Crude Oil Bearish Trajectory Underway? Will this hurt our Ringgit?

Taurus Brown Research

Publish date: Thu, 11 Aug 2016, 07:39 AM

Technical Readings

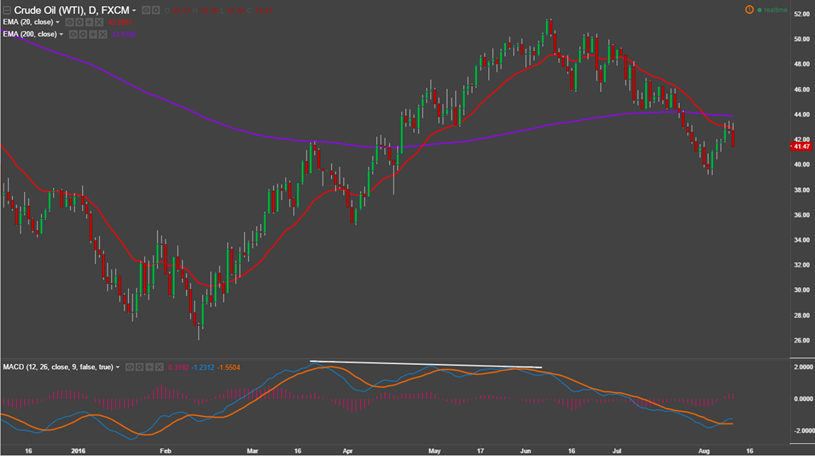

Following three failing attempts to break above the EMA20 line, the price of WTI Crude Oil (FX: USOIL) eventually resumed its downward trajectory with a decisive 3% intraday dip as the lead. The bearish trend kicked off when the price earlier formed a bearish divergence with respect to MACD, which can be inferred by contrasting the degree (downward sloping) of the white line above with the price trend in the same period.

Why is it falling?

The possible reasons of the fall could be attributed to a series of disappointments in the recent crude oil inventories data as well as an ongoing oil glut that remains unresolved.

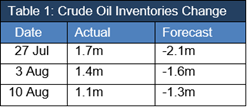

In the past three releases of the crude oil inventories change, analysts had forecasted that crude oil inventories would fall (see Table 1). However, the actual data turned out to be an increase in inventories in each of the three releases, as opposed to their expectations. We believe the continuing disappointments of the data have been the fuel to the fall in price of WTI Crude Oil.

Source: Bloomberg

In addition, data compiled by Bloomberg shows US Crude Oil supplies continue to pile up and is currently close to an all-time high. The finding serves as an evidence of an unresolved oil glut in the market and continually provokes worries that the price will eventually trade near OPEC’s cost of production to reach an equilibrium, which ranges from $8.50/barrel to $35.40/barrel according to Market Realist (see Table 2).

Potential Aftermath

The possible aftermath of the fall in crude oil prices is Ringgit depreciation. To recapitulate, crude oil related revenue constituted about 30% of Malaysian government revenue – see Table 3. A fall in crude oil prices directly affect Malaysian government revenue and currency players usually digest such finding as unfavourable to our Ringgit. To present an empirical observation, when crude oil price nosedived over 50% in 2014, Ringgit depreciated more than 20% against USD despite the effort by Malaysian government in utilising approximately 25% of international reserves to support our currency.

How now Taurus Brown?

If Ringgit is anticipated to depreciate, export-oriented companies can serve as a good hedge against a loss in our currency value. When Ringgit falls, companies of which revenue receipts are denominated in foreign currencies will see increase in top-line figure (sales), all else equal. Examples of such companies include Unisem (M) Bhd, Inari Amerton Bhd, Top Glove Corporation Bhd etcetera.

Follow us on facebook at fb.com/TaurusBrownCo or visit our website at www.taurusbrown.com to get more stories like this.

Disclaimer

All materials and findings contained in this report are solely for educational purposes and in no way serve as advices for individual readers to act upon.

buddyinvest

Noted

2016-08-11 07:40