The Must-Knows Before Market Opens (17/12/2016)

Taurus Brown Research

Publish date: Sat, 17 Dec 2016, 07:56 PM

News Highlights:

- Interest rate raised by Fed for the first time in 2016

- Apple can finally sell iPhone 7 in Indonesia

- Puncak Niaga to purchase construction firm for RM210million

U.S. economy

Interest rate raised by Fed for the first time in 2016

America’s key interest rate has been increased by 0.25% by the Federal Reserve on 14 December 2016. This signifies Fed is confident that U.S. economy is improving. Fed’s chair, Janet Yellen says that economic growth has picked up since the middle of the year and the economy is expected to continue to perform well. The hike indicates that U.S. economy no longer needs Fed’s crutches and the consumers and business can afford to pay higher interest rate. Jobs in America has increased for 74 consecutive months with unemployment rate fallen to 4.6%, the lowest since 2007.

The stock market fell after rate hike with Dow Jones falling more than 100 points. – CNN Money

Apple Inc (Last price: $115.97)

Apple can finally sell iPhone 7 in Indonesia

From January 2017 onwards, all 4G mobile devices sold in Indonesia must have a local content of at least 30%. The rule can be met in terms of hardware, software or investment commitment. Therefore, Apple’s commitment to invest around 44 million USD for a research and development centre in Indonesia has finally enabled its iPhone 7 to be sold in the country. Apple is currently facing an intense competition in Indonesia with Samsung and Oppo leading the smartphone market in terms of sales volume. – The Edge

Puncak Niaga Holdings Berhad (Last price: RM0.90)

Puncak Niaga to purchase construction firm for RM210million

Puncak Niaga is planning to acquire TRIplc Bhd for RM210million to enhance its construction segment revenue and its long term growth prospect. The acquiree currently holds two service concessions awarded by the Malaysian government and University Teknologi Mara (UiTM) and is a profitable construction firm. Puncak Niaga believes that the acquisition will contribute accretive growth to the group. The proposed acquisition will be funded by internal funds and bank borrowings and the group expects the acquisition by second half of 2017, subject to relevant approval from the regulators. – The Edge

Domestic Market

Bear says one month is enough hibernation

Bearish trend resumption. Last week, the FBMKLCI index saw an earlier-than-expected downtrend resumption as Ringgit weakness continued to weigh on the Malaysian stock market. The pullback came prior to hitting its EMA200 and trendline resistance. This week, we believe the index has more than 20 points downside as it revisits the support at 1613.35. Moving forward, the development of crude oil prices and the Ringgit would help to determine the index’s direction. All in, we expect the index to continue its downward trajectory in the immediate term, before window dressing come into play in the last week of December, if any. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

