The Must-Knows Before Market Opens (05/11/2016)

Taurus Brown Research

Publish date: Sat, 05 Nov 2016, 09:39 PM

News Highlights:

- TNB’s acquisition of GMR Energy completed

- Another recall for Samsung?

- S&P 500 on the LONGEST losing streak

Tenaga Nasional Bhd (Last price: RM14.30)

TNB’s acquisition of GMR Energy completed

The acquisition of Indian power company, GMR Energy Limited (GEL) for US$300mil by Tenaga Nasional Berhad (TNB) has completed hence marking an entry of TNB into India’s power sector with a compound annual growth rate (CAGR) of 6% to 7%.

According to the CEO of TNB, the acquisition is highly strategic as it seeks to harness the future value of India’s large and supply constrained power market. The transaction will be funded both internally as well as externally and will be earnings accretive by financial year 2018. – TheStar

Samsung Electronics Co Ltd (Last price: 1,627,000 KRW)

Another recall for Samsung?

Samsung’s washing machine door detached mid-wash, which caused a consumer to suffer a jaw injury, has forced the company to recall 2.8 million of its washing machines.

Samsung currently has 9 complaints over washing machine related injuries and more than 700 complaints for excessive vibration or detaching door of its washing machines. The recall was done voluntarily to reduce risk at users’ home and to provide users with easy and simple choices in response to the recall. – BBC

U.S. Economy

S&P 500 on the LONGEST losing streak

The S&P 500 ended lower on Friday for the ninth straight day, marking the longest losing streak in more than 35 years. Investors being in the cautious mood has caused both the Dow Jones industrial average and the Nasdaq Composite to fall 0.24%, while S&P 500 fell 0.17%. Notwithstanding the strong U.S employment report, the market bounced but failed to hold as investors decided to reduce their exposure amid uncertainties arising from U.S presidential election. – The Edge

