, PosLaju is planning to spend up to RM200m to build 3 more integrated parcel centres (IPC) for the expansion of its express and courier service’s capacity. IPCs are “fully automated” centres and rely heavily on automated machines with only 20% manual intervention. The expansion for PosLaju is necessary in view that e-commerce is growing tremendously and as enhancement to its services as the main postal provider in Malaysia.

The three new IPCs will be able to increase the parcel processing capacity of PosLaju to 1.5million items per day from the current 400k items per day. – The Edge

Apple Inc. (Last price: $113.95)

Apple investing into wind turbines?

To achieve the goal of using 100% renewable energy, the iphone maker struck a deal this week to purchase a 30% stake in three subsidiaries of China’s biggest wind turbine manufacturer, Goldwind. As electronics manufacturing in China uses a lot of energy from polluting coal power stations and most of Apple products are made in China, Apple is trying to compensate for that by investing into renewable energy. The investment will add 285 megawatts of clean energy to China’s grid offsetting some other source of energy used by its operations and its supplier. – CNN

Steel Industry

China is upset with the European Union (EU)

The EU has just launched an investigation to determine whether Chinese firms are dumping steel products into Europe. This has upset China as China thinks that Europe’s steel problems are caused by their region’s own economic weakness. China’s Head of Trade Remedies Investigations department said that EU should analyze its problem rationally and should not adopt mistaken trade protectionist measures that limits fair market competition.

The EU presently has 40 anti-dumping and anti-subsidy measures in place and 18 of them are China products. There are also twenty more ongoing investigations in relation to steel products. – The Edge

Domestic Market

Bears conceded and bowed down to the bulls

Bullish in the immediate term. As addressed in our previous report, we noted that the index closed above the EMA10 (red) for the first time in more than three weeks, and asserted that the FBMKLCI index would head upward to its first notable resistance. Currently, the index has come to test the EMA50 line (green), which once penetrated, could prompt the index to rally further to EMA200 (purple), which is coincidently its trendline resistance. We also understand that the MACD line has recently seen an upward crossing, flashing signs of a short-term rally. Notwithstanding the positive signal, we believe a bullish re-entry of the index can only be called if the upper boundary of the sideways channel (1724.44) is broken. All in, we anticipate the index to rally to the EMA200 line in conjunction with a year-end window dressing practice, but remain cautious on the larger trend. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

Bull on a rampage! But it needs some rest now.

Retracement at 227x. As correctly anticipated in our previous report, the S&P500 index rebounded from the 23.6% Fibonacci level (2183.6), which was coincidently the index’s immediate support (2187.9). Subsequently, the index rallied strongly to form new highs in tandem with a “Santa Claus Rally” and a “Trump bump”. For now, we believe the index has limited space for upside and is poised to see a rally pause in the immediate term as RSI continues to stay above 70, a level at which an instrument is deemed overbought. Specifically, we opine that the index would retrace from the upper boundary of the channel depicted above (purple), around the 227x level. On the bright side, we draw comfort that the MACD reading has broken the curse of “MACD bearish divergence” by penetrating above its trendline resistance (black line drawn in MACD reading). To sum up, we foresee a retracement (~227x) in the immediate term following a strong rally, but maintain that the overall trend technically remains in a healthy upward trajectory. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