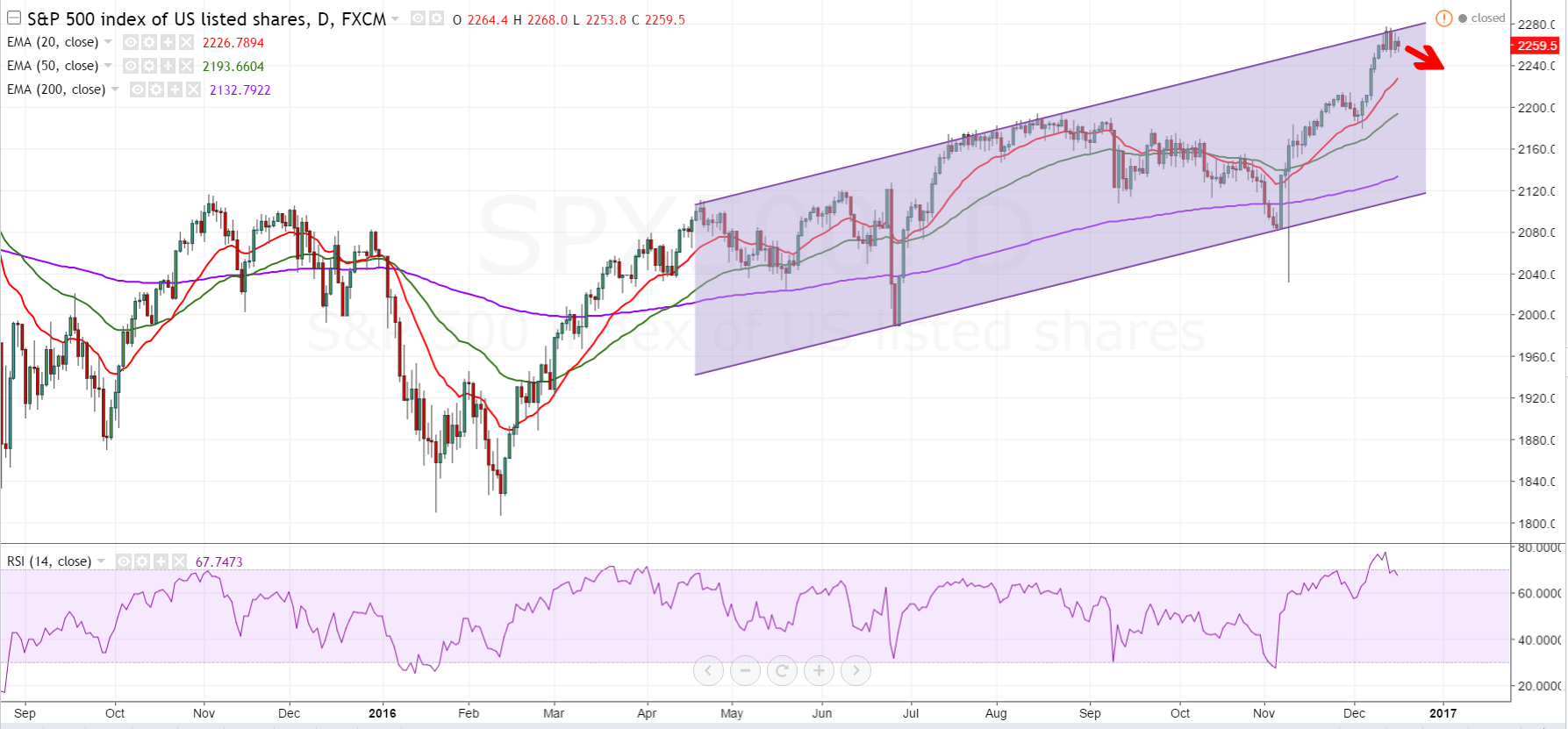

The Fed was such a party pooper! Booo~

Economic Outlook

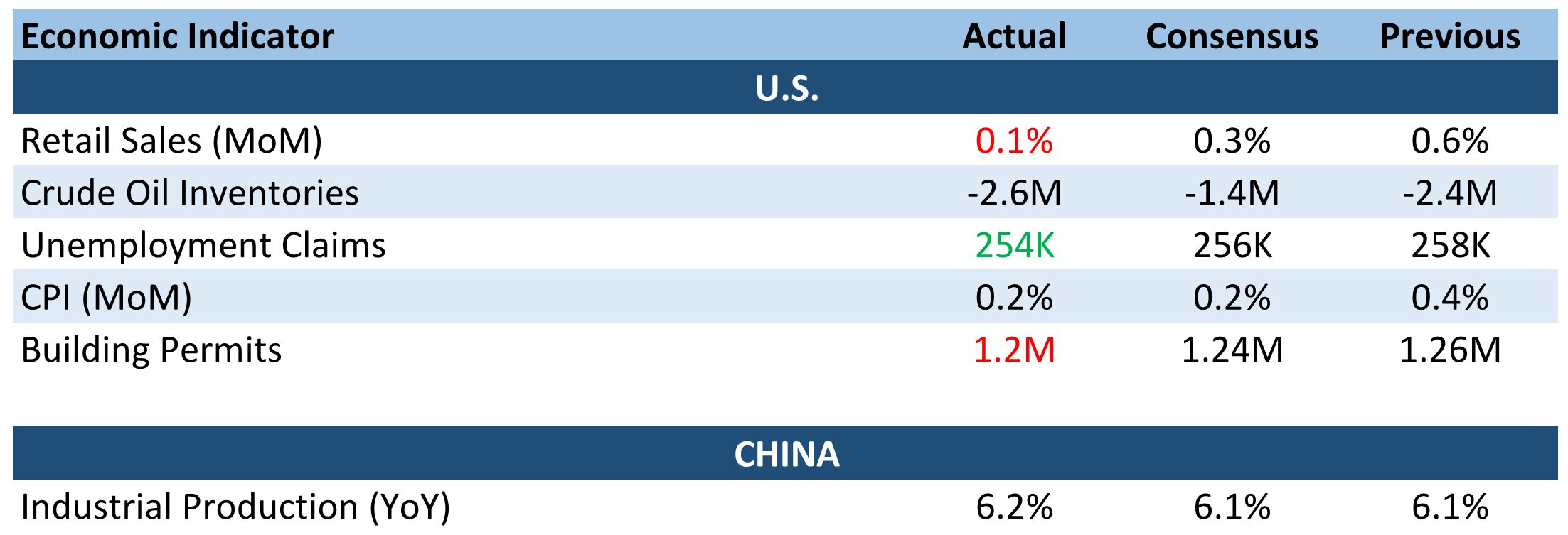

Retail sales in the U.S. rose less than forecast for the month of November after showing robust back-to-back growth in the previous two months. The U.S. Census Bureau reported an uptick of 0.1% in retail sales to $465.5 billion, falling short of consensus which called for an increase of 0.3%. Nine of the thirteen major retail categories showed gains that were mainly led by furniture stores and restaurants. Automotive sale is one of the four categories that reported a decline. Stripping off automotive sale which represent 20% of retail sales, core retail sales registered an increase of 0.2% for November.

This week’s change in crude oil inventories held by commercial firms decline further by -2.6 mil barrels from previous week’s decline of -2.4 mil barrels. At 483.2 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year. Brent and Crude closed -0.76% and -0.20% lower over the week at $52.00 and $55.28.

The amount of individuals who filled for employment benefit for the past week fell by 4,000 to 254,000 following last week’s slide of 10,000. However, the less volatile 4-week moving average increased by 5,250 to 257,750 from previous week’s unrevised average of 252,500. This marks 93 consecutive weeks of initial claims below 300,000, complementing the Fed’s rate hike of another 25 basis points.