Domestic Market

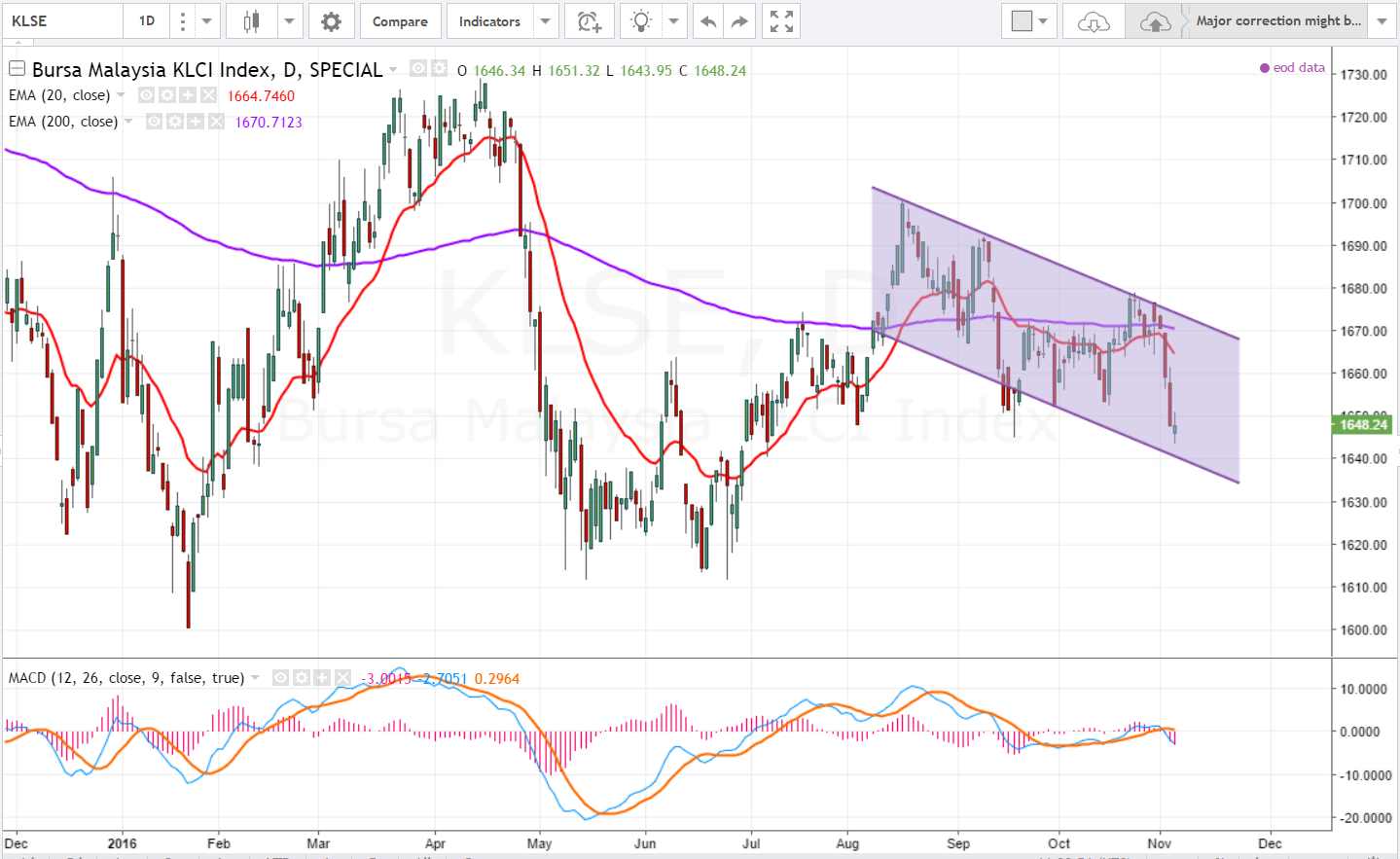

Time for a break, Mr. Bear

Technical Rebound at ~1640. The FTSE Bursa Malaysia KLCI index has been trending steadily lower within the bearish channel (purple) depicted above and has recently dived to the channel’s lower boundary. On November 4th, the Index rebounded marginally on early hopes of a technical rebound and eventually closed at 1,648.24. We opine that the bearish trend will take a short break and rebound from the channel’s lower boundary, but maintain the view that the overall trend remains unfavourable. Notice that the MACD has recently saw a slight downward cross below the signal line, which elucidates a shaky price movement and a bearish signal. To sum up, we anticipate the index to see a technical rebound in the immediate term, before continuing its downward trajectory. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International market