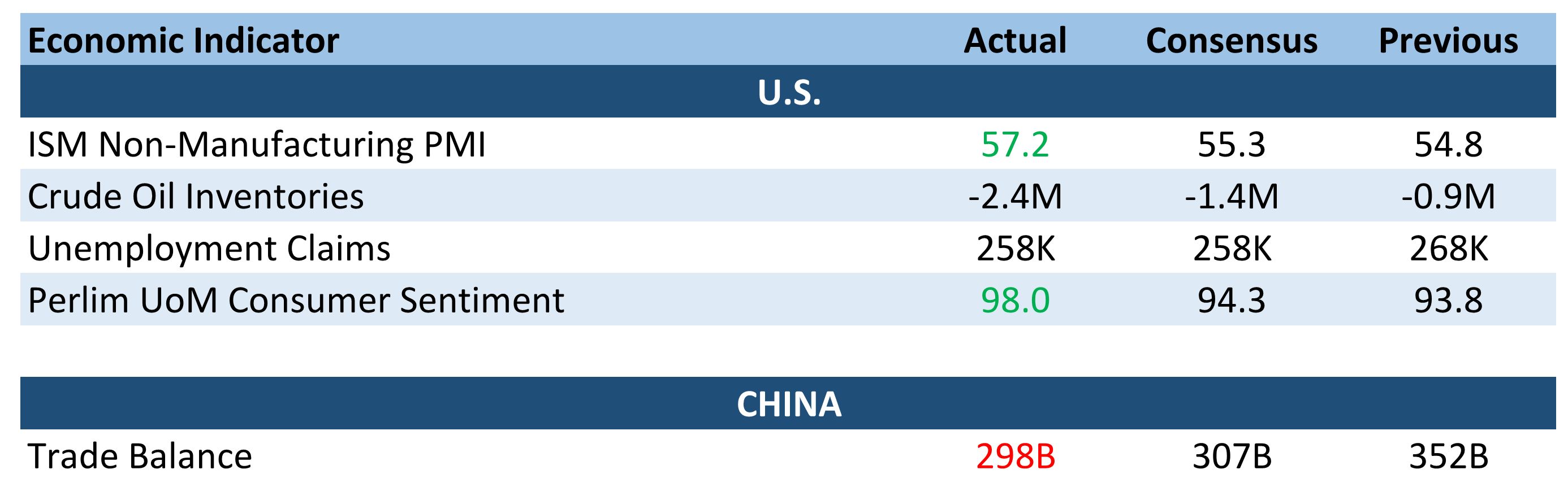

Service sector in the U.S. expanded in November at the fastest clip since October last year. The Institute for Supply Management (ISM) reported the non-manufacturing index at 57.2, exceeding consensus of 55.3. Reading above 50.0 indicates the non-manufacturing sector economy is generally expanding. Sixteen industries reported growth in November including agriculture, education, finance, transportation and management of companies. Health care & social assistance is the only industry that reported contraction.

The amount of individuals who filled for employment benefit for the past week slide by 10,000, which came in-lined with estimates of 258,000. The 4-week moving average increased by 1,000 to 252,500 as compared to previous week’s unrevised average of 251,000. Last week’s report by the labor department recorded a solid increase of 178,000 jobs in November and a nine-year low employment rate of 4.6%. These numbers serves as a support to the Fed’s hawkish stance which is predicted to result in a rate hike in next week’s FOMC meeting.

This week’s change in crude oil inventories held by commercial firms dropped by -2.4mil, falling more than last week’s reduction of -0.9mil and estimates of -1.4mil. Oil prices edged down during the week as doubts lingers over [1] OPEC’s execution of the agreed upon 1.2mil bpd cut effective January 2017 and [2] OPEC’s ability to convince non-OPEC members to participate in the remaining 600,000 bpd cut. Notwithstanding that, Kremlim spokesman Dmitry Peskov’s claim—which stated that Putin agreed to take on 300,000 bpd reduction—buoyed oil prices to close marginally higher. Crude and Brent closed 1.0% and 0.2% higher this week at $51.45 and $52.29 respectively.

Consumer confidence in the U.S. soared in early December to a reading of 98.0, just 0.2 below the peak in 2015—which was the highest level since the start of 2004. The surge was largely attributable to consumers’ reaction to Trump’s surprise victory. In terms of economic development, many consumers mentioned that they are expecting positive impact of the new economic policies that will be introduced by President-elect Donald Trump.

China’s trade balance edge down 3% below the estimated figure—which has already anticipated a 5% drop from previous month of 325bil. November’s trade balance registered at 298B (USD 44.61 bil) indicates that China’s trade surplus is narrowing. Imports went up 6.7% to USD 129.12 billion, compared to a 1.4% fall in October while market expected a 1.3% decline. In yuan-denominated terms, exports saw an increase of 5.9% from a year ago, marking the first increase in three months. Inbound shipments jumped 13.0%, following a 3.2 percent rise in October.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016

Discussions

But Gdex got Japan post, Singapore Post.......and I think Alibaba behind it.

Pos got what? Kampong power?

Then what about the German DHL? They die already? DHL is trebling its capacity in Malaysia.

2016-12-11 01:27

Paul247..no loan please..we want good and credible stock tip here..you got any?

2016-12-12 07:37

calvintaneng

Pos Malaysia plans up to RM200m expansion

The wholly owned subsidiary of Pos Malaysia, PosLaju is planning to spend up to RM200m to build 3 more integrated parcel centres (IPC) for the expansion of its express and courier service’s capacity. IPCs are “fully automated” centres and rely heavily on automated machines with only 20% manual intervention. The expansion for PosLaju is necessary in view that e-commerce is growing tremendously and as enhancement to its services as the main postal provider in Malaysia.

The three new IPCs will be able to increase the parcel processing capacity of PosLaju to 1.5million items per day from the current 400k items per day. – The Edge

Calvin comments:

There is a projected rise of 90 cts for each parcel delivery.

If Pos Laju expands to 1.5 mil items per day it means

1.5 mil x .90 cts = Rm1.35 millions per week day or Rm6.75 mil per week.

And for 1 year = 6.75 mil x 52 = That's Rm351 millions extra profits per year.

This is the pricing power of a monopoly like POS. No wonder DRB has increased its stake tp 53.5%.

2016-12-11 00:51