CPI inflation in the U.S. came in line with expectation for November. The increase of 0.2% was on the back of gasoline prices which increased 2.7% in November after a 7.0% run up in the previous month. Core CPI – which strips out volatile energy and food prices – came in at 0.2% from last month and 2.1% YoY. This was bolstered by rent prices and motor vehicle insurance prices that increased 0.3% and 1.0% respectively from previous month.

Building permits in November registered below estimates at 1.20 mil, 4.7% below the revised October rate of 1.26 mil. Notwithstanding that, the U.S Census Bureau reported an increase of 5.0% in the single-family housing permits and a 30.0% increase for 2 to 4 units housing. Housing starts were at 1.09 mil, this is 18.7% below last month’s figure of 1.34 mil. The decrease is mainly attributable to the slowdown in high rise residence. However, the majority of U.S. buyers do not purchase apartment buildings, thus tracking single-family data serves as a better gauge to the U.S. new construction.

Industrial production in China rose during Q3 of this year at an annualized rate of 6.2%, beating consensus and previous month’s result of 6.1%. The 6.7% and 9.9% increase in manufacturing output and the production and supply of utilities outweighs the decrease of 2.9% in mining sector output. Crude steel output surged 5% YoY; electricity output increased 7% YoY while coal output fell by 4% YoY.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016