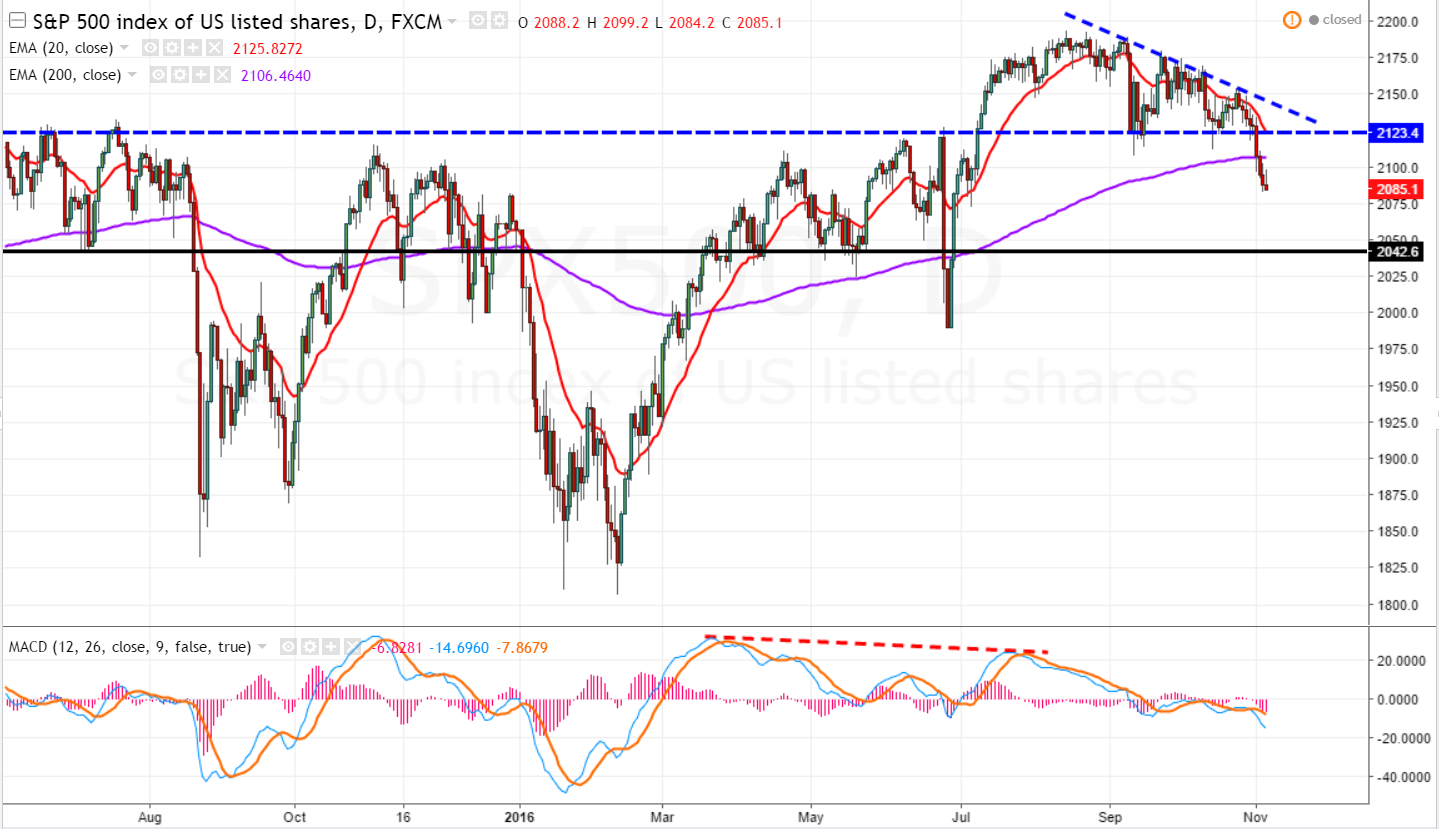

Descending Triangle Support Broken!!

Still bearish. As predicted by our previous report, the S&P500 index has broken the support at 2,123.4 and dipped below the EMA200 territory. This followed a descending triangle and a bearish divergence addressed in our earlier commentaries. We note that the index fell almost 10% the last 2 times it dipped below the EMA200 line. In view of that, we opine that the bearish trend is just getting warmed up as the index only recently dipped below EMA200 line. We think the index will test the immediate support at 2,042.6, before consolidating further. On a separate note, the outcome of the presidential election to be held next week will be closely watched by investors to form a decisive consensus on the market direction. All in, we reiterate our bearish stance on the index with the immediate support at 2,042.6. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

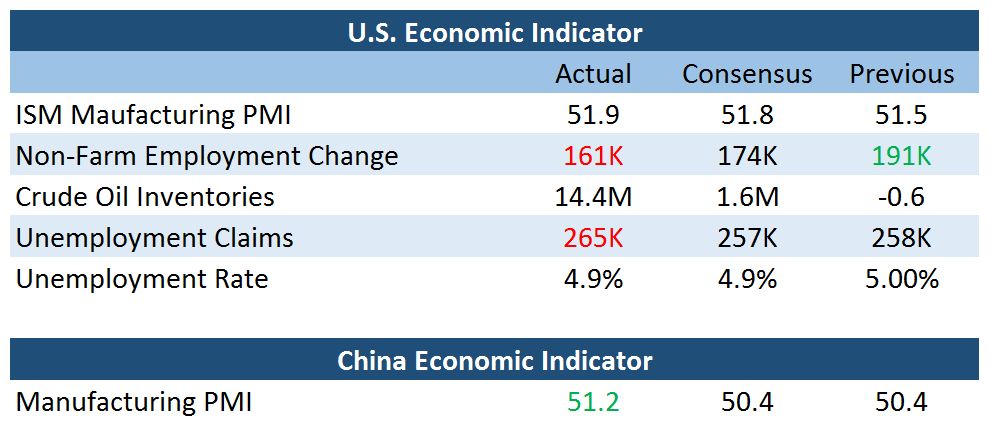

This week’s crude oil inventories held by commercial firms shocked the market by showing its largest surplus in more than 3 decades with 14.4M barrels, which was 800% higher than the consensus. This resulted in crude oil prices falling for 3 consecutive days throughout the past week to close 2.3% lower at $44.10, as the data provoked pessimistic sentiment. To make matters worse, OPEC ministers have failed again to reach an agreement in last week’s meeting to reduce the cartel’s production back to July 2016 levels.

In the labour market, Non-farm employment change was at 161k with employment continued to trend up in healthcare, professional and business services, and financial activities. The number of individuals who filed for unemployment insurance during the past week (initial claims) was 3.1% below consensus, increasing from 257k a week earlier to 265k. The number of claims continued to remain below 300k for 87 straight weeks, a threshold that signifies strong labor market conditions. With unemployment rate holding at a healthy 4.9% percent this year, fewer skilled candidates are available for openings thus prompting managers to hold onto their employees.

U.S. ISM Manufacturing PMI rose modestly above consensus at 51.9 from 51.5 the previous month, indicating growth in manufacturing for the second consecutive month. New orders index registered at 52.1 in October, which is generally consistent with an increase in the Census Bureau’s series on manufacturing orders. Eight of the industries that reported growth in new orders are apparel, leather & allied products; food, beverage & tobacco products; miscellaneous manufacturing; petroleum & coal products; paper products; plastics & rubber products; computer & electronic products; and chemical products.

China’s Manufacturing PMI, which measures large state-owned factories rose 1.6% against previous month’s to 51.2 for October, this 2-year high indicates that the second-largest economy is stabilizing.

Indicators to lookout next week – Trade Balance; Crude Oil Inventories; Unemployment Claims and Presidential Election.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016

Blink22

the US elections has gripped the market the last days.

world economy looks healthier now than say, a few months ago.

2016-11-06 09